Getting a car loan with a 686 credit score is definitely possible, but your interest rate may be higher than borrowers with excellent credit. While there is no specific minimum credit score needed to qualify for auto financing, most lenders view a score of 686 as average to good credit. By understanding how your credit score affects your loan terms, shopping around for lenders, and taking steps to improve your credit, you can get affordable auto financing even with imperfect credit.

What Credit Score Do Most Lenders Want?

There is no universal minimum credit score requirement to qualify for a car loan. Every lender has their own lending standards and risk tolerance. However, industry data shows that very few people actually get approved for auto loans with scores below 600

According to Experian, 66% of auto loans go to borrowers with credit scores of 661 or higher. Only around 18% go to those with scores between 601 and 660. Less than 3% go to those scoring 500 or below.

So while it’s possible to get a car loan with a score as low as 500 the terms likely won’t be very favorable. Most lenders view a 686 credit score as average to good so you should have plenty of financing options. But your interest rate will be higher than borrowers with scores in the good to excellent range (720+).

How Credit Scores Affect Car Loan Rates

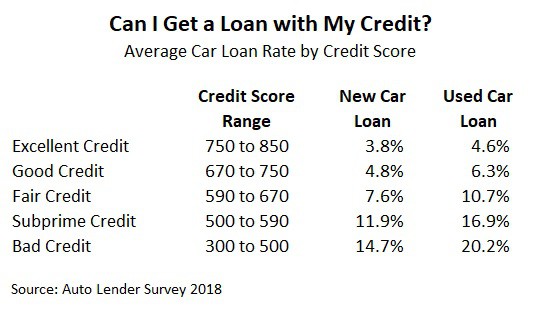

In auto lending, your credit score has a major impact on the interest rate you’ll pay. The higher your score, the lower your rate.

For example, according to Experian data, in the fourth quarter of 2022:

-

Borrowers with super prime credit (781-850) paid an average 5.99% on used car loans.

-

Those with prime credit (661-780) paid around 7.83%.

-

Those with nonprime credit (601-660) paid about 13.74%.

-

And those with subprime credit (501-600) paid around 18.99%.

As you can see, the interest rate differences are quite significant based on your credit tier. With a 686 score, you’ll likely pay somewhere around the average prime rate unless you have other strong qualifying factors.

How to Get the Best Car Loan Rate With a 686 Credit Score

While a 686 credit score likely won’t get you the rock-bottom interest rates, there are things you can do to ensure you’re getting the best deal:

-

Shop around: Compare rate quotes from multiple lenders. Local banks, credit unions, and online lenders are all worth considering.

-

Get prequalified: Many lenders allow you to get prequalified to see potential loan offers without a hard credit check. This allows you to compare real offers.

-

Offer a larger down payment: A bigger down payment signals lower risk to lenders and may help you secure a better interest rate. Aim for 20% down if possible.

-

Add a co-signer: Asking a family member with good credit to co-sign allows you to take advantage of their better credit score.

-

Consider a shorter loan term: Opting for a 3-year loan instead of 5-year loan means less interest paid over the life of the loan.

-

Improve your credit: Boosting your score before applying could get you a much better rate. Pay down balances, dispute errors, and pay bills on time.

Minimum Credit Scores Needed by Popular Lenders

While every lenders’ standards differ, here are some published minimum credit requirements from major auto lenders:

- Capital One – 500

- Chase – 620

- Bank of America – 660

- Wells Fargo – 620

- PenFed Credit Union – 660

- Local credit unions – 600-650

As you can see, a 686 FICO score exceeds most lenders’ minimum requirements. However, the higher your score is above these thresholds, the better your interest rate will be.

How to Improve Your Credit Score Before Applying

If time is on your side, take a few months to boost your credit score before applying for a car loan. Even a small score improvement could mean big savings on your auto financing. Here are some tips:

-

Pay down balances: Having high balances hurts your credit utilization ratio. Pay down credit cards and other revolving debts.

-

Dispute errors: Errors on your credit reports could be dragging down your score. Dispute any inaccuracies you find.

