There’s no doubt that using credit cards can make life easier. When everyone from the flower vendor at the farmers market to your favorite food truck accepts plastic, it seems like a no-brainer to use your card for everyday purchases.

But using your credit card isn’t always the smart choice. While earning airline miles and cash-back with credit card use are definitely perks, there are times when those benefits — and the convenience of paying with a credit card — don’t outweigh the drawbacks. Whether or not you’re a first-time credit card user, you should protect yourself by steering clear of the cons of credit cards in these five situations.

You can sometimes find steep discounts online, and free shipping makes it tempting to hit “add to cart” rather than heading out to brick-and-mortar stores. But before clicking the “confirm order” button, make sure you’re browsing a secure website.

How can you know? The website’s address should start with https:// instead of http://. The “s” indicates that the site is encrypted and secure, so your credit card information and personal data should be safe from hackers trying to steal your information.

Another tip: Take a second look at the URL. Does the site address make sense, or does it appear as though it’s coming from an untrustworthy source or a foreign location? Unless you’re confident that the online store is legit, it is best to avoid using your credit card on sites with addresses containing a country code such as .tk (Tokelau), .cn (China), .ml (Mali) or others you don’t recognize. Of course, there are plenty of shady online stores that end in .com, .shop and .net, too.

Watch for too-good-to-be-true deals as well. If you’re shopping for a pair of running shoes and the price ranges from $100 to $125 on trustworthy sites, be suspicious about finding them for $40 on a site you’ve never heard of.

You might be tempted to reach for your credit card for certain big-ticket items. And sure, there can be benefits to charging a new TV or couch, but make sure you have a plan to pay off these high-dollar purchases.

Think of your credit card as an unsecured loan with accrued interest on the balance if you don’t pay it each month. A good rule of thumb is that if you can’t afford the entire balance, then you should at least be able to pay off half the purchase within a month of the charge. You should then have a strategy for paying down the other half within six months.

Credit card interest rates are averaging close to 25%. So, if you can’t afford to pay off the balance quickly, you’ll end up paying a lot more for that expensive item. It’s smarter to save up until you can afford it.

When should I use my credit card? If you get benefits from using a credit card, like cash back or an extended warranty, go ahead and pull out the plastic — just make a payment right away with the cash you’ve saved up to cover the cost.

If you’re enjoying dinner or drinks with friends at a restaurant or bar, think twice about using your card to pay. Going into the night with the mindset that you’re paying in cash can help you rein in your spending.

Plus, restaurants and bars are places where the server generally takes your credit card out of your sight when you pay your bill. That’s one of the disadvantages of using credit that puts you at risk. They might use a skimming device to steal your credit card data and use that data for purchases.

While you might not be responsible for these fraudulent purchases, reporting them and replacing your card is a hassle. It’s always safer to pay with cash if there’s a chance your card will be out of your view.

Have you received a notice about the rates on your card increasing? It’s possible that your introductory annual percentage rate (APR) is almost up, but you may also be getting close to your credit limit.

A rate increase is a warning from the credit card company that they’re trying to deter you from using your entire spending limit. If you go over your credit limit, along with a higher interest rate, your credit card company could lower your credit limit, require higher minimum payments or even cancel your card. Work to pay down your debt before you add more charges to your statement.

If you’re using your credit card to build your credit and you carry a balance from month to month, you could be lowering your credit score. Your credit score predicts how likely you are to pay your bills, based on your payment history and your responsible credit use.

It’s always a good idea to keep your credit score as high as possible. So, pay off your credit cards every month or keep the balances to a minimum. It’s especially important to keep your credit score as high as possible if you plan to apply for a mortgage within the next six months to a year, since a better credit score may qualify you for lower interest rates.

Credit cards can be very useful financial tools when used responsibly. However, there are certain situations where it is better to avoid using your credit card. In this article, we’ll discuss the most common instances where you should put your card away and consider other payment options.

If You Can’t Pay Off The Balance

The number one reason not to use your credit card is if you do not have the funds to pay off the balance in full each month Carrying a balance on your credit cards leads to accumulating high-interest debt that can be difficult to get out of

If you cannot pay off your credit card balances every month only use your card for absolute necessities and emergency expenses. Rely on cash, debit cards or other resources for discretionary spending until you pay down your credit card debt.

When You Haven’t Checked Your Available Credit

It’s important to keep track of how much available credit you have at any given time. Do not make assumptions or guesstimate your available balance. Before using your credit card, log in to your account and check your current balance versus your credit limit

Maxing out your credit cards negatively impacts your credit score. As a rule of thumb, do not let your balances exceed 30% of your total credit limit across all cards. If your next purchase will put you over that 30% threshold, hold off until you’ve paid down the balances.

