Buying a house is an exciting milestone in life. However, it also requires careful financial planning. Many homebuyers wonder if they can qualify for a mortgage with only one year of income. The answer is yes, it is possible in certain situations.

How Lenders Evaluate Income

When reviewing a mortgage application lenders want to see steady and consistent income over time. This gives them confidence that you’ll be able to make monthly payments. Lenders generally look for a two-year history of stable income. However exceptions can be made in some cases.

For conventional loans, lenders may approve you with only one year of income if you have strong compensating factors. These include a high credit score, significant assets and savings, and a low debt-to-income ratio. The lender will look at your entire financial picture to assess if you are a low risk.

For government-backed loans, such as FHA and VA, the rules can be a bit more flexible. These programs may allow one year of income documentation with a letter explaining any gaps or recent changes in employment.

Factors That Improve Your Chances

Though every situation is different. here are some things that can strengthen your chances of qualifying with only one year of income

-

Strong credit – A credit score of 740 or higher will show lenders you are responsible with credit and debts. Good credit can offset concerns about short income history.

-

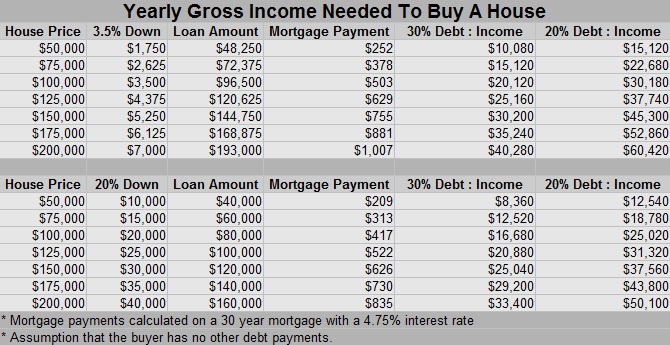

Low debt-to-income ratio – Your total monthly debt payments should not exceed 36% of gross monthly income. The lower your DTI, the better.

-

Large down payment – Putting down 20% or more will reduce the mortgage amount and show you have savings.

-

Cash reserves – Having 12 months of mortgage payments in the bank provides a safety net if your income drops.

-

Employment in the same field – Remaining in the same line of work smooths over gaps in employment.

-

High income – Earning well above the required minimums provides a buffer.

-

Significant assets – Money in retirement and investment accounts indicates financial stability.

-

Home equity – If you have equity from selling a home, it shows you can handle the responsibilities of ownership.

-

Strong employment history – Having over 2+ years experience in your occupation establishes your earnings power.

-

Satisfying any overlays – Many lenders add their own requirements on top of basic program guidelines.

The more factors you can line up, the better your chances. Work on improving your credit, increasing savings, and paying down debts prior to applying.

Government-Backed Loans Offer Flexibility

Government loans through FHA, VA, and USDA give more leeway for thin credit files and short income history.

FHA loans require just one year of employment history. Gaps can be explained with a signed letter from the borrower. FHA evaluates income stability and not length of time in a job.

VA loans have no set requirement for length of employment. Underwriters review all factors including education, training, and prior experience to assess income stability.

USDA loans can be easier to qualify for with one year of income. Guidelines require “reasonable prospects” of continued employment. Stable earnings and job history are more vital than duration of employment.

Government programs may request an employment verification even if you’ve been on the job under six months. Check with loan officers to see if you meet requirements.

Steps to Buying with One Year of Income

Here are key steps to navigate buying a home with only one year of earnings:

-

Shop multiple lenders to find programs suited to your situation. Compare pre-approval offers side-by-side.

-

Get pre-qualified to see the maximum home loan amount you may be eligible for.

-

Review your income, assets, debts, and credit to highlight strengths of your application.

-

Save up funds for down payment and closing costs early in the process.

-

If changing jobs, explain the situation in a letter and provide previous W-2s.

-

Be prepared to provide 12 months of bank statements to document consistent income.

-

Make a larger down payment, if possible, to increase your chances.

-

Consider having a co-borrower on the loan to supplement your income.

-

Look at government loans (FHA, VA, USDA) as they offer more flexibility.

-

Talk to your loan officer throughout the process to ensure you submit everything needed.

With preparation and an understanding of the requirements, many homebuyers can qualify for a mortgage with only one year of income. Focus on compensating factors like credit, savings, low debts, and steady employment history. Consider government loan programs for expanded options as well.

Alternative Income Documentation Programs

If you are self-employed or have an irregular income stream, alternative income documentation programs may be an option.

Bank statement loans look at deposits coming into your account rather than tax returns to document earnings. You’ll need 12 or 24 months of statements.

1099-only loans allow you to qualify using just your 1099s for proof of income. Two years of 1099s are typically required.

One-year income programs are available from some lenders and allow qualifying with just one year of tax returns. These often require good credit scores and larger down payments.

