A tier 2 credit score is a score that falls within the range of 670 and 799. Higher credit scores would be categorized within the first credit tier while scores below 670 would fall under the third credit tier.

A credit tier is a way of organizing consumers and their credit scores. The most common ways of organizing credit scores are in credit tiers or ranges.

Your credit score is a three-digit number that represents your financial habits and behavior. Most lenders use credit scores, among other factors, to determine if borrowers are qualified for the financial products they offer. Credit scores can vary widely from person to person, but it’s common for people to have tier 1 or tier 2 credit.

When looking for loans or lines of credit, it’s essential to know and understand your credit score so you apply for the appropriate products. Here, you will learn more about your FICO score, how to identify your credit score tier, and how to achieve top-tier credit if that is your financial goal.

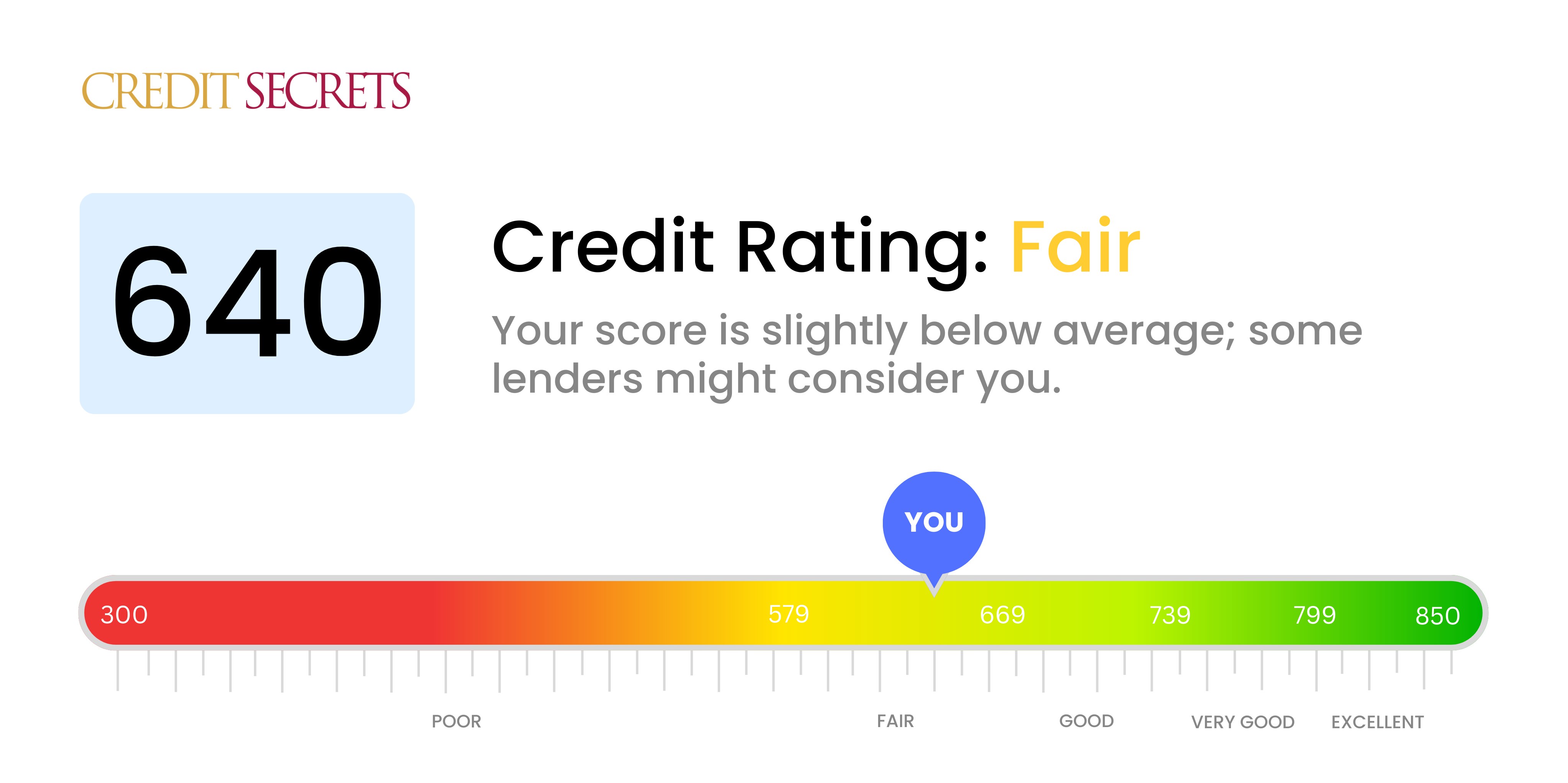

Hey there, fam! If you’ve just checked your credit score and saw that 640 pop up, you’re prob’ly wondering, “What tier is a 640 credit score, and is it even decent?” Well, I’m here to break it down for ya in plain English. Spoiler alert: a 640 credit score lands in the “fair” credit tier, which sits between 580 and 669 on the FICO scale. It ain’t the worst, but it ain’t gonna get you the VIP treatment from lenders either. In some classifications, it’s considered Tier 4 (fair/poor), which means you’re not in the gutter, but you’ve got room to climb.

Stick with me and we’ll dig into what this score really means for your wallet how it stacks up against other tiers, and most importantly, how we can get it movin’ up to better territory. Whether you’re trying to snag a loan, buy a car, or just figure out where you stand, I’ve got your back with all the deets. Let’s dive in!

What Tier Is a 640 Credit Score? Let’s Get the Basics Down

First things first, let’s chat about credit score tiers. These are basically buckets that lenders use to figure out how risky it is to lend you money. The higher your score, the less risky you seem, and the better deals you get. Most credit scores, like FICO and VantageScore, run on a scale from 300 to 850. Here’s how they usually break down into tiers:

