“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

Hey there, fam! If you’re sittin’ there wonderin’, “Can I get a car loan with a 705 credit score?” I’m here to tell ya straight up—yep, you sure can! At 705, you’re in a pretty darn good spot to snag that loan and roll outta the dealership with your dream ride. But, hold up, there’s more to it than just a “yes.” We’re gonna dive deep into what that score means, what kinda deal you might get, and how to make sure you ain’t payin’ through the nose on interest. Stick with me, and let’s figure this out together!

What’s the Deal with a 705 Credit Score? Is It Any Good?

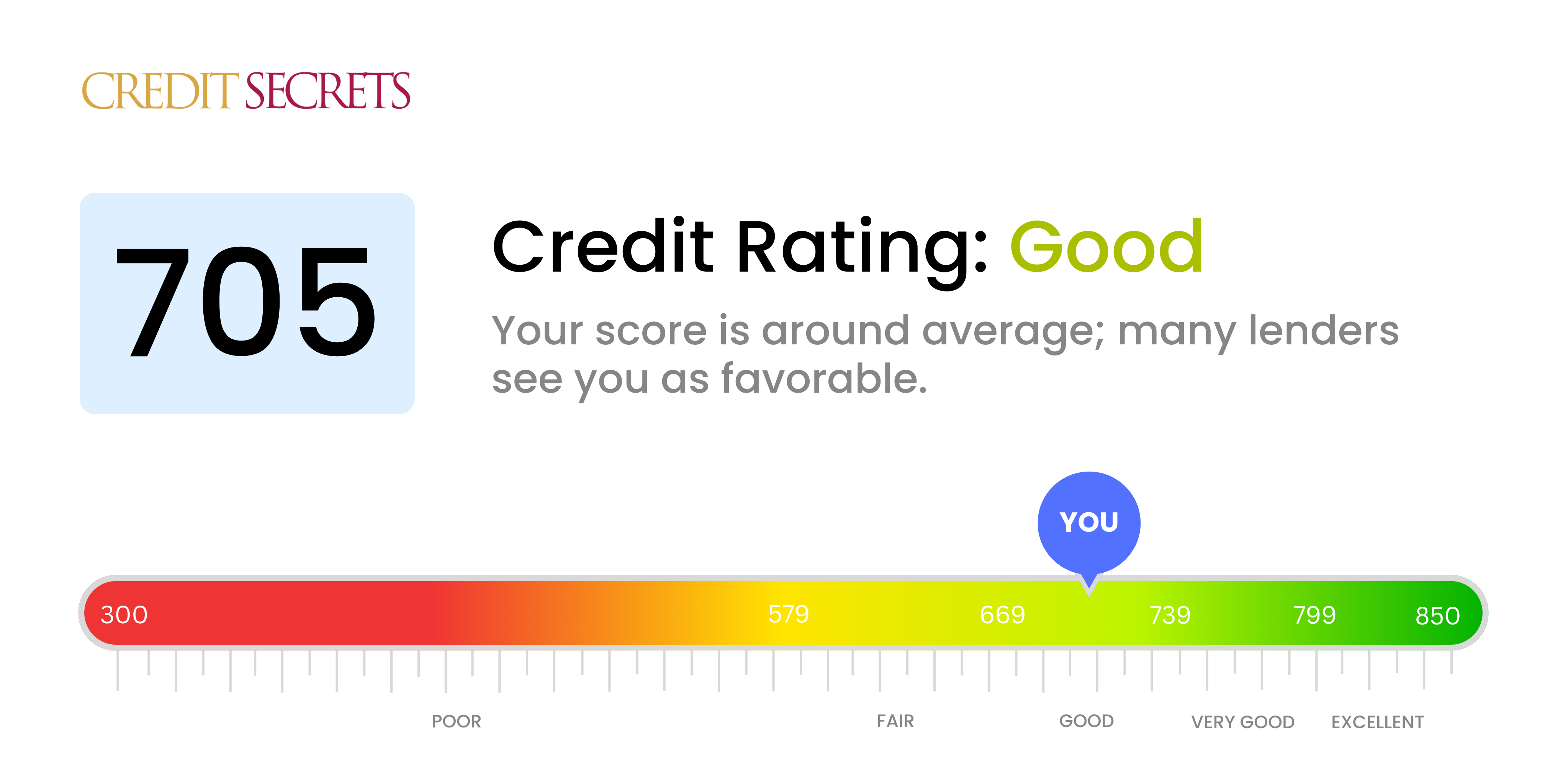

First things first, let’s chat about what a 705 credit score really means. In the big ol’ world of credit, scores run from 300 to 850, and where you land tells lenders if you’re a safe bet or a risky gamble. A 705? That’s sittin’ pretty in the “good” range, usually pegged between 670 and 739 on most scales like FICO or VantageScore. It ain’t “excellent” (that’s more like 750 and up), but it’s way better than average, and it shows you’ve been handlin’ your bills and debts with some serious responsibility.

