With news reports of home prices seemingly always on the rise and interest rates sticking stubbornly at elevated levels, it can be easy to see the challenge to buying a house in the current market. But you’ve landed here because you’re asking yourself, “How much house can I afford on a $120K salary?” We have a stat that should be encouraging:

According to data for 2023 from the U.S. Census Bureau, the median household income is $80,610. Everyone has a different lifestyle, and you could always use more money. But if you’re making $120,000, you can feel pretty good about your situation and the resources you might have to buy a house with the right budgeting practices.

Speaking hypothetically, your budget range for a home on a $120,000 salary is $285,088 – $440,771. This is based on buying in Atlanta with $25,000 saved and $1,225 in monthly debt (national average) with a credit score of at least 720. The interest rate is 7.125%. Assumed taxes and a $67 monthly homeowners insurance premium were included.

Every situation is different. So much goes into determining what you can afford that the only right answer can be provided by a Home Loan Expert when you apply and a lender goes deep on your financial situation. Without doing that, the answer is always, “It depends.” This is both true and deeply unsatisfying.

We’ll get more into this later, but for now, know that any decent mortgage calculator is going to give highly variable results based on the following factors:

You can put in your own numbers with our Home Affordability Calculator to get an idea of how much buying power you have prior to diving into the mortgage process.

Buying a house is one of the most exciting yet daunting experiences for many people With home prices and mortgage rates fluctuating, it can be challenging to determine how much house you can realistically afford. If you make around $120,000 per year, you may be wondering – how much house can I buy with a $120k salary?

Factors That Determine How Much House You Can Buy

Your income is certainly a major factor but not the only one that shapes your homebuying power. Here are some key considerations

-

Down payment amount The recommended 20% down payment gives you advantages like avoiding PMI and getting better rates, but lower down payments are possible too The more you put down upfront, the less you’ll need to borrow

-

Debt-to-income ratio: Lenders want to see that your total monthly debt payments, including the future mortgage payment, are less than 36% of your gross monthly income.

-

Credit score: The higher your score, the better mortgage rate you can likely qualify for.

-

Location: Prices vary greatly between cities and regions. The same budget stretches further in lower-cost areas.

-

Type of mortgage: Options like FHA and VA loans have more flexible credit and down payment requirements. Conventional loans offer better rates with 20% down.

The 28/36 Affordability Rule

A popular guideline is the 28/36 rule, which says to limit:

- Monthly housing costs to 28% of your gross monthly income

- Total monthly debt payments to 36% of your gross monthly income

So if you make $120,000 annually, your monthly gross income is $10,000. Following the 28/36 rule, your maximum monthly housing payment would be $2,800.

Estimating Your Affordable Home Price

As an example, let’s assume you take out a 30-year fixed conventional mortgage with a 20% down payment and current interest rate around 7%.

Plugging these numbers into a mortgage calculator shows that with a $2,800 payment cap, you could borrow around $470,000. So if you have 20% down, or $94,000, your total affordable home budget would be approximately $564,000 on a salary of $120,000.

This gives you some room between the $2,800 figure and your actual resulting payment of around $2,500. That leaves space for property taxes, insurance, and other ownership costs before hitting your limit.

Of course, this varies based on your unique financial specifics like savings, debts, credit score, and desired location. Speaking with a lender to get preapproved will give you a more accurate picture of your price range.

Tips for Sticking to Your Budget

While a $120k income may qualify you for more expensive homes in some areas, staying conservative is wise, especially when rates are high. Here are some tips:

- Get preapproved for a mortgage first so you know your limit

- Make a sizable down payment if possible to reduce borrowing

- Pick a home well below your max budget for financial security

- Select a lower-priced region if you have flexibility to relocate

- Consider alternatives like buying a fixer-upper to save money

The bottom line is that a $120,000 salary can certainly afford you a comfortable lifestyle in many markets. But don’t overextend yourself. Find an experienced real estate agent and lender to help guide you towards a home you love while maintaining your financial goals.

What percentage of my income should I put toward a mortgage?

One of the most common guideposts is the 28/36 rule. The idea here is that you spend no more than 28% of your pretax income on your monthly mortgage payment and no more than 36% of your income on your overall debts.

It’s important to remember that your house payment is more than the cost of the loan itself. It also includes taxes, mortgage insurance and homeowners insurance.

Once you do this calculation, you can then add back in the rest of your debts to come up with your overall debt-to-income ratio. Here are the formulas for the ratios, starting with the housing expense ratio:

Principal + Interest + Taxes + Homeowners insurance

Mortgage insurance and homeowners association fees may be included in the above, but not everyone has them. There is no mortgage insurance at all on conventional loans for single-unit primary residences if you make a 20% down payment.

Here’s the formula for DTI:

Your total debts include not just your mortgage payment, but also things like student loans and personal loans, car payments and the minimum amount due on credit cards.

The 28/36 rule isn’t the only one that’s helpful to know when it comes to the percentage of income toward a mortgage. For FHA and VA loans, it’s quite common for the standard to be that you spend no more than 38% of your budget on housing and 45% on total debts. For conventional loans, you usually want to keep your DTI under 43%.

Mortgage breakdown on a $120K salary

So we’ve gone over what a mortgage payment looks like in one very specific situation to give you a general idea, but what happens if we play with the numbers a bit?

