Its an age-old question we receive, and to answer it requires that we start with the basics: What is the definition of a credit score, anyway?

Generally speaking, a credit score is a three-digit number ranging from 300 to 850. Credit scores are calculated using information in your credit report. Your payment history, the amount of debt you have and the length of your credit history are some of the factors that make up your credit scores.

There are many different credit scoring models, or ways of calculating credit scores. Credit scores are used by potential lenders and creditors, such as: banks, credit card companies or car dealerships, as one factor when deciding whether to offer you credit, like a loan or credit card. Credit scores help creditors determine how likely you are to pay back money they lend.

Its important to remember that everyones financial and credit situation is different, and theres no credit score “magic number” that guarantees better loan rates and terms.

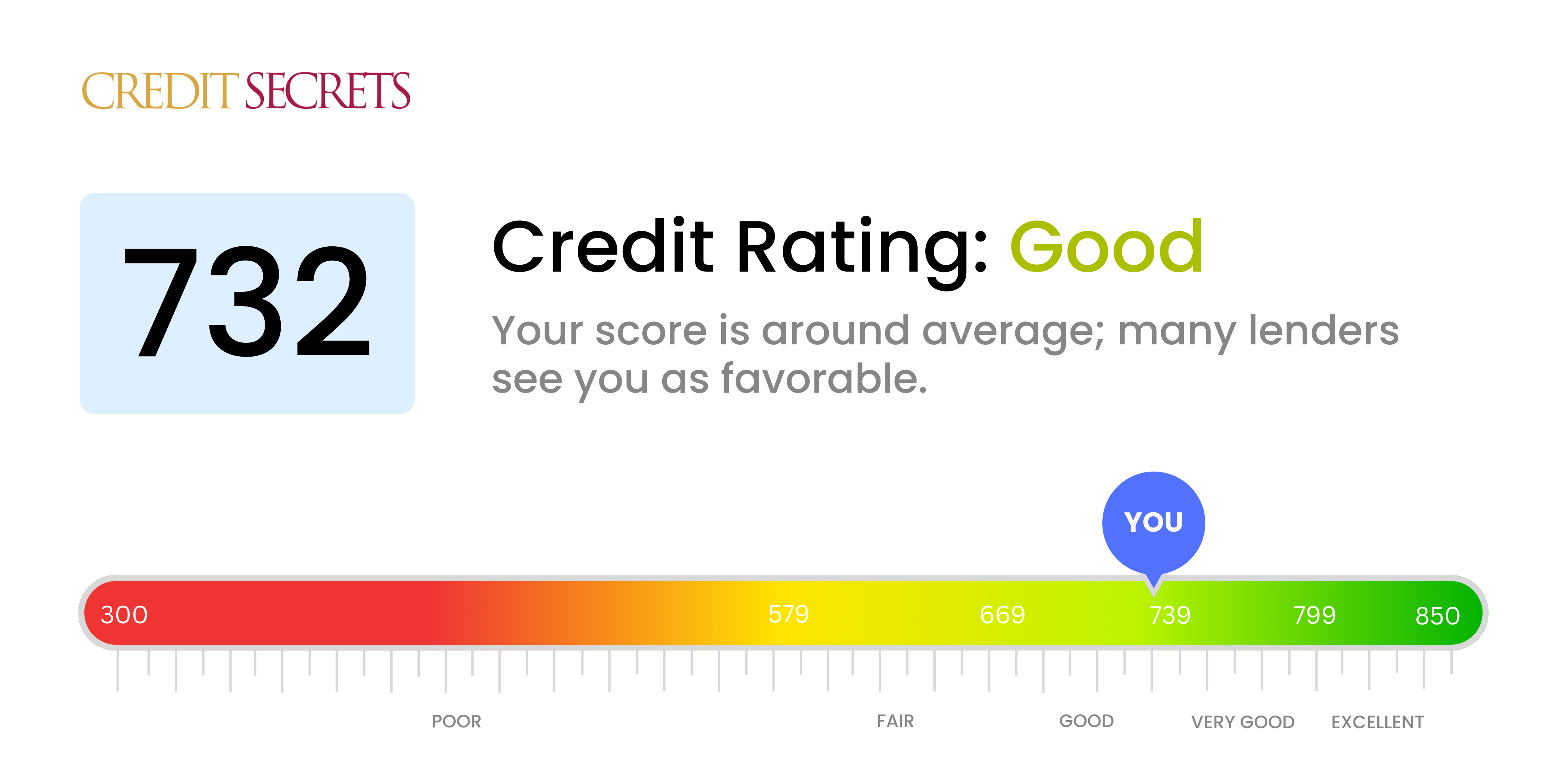

Hey there, fam! If you’re wonderin’, “Is 732 a good credit score?” then you’ve landed in the right spot I’m gonna give it to ya straight—yes, a 732 credit score is considered good by most lenders It’s a solid number that says you’re likely to pay back what ya borrow, and it can open up some pretty sweet opportunities for loans and credit cards. But, lemme tell ya, while it’s good, it ain’t the best, and there’s room to level up for even better deals. Stick with me at [Your Company Name], and we’ll break down what this score really means, why it matters, and how you can push it higher. Let’s dive in!

What Exactly Is a Credit Score, and Where Does 732 Fit?

Before we get too deep, let’s make sure we’re on the same page. A credit score is like a report card for your financial behavior. It’s a number between 300 and 850 that tells lenders how risky it might be to lend ya money. The higher the score, the less risky you look, and the more likely you are to snag approvals and lower interest rates. Easy peasy, right?

Now. here’s how the ranges typically shake out (based on the FICO model which is super common)

- Exceptional: 800-850 (The VIP club—best rates, best terms)

- Very Good: 740-799 (Almost top-tier, awesome perks)

- Good: 670-739 (Solid ground, decent options—where 732 lives)