To put it in perspective the typical FICO score for folks in the U.S. hovers around 715 lately and another common score, VantageScore, averages about 703. So, with a 705, you’re right around the middle of the pack—maybe even a smidge above. That’s a solid place to be! Lenders look at this and think, “Alright, this person prolly pays on time, we can work with ‘em.” But, just ‘cause it’s good don’t mean you’ll get the absolute best rates out there. We’ll get to that in a sec.

Here’s a quick lil’ breakdown of where 705 stands in the credit score game:

- Excellent (750-850): Top-tier, best rates, lenders love ya.

- Good (670-749): That’s us at 705! Decent rates, approval likely.

- Fair (580-669): A bit iffy, higher rates, approval trickier.

- Poor (300-579): Tough luck, crazy high rates if you even get approved.

So, pat yourself on the back—705 means you ain’t in no financial dumpster fire You’re lookin’ respectable to most banks and lenders

Can You Actually Get That Car Loan with a 705 Score?

Alright, let’s cut to the chase on the big question—can ya get that car loan? Abso-frickin’-lutely. With a 705 credit score, you’re well above the minimum needed for most auto loans. See, a lotta used car loans go to folks with scores as low as 675, and new car loans often start around 600 or so for basic approval. At 705, you’re clear of those baselines by a country mile. Most lenders will give you a thumbs-up, assumin’ your income and other stuff checks out (more on that later)

Now, what kinda loan are we talkin’? Here’s the skinny on what you might expect for both new and used cars with a score like yours:

- New Car Loan: You’re likely lookin’ at an interest rate (APR) around 6.7% to 7%. Not the cheapest out there (folks with 750+ might snag 5% or lower), but it ain’t gonna break the bank neither.

- Used Car Loan: Rates tend to be higher here, prob’ly around 9% to 9.7%. Again, not the worst—people with lower scores pay double digits easy—but not the cream of the crop.

To give ya a real feel for it, let’s say you’re borrowin’ $30,000 for a new whip over 60 months (that’s 5 years). At a 7% APR, your monthly payment would be about $594, and you’d shell out around $5,640 in interest over the life of the loan. Not terrible, but if your score was higher, you’d save a chunk. For a used car at 9.5% APR on the same amount and term, you’re payin’ closer to $630 a month and over $7,800 in interest. Ouch, that stings a bit more.

Here’s a handy table to show how rates might look based on credit score ranges for a 60-month loan term:

| Credit Score Range | New Car APR (Approx.) | Used Car APR (Approx.) |

|---|---|---|

| 781-850 (Superprime) | 5.5% – 6% | 7.5% – 8% |

| 661-780 (Prime) | 6.7% – 7% | 9% – 9.7% |

| 601-660 (Nonprime) | 9.5% – 10% | 14% – 15% |

| 501-600 (Subprime) | 12% – 13% | 18% – 19% |

As you can see, at 705, you’re in the “Prime” zone, gettin’ rates that are decent but not VIP status. Still, approval? That’s almost a given unless somethin’ else in your finances is a hot mess.

What Else Matters Besides My 705 Score?

Now, don’t go thinkin’ that a 705 credit score is the only thang lenders are peepin’ at. Nah, they’re nosy as heck and wanna know the full picture before handin’ over that cash for your car. Here’s some other stuff that can make or break your loan deal:

- Debt-to-Income Ratio (DTI): This is a fancy way of sayin’, “How much of your paycheck is already goin’ to bills?” Lenders like to see a DTI under 40%. So, if you make $5,000 a month, your debts—think car payments, rent, credit card minimums—shouldn’t be more than $2,000. For folks with scores in the 640-720 range like us, some lenders might cap ya at a 50% DTI, but lower is always better. If your DTI is high, they might approve a smaller loan or jack up the rate.

- Down Payment: How much cash you plunkin’ down upfront? A bigger down payment (like 20% or more) shows you’re serious and lowers the amount you gotta borrow, which can snag ya a better rate. If you’re only puttin’ down 5%, expect a stricter look at your app.

- Loan Term: How long ya wanna take to pay it off? Longer terms (like 60 or 72 months) mean smaller monthly payments but more interest overall. Shorter terms (36 months) cost less in the long run but hit harder each month. With a 705, you can often get up to 60 months no prob.

