Having a good credit limit on your credit card can be beneficial in many ways But what constitutes a “high” credit limit these days? Is a $2500 credit limit considered high or just average? In this comprehensive guide, we’ll explore what credit limits are, examine the factors that determine your credit limit, look at average limits across different demographics, and provide tips for getting a higher credit limit

What is a Credit Limit?

A credit limit is the maximum amount of credit a lender approves you to access on a credit card or line of credit. It’s the ceiling on how much you can borrow on that account. Credit limits give lenders a way to limit their risk exposure on borrowers. Higher limits often signal that the lender sees you as a lower credit risk based on your creditworthiness.

Credit limits matter for a few key reasons:

-

Credit utilization – The ratio of how much you currently owe versus your total available credit limit is called credit utilization. This ratio makes up a meaningful part of your credit score calculation. To keep your score optimized, experts recommend keeping utilization below 30%. Higher limits help keep utilization low.

-

Ability to manage debt – Lenders grant higher limits to borrowers they deem more responsible and able to manage larger lines of credit Gaining limit increases shows lenders your improved ability to handle credit

-

Big purchases – Higher credit limits make financing large purchases easier and may allow you to forgo tying up cash in debit transactions.

What Determines Your Credit Limit?

When a lender reviews your credit card or loan application, they assess your creditworthiness to decide what credit limit to grant you The main factors that influence this decision include

-

Credit score – Your numerical credit score summarizes your credit history, bill payment habits, types of credit used, credit age, and other factors into a three-digit number. Higher scores signal lower credit risk and often lead to higher approved limits.

-

Income – Documented income demonstrates your ability to make monthly payments on any borrowed money. Higher incomes often equate to higher limits.

-

Existing debt – Lenders look at your current debt burdens when deciding your limit. Too much existing debt may restrict an otherwise high limit.

-

Assets – Assets like homes, retirement savings, and investments help reassure lenders of your financial stability and ability to repay debt. Strong assets often lead to higher limits.

-

Credit history – Robust length and diversity of positive credit experiences lowers risk in lenders’ eyes and leads to higher limit approvals. Too limited of a credit history can restrict limits.

Average Credit Limits by Demographic

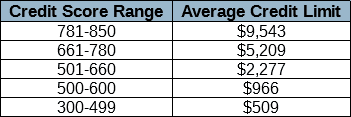

Average approved credit limits vary significantly across different demographics. According to 2022 Experian data:

-

Baby Boomers (born 1946-1964) – $40,000

-

Generation X (born 1965-1980) – $36,000

-

Millennials (born 1981-1996) – $30,000

-

Generation Z (born 1997-2012) – $11,290

In general, older generations have higher limits thanks to their longer credit histories, higher incomes, and accumulated assets. But any responsible borrower who builds up their creditworthiness can gain higher limits over time.

When you’re just starting out, expect initial limits in the $1,000 ballpark. As you demonstrate prudent financial habits and responsibility, you can gain periodic limit increases to $5,000, $10,000, and over time even $20,000+.

Tips to Increase Your Credit Limit

If your current credit limit seems low, here are smart strategies to get it raised:

-

Improve your credit – Increasing your credit score through diligent bill payments, diverse credit mixes, lowering debts, and avoiding mistakes will make lenders more likely to grant you a higher limit.

-

Ask for a raise – After 6 months or more of on-time payments with your current issuer, request a credit limit increase. This signals you can responsibly handle more.

-

Lower your utilization – Using a lower percentage of your current limit demonstrates you don’t need maxed out credit, making you a candidate for more.

-

Increase income/assets – Documenting your financial growth in these areas gives lenders confidence in your ability to manage higher limits.

-

Get a new card – Opening a new account and getting approved for an initial higher limit can add to your total available credit and increase your overall limit.

Is $2,500 a High Credit Limit?

Given the average credit limits cited earlier, a $2,500 limit falls around the averages for younger Millennials and Gen Z borrowers. It’s well below the mainstream averages for Gen X and Baby Boomers.