| Tier | FICO Score Range | What It Means |

|---|---|---|

| Exceptional (Tier 1) | 800 – 850 | You’re golden. Best rates, no prob’s. |

| Very Good (Tier 2) | 740 – 799 | Still awesome, great offers comin’ your way. |

| Good (Tier 3) | 670 – 739 | Pretty solid, decent terms on loans. |

| Fair (Tier 4) | 580 – 669 | Meh, you’ll qualify, but with higher costs. |

| Poor (Tier 5) | 300 – 579 | Rough spot, approvals are tough and pricey. |

So, with a 640 credit score, you’re sittin’ smack in the “fair” tier or Tier 4 if we’re goin’ by some broader labels out there. It means you’ve got some credit history maybe a few bumps along the road, but you’re not in dire straits. Lenders won’t roll out the red carpet, though—they’ll likely charge higher interest rates or ask for bigger down payments ‘cause they see you as a bit of a gamble.

Why does this tier matter? ‘Cause it’s the lens through which banks, credit card companies, and even landlords judge ya. A 640 ain’t gonna lock you out of everything, but it’s a signal to work on boosting that number for better financial perks. Let’s unpack what you can actually do with this score next.

What Can You Do with a 640 Credit Score? Real Talk

Alright, so you’re in the fair credit tier with a 640 It’s not the end of the world, and you can still get stuff done financially. But, real talk, there’s gonna be some catches—higher fees, steeper rates, and less shiny offers. Here’s the lowdown on what you can expect when you’re rockin’ this score

- Credit Cards: You can prob’ly snag a credit card, no doubt. Thing is, it might come with higher interest rates or annual fees. Unsecured cards (no deposit needed) are within reach, and some might even toss in basic rewards. If you’re lookin’ to build credit, a secured card—where you put down a deposit as your limit—could be a smart move. Just don’t expect them 0% intro APR deals; those are for the big dogs with higher scores.

- Auto Loans: Need a car? You’re in luck, ‘cause auto loans are doable with a 640 score. Over 40% of auto loans go to folks with scores under 700, so you’re not alone. But brace yourself—the interest rates will sting more than for someone with prime credit (think 720 or higher). We’re talkin’ APRs way above the 5% mark that prime borrowers might get. Bigger monthly payments, yo.