- Fair: 580-669 (Eh, it’s okay, but approvals get trickier)

- Poor: 300-579 (Tough spot, limited access to credit)

So, at 732, you’re sittin’ comfy in the “good” range. It’s above the U.S. average, which hovers around 714, meanin’ you’re doin’ better than a lotta folks. But, since it’s on the lower end of “good,” you might not get the absolute best interest rates or the fanciest credit card rewards. Still, it’s a game-changer dealio compared to lower scores.

Why Is 732 Considered Good? The Big Picture

Lenders look at a score like 732 and think, “Alright, this person’s got their act together.” It signals you’ve probably got a history of payin’ bills on time and managin’ debt without goin’ overboard. Here’s why that matters:

- Higher Approval Odds: With a 732, you’re more likely to get the green light on credit cards, personal loans, and even mortgages compared to someone with a “fair” or “poor” score.

- Better Terms: You won’t get slapped with sky-high interest rates like lower scores might. It’s not the cheapest money, but it’s way more affordable.

- More Options: A good score unlocks a wider range of financial products. Think cash back cards or loans for big purchases.

But, real talk it ain’t perfect. You’re close to the “very good” range (startin’ at 740), where the real sweet deals kick in. A few points higher could save ya thousands in interest over time especially on somethin’ big like a house loan.

What Can You Get with a 732 Credit Score?

Alright, let’s get down to the nitty gritty—what doors does a 732 score actually open? We’re talkin’ credit cards, loans, mortgages, and more. I’ve been there, checkin’ my score and wonderin’ what I qualify for, so let’s break it down together.

Credit Cards You Can Snag

With a score of 732, you’re in a good spot to apply for some dope credit cards. You might not get the ultra-exclusive ones with insane perks, but there’s plenty of solid choices:

- Cash Back Cards: These are great if you wanna earn a lil’ somethin’ while you spend. Some give ya a flat rate on every purchase, while others boost rewards in categories like groceries or gas.

- 0% Intro APR Cards: Plannin’ a big purchase or need to pay off debt? These cards let ya avoid interest for a set period as long as you make minimum payments. Pretty handy!