-

Become an authorized user: Ask a family member with good credit to add you as an authorized user on a credit card account.

-

Limit hard inquiries: Each application for credit results in a hard inquiry, so avoid applying for other loans or credit cards.

-

Pay on time: Payment history is the biggest factor in your score. Pay all bills on time, including utilities.

-

Monitor your credit: Sign up for free monitoring services to track your credit scores and reports.

Alternatives With Bad Credit or No Credit History

For those with very poor credit or no credit history at all, buying a car can be challenging but there are still financing options available:

-

Subprime lenders: Specialty lenders provide auto financing to borrowers with bad credit, but rates are very high.

-

Down payment assistance: Many non-profit organizations provide down payment assistance to help people with poor credit buy a reliable used car.

-

Lease-to-own: These let you essentially rent a car for 12-24 months, with an option to buy it when the lease ends.

-

Co-signer: Having a relative with good credit co-sign the loan improves your chances and gets you better terms.

-

Secured loan: Some lenders offer secured auto loans, which require an asset like cash or stocks as collateral.

-

Buy an inexpensive used car with cash: Save up to make an all-cash purchase of an older used vehicle you can afford.

Can I get a car with a 500 credit score?

Its definitely possible to get approved for financing with a 500 score, but youll likely get a higher interest rate. Coming in with a larger down payment can help, as will having a co-signer.

Pay your bills on time

Your payment history is extremely important to your credit score, as it makes up 35% of FICO’s overall calculation. Every on-time payment helps improve your credit score, especially if you are paying a balance in full.

How a Car Loan Affects Credit Score – Auto loans raise or lower scores? How fast? How many points?

FAQ

Is 686 a good credit score to buy a car?

To buy a car, a credit score of around 660 or higher is typically needed to secure favorable loan terms, though higher scores can lead to better interest …

What credit score is needed for a $30,000 car loan?

Quick Answer. While it’s possible to get an auto loan with nearly any credit score, most lenders are looking for buyers in the prime credit score range with a credit score of 661 or above for the best terms and rates.

What kind of loan can I get with a 686 credit score?

Unsecured Personal Loans: These loans do not require collateral and are based solely on your creditworthiness. With a credit score of 686, you are more likely to qualify for unsecured personal loans with favorable terms.

What can you do with a 686 credit score?

A FICO® Score of 686 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Can you get a car loan with a 660 credit score?

Most approved borrowers have credit scores of 661 or higher, but there is no set score to get an auto loan. Having a credit score below 660 could make it harder and more expensive — though not impossible — to finance your car. Here is what you need to know about auto loan credit scores and how to increase your score to get a better rate.

What credit score do you need for a car loan?

Most used auto loans go to borrowers with minimum credit scores of at least 675. For new auto loans, most borrowers have scores of around 730. The minimum credit score needed for a new car may be around 600, but those with excellent credit often get lower rates and lower monthly payments.

Can you get a car with a bad credit score?

If you have a credit score that ranks in the prime or higher category, you’ll have a much easier time getting approved for a car loan with a lower interest rate. No credit or a bad credit score will make approval much more difficult. Can I get a car with a 500 credit score?

Is 850 a good credit score for a car loan?

If your credit score is between 781 and 850, you’re classed as having Super Prime credit. 850 is the highest possible credit score on the VantageScore and FICO rating systems. People with Super Prime credit scores are likely to be offered the lowest interest rates on a car loan, as lenders will see them as very financially responsible.

Can a high credit score lower car interest rates?

Raising your credit score or FICO auto score may help you lower your rates. According to an automotive finance market report from Experian, a car buyer with a credit score between 501 and 600 may receive an interest rate as high as 17.78 percent.

Can a low credit score help you get a car loan?

Borrowers with scores of 501 to 600 account for more than 15.64% of cars financed, while people with scores of 500 or below account for 2.39%, according to Experian. A lower credit score won’t necessarily keep you from securing a car loan, but it might spike your interest rate, leading to higher payments. Stress less. Track more.