Credit Karma promises to provide you with your credit score and credit report for free. But is it giving you the same information that a lender will access if youre applying for a mortgage or a car loan? And for that matter, is it giving you anything that you cant get elsewhere?

To answer those questions, it helps to know what Credit Karma is, what it does, and how its VantageScore differs from the more familiar FICO score.

Credit scores are an important part of your financial life. They determine whether you get approved for credit cards, loans, mortgages, and more. They also impact the interest rates you’ll pay. So it’s essential to monitor your scores regularly.

Many people use Credit Karma to check their credit scores for free. But does Credit Karma actually give you your FICO score? Let’s take a closer look.

What is a FICO Score?

FICO scores are the most widely used credit scores in lending decisions FICO stands for Fair Isaac Corporation, the company that created the FICO scoring model.

Lenders use FICO scores to determine your credit risk. These scores range from 300 to 850. In general, the higher your FICO score, the lower your perceived credit risk.

There are several different FICO score versions tailored to specific types of credit:

-

FICO Score 8: The most commonly used FICO score. Used for credit card applications, personal loans, student loans, etc.

-

FICO Auto Score: Used for auto loan applications.

-

FICO Bankcard Score Used for credit card applications

-

FICO Mortgage Score: Used for mortgage applications.

So when you check your “FICO score,” you need to know which version you’re looking at. The score lenders use depends on the type of credit you’re applying for.

What Score Does Credit Karma Provide?

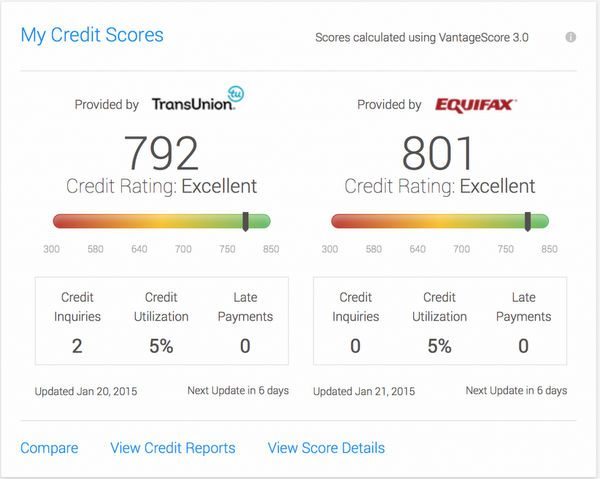

Credit Karma provides your VantageScore 3.0 credit score for free. This is a credit score created by the three major credit bureaus – Equifax, Experian, and TransUnion.

VantageScore and FICO scores differ in a few key ways:

-

Scoring model: The algorithms used to calculate the scores are different. So the same credit report factors (payment history, credit utilization, etc.) are weighted differently.

-

Score range: VantageScore ranges from 300-850, the same as FICO. But the scores from each model won’t directly correlate. For example, a 720 VantageScore doesn’t equal a 720 FICO score.

-

Versions: There’s only one base VantageScore (3.0). But FICO offers many industry-specific versions.

So while Credit Karma provides free access to credit scores, they aren’t FICO scores. If you apply for credit, lenders will most likely use your FICO score – not your VantageScore from Credit Karma.

Why Does it Matter?

You’re probably wondering why it matters whether Credit Karma gives you FICO scores or VantageScores.

Here are a few key reasons:

-

FICO is more widely used: Like we mentioned earlier, FICO scores are used in over 90% of lending decisions in the U.S. So your VantageScore probably won’t align with the scores lenders look at.

-

Scores can differ significantly: While both score types generally range from 300-850, your actual scores can differ quite a bit between models. A 700 FICO score doesn’t necessarily equal a 700 VantageScore.

-

Risk assessment differs: Factors are weighted differently in the FICO and VantageScore models. This means you may be perceived as higher or lower risk depending on the model.

-

Impacts rates/approvals: Since lenders use your FICO scores, those are what determine whether you get approved and what rates you pay. VantageScores don’t have a direct impact.

So checking your VantageScore through Credit Karma isn’t useless. It can provide some insight into your general credit standing. But FICO scores give you a much better idea of how lenders view your creditworthiness.

How to Check Your FICO Score for Free

The good news is you have several free options for checking your actual FICO score:

-

Credit cards: Many issuers like American Express, Bank of America, Chase, Citi, and Discover provide free FICO scores to cardholders through their online accounts.

-

Banks and lenders: Some banks, mortgage lenders, and financial institutions offer free FICO access to checking account holders or applicants.

-

myFICO: You can sign up for a free account at myFICO.com which provides your FICO score based on Experian data.

-

Experian: Sign up on Experian’s website for free access to your FICO 8 score based on your Experian credit report.

-

Credit unions: Some credit unions provide members with free monthly FICO scores.

Checking your real FICO score from time to time is important – especially before applying for new credit. It provides the most accurate picture of your credit health from a lender’s perspective.

Credit Karma Score Factors

While Credit Karma doesn’t provide FICO scores, it’s still useful for monitoring your credit. Here are the main factors that go into your VantageScore 3.0 on Credit Karma:

-

Payment history (32%): Whether you pay your bills on time, including credit cards, loans, etc. Recent late payments hurt more.

-

Credit utilization (23%): How much of your available credit you’re using. Lower utilization is better.

-

Credit history length (15%): The average age of your credit accounts. Older is usually better.

-

Credit mix (10%): Whether you have different types of credit – credit cards, loans, mortgages, etc. Variety helps.

-

New credit inquiries (10%): Applying for multiple new credit accounts recently can lower your score.

-

Available credit: Having access to more unused credit helps your score.

-

Depth of credit: A healthy mix of installment loans and revolving credit cards boosts scores.

-

Outstanding debt: Owing less debt relative to credit limits improves scores.

Monitoring these factors through Credit Karma can give you an idea of what’s helping or hurting your credit. Just keep in mind it uses VantageScore, not FICO.

Improving Your Credit Karma Score

Here are some tips for improving your VantageScore on Credit Karma:

- Pay all bills on time. Set up autopay if needed.

- Keep credit utilization low on all cards. Aim for 30% or less.

- Don’t close your oldest credit accounts. Maintain credit history.

- Limit new credit card applications. Too many hurt your score.

- Ask lenders to remove incorrect negative information from your credit reports.

- Build your credit if needed. Get a secured card or become an authorized user.

- Monitor your VantageScore regularly and watch for any drops. Address issues quickly.

Building healthy credit habits takes time, but you should see your scores slowly improve as you follow these tips. Of course, different factors impact FICO and VantageScore. But in general, these tactics will optimize both score types over time.

The Takeaway

Credit Karma provides free access to VantageScores, not FICO scores. While VantageScore gives you an idea of your credit standing, lenders actually use your FICO when making decisions. So it’s important to check your real FICO periodically too.

There are several ways to access your FICO scores for free, including credit cards, banks, lenders, and third-party sites like myFICO and Experian. Monitoring both FICO and VantageScores ensures you have a complete credit picture.

Understanding the differences between the scores Credit Karma provides versus your actual FICO scores helps set accurate expectations when applying for credit. Check your FICO before any major applications to avoid surprises!

VantageScore or FICO Score: Does It Matter?

VantageScore and FICO are both mathematical models used calculate credit ratings based on consumers use of credit. FICO is the older and better-known model, having been introduced in 1989. VantageScore made its debut in 2006.

In addition, VantageScore and FICO each offer multiple scoring models, some tailored to specific industries such as mortgage or auto loan lenders. So not only might your VantageScore and FICO score differ slightly, but you may have several different VantageScores or FICO scores depending on the particular model used to compute them.

However, your scores should be in the same basic range on any or all of those models. You should not have a “very good” VantageScore and only a “fair” FICO score.

Is Credit Karma Really Free?

Yes. Credit Karma will not charge you any fees. You can apply for loans through the site, and the company will collect a fee if you do.

Does Credit Karma Provide FICO Score? – CreditGuide360.com

FAQ

Can I get my FICO score on Credit Karma?

Credit Karma doesn’t offer FICO® credit scores, which are calculated differently from VantageScore credit scores. While the three major credit bureaus collaborated to create the VantageScore model, FICO is a separate organization with its own scoring models.

How do I get my actual FICO score?

Why doesn’t Credit Karma show FICO?

How accurate is Credit Karma to your FICO score?

How many points is Credit Karma off, on average? Credit Karma scores can be off by about 20 to 25 points compared to FICO scores.Jun 27, 2024

Does Credit Karma provide a FICO score?

Credit Karma does not provide a FICO Score; it provides your VantageScore 3.0. You can get a free FICO Score and free credit report from Experian. You may also be able to get your credit score from your bank or credit card company, but you’ll need to clarify whether it is the FICO Score or the VantageScore.

What are Credit Karma’s credit scores?

Credit Karma’s credit scores are VantageScores, a competitor to the more widely used FICO scores. Those scores are based on the information in your credit reports from Equifax and TransUnion, two of the three major credit bureaus. Your Credit Karma score should be relatively close to your FICO score.

Does Credit Karma reflect my credit information?

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those bureaus. The scores we provide are actual credit scores pulled from two of the major consumer credit bureaus, not just estimates of your credit rating.

Does Credit Karma offer free credit scores?

Credit Karma works with Equifax and TransUnion, two of the three major consumer credit bureaus, to give you access to your free credit scores and free credit reports. (Experian is the third major consumer credit bureau.) Does Credit Karma offer free FICO® credit scores?

How can Credit Karma help you improve your credit score?

Credit Karma is a useful tool for those looking to improve their credit scores. It provides free credit monitoring through daily or weekly updates to your VantageScore. VantageScores might be higher than FICO scores due to differences in calculation methods. Credit Karma can help you identify areas for improvement and track your progress.

How accurate is my Credit Karma score?

Your Credit Karma score, which is generated using the VantageScore model and data from TransUnion and Equifax, is updated every week, so it should be accurate. Keep in mind, though, that your score’s accuracy is affected by whether your credit report is correct.