- Balance Transfer Cards: Got debt on another card with crazy interest? Transfer it to one of these for a lower rate and manage it better.

- Travel Rewards Cards: If you’re a frequent flyer, you might qualify for cards with perks like airport lounge access or credits for travel fees.

Just a heads up, tho, the most elite cards might still be outta reach until you bump that score up a notch.

Personal Loans with a 732 Score

Need some extra cash for a big expense? A 732 score usually qualifies ya for personal loans. Lenders check more than just your score—like income and debt—but here’s what you might use a loan for:

- Debt Consolidation: Combine multiple debts into one loan with a lower rate. This can save ya on interest and simplify payments.

- Major Purchases: Wanna buy somethin’ big without maxin’ out a credit card? A personal loan lets ya spread payments over time.

- Home Improvements: Fixin’ up the crib? If tappin’ home equity ain’t an option, a personal loan can cover renos.

Most lenders see 732 as a safe bet, so approval odds are in your favor, often with decent rates.

Mortgages and Home Buyin’

Dreamin’ of owning a home? A 732 score puts ya in a strong position to apply for a mortgage, tho lenders also look at stuff like your down payment and debt-to-income ratio. Here’s the types you might consider:

- Conventional Loans: These ain’t government-backed, and with a score in the mid-700s, you got a shot at competitive rates.

- FHA Loans: Need a smaller down payment? You’re well above the minimum score (580 for 3.5% down), so this could work.

- VA or USDA Loans: If you’re a vet or buyin’ in a rural area, these have looser score rules, and you’re golden with 732.

A higher score gets ya better rates, but 732 ain’t gonna hold ya back much here.

Auto Loans for That New Ride

Shoppin’ for a car? The best auto loan rates often go to folks with good or excellent credit, and 732 fits the bill for “good.” You can likely get a decent deal, especially if ya shop around—banks and credit unions might beat dealership rates. Gettin’ preapproved can also give ya leverage to negotiate. If your score’s climbed since your last car loan, refinancin’ could lower your rate too.

What Goes Into Your 732 Credit Score? Breakin’ It Down

Now that we know 732 is good, let’s peek under the hood and see what factors build this number. Understandin’ this helps ya maintain or boost it. Here’s the breakdown for the FICO Score 8 model, which is widely used:

| Factor | Weight | What It Means |

|---|---|---|

| Payment History | 35% | Do ya pay on time? Late payments hurt big time. Lenders love consistency. |

| Amounts Owed (Utilization) | 30% | How much debt ya got vs. your credit limit. Keep it under 30% for best results. |

| Length of Credit History | 15% | How long ya had credit accounts. Older is better—shows experience. |

| Credit Mix | 10% | Variety of credit (cards, loans). Shows ya can handle different types. |

| New Credit | 10% | Recent applications. Too many hard inquiries can ding your score a lil’. |

At 732, you’re likely doin’ well in most of these, but maybe there’s a weak spot or two. For instance, if your credit history is short (average for 700-749 is about 4 years), that could be holdin’ ya back from “very good.”

How to Keep or Improve Your 732 Credit Score

Alright, 732 is good, but why settle? Let’s talk about keepin’ this score solid or pushin’ it into the “very good” or “exceptional” range for them juicy low rates. I’ve been down this road, messin’ up here and there, so trust me when I say these tips work.

1. Pay Bills on Time, Every Time

This is the biggie—35% of your score! Set up auto-payments or reminders on your phone. Even one late payment can knock ya down a peg, and it takes time to recover. If ya got overdue accounts, catch up ASAP.

2. Keep Credit Utilization Low

Don’t max out them cards! Aim to use less than 30% of your total credit limit. So, if ya got $10,000 in limits, keep balances under $3,000. Pay down debt if it’s creepin’ up, and don’t close old cards—keepin’ ‘em open boosts your limit.

3. Don’t Apply for Too Much New Credit

Every time ya apply for a card or loan, it’s a “hard inquiry,” which can drop your score a few points temporarily. Space out applications, and only apply for what ya really need. Checkin’ your own score don’t count, tho, so monitor away!

