Debt settlement may reduce your debt, but expect an impact to your credit score Part of the Series Bad Credit Guide

Debt settlement companies offer to help clear your outstanding debts by negotiating a smaller amount than you actually owe. Debt settlement typically has a negative impact on your credit score. The exact impact depends on factors like the current condition of your credit, the reporting practices of your creditors, the size of the debts being settled, and whether your other debts are in good standing.

A debt settlements impact on your credit score will also depend on how much the debt is settled for compared to the original balance and other factors.

Settling an account for less than the full balance owed can significantly impact your credit score. The exact number of points your score drops depends on several key factors.

How Settling Debt Affects Your Credit Score

When you settle a debt, you agree to pay the creditor or debt collector less than the total amount owed in exchange for them closing the account. Settling can provide financial relief, but it also damages your credit in a few ways

-

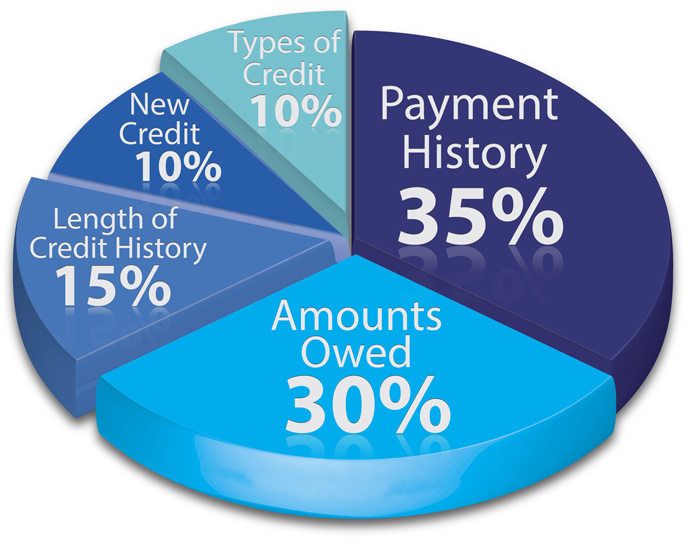

Payment History: Settling an account indicates you were unable to make payments as originally agreed, hurting your track record of on-time payments. This payment history factor makes up 35% of your FICO score.

-

Amounts Owed: Settling can improve this factor by lowering balances. But it also shows you didn’t pay back what you owe in full. Amounts owed is 30% of your score.

-

Credit Mix Settling may remove an account from your credit mix, FICO scores like to see responsible use of different account types

-

New Credit: Applying for new credit to replace settled accounts can hurt your score if done too often. New credit makes up 10% of your FICO score.

So settling almost always causes your credit score to drop but not in an equal way for everyone. The impact depends on your starting score and specific credit situation.

Factors That Determine Score Drop from Settling

According to credit scoring company FICO, here are some of the key factors that affect how many points your score drops after settling debt:

-

Starting Score: People with excellent credit scores of 760+ will likely see a greater point drop than those starting with lower scores.

-

Age of Settled Debt: More recent delinquent accounts hurt worse than older ones. Settling new debt impacts scores more.

-

Amount Settled: Bigger settlement amounts or percentages cause worse damage. Settling a $10,000 balance hurts more than a $1,000 one.

-

Number of Accounts Settled: Settling multiple accounts at once takes a heavier toll compared to just one.

-

Other Credit Activity: If you have late payments or other negatives aside from the settlement, the score impact worsens.

-

Credit History Length: A short credit history amplifies the effect of a settlement versus someone with a long established history.

Estimating the Score Drop from Settling Debt

While it’s impossible to predict exactly how many points settling an account will reduce your credit score, some general estimates based on starting score ranges give a rough idea:

- Excellent Credit (760+): 100 to 150 points or more

- Good Credit (680 to 759): 60 to 120 points

- Fair Credit (580 to 679): 50 to 110 points

- Poor Credit (Below 579): 30 to 80 points

The drop can be less if you have multiple negative marks already dragging your scores down before the settlement. Or if it’s an older, smaller debt. But for someone with pristine credit settling a recent, large account balance, 150 points or more lost is possible.

Rebuilding Your Credit after Settling

The settled account will stay on your credit reports for up to 7 years. But you can start rebuilding your credit right away. Here are some tips:

- Pay all bills on time going forward

- Lower credit card balances below 30% of limits

- Limit new credit applications

- Ask creditors for credit limit increases

- Become an authorized user on someone else’s account

With a plan to add positive information, your scores can start improving after 6 months or so. But full recovery may take a few years. The settlement will hurt less over time too.

Should You Settle Debt?

Settling accounts can provide financial relief in tough situations but seriously damages your credit. Weigh the pros and cons carefully before making this credit score-lowering decision. In many cases, there are better alternatives to settling that won’t hurt your credit as badly while still reducing debt.

Can Debt Settlement Be Removed From Credit Report?

Once a debt settlement is on your credit report, you cannot have it removed. It will likely stay on your credit report for up to seven years.

How Debt Settlements Work

Your credit report is a snapshot of your financial past and present. It displays the history of each of your accounts and loans, including the original terms of the loan agreement, the size of your outstanding balance compared with your credit limit, and whether payments were timely or skipped. Each late payment is recorded.

You can negotiate a debt settlement arrangