If you recently purchased a home, you may be wondering if you paid points on your mortgage and if so how paying points could benefit you come tax time. Paying points which are fees paid to lower your mortgage interest rate, can seem confusing but with the right information, you’ll know if you paid points and if they are deductible on your tax return.

What Are Mortgage Points?

Mortgage points, also known as discount points or loan origination fees, are charges paid by the borrower to the lender at closing. Each point is equal to 1% of the mortgage loan amount. For example, if you get a $200,000 mortgage, each point would equal $2,000.

Lenders offer points as a way for borrowers to lower their interest rate – typically around 0,25% per point on a 30-year fixed mortgage Paying more points upfront reduces your ongoing monthly payments but increases your upfront closing costs

There are two main types of mortgage points:

-

Origination Points: These points go to the lender to cover processing costs. They don’t lower your rate but are often required.

-

Discount Points These directly reduce your interest rate and are optional They represent prepaid interest to the lender

How Can I Tell if I Paid Points?

When applying for a mortgage, your lender should disclose all fees and closing costs on your Loan Estimate document. This will outline any origination fees or discount points related to your loan.

However, the best way to know for sure if you paid points is to review your final Closing Disclosure or HUD-1 settlement statement. This lists all charges associated with your mortgage transaction.

Look for fees labeled as “loan origination” or “discount points” under the Origination Charges section. The number of points and dollar amount paid will be clearly stated.

For example, you may see:

- Origination Fee (1 point): $2,000

- Discount Points: 2 @ $2,000 = $4,000

This means you paid 1 origination point and 2 discount points, totaling $6,000 in points on your $200,000 mortgage.

Are My Mortgage Points Tax Deductible?

In most cases, yes – you can deduct mortgage points paid on your primary residence and second home on your tax return. However, there are some specific IRS rules surrounding point deductibility:

-

Main Home Purchase: Points fully deductible in year paid if funds weren’t borrowed from lender.

-

Main Home Refinance: Points deductible over life of loan.

-

Second Home: Points deductible over life of loan.

-

Investment Property: Points not deductible.

-

Home Equity Loan: Points not deductible.

-

Cash-Out Refinance: Points not deductible.

Other requirements apply, such as the fees must be clearly labeled as points and cannot exceed what is customary in your area. The loan amount also affects limits on the deduction.

Work with your tax professional to determine your eligibility to deduct points and the proper filing method based on your loan details.

How Do I Deduct Points on My Tax Return?

If you meet all requirements, deducting mortgage points is fairly simple:

-

Your lender will report points paid on Form 1098 along with your mortgage interest.

-

Transfer the amount from Box 6 of Form 1098 to Line 8a of Schedule A when itemizing.

-

For any points not shown on Form 1098, enter the additional amount separately on Line 8c of Schedule A.

-

Claim Schedule A with your Form 1040 to deduct the points.

-

Deduct the full amount in the year paid if you meet the main home purchase requirements. Otherwise, deduct them over the loan term.

TurboTax and other tax software will guide you through determining the proper deduction method and claiming points based on your mortgage situation.

Strategies for Paying Mortgage Points

Paying points upfront to reduce your interest rate can pay off through lower monthly payments and bigger tax deductions. Consider these tips:

-

Compare how much rates drop per point when shopping lenders.

-

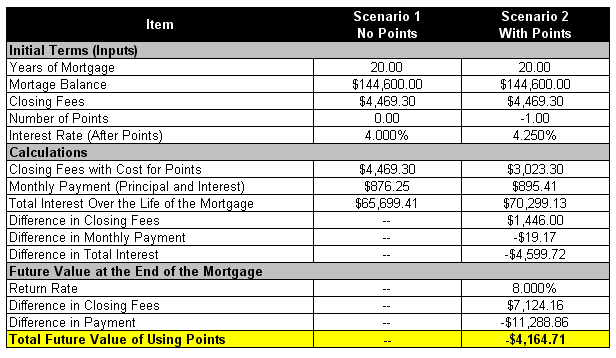

Calculate your break-even time to recoup point costs through savings.

-

Pay points if you plan to stay in the home long term.

-

Use points for a lower rate rather than making a larger down payment.

-

Ask the seller to contribute to point costs.

-

Know deductibility rules and consult a tax pro if uncertain.

-

Review your Loan Estimate and track points paid at closing.

Paying mortgage points can be well worth the extra costs at closing if used strategically over the life of your home loan. Being aware of what you paid and the tax benefits will ensure you maximize your deduction. Consult with tax and mortgage professionals to determine if paying points fits your unique financial situation.

How do I find out if I have points paid when I bought my house? Is it shown somewhere in the paperwork?

If you have points, they should be listed in Box 6 of your Form 1098, Mortgage Interest Statement.

If you have your closing documents, you can do the following:

- Locate the “Settlement Statement” in the closing documents. The name should be clearly defined at the top of the document. The settlement statement includes all costs and exchanges of funds for both you and seller that occurred when you purchased the property.

- Look for a charge on the settlement statement that contains the words “points” or “loan discount.” Points may have been paid by the borrower or the seller, so check both the borrower and seller columns for the amount. The cost may also be split between the borrower and seller. In that case, add the two amounts together to determine the total mortgage points paid.

For more information on points and their deductibility, you can reference the FAQ below:

Do you have an Intuit account?

Youll need to sign in or create an account to connect with an expert. 1 Best answer

Is Buying Mortgage Points Worth It?

FAQ

How do I know if I paid mortgage points?

The amount is clearly shown on the settlement statement (such as the Settlement Statement, Form HUD-1) as points charged for the mortgage. The points may be shown as paid from either your funds or the seller’s.

Where can I find points paid?

Usually, your lender will send you Form 1098, showing how much you paid in mortgage points and mortgage interest during the year.

Where do you find points on a closing statement?

The settlement statement — usually a HUD-1 — clearly states the amount of points paid in connection with the closing. The points are shown as a percentage of the amount of the mortgage principal.

Does every mortgage have points?

Similar to discount points, you’ll pay origination points as part of your closing costs. Not all lenders charge origination points. Some lenders allow borrowers to get a loan with no or reduced closing costs or origination points. They often compensate for that with a higher interest rate or other fees, however.

How do you pay points on a mortgage loan?

Paying points is an established business practice in the area where the loan was made. The points paid weren’t more than the amount generally charged in that area. You provide funds, at or before closing, at least equal to the points charged. You can’t use funds borrowed from your lender or mortgage broker to pay the points.

How do points work on a home loan?

Points aren’t paid for other costs associated with home buying, such as appraisal fees, inspection fees or title fees. You didn’t borrow the money to pay points from your lender or mortgage broker. The loan is used to buy or build your main home. Points are computed as a percentage of the principal amount of the mortgage.

What are mortgage points & how do they work?

Mortgage points are an additional upfront cost when you close on your loan, but they’re also a way for borrowers to negotiate a lower interest rate on their mortgage. For example, by paying upfront 1% of the total interest to be charged over the life of a loan, borrowers can typically unlock mortgage rates that are about 0.25% lower.

Should you buy mortgage points?

Purchasing mortgage points allows you to “buy down” the interest rate on a home loan. Doing so may result in a lower monthly mortgage payment and save you money on interest charges over the long term. The IRS also offers a tax break to eligible taxpayers who buy points on a mortgage.

How do you calculate mortgage points?

Points may have been paid by the borrower or the seller, so check both the borrower and seller columns for the amount. The cost may also be split between the borrower and seller. In that case, add the two amounts together to determine the total mortgage points paid.