To Earn Rewards You Can’t Pay Off

The rewards and perks offered by credit cards can certainly be enticing. However, you should not use credit cards to earn rewards if you are not able to pay off the balances right away.

The high interest charges will always negate any rewards earned. Make sure you can comfortably afford any purchases you put on your credit card specifically to accumulate points or miles. Only charge rewards when you have the cash to pay in full.

Out of Desperation or Emotional Spending

Do not use your credit cards as a crutch during times of financial hardship or emotional turmoil. It may be tempting to rely on credit when you’re feeling down or when an unexpected emergency expense comes up, but it often leads to regret and larger debt burdens.

During periods of stress, step back and reevaluate your financial situation before charging discretionary purchases on credit cards. Get support, make a plan, and find alternative solutions that will not put you deeper in debt.

Just Before Applying for a Mortgage

If you plan to apply for a mortgage soon, go very light on credit card usage in the months leading up to your application. The balances shown on your credit report influence mortgage approval and your interest rate.

Even if you pay off the charges quickly, high balances can result in higher utilization ratios which bring down your credit scores. Every point counts when seeking the best terms on a mortgage.

When You’ll Exceed Your Limit

Do not charge more to your credit card than its set spending limit. While the 2010 CARD Act banned over limit fees in most cases, exceeding your limit can still negatively impact your credit score.

Before mindlessly swiping for convenience, take two seconds to check your balance in your banking app. Or set up account alerts that will notify you if you are getting close to your credit limit. Leave a nice cushion under your limit.

Without Monitoring Transactions

While not using your credit card seems safe, that can actually expose you to risk if you fail to monitor your open accounts. Check all statement activity regularly to ensure there are no fraudulent charges or recurring bills you’ve forgotten about.

Unmonitored accounts are prime targets for fraudsters. Log in frequently, watch for suspicious transactions, and take advantage of account monitoring features offered by your card issuer.

On Unsecured Public Wi-Fi

Do not use your credit card on unsecured public Wi-Fi or devices that may have spyware or malware. The lack of encryption on public hotspots means your payment details can easily be intercepted by bad actors “listening in” nearby.

To safely make purchases and bank online outside your home, use your phone’s mobile hotspot or a trusted VPN app to secure your connection. Never access financial accounts on shared computers in places like libraries, hotels, and internet cafes.

Without Reading the Fine Print

Promotional financing offers and retail store credit cards often seem appealing, especially for large purchases. However, the deferred interest and hidden fees in the fine print can quickly turn a good deal into an expensive debt trap.

Always read the terms and ask questions before signing up for specialized credit tied to a single retailer. Calculate whether the offer truly saves you money compared to using a general cash back or rewards credit card.

On Unverified Websites

Only use your credit card on secure websites that have “https” URLs and have been verified by organizations like the Better Business Bureau, TRUSTe, McAfee, or Norton. Avoid sites you arrived at through pop-up ads or suspicious links.

Legitimate businesses will have professional looking websites with working contact info. Do your research to ensure the company is real before entering any sensitive payment information.

Under Pressure

High-pressure sales tactics are red flags when considering a new credit card or financing offer. Unscrupulous lenders may push cards on people with bad credit or on desperate borrowers who feel they have no other options.

Walk away from pushy offers that require an immediate decision. Take your time to weigh alternatives and get familiar with fees and interest rates. A reputable lender will allow time for you to review terms and make an informed choice.

When Impaired

You should always have full control of your mental faculties when making major financial decisions. Never use your credit card excessively while under the influence of drugs, alcohol, lack of sleep, or strong emotions.

Impaired judgement often leads to expensive impulse purchases and financing choices that seem logical in the moment but are later regrettable. If you tend to overspend when tired or intoxicated, leave the credit cards at home.

For Bills With Card Fees

Some service providers tack on “convenience fees” for paying bills with a credit card. The fee may cancel out any rewards you earn. Run the numbers in advance to make sure the net rewards justify the cost.

Additionally, avoid using your credit card to pay rent, tuition, or other expenses that do not normally accept credit payments. There are usually steep processing fees, making checks or ACH transfers better options.

Without Informing Your Partner

If you share finances with a spouse or partner, it’s wise to discuss any major credit card purchases before whipping out your plastic. Even if you have separate accounts, large purchases impact household budgets.

Maintaining open communication about your respective spending habits helps avoid conflicts and overspending. Set shared ground rules for when you need to consult your significant other before making a high-dollar credit purchase.

When Your Debt is Already High

Avoid using your credit cards altogether when you are working to pay down significant balances on multiple accounts. The deeper you are buried in credit card debt, the more important it is to temporarily halt card spending.