We’ve kept the interest rate the same at 7.125% because it may go up or down, but you don’t control that. You can control the debt you have and your down payment. Let’s look at several scenarios:

| Existing debts | Cash on hand | Mort affordable | Stretching it |

|---|---|---|---|

| $2,000 | $15,000 | $190,512 | $346,195 |

| $0 | $15,000 | $410,806 | $582,094 |

| $3,000 | $40,000 | $106,575 | $255,977 |

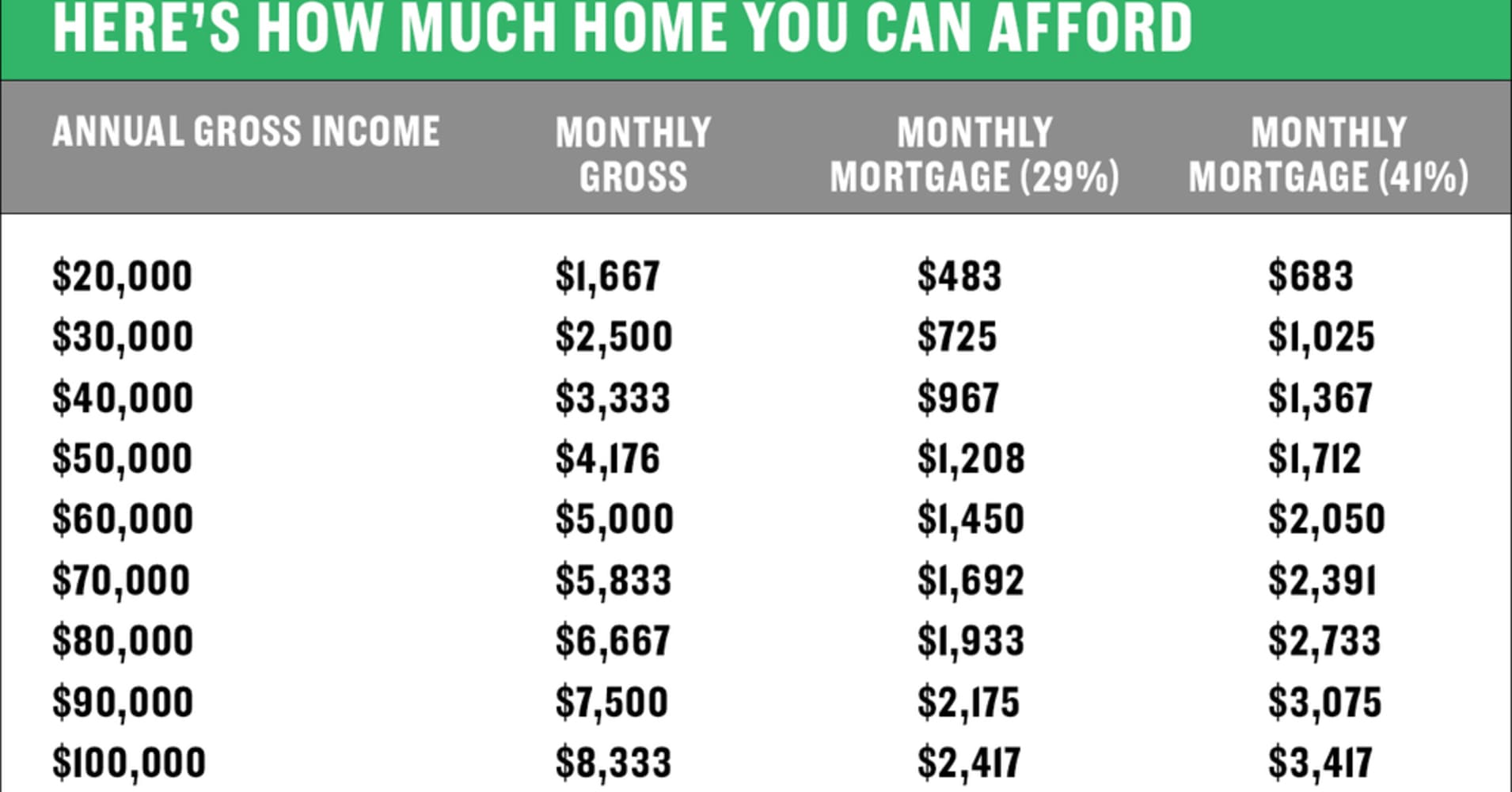

How Much Home You Can ACTUALLY Afford (By Salary)

FAQ

How much of a house can I afford if I make 120k a year?

With a $120,000 annual salary, you could potentially afford a house priced between $450,000 and $500,000, depending on your financial situation, credit score, and current market conditions. However, this is a broad range; your specific circumstances will determine where you fall.Aug 30, 2024

Is a household income of 120k good?

$120000 is the 70th percentile of household income. It’s arguably within the middle class, but definitely upper middle class. Middle class is 2/3rds median income to twice median income, so 47k to 141k.

How much house can I afford if I make 125 000 a year?

Can I afford a 400k house on 100k salary?

100k Salary How Much House Can I Afford: Example

Assuming a 20% down payment and a 4% interest rate on a 30-year fixed-rate mortgage, you could potentially afford a home priced around $400,000.