According to the Government of Canada, a credit score is a 3-digit number that represents how likely a credit bureau thinks you are to pay your bills on time.1 It can be an important part of building your financial confidence and security.1 For example, building a good credit score could help you get approved for loans and larger purchases, like a home.1 You may also be able to access more competitive interest rates.1

There are two main credit bureaus in Canada: Equifax and TransUnion.1 These are private companies that keep track of how you use your credit.1 They assess public records and information from lenders like banks, collection agencies and credit card issuers to determine your credit score.1

Your credit score is one of the most important factors lenders consider when reviewing your application for credit cards, loans, mortgages and more. So what does a credit score of 744 mean? Is a 744 credit score considered good or bad? Let’s take a detailed look.

What is a Credit Score?

A credit score is a three-digit number calculated based on information in your credit report, which shows your history of borrowing money and paying bills The most commonly used credit scores range from 300 to 850 The higher your score, the lower the risk you pose to lenders.

There are a few different credit scoring models, but FICO scores and VantageScores are the most widely used. FICO scores make up 90% of lending decisions. This article focuses on FICO scores.

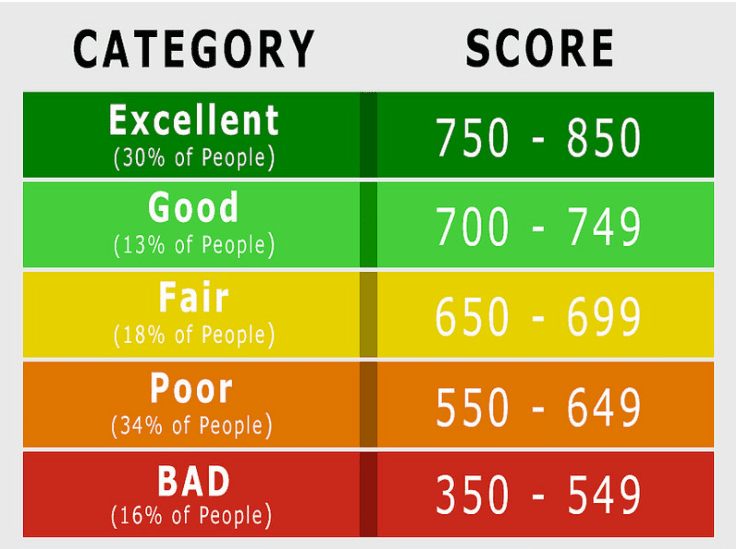

Credit Score Ranges

FICO puts credit scores into the following ranges

- 800-850: Exceptional

- 740-799: Very Good

- 670-739: Good

- 580-669: Fair

- 300-579: Poor

So where does 744 fall? With a score of 744, you’re safely in the ‘Very Good’ credit score range

Is a 744 Credit Score Good or Bad?

A FICO score of 744 is considered very good. It’s well above the average credit score of 710. If your score is 744, lenders will likely offer you their best rates and terms.

Here’s a breakdown of how a 744 credit score compares:

- A 744 credit score is 74 points higher than the average FICO score of 710.

- A 744 credit score is in the top 25% of all scores, better than 75% of consumers.

- A 744 credit score is well above the “good” credit threshold of 670.

So a credit score of 744 is undoubtedly good. But is there still room for improvement? Let’s look at some pros and cons of a 744 credit score.

The Pros of a 744 Credit Score

A 744 FICO score offers many benefits, including:

-

Lower Interest Rates: With a Very Good score, you’ll qualify for the best interest rates from most lenders, saving substantially on credit costs over time.

-

Better Loan Terms: In addition to lower rates, you can land other perks like waived fees, low or no down payment requirements, and shorter loan terms.

-

Higher Credit Limits: Credit card companies will be more generous with credit limits since your 744 score proves you can handle more available credit responsibly.

-

Easier Approval: There’s very little risk of denial with a 744 score. You’ll sail through most approval processes.

-

More Bargaining Power: You can negotiate even better terms by highlighting your excellent score during the application process.

-

Robust Credit Profile: Your long and well-managed credit history is a valuable asset you’ve built.

The Cons of a 744 Credit Score

While a 744 credit score is considered Very Good, there are a few potential downsides:

-

Complacency: Once your score is Very Good, it can be tempting to stop monitoring your credit or make riskier financing decisions. But scores fluctuate, so ongoing diligence is key.

-

Higher Fraud Risk: Identity thieves target consumers with excellent credit histories. Stay vigilant and consider credit monitoring or identity theft protection services.

-

Higher Credit Limits: Don’t take on more available credit than you need just because you qualify. Unused credit limits still factor into your credit utilization ratio.

-

Pre-approvals: Lenders may flood your mailbox with tempting offers thanks to your strong score. But pre-approved doesn’t always mean approved, so submit full applications with caution.

-

Score Plateau: Reaching the top 25% gets challenging. Raising your score from Very Good to Exceptional requires consistency and precision.

How to Raise Your Credit Score from 744 to 800+

Here are some tips to improve an already very good 744 score to the Exceptional 800+ range:

-

Lower Credit Utilization below 30%, ideally 10%, on revolving accounts like credit cards. This has a major impact on your score.

-

Pay Bills Early to avoid any risk of late payments. Set payment reminders if needed.

-

Limit Hard Inquiries from applying for new credit often. Comparison shop for loans within a focused time period.

-

Monitor Your Credit for any inaccuracies or suspicious activity using your free annual credit reports.

-

Increase Credit History Length by keeping your oldest accounts open. Long credit history boosts your score.

-

Diversify Credit Mix with a balance of installment loan and revolving accounts, avoiding red flags like maxing out limits.