- Your Income: Lenders wanna know you can afford the payments. For a score between 640 and 720, they might let your monthly payment be up to 20% of your gross monthly income. Make $4,000 a month? That’s an $800 car payment max, roughly. Disposable income counts too—if you got plenty left after bills, they’re more chill.

- Who’s Lendin’: Not all banks or dealerships are the same, ya know. Some got tighter rules, some are more lax. Interest rates can swing wild depending on who you pick, even with the same score. Shoppin’ around ain’t just smart—it’s a must.

So, yeah, a 705 score gets your foot in the door, but if your DTI is outta whack or you ain’t got much to put down, you might not get the sweetest deal. Keep them other ducks in a row, my friend.

What If I Mess Up? The Risk of a Late Payment

Real talk—keepin’ that 705 score safe is key ‘cause one lil’ slip can cause a big ol’ kerfuffle. If you miss a payment by 30 days or more, your score could tank hard—like, drop 100 points hard. That’s enough to push ya outta the “good” range and into “fair” territory, where rates suck and approval gets dicey. Missin’ a payment by a couple days ain’t the end of the world, but don’t make a habit of it. Set up auto-payments or reminders on your phone so you don’t gotta stress about forgettin’. Trust me, I’ve been there with a late bill or two, and it’s a headache you don’t want.

How to Boost Your Chances or Get a Better Deal

Alright, so you got a 705, and you can get a car loan. But why settle for “okay” when you can aim for “awesome”? Here’s some tips from ya boy to either bump up that score or sweeten the loan terms:

- Shop Around Like Crazy: Don’t just take the first offer from the dealership. Hit up banks, credit unions, online lenders—heck, ask your grandma if she knows a guy. Rates can vary big time, and since checkin’ multiple lenders in a short window (like 2 weeks) usually counts as one inquiry on your credit, it don’t hurt to compare.

- Bump That Score Up: Even a lil’ jump to, say, 720 can shave off some interest. Pay down credit card balances to keep your usage under 30% (like, if your limit is $10,000, don’t owe more than $3,000). Make sure every bill’s on time. Don’t close old accounts neither—keep ‘em open to show a long credit history.

- Save for a Fat Down Payment: If you can scrape together 20% or more to put down, lenders see you as less risky. It cuts the loan amount too, savin’ you on interest. Start sockin’ away cash now if ya can.

- Go for a Shorter Term: I know, higher monthly payments sound scary, but a 36-month term over a 60-month one means you pay way less interest overall. If your budget can swing it, do it.

- Get Pre-Approved: Walk into that dealership with a pre-approval letter from a lender. It’s like showin’ up with a loaded wallet—they know you’re serious, and it gives ya bargainin’ power. Plus, it speeds up the whole process.

- Consider Used vs. New: Used cars often got higher rates, but the sticker price is lower, so ya might save overall. Weigh it out—sometimes a gently used ride with a decent rate beats a pricey new one.

I’ve seen buddies with scores like ours get stuck with meh rates ‘cause they didn’t shop around or prep right. Don’t be that guy. Put in the legwork, and you might surprise yourself with a better deal than ya thought.

Other Loans You Might Qualify For with a 705

While we’re on the car loan train, lemme toss in a quick word about other financin’ you could snag with a 705 score. You’re in a good spot for personal loans too—most need a minimum of 610-640, and you’re way past that, likely gettin’ an APR around 15% or so. Mortgages? You’re golden above the 620 mark for conventional loans or 580 for FHA ones, though top rates might slip through your fingers. Even student loans are a breeze, since a lotta those go to folks under 740. So, your 705 ain’t just good for cars—it opens doors all over.

Wrappin’ It Up: You Got This!

So, can you get a car loan with a 705 credit score? Bet your bottom dollar you can! It’s a solid score that puts ya in the “good” category, and most lenders will welcome ya with open arms, assumin’ your income and debts line up right. You might not get the rock-bottom rates reserved for the 750+ crowd, but with expected APRs around 6.7-7% for new cars and 9-9.7% for used, you’re still in a decent spot. Factor in stuff like your DTI, down payment, and who you borrow from, and you can tweak the deal in your favor.

Me and the crew at our lil’ blog here wanna see ya drivin’ off happy, so take them tips to heart—shop around, boost that score if ya can, and don’t skimp on the down payment. Got questions or wanna share how it went? Drop a comment below. We’re all ears! Now go get that car, fam—you’ve earned it!