4. Build a Diverse Credit Mix

Got just credit cards? Maybe consider a small installment loan if it fits your life. Lenders like seein’ ya can juggle different credit types. But don’t take on debt just for the sake of it—be smart.

5. Let Your Credit History Age

Time is your friend here. The longer ya got accounts open, the better. Don’t close old cards even if ya don’t use ‘em much. That history adds up and helps your score grow.

6. Check Your Credit Report for Errors

Mistakes happen, y’all. Pull your credit report for free (there’s ways to do this online) and look for weird stuff like accounts that ain’t yours or late payments ya didn’t make. Dispute errors with the credit bureaus to get ‘em fixed.

Bonus Tip: Be Patient, It Ain’t Overnight

Climbin’ from 732 to, say, 750 or 800 takes time. Stick to good habits, and you’ll see progress. I remember stressin’ over a small dip once, but steady moves got me back on track.

Benefits of Pushin’ Past 732

Why bother improvin’ if 732 is already good? ‘Cause the perks get sweeter, fam! Here’s what ya gain by hittin’ “very good” (740-799) or “exceptional” (800-850):

- Lower Interest Rates: Save big bucks on loans. Even a 1% difference on a mortgage adds up to thousands over years.

- Better Card Rewards: Access elite cards with crazy cash back, travel perks, or sign-up bonuses.

- Easier Approvals: Lenders roll out the red carpet. Less hassle, more “yes” answers.

- Negotiatin’ Power: Higher scores mean you can haggle for better terms on loans or cards.

I’ve seen pals with scores in the 800s get deals I could only dream of at 732. It’s worth the grind to get there.

Common Pitfalls to Avoid with a 732 Score

Even with a good score, ya can slip up if you’re not careful. Here’s some traps I’ve dodged (or fallen into, oops):

- Missin’ Payments: Life gets busy, but even one late payment can hurt. Automate if ya gotta.

- Runnin’ Up Debt: Easy to overspend with a good score givin’ ya access. Keep that utilization low.

- Applyin’ for Too Much: Every application dings ya a bit. Don’t go wild applyin’ for every card out there.

- Ignorin’ Your Report: Errors or fraud can mess ya up. Check your report now and then.

Stay sharp, and that 732 won’t drop into “fair” territory, which is a headache to climb outta.

Real Talk: My Take on a 732 Credit Score

Look, I gotta be real with ya—havin’ a 732 score is somethin’ to be proud of. It shows you’re managin’ your money better than a lotta folks out there. But, in my book, “good” is just the startin’ line. At [Your Company Name], we’re all about pushin’ boundaries, and I’m rootin’ for ya to aim higher. Imagine the freedom of snaggin’ the lowest rates or gettin’ approved for anything ya need without battin’ an eye. That’s the goal!

When I was hoverin’ around this range, I focused hard on payin’ off a lil’ debt and keepin’ my cards in check. Took a few months, but seein’ my score creep up felt like winnin’ a small lottery. You got this too—just take it step by step.

Next Steps: What Should You Do Now?

So, you’ve got a 732 credit score, and ya know it’s good but not the peak. Here’s your action plan to keep rollin’ or level up:

- Check Your Score and Report: Make sure it’s accurate. Look for free ways to peek at your TransUnion or Equifax reports.

- Set a Goal: Wanna hit 740 for “very good”? Or shoot for 800? Write it down.

- Tighten Up Habits: Pay on time, lower debt, don’t over-apply. You know the drill by now.

- Monitor Progress: Keep an eye on changes. Some services send alerts if somethin’s off.

- Celebrate Wins: Even a small jump to 735 is progress. Pat yourself on the back!

If ya got specific questions—like what card to apply for or how a loan might affect ya—drop us a line at [Your Company Name]. We’re here to help ya navigate this financial jungle.

