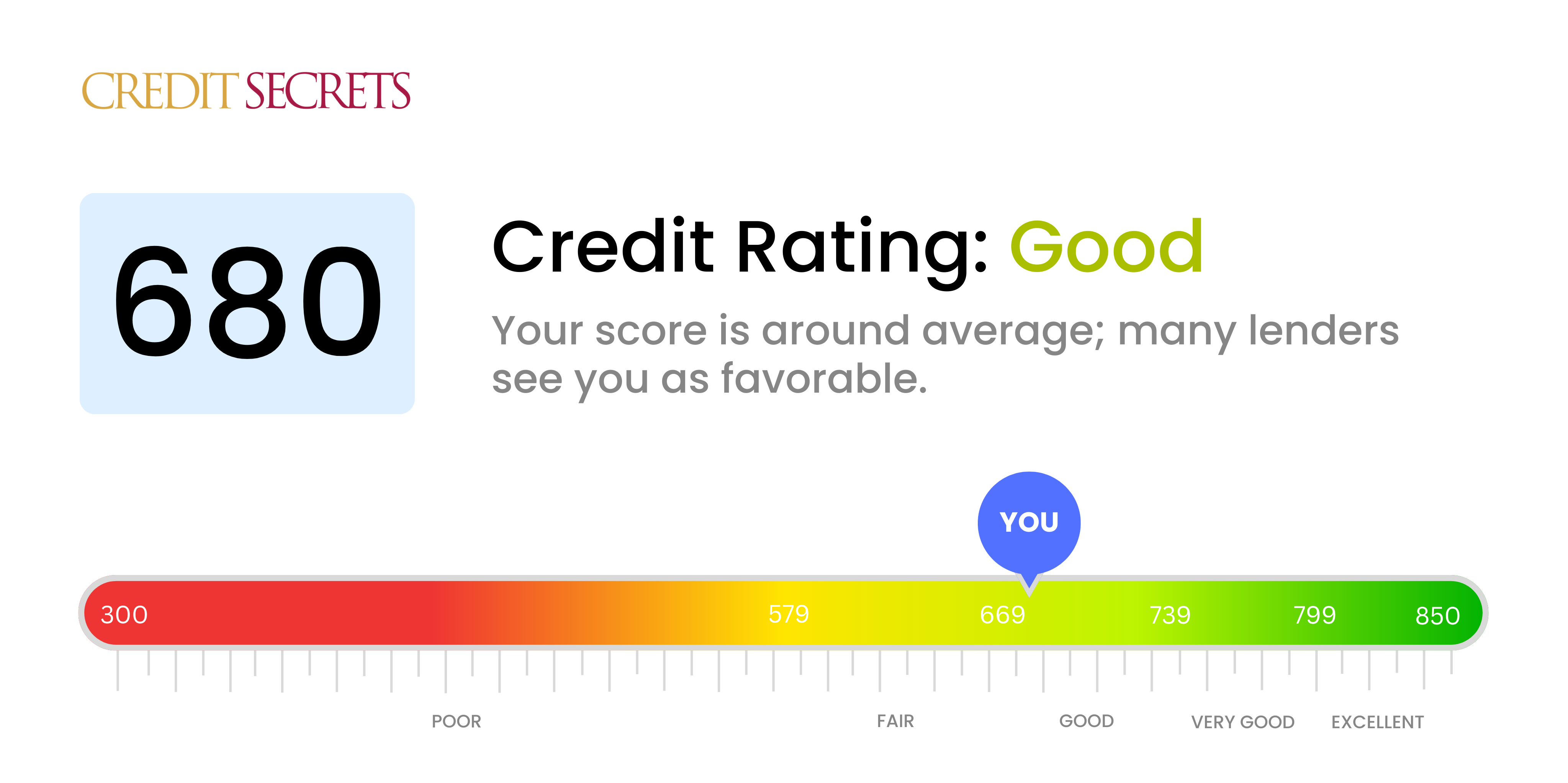

A credit score of 680 puts you in the “good” credit range, but is it good enough to get approved for a mortgage and buy a house? As an experienced mortgage advisor, I’m often asked this question by homebuyers who want to know if their credit score will allow them to achieve their dream of homeownership.

The short answer is yes, a 680 credit score is generally considered good enough to qualify for a mortgage, albeit not the most competitive mortgage rates However, there are several factors to consider beyond just your credit score when determining if you can get approved for a home loan

In this comprehensive guide, I’ll walk through everything you need to know about using a 680 credit score to buy a house, including:

- What lenders think of a 680 credit score

- Types of mortgages available with a 680 credit score

- Tips for getting the best mortgage rates

- Strategies for raising your credit score even higher

- When a 680 credit score may not be good enough

What Do Lenders Think About a 680 Credit Score?

In the mortgage industry, a 680 credit score is considered right on the border between good and fair credit. Here’s how lenders view a score of 680 when evaluating a mortgage application:

-

A 680 is high enough to meet the minimum requirements for most conventional and government-backed loans. Many lenders require a minimum score of 620 or 640

-

However, a 680 score is below the average approved credit score for mortgages, which is around 720. So lenders will view a 680 as good but not great credit.

-

With a 680 score, you won’t get access to the very best mortgage interest rates. Those are reserved for borrowers with scores of 740+ who are seen as lower risk.

-

Lenders will want to look closely at your entire credit profile and debt-to-income ratio, not just your score. A 680 means you’ll face stricter approval criteria in these areas.

Mortgage Loans Available with a 680 Credit Score

The good news is that a 680 credit score makes you eligible for a wide variety of both conventional and government-backed mortgage programs.

Conventional loans – A 680 score meets the minimum requirements for most conventional mortgages. However, you’ll typically need private mortgage insurance (PMI) unless you make a down payment of 20% or more.

FHA loans – FHA has a minimum credit score requirement of just 580, so a 680 score is well above the threshold. But FHA will look closely at your debt ratios.

VA loans – No minimum credit score is required for VA loans. However, a 680 FICO puts you in a strong position to be approved.

USDA loans – Like VA loans, USDA mortgages don’t have a minimum credit score. A 680 makes approval highly likely.

The bottom line is that a 680 credit score provides plenty of mortgage options. The key is finding the right lender who will view your entire application favorably to get you the best deal.

Tips for Getting the Best Mortgage Rates with a 680 Score

While a 680 credit score meets minimum requirements, it pays to boost your score as much as possible to get better mortgage rates. Here are some tips:

-

Shop around with multiple lenders to compare rates and fees. Different lenders interpret credit scores differently.

-

Make a larger down payment if possible, ideally 20% to avoid PMI on a conventional loan.

-

Pay down debts and reduce your debt-to-income ratio as much as you can ahead of applying.

-

Limit new credit inquiries as these can ding your score temporarily.

-

Consider paying discount points at closing to buy down your mortgage rate.

-

Provide documentation explaining any credit blemishes to show they were one-off events.

The higher you can boost your credit score before applying, the more likely you are to qualify for the lowest available interest rates.

How to Improve Your Credit Score to Buy a House

If your credit score is currently right around 680, here are some tips for improving it to potentially get better mortgage rates:

-

Review your credit reports and dispute any errors. Errors can significantly drag down your score.

-

Pay all bills on time each month. Your payment history is a big factor in your score.

-

Pay down credit card and revolving debt balances. High balances hurt your credit utilization ratio.

-

Hold off on applying for new credit until after you close on your home loan.

-

Have a mix of credit types – like credit cards, auto loans, and a mortgage. This can help boost your score.

-

Sign up for credit monitoring to stay on top of your score trends.

With diligent credit management, it may be possible to increase your score into the low 700s within 6-12 months for an even stronger mortgage application.

When a 680 Credit Score May Not Be Enough

While generally sufficient for approval, there are certain situations where a 680 credit score by itself may not be enough to guarantee a mortgage:

-

Jumbo loans – For high-balance mortgages over $647,200, lenders often require 720+ credit scores.

-

Multiple credit issues – If you have a history of late payments, collections, or other major derogatory marks, a 680 may not outweigh them.

-

High debt ratios – With a 680 score, high debt-to-income ratios above 50% can jeopardize approval chances.

-

Insufficient credit history – Scores can be inflated if you have very few accounts or a short credit history.

-

Co-borrowers with poor credit – Your 680 score won’t necessarily offset a co-borrower with a poor score.

The bottom line is mortgage approval depends on your entire financial picture. While helpful, a 680 credit score alone does not guarantee you’ll be approved without meeting other requirements.

The Takeaway: Is a 680 Credit Score Good Enough to Buy a House?

A FICO credit score of 680 puts you well within the good credit range and opens the door to most mortgage options. However, it is considered just average by many lenders, so you may not get the rock-bottom interest rates.

With some work to reduce debts and potentially boost your score higher, a 680 credit score can certainly allow you to achieve the dream of homeownership. But be prepared for your credit profile to be examined closely, and don’t expect to automatically qualify for the advertised ultra-low rates.

As your experienced advisor, I’m happy to provide tailored guidance based on your unique financial situation. My team and I will help you put together the strongest application possible and find mortgage lenders who will view your 680 credit score favorably. Contact me today to start the conversation!

Mortgages that are harder to get with 680 credit

There are a few mortgage loan types that will be tougher to get with 680 credit. Namely:

- Jumbo loans: Typically require a 700-720 credit score or higher. In most parts of the U.S. a jumbo loan is any mortgage over $

- 80/10/10 loans: This is a sort of hybrid mortgage that involves getting both a traditional mortgage loan and a home equity loan at the same time to avoid mortgage insurance. 80/10/10 loans might be available with a credit score of 680, but it will be easier to get one with a score in the 700s

- Home equity loan or home equity line of credit (HELOC): Home equity financing may be available with a 680 credit score. But many lenders set their own minimums starting at 700 or higher

If you’re looking to buy a more expensive home or tap into your home equity, it might be worth raising your credit score a little before you apply.

Even if you can qualify for one of these loans with a score of exactly 680, you’ll get better rates if your score is 700 or above.

Dispute errors on your credit report

It’s not uncommon for credit reporting agencies to have inaccurate information on your credit report. If you identify any errors, file a dispute with both the creditor and the credit bureau.

You can get free credit reports from freecreditreport.com and pull your FICO score from MyFico.

Can I Get A Home Loan With 680 Credit Score? – CreditGuide360.com

FAQ

Can you buy a house with a credit score of 680?

A 680 credit score is considered “good” and gives you access to some of the best mortgage options. Conventional Loans offer competitive rates and terms, making them highly attractive. Government-backed mortgages like FHA Loans are still available, but they may be less advantageous compared to conventional options.

What credit score is needed for a $250000 house?

What credit score do I need to buy a $250,000 house? You can buy a $250,000 house with a wide range of credit scores, from as low as 500 to as high as 800+.Mar 19, 2025

Can I get a good mortgage rate with a 680 credit score?

Conventional loans are accessible with a 680 credit score. Borrowers often secure competitive interest rates, as this score demonstrates responsible credit habits. A minimum down payment of 3% is typical for first-time buyers. However, private mortgage insurance (PMI) is required if the down payment is below 20%.

How big of a loan can I get with a 680 credit score?