-

Dispute Any Errors in your credit reports to maximize your score. Even minor mistakes can be fixed.

-

Practice the 1% Rule by keeping revolving balances at less than 1% of the credit limit on each card.

The Takeaway on 744 Credit Scores

A FICO score of 744 firmly places you in the Very Good credit range. Lenders will offer you excellent rates and terms reserved for the top 25% of borrowers. While no score is perfect, a 744 credit score provides significant financial opportunities and advantages.

With responsible credit management, you can achieve an Exceptional credit score over 800. But even at 744, you’re already leaps and bounds ahead of most consumers when it comes to creditworthiness.

Table Summary of 744 Credit Score

| Credit Score Range | 744 Score Position |

|---|---|

| 300-850 Overall Range | Very Good (Top 25%) |

| Exceptional: 800-850 | 26 Points From Range |

| Very Good: 740-799 | Solidly Within Range |

| Good: 670-739 | 74 Points Above Range |

| Fair: 580-669 | 164 Points Above Range |

| Poor: 300-579 | 364 Points Above Range |

So if you’re wondering, “Is a 744 credit score good or bad?”, the answer is clear. A 744 credit score is very good and offers you significant advantages for borrowing money responsibly. Monitor your credit, practice excellent credit habits, and your 744 score will easily climb even higher over time.

What’s a good credit score?

It depends on the scoring model used. In Canada, according to Equifax, a good credit score is usually between 660 to 724. If your credit score is between 725 to 759 it’s likely to be considered very good. A credit score of 760 and above is generally considered to be an excellent credit score.2 The credit score range is anywhere between 300 to 900.2 The higher your score, the better your credit rating.2

Your credit score helps lenders to assess your credit capacity.1 The higher your score, the more likely you are to get approved for loans and credit.1 It may also be checked when applying to rent a property or when applying for certain jobs.1 However, everyone’s financial situation is different and your credit score will change over time based on your credit history and the amount of debt you owe.

According to the Government of Canada, your credit history is a record of your debt repayments on credit cards, loans and lines of credit.1 Your credit history helps determine your credit score.1 That’s why it’s important to be smart about how you use and manage your credit.

How to check your credit score

The federal government says it’s important to check your credit score so you know where you stand financially. Both Equifax and TransUnion provide credit scores for a fee.

Check your credit score

You can check your credit score with the TransUnion CreditView® Dashboard in the TD app. Checking in the TD app will not affect your credit score in any way. Learn more

How to increase your credit score

The Government of Canada states that your credit score will increase if you manage credit responsibly and decrease if you have trouble managing it.1

Here are some tips from the Government of Canada to help improve your credit score:

- Establish credit history by getting a credit card and using it for things you would buy anyway.3 You can access and view your credit history by obtaining a credit report through a credit bureau. You’re able to request a free copy of your credit report every 12 months from Equifax and Transunion with no impact on your credit score. You can order the report by phone, email and online.4

- Try to pay your bills on time and in-full in order to maintain a good repayment history and improve your score.3 If you can’t pay the full bill, aim to meet the minimum payment.3 Contact your lender if you think you’ll have trouble paying your bill.3

- Don’t apply for credit or switch credit cards too often.3 Make an effort to keep your total debt in check and don’t let small balances add up.3

And here’s a tip from us: Try to get the most out of your credit card and stay on track when it comes to paying it off. One way to help stay on top of your payments could be to set up pre-authorized payments from your bank account to your credit card.

Check out this video that breaks it down in simple terms:

How to maintain your credit score

One way to maintain your credit score is to try to stay within the 35% ratio mentioned above.3 Add up all your credit limits and multiply the total by 35%. That’s the amount you should ideally try to avoid exceeding when borrowing money or using credit.3

Avoid applying for too much credit

There are some downsides to having too many credits cards. You may be tempted to use them and spend more.

According to the federal government, you should also avoid applying for too many loans, having too many credit cards and requesting too many credit checks in a short timeframe.3 That’s because it could negatively impact your credit score too.3

Stay within your credit limit

Avoid going over your credit limit. If you go over your limit, it could lower your credit score.3

Overall, having a good credit score can help boost your financial confidence and security. So, congrats on taking the first step by learning how credit scores work and how you can improve yours!

-

How to make a budget [Video]

Learning how to make and follow a budget is an important step on your journey towards financial confidence.

-

Tips to reduce your spending

Check out our advice for cutting down on your spending to help you save, even during challenging times.

-

Check your credit score

You can check your credit score with the TransUnion CreditView® Dashboard in the TD app. Checking in the TD app will not affect your credit score in any way. Get a free check of your credit score. Learn more

-

TD Debt Consolidation Calculator

Find your debt-freedom date and quickly calculate how soon you can be debt-free. TD Debt Consolidation Calculator Calculate

-

Looking for a credit card?

Use our Credit Card Selector Tool to help you choose. Looking for a credit card? Explore your options

Is A Credit Score Of 744 Good? – CreditGuide360.com

FAQ

What can a 744 credit score get you?

| Type of Credit | Do You Qualify? |

|---|---|

| Auto Loan | YES |

| No Annual Fee Credit Card | YES |

| Credit Card with Rewards | YES |

| 0% Intro APR Credit Card | MAYBE |

How common is a 750 credit score?

Is 744 a good credit score to buy a car?

… ScoreΘ falls within a range, from 740 to 799, that may be considered Very Good. A 744 FICO® Score is above the average credit score

What credit score is needed for a $250000 house?

What credit score do I need to buy a $250,000 house? You can buy a $250,000 house with a wide range of credit scores, from as low as 500 to as high as 800+.Mar 19, 2025