No income verification loans remove income documentation altogether for some borrowers. Instead, they evaluate factors like assets, credit, and equity.

Be aware that these programs often come with higher rates and costs. But they can provide mortgage options if W-2 income alone doesn’t qualify you.

Considerations for First-Time Home Buyers

First-time buyers may be more likely to have limited income history. College graduates often start working full-time just one or two years before applying for a mortgage.

Recent graduates can strengthen their applications by:

-

Saving up a larger down payment of at least 10-20%

-

Keeping credit scores above 740

-

Minimizing monthly debts and spending

-

Having a co-signer with longer income history

-

Looking at FHA, VA, and USDA loans

-

Using gift funds from relatives for some costs

-

Providing transcripts showing relevant education

-

Getting a strong pre-approval letter from a lender

With the right preparation, many first-time buyers can still qualify for a mortgage with just one year of income.

Partnering With the Right Lender

Finding an experienced lender is key to getting approved when you don’t meet standard requirements. The right lender will understand the nuances of low income documentation loans and know how to put together a winning application package. Mortgage brokers that offer a wide variety of loan products can be a great resource.

Be sure to ask potential lenders about:

-

Their experience with one-year income programs

-

What their income documentation requirements are

-

If they offer alternative income loans

-

Down payment assistance programs they work with

-

Tips to improve your chances of approval

A knowledgeable lender will work closely with you and walk you through all the steps of buying a home. They’ll let you know upfront if you meet requirements or what areas need improvement before applying.

Buying a house on one year of income can be challenging, but is possible in many cases with preparation and persistence. Partner with lenders experienced in limited income documentation loans. Explore alternative programs like FHA and VA loans. Improve your financial profile and compensate for short earnings history. With prudent steps, you can still achieve the dream of homeownership.

Self-employed mortgage loan requirements

Most mortgage lenders require at least two years of steady self-employment before you can qualify for a home loan. Lenders define “self-employed” as a borrower with an ownership interest of 25% or more in a business, or one who is not a W-2 employee.

However, there are exceptions to the two-year rule:

- You might qualify with just one year of self-employment if you can show a two-year track record in a similar line of work. You’ll need to document an equal or greater income in the new role compared to the W2 position

- Some lenders will even count one year of related employment plus one year of formal education or training as an acceptable work history

If you’ve been self-employed for less than one year, you’re not likely to qualify for a home loan.

In addition to proving their employment history, self-employed borrowers need to meet standard loan program requirements. Guidelines vary by loan type but in general, as a self-employed home buyer, you’ll need to meet the following requirements:

- Credit score: Lenders typically require a credit score of 620 or higher. Maintain a good credit history and address any issues before applying.

- Debt-to-income ratio: Your debt-to-income ratio (DTI) should be below 43%. This ratio compares your monthly debt obligations to your monthly income. A lower ratio demonstrates your ability to manage debt and makes you a more attractive borrower.

- Stable income and cash flow: Lenders want to see that your business generates consistent income to cover your mortgage payments. Generally, they require a history of stable self-employment income for at least two years.

- Down payment: The down payment requirements for self-employed borrowers are similar to those for traditional borrowers. Depending on the loan type, you may need to put down as little as 3% (conventional loans) or 3.5% (FHA loans).

- Additional savings: Some lenders may require self-employed borrowers to have cash reserves to cover mortgage payments in case of business downturns. The amount varies but typically ranges from 6 to 12 months’ worth of mortgage payments.

Self-employed mortgage loan: Is it possible?

Absolutely, being self-employed does not automatically disqualify you from obtaining a mortgage.

In fact, there are various types of mortgages for self-employed individuals designed specifically to meet their unique personal finance needs. While obtaining a self-employed mortgage loan may require a bit more documentation and underwriting scrutiny, it’s certainly possible.

Self-employed home loans could also require more substantial cash reserves or a larger down payment to offset the lender’s risk, given that self-employed income can sometimes be inconsistent.

For the most favorable mortgage terms, it’s recommended to work with lenders who specialize in catering to self-employed individuals. These financial institutions often have more experience and flexibility in dealing with income that may not be as steady as that of a W-2 employee.

In this article (Skip to…)

Impossible to Buy a House With a $60,000 Income?

FAQ

Can I get a mortgage with one year of income?

Getting a mortgage with less than two years of work history is possible through a non-traditional mortgage program called Non-Qualified mortgages or Non-QM.

Can you get a mortgage with 1 year work history?

Do you need 2 years of income to buy a house?

Conventional home loans are arguably the most popular type of mortgage. They generally require at least two years of employment history to qualify. However, less than two years may be acceptable if the borrower’s profile demonstrates “positive factors” to compensate for shorter income history.

Can I buy a house with only one year of taxes?

Central Coast Lending allows borrowers to qualify for a mortgage with income represented by just one year of tax returns.