NINA loans, which stands for “no income, no asset” loans, were a type of mortgage popular in the early to mid-2000s that required little to no documentation from borrowers. As the name suggests, borrowers did not have to verify their income, employment, assets, or cash reserves to qualify for these loans. This made NINA loans quick and easy to obtain. However, NINA loans are widely blamed as a major contributor to the housing crisis and 2008 financial collapse. So do NINA loans still exist today?

A Brief History of NINA Loans

NINA loans originated in the early 2000s as a loan product marketed to self-employed borrowers who had difficulty verifying their income through tax returns or pay stubs. Mortgage lenders realized there was a market for loans that did not require income verification and expanded their offerings to allow any borrower to qualify for a NINA loan.

At the height of their popularity from 2004 to 2007 NINA loans accounted for up to 50% of all loans issued to subprime borrowers in some markets. With a NINA loan, just about anyone could qualify to purchase a home, regardless of their actual income or assets.

How NINA Loans Contributed to the Housing Crisis

The problem with NINA loans was that they ignored a borrower’s ability to repay. By not verifying income or assets, many borrowers were approved for mortgages well beyond what they could afford.

When introductory teaser rates on NINA loans reset to much higher rates after the first couple years, many borrowers could no longer afford their mortgage payments. This led to skyrocketing default and foreclosure rates, contributing to the housing market crash and subsequent 2008 financial crisis.

The Downfall of NINA Loans

In response to the housing crisis the government enacted new regulations and lending standards to protect consumers from predatory and risky loan products. The 2010 Dodd-Frank Act established strict ability-to-repay rules requiring lenders to carefully document and verify a borrower’s income assets, employment, and credit profile before approving a mortgage.

These regulatory changes effectively eliminated NINA loans for owner-occupied home purchases. Subprime lenders could no longer hand out no-doc mortgages to just anyone who applied.

Do NINA Loans Still Exist for Investment Properties?

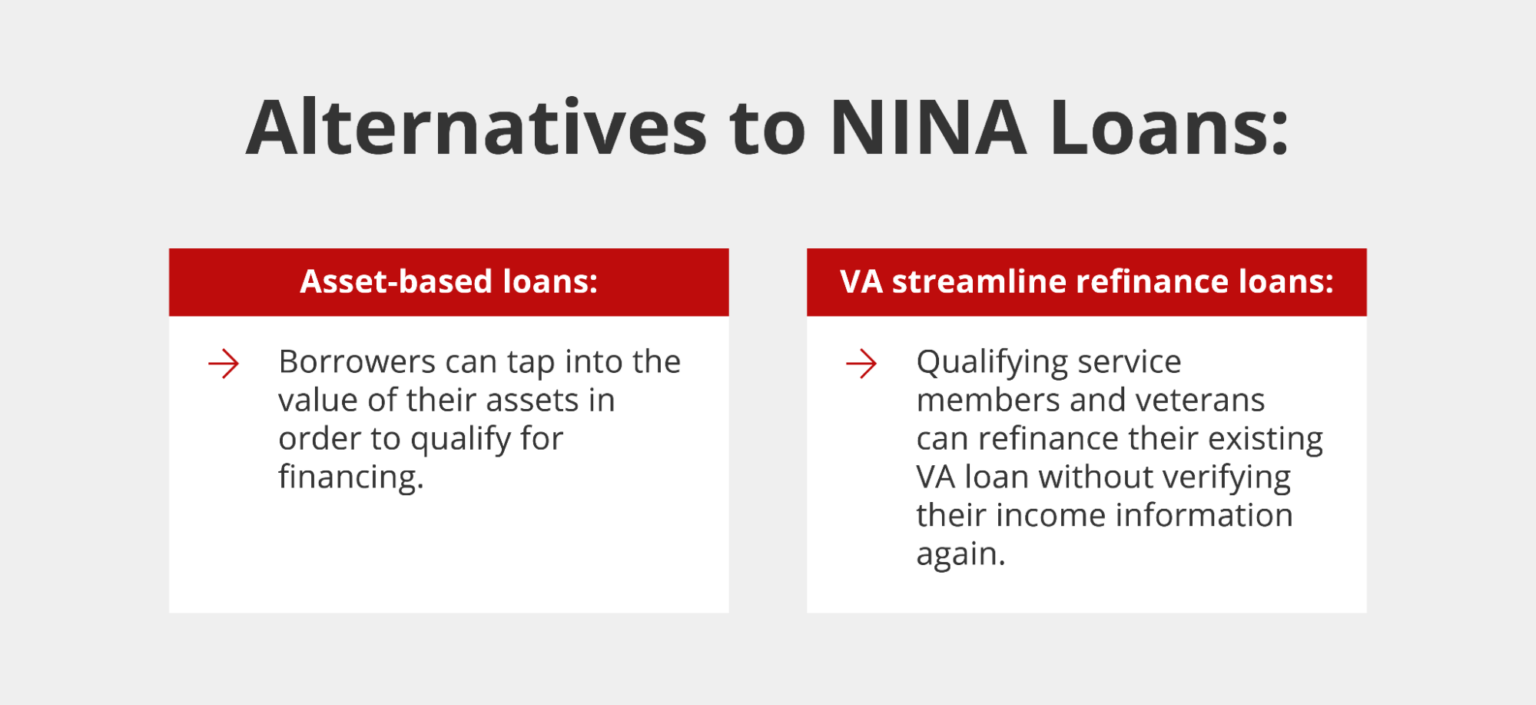

While NINA loans are no longer available for primary residences, they do still exist for investment property purchases in limited circumstances.

The Dodd-Frank ability-to-repay rules contain an exemption for real estate investors. As long as the lender can document that the rental income from the property will be sufficient to cover the monthly mortgage payment, it can be approved as a NINA investment property loan.

These NINA investor loans come with strict requirements, including:

- Minimum credit scores around 700

- Down payments of at least 20-30%

-Strong projected rental income from the property

The Risks of NINA Loans Today

NINA loans still come with considerable risks for both lenders and borrowers. Without verifying the borrower’s personal income or assets, there is a lack of evidence that they can repay the loan if the rental income falls short.

Borrowers also risk getting in over their heads if their actual income and expenses were never properly documented. And if they default, the property could be foreclosed on.

For these reasons, NINA loans make up only a tiny fraction of overall mortgage originations. Most lenders today adhere to strict underwriting standards and require full documentation from all borrowers to prevent a repeat of the housing crisis.

The Bottom Line

What Is a No Income/No Asset (NINA) Mortgage?

No income/no asset (NINA) mortgages are a type of reduced documentation mortgage program where the lender does not require the borrowers to disclose their income or assets as part of the loan calculations. However, the lender does verify the borrowers employment status before issuing the loan.

Learn more about how a NINA mortgage works, who can benefit from using one, as well as some of the pros and cons.

- A NINA (no income/no assets) mortgage is designed for borrowers who may not qualify for a traditional loan.

- A NINA loan does not require verification of your assets or income, making them more risky for lenders.

- Borrowers using a NINA mortgage may have little ability to repay the loan.

- NINA loans come with higher interest rates than traditional mortgages.

NINA vs. NINJA Loans

The slang term NINJA loan applies to credit extended to a borrower with no income, job, or assets. With this type of loan, the bank approves the mortgage based solely on the borrowers credit score.

Unlike a NINA loan, a NINJA loan can be issued to an individual with no income at all. NINJA loans became less frequent after the 2007-08 financial crisis, as the government implemented new regulations to improve standard lending practices.

(NINA) No Income No Asset Loans

FAQ

Do no income verification loans still exist?

Today’s no-income verification mortgages are different. While they’re a type of no-doc/low-doc mortgage loan and offer flexibility in how you prove your income, you’ll still need to provide documentation — just not the traditional W-2s and tax returns.

How to get a Nina loan?

- A higher credit score. Most NINA lenders require a higher credit score than usual. …

- A bigger down payment. Expect to make at least a 20% down payment. …

- Sufficient rental income.

Do piggyback loans still exist?

The “piggyback” structure was common during the mortgage boom in the early to mid-2000s. It is rare today, but could return.

Are Ninja loans illegal?

Ultimately in January 2014, Ninja loans were made illegal under regulation Z, which is within the Ability to Repay and Qualified Mortgage Standards ruling. This prevents creditors from making a mortgage loan unless the borrower being able to reimburse the loan.