As a result, $2,500 is generally considered more of an entry-level or average limit, rather than a high one. That said, it’s an excellent starting point for someone just establishing credit. With time and diligent financial habits, most people can gain steadily higher limits from there.

The good news is that your limit today doesn’t have to define your credit access forever. Responsible borrowing, robust credit mix usage, and keeping card balances low compared to limits will demonstrate to lenders your ability to handle higher credit limits down the road.

How Much You Should Spend With a $2,500 Credit Limit

- Spending between $25 and $250 per month is best for your credit score.

- You should avoid having a balance above $750 when your monthly statement gets generated.

- Even if you spend $0, your credit score will still improve just by having the account open.

In case you need to spend more than 30% of your credit limit in a given month, you should pay off some or all of your balance early. The balance listed on your monthly credit card statement is used to calculate credit utilization. This answer was last updated on 06/19/25 and it was first published on 06/12/24. For the most current information about a financial product, you should always check and confirm accuracy with the offering financial institution. Editorial and user-generated content is not provided, reviewed or endorsed by any company.

Adam McCann , Financial Writer

If your credit limit is $2,500, you should ideally spend around $25 to $250 each month, then pay off your full statement balance by the due date. This will help your credit score increase as fast as possible and allow you to avoid paying interest.

If you can’t manage to spend this little on your card, just strive to keep your spending below 30% of your credit limit. Once your credit utilization exceeds 30% of your credit limit, it starts being detrimental to your credit score.

this card claims to have a $2500 credit limit W/O CREDIT – CREDIT BUILDER or REAL CREDIT CARD?

FAQ

How much of a $2500 credit limit should I use?

This means that with a credit limit of $2,500, you should aim for no more than $750 of purchases per month. Some lenders are even looking for a utilization rate below 10%, meaning no more than $250.Oct 16, 2024

What is considered a high credit limit?

Is 2500 a good credit line?

A $2,500 credit limit is good if you have fair to good credit, as it is well above the lowest limits on the market but still far below the highest.May 15, 2025

What is the credit card limit for $30,000?

What is the credit card limit for a salary of ₹30,000? The minimum and maximum limit on a ₹30,000 monthly salary is based on a variety of factors. However, the minimum credit card limit in India is 2 times your monthly income and the maximum can be 3 times. This comes to a credit limit between ₹60,000 and ₹90,000.

Do credit cards have credit limits?

Credit cards have credit limits, or maximums that dictate how much a cardholder can spend on the card before needing to pay the balance. According to Experian, the average credit limit for Americans across all credit cards was $29,855 as of the third quarter of 2023.

What is the best credit card limit?

In the end, there’s no such thing as a “good” or “bad” credit limit—the best credit card limit for you depends on the way you use your card. Was this article helpful? Secured Card Deposit Range: If approved, you must make a minimum security deposit of $200 (or more, in increments of $100 up to $2,500), which will equal your requested credit limit.

Do you qualify for a credit limit increase?

To determine whether you qualify for a credit limit increase, credit card issuers may assess changes in your income or credit score. They typically also consider whether you’ve used your card responsibly overall by paying your bills on time and keeping your balance low.

Is a higher credit limit a good idea?

Keep in mind, a request for a credit limit increase may result in the credit card company placing a hard inquiry on your credit report, which can have a negative impact on your credit score. A higher credit limit could be a good choice for you. The best fit depends on your unique circumstances.

What happens if a credit card has a higher credit limit?

The higher the credit limit, the more money the borrower is allowed to charge on a credit card. If the cardholder attempts to charge purchases using a credit card past the maximum credit limit, the card may be declined at the time of purchase or the cardholder may be charged a penalty fee.

How much credit utilization should a credit card holder have?

We recommend keeping credit utilization under 30% to maintain a good credit score. Lower credit utilization also helps boost credit card limits. A credit card issuer will always analyze an applicant’s credit history to determine how much their credit limit should be.