Make a debt reduction plan and focus on paying more than the minimums each month. Once you’ve made significant progress lowering your debt, you can cautiously resume credit card spending within reason.

The Bottom Line

Credit cards offer convenience and rewards when used wisely, but too often consumers get caught up in debt traps. Avoid credit cards when you lack available funds, when you’ll incur interest and fees, for unnecessary purchases, or without carefully reading the terms. Monitor accounts diligently, stick to a budget, and pay balances in full each billing cycle. If you cannot use credit cards responsibly, keep them tucked away to avoid temptation and unnecessary interest charges. Apply these tips to enjoy your credit cards stress-free!

Want to learn more?

Contact a local FBFS agent or advisor for answers personalized to you.

Add a Layer of Protection for Peace of Mind

Paying with plastic can make life easier — but it’s important to know when not to use a credit card. If you’re worried that your card numbers may be at risk, consider adding ID Theft Protection to your homeowner’s or renter’s insurance for an added layer of security.

I Stopped Using a Credit Card For 30 Days and THIS Happened!

FAQ

When should you not use a credit card?

- Your monthly rent or mortgage payment. …

- A large purchase that will wipe out available credit. …

- Taxes. …

- Medical bills. …

- A series of small impulse splurges. …

- Bottom line.

Can I use my credit card whenever?

There is no required down time for credit cards, you can use them continuously once you understand the relationship between two important dates.

How long can you not use a credit card before it closes?

What bills cannot be paid with a credit card?

What happens if you don’t use a credit card for a year?

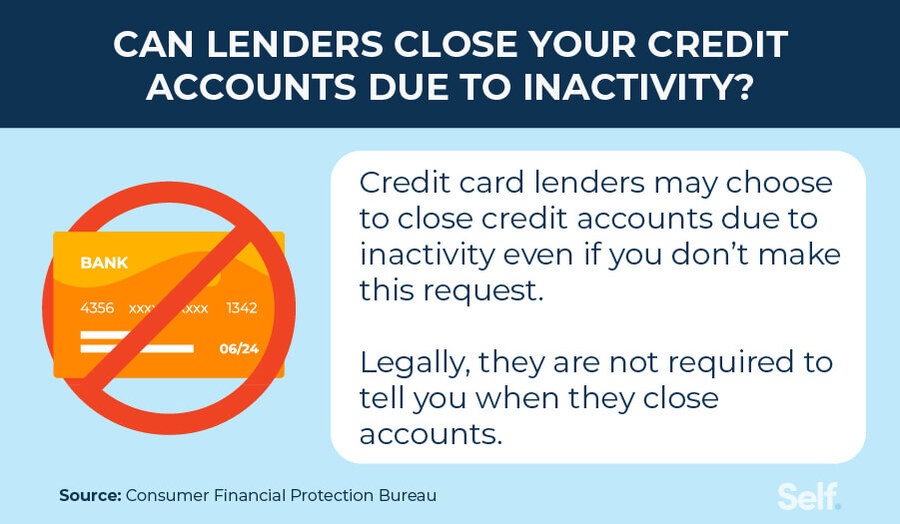

If you don’t use a credit card for a year or more, the issuer may decide to close the account. In fact, inactivity is one of the most common reasons for account cancellations. When your account is idle, the card issuer makes no money from transaction fees paid by merchants or from interest if you carry a balance.

Should you keep a credit card if you never use it?

Your overall credit utilization rate won’t go over 30%. There’s no clear incentive to keep the card (rewards, cash back, low interest rate). The incentive is the first thing to review. Consider why the card is never used and whether there’s enough reason to keep it open. Is there cash-back potential to be taken advantage of?

Do I need to use my credit card all the time?

Fortunately, you don’t have to use your card all the time to keep it active. Here are some strategies for using it and making on-time payments: Use your card for everyday essentials like groceries or a weekly coffee purchase. These transactions keep your account active without increasing your spending.

Does not using my credit card affect my credit score?

Learn more about our partners and how we make money. Not using your credit card doesn’t hurt your score. However, your issuer may eventually close the account due to inactivity, which could affect your score by lowering your overall available credit. For this reason, it’s important to not sign up for accounts you don’t really need.

What happens if you stop using your credit card?

Both actions have the potential to lower your credit score. If you stop using your credit card for new purchases, your card issuer can close or curb your credit line and impact your credit score. Your credit card may be closed or restricted for inactivity, both of which can hurt your credit score.

Should you use your credit card if you’re not able to pay off?

You shouldn’t use your credit card when you’re not able to pay off the balance. But are there other times you should you avoid it? Leslie H. Tayne, a debt-relief attorney and founder of Tayne Law Group, explains.