Wrappin’ It Up: 732 Is Good, But You’re Just Gettin’ Started

There ya have it, peeps—a deep dive into whether 732 is a good credit score. Spoiler: it is, and it sets ya up nicely for a range of financial moves, from credit cards with rewards to mortgages for your dream pad. But don’t get too comfy; with a lil’ effort, pushin’ past 732 can unlock even better rates and opportunities. Stick to them good habits—pay on time, keep debt low, check your report—and you’ll be cruisin’ to the top tiers in no time.

We at [Your Company Name] are cheerin’ ya on every step of the way. Got thoughts or need a hand with your next financial play? Hit us up in the comments or reach out. Let’s keep buildin’ that credit muscle together, alright? Keep grindin’!

What are credit score ranges and what is a good credit score?

Credit score ranges vary depending on the scoring model. Higher credit scores mean you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a request for credit. Most credit score ranges are similar to the following:

- 800 to 850: Excellent Credit Score Individuals in this range are considered to be low-risk borrowers. They may have an easier time securing a loan than borrowers with lower scores.

- 740 to 799: Very Good Credit Score Individuals in this range have demonstrated a history of positive credit behavior and may have an easier time being approved for additional credit.

- 670 to 739: Good Credit Score Lenders generally view those with credit scores of 670 and up as acceptable or lower-risk borrowers.

- 580 to 669: Fair Credit Score Individuals in this category are often considered “subprime” borrowers. Lenders may consider them higher-risk, and they may have trouble qualifying for new credit.

- 300 to 579: Poor Credit Score Individuals in this range often have difficulty being approved for new credit. If you find yourself in the poor category, its likely youll need to take steps to improve your credit scores before you can secure any new credit.

Lenders use credit scores along with a variety of other types of information — such as information you provide on the credit application (for example: income, how long you have lived at your residence, and other banking relationships you may have) in their loan evaluation process. Different lenders have different criteria when it comes to granting credit. That means the credit scores they accept may vary depending on their criteria.

Score providers, such as the three nationwide credit reporting agencies (NCRAs)—Equifax®, Experian® and TransUnion®—and companies like FICO® use different types of credit scoring models and may use different information to calculate credit scores. Therefore, credit scores may be different from each other. Not all creditors and lenders report to all credit score providers.

What is the average credit score?

As of January 2024 the average credit score in the United States was 701. While this is the average credit score, it falls in the Fair Range.

Is 732 A Good Credit Score? – CreditGuide360.com

FAQ

What can I do with a 732 credit score?

Credit Rating: 732 is a good credit score. Borrowing Options: Most borrowing options are available, and the terms are likely to be attractive. For example, you might be able to qualify for the best credit cards and some of the best personal loans.

Is 732 a good credit score to buy a car?

According to Experian, a target credit score of 661 or above should get you a new-car loan with an annual percentage rate of around 6.70% or better, or a …Jun 9, 2025

What is a respectable credit score?

For a score with a range of 300 to 850, a credit score of 670 to 739 is considered good. Credit scores of 740 and above are very good while 800 and higher are excellent. For credit scores that range from 300 to 850, a credit score in the mid to high 600s or above is generally considered good.

Can I buy a house with a 732 credit score?

Yes, a credit score of 732 is generally considered good and should allow you to buy a house. Lenders typically look for scores of 620 or higher for conventional loans, and your score comfortably exceeds this minimum.

Is a credit score of 732 considered good?

A FICO ® Score of 732 falls within the Good range (scores from 670 to 739). The average U.S. FICO ® Score, 714, also falls within the Good range.

Can I get a personal loan with a 732 credit score?

With a credit score of 732, you can get approved for a personal loan by most lenders. However, your interest rate may be higher than someone with a ‘Very Good’ or ‘Excellent’ credit score. It’s best to avoid payday loans and high-interest personal loans as they can create long-term debt problems and contribute to a further decline in credit score.

Is a 732 FICO ® score good?

A 732 FICO ® Score is considered Good, but by raising it into the Very Good range, you could qualify for lower interest rates and better borrowing terms. To get started, check your free credit report from Experian and find out the specific factors that impact your score the most.