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

- • Auto Loans

- • Personal loans

Calendar Icon 4 Years of experience Rebecca Betterton, a Certified Financial Education Instructor℠, is a writer for Bankrate who has been reporting on auto loans since 2021.

- • Auto loans

- • Personal loans

Calendar Icon 8 Years of personal finance experience Kellye Guinan is an editor and writer with over seven years of experience in personal finance.

- • Social Impact Entrepreneurship

- • Economic & Public Policy

Emmanuel Nyame is a member of Bankrate’s Financial Review Board and the CEO of Twelvenets, where he leads campaigns that drive community and economic growth.

At Bankrate, we take the accuracy of our content seriously.

“Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

Bankrate is always editorially independent. While we adhere to strict , this post may contain references to products from our partners. Heres an explanation for . Our is to ensure everything we publish is objective, accurate and trustworthy. Bankrate logo

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our loans reporters and editors focus on the points consumers care about most — the different types of lending options, the best rates, the best lenders, how to pay off debt and more — so you can feel confident when investing your money. Bankrate logo

Bankrate follows a strict editorial policy, so you can trust that we’re putting your interests first. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions.

We value your trust. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. Our editors and reporters thoroughly fact-check editorial content to ensure the information you’re reading is accurate. We maintain a firewall between our advertisers and our editorial team. Our editorial team does not receive direct compensation from our advertisers.

Bankrate’s editorial team writes on behalf of YOU – the reader. Our goal is to give you the best advice to help you make smart personal finance decisions. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Our editorial team receives no direct compensation from advertisers, and our content is thoroughly fact-checked to ensure accuracy. So, whether you’re reading an article or a review, you can trust that you’re getting credible and dependable information. Bankrate logo

Auto loan interest rates by credit score

When you apply for a car loan, the average auto loan rate you receive will primarily be based on your credit score.

| Credit score | New cars | Used cars |

|---|---|---|

| Super prime (781-850) | 5.18% | 6.82% |

| Prime (661-780) | 6.70% | 9.06% |

| Nonprime (601-660) | 9.83% | 13.74% |

| Subprime (501-600) | 13.22% | 18.99% |

| Deep subprime (300-500) | 15.81% | 21.58% |

Borrowers in the super prime range are more likely to qualify for auto loans with below-average rates. That said, there are bad credit auto loans available, but the cost of financing a car may be significantly higher. Learn more:

Can I Get A Car Loan With 630 Credit Score? – CreditGuide360.com

FAQ

Is 705 a good credit score for a car loan?

… you’re solidly in the good range and will likely qualify for a wide variety of credit cards, loans and other financial products but might not get the best …Mar 10, 2025

Is 700 a good credit score to buy a car?

What auto loan interest rate can I get with a 750 credit score?

| Credit Score | New Car Loan | Used Car Loan |

|---|---|---|

| 750 or higher | 11.87% | 12.12% |

| 700-749 | 11.18% | 11.43% |

| 600-699 | 17.47% | 17.72% |

| 451-599 | 20.17% | 20.42% |

What credit score do you need to buy a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn)

Is 705 a good credit score?

A 705 credit score is a good credit score. The good-credit range includes scores of 700 to 749, while an excellent credit score is 750 to 850, and people with scores this high are in a good position to qualify for the best possible mortgages, auto loans and credit cards, among other things. Credit Rating: 705 is a good credit score.

Can you get a car loan with a 705 credit score?

If you’re planning big-ticket purchases or a balance transfer that will take months to pay down, compare credit cards with 0% introductory APR offers. You should be able to get approved for a decent car loan with a 705 credit score, considering that more than 60% of all auto loans go to people with credit scores below 740.

Can you get a student loan with a 705 credit score?

Student loans are some of the easiest loans to get with a 705 credit score, seeing as more than 70% of them are given to applicants with a credit score below 740. A new degree may also make it easier to repay the loan if it leads to more income.

How much is a 750 credit score for a car loan?

A buyer with a 750 FICO score may qualify for $85000 at 96 months, but a 650 score may be maxed out at $35000 for 72 months. Move the time and money squares full to the right to view your max payment in the credit score auto loan calculator. How much does interest rate affect my monthly payment?

What credit score do you need for a car loan?

Most used auto loans go to borrowers with minimum credit scores of at least 675. For new auto loans, most borrowers have scores of around 730. The minimum credit score needed for a new car may be around 600, but those with excellent credit often get lower rates and lower monthly payments.

How does my financial information affect my car loan details?

It can be confusing to know how your financial information affects your loan details. Lenders use credit scores, or FICO scores, to determine what kind of car loan they can give you. Credit scores are numbers based on credit scoring models that auto lenders use during the financing process.