- Mortgages: Dreamin’ of a house? A 640 score can get you a mortgage, especially if you’re eyein’ government-backed options like FHA loans, which are more forgiving. But here’s the rub: you’ll likely need a heftier down payment, and the interest rates won’t be kind. A lil’ bump in your score could save you thousands over the life of the loan.

- Personal Loans: This one’s a maybe. You might qualify for a personal loan, but the terms ain’t gonna be pretty. Expect APRs in the double digits, sometimes as high as 35% or more, depending on the lender. If it’s for somethin’ urgent, shop around hard. If not, maybe hold off and work on your score first.

Bottom line? A 640 credit score gets you in the door for most stuff, but you’re payin’ a premium for it. I’ve been there, man—feelin’ like every loan application comes with a side of “gotcha” fees. It’s frustrating, but it’s also a wake-up call to level up. Speaking of which, let’s get into how we can push that score outta the fair zone.

How to Improve Your 640 Credit Score: Steps to Climb the Tiers

Now that we know where a 640 stands, let’s talk about gettin’ it higher. I ain’t gonna sugarcoat it—improving your credit score takes time and discipline, but it’s totally doable. Me and my crew at [Your Company Name] have seen plenty of folks jump from fair to good or even very good by stickin’ to some key habits. Here’s your game plan to move up them tiers:

1. Pay Them Bills on Time, Every Time

This is the biggie, y’all. Your payment history is like 35% of your FICO score, so missin’ a payment is like shootin’ yourself in the foot. Set reminders, automate payments, do whatever it takes to pay credit cards, utilities, rent—everything—on time. Even one late payment can ding your score, and I’ve made that mistake before. Don’t be me.

2. Cut Down Your Credit Utilization

Here’s a fancy term that just means don’t max out your cards. Keep your balances below 30% of your credit limit. So, if your card’s limit is $1,000, don’t owe more than $300 on it. High balances make lenders nervous, thinkin’ you’re overextended. Pay down what you owe, and watch that score creep up. I slashed my utilization a few years back, and it was a game-changer.

3. Check Your Credit Report for Screw-Ups

Errors happen, and they can tank your score for no reason. Grab your free credit report from the major bureaus and scan for mistakes—like late payments you didn’t make or accounts that ain’t yours. Dispute anything funky. I once found a weird account on my report, disputed it, and bam—score went up a notch.

4. Become an Authorized User

Got a friend or family member with killer credit? Ask ‘em to add you as an authorized user on their credit card. Their good habits can rub off on your score, as long as they keep payin’ on time. Just don’t abuse the card, ‘kay? It’s a favor, not a free-for-all.

5. Consider a Secured Credit Card

If you’re strugglin’ to get approved for regular cards, a secured credit card is your buddy. You put down a deposit, say $200, and that’s your limit. Use it for small purchases, pay it off each month, and it builds your credit history. I started with one of these back in the day, and it helped me climb outta the fair zone.

6. Give It Some Time, Homie

Credit ain’t a quick fix. The age of your accounts matters, so don’t close old cards even if you don’t use ‘em much. Keep ‘em open to boost the average age of your credit history. Patience is key—stick with good habits, and you’ll see results over months, not days.

Bonus Tip: Don’t Apply for Too Much at Once

Every time you apply for new credit, it can cause a hard inquiry, which dings your score a lil’. Space out applications, and only apply for what you really need. I learned this the hard way after applyin’ for three cards in a month—oops.

If you follow these steps, a 640 can turn into a 670 or higher, movin’ you into the “good” tier. That’s where the sweeter deals start rollin’ in—lower rates, better approval odds. We’re all about gettin’ you there, so let’s keep pushin’.

Why Does Movin’ Up Tiers Matter So Much?

You might be thinkin’, “Why bother grindin’ to improve my score? I’m gettin’ by with 640.” Fair point, but here’s why it’s worth the hustle. Jumpin’ from fair to good credit (670-739) can save you serious cash. We’re talkin’ thousands less in interest on a mortgage or car loan over time. Plus, you get access to better credit cards with rewards or 0% intro offers—stuff that’s outta reach right now.

I remember when my score hit the good range; it felt like a weight lifted off my shoulders. Suddenly, lenders weren’t lookin’ at me like I was a risk. They were offerin’ me stuff I actually wanted. That’s the freedom we’re aimin’ for. A higher tier ain’t just a number—it’s peace of mind and more options.

Common Myths About a 640 Credit Score—Busted!

Before we wrap this up, let’s clear up some nonsense I’ve heard floatin’ around about fair credit scores like 640. Me and the team at [Your Company Name] wanna make sure you ain’t fallin’ for these traps:

- Myth: “A 640 score means I can’t get approved for anything.” Nah, not true. You can qualify for loans and cards, just with tougher terms. Don’t let this stop ya from applyin’—just shop smart.

- Myth: “Improving my score is impossible.” Wrong again! It takes effort, but with consistent on-time payments and low balances, you can climb tiers. I’ve done it, and so can you.

- Myth: “All lenders see a 640 the same way.” Nope, different lenders got different cutoffs. Some might be cool with 640 for a loan, while others want 680. Always compare options.

Don’t let these myths mess with your head. Knowledge is power, and now you’ve got the real scoop.

Wrapping It Up: Your 640 Credit Score Ain’t the End, It’s the Start

So, to answer the big question—what tier is a 640 credit score?—it’s fair credit, sittin’ in the 580-669 range, often labeled as Tier 4. It’s not terrible, but it’s not great either. You can still get credit cards, auto loans, even a mortgage, but you’re gonna pay more in interest and fees than folks with higher scores. That’s the hard truth.

But here’s the good news: you’ve got the power to change it. Me and the peeps at [Your Company Name] believe in ya. Start with payin’ bills on time, keepin’ your card balances low, and checkin’ for errors on your report. Little by little, you’ll nudge that score up to the “good” tier and beyond. I’ve been in your shoes, stressin’ over every application, but with some grit, I got to a better spot. You will too.

Got questions or wanna share your credit journey? Drop a comment below—I’m all ears. Let’s keep this convo goin’ and get you on the path to financial wins. Catch ya later!

Pay More if Possible When Paying Off Debt

As you make your monthly debt payments on time, consider paying more than just the minimum amount due. With most forms of debt, lenders will charge an interest rate based on the amount a borrower owes. The less your balance is, the less you may pay in interest rates. So, by paying more towards your debt each month, you can end up saving money and paying off your debt faster!

What Is a Credit Tier?

When it comes to credit tiers, there are four, with tier four being the lowest and tier one being the highest tier. Here is a breakdown of the credit tiers:

- Tier 1: 800 – 850

- Tier 2: 799 – 670

- Tier 3 Credit Score: 669 – 300

- Tier 4: beginning score of 300.

When it comes to credit ranges, scores are broken down even more specifically. Organizing credit score ranges would look like this:

- Exceptional: 800 – 850

- Very Good: 740 – 799

- Good: 670 – 739

- Fair: 580 – 669

- Poor: 300 – 579

What Can I Do With A 640 Credit Score? – CreditGuide360.com

FAQ

What credit score is considered tier 2?

A tier 2 credit score is a score that falls within the range of 670 and 799. Higher credit scores would be categorized within the first credit tier while scores below 670 would fall under the third credit tier. A credit tier is a way of organizing consumers and their credit scores.

What tier is 640 credit?

Poor credit: 300 to 579. Fair credit: 580 to 669. Good credit: 670 to 739. Very good credit: 740 to 799.

How rare is credit score over 800?

What it means to have a credit score of 800. A credit score of 800 means you have an exceptional credit score, according to Experian. According to a report by FICO, only 23% of the scorable population has a credit score of 800 or above.

Is a credit score of 640 considered good?

A 640 credit score isn’t exactly good or bad: It is classified as “fair” on the popular FICO® Score scale. It’s not a “good” credit score, but that doesn’t mean you can’t reach some of your financial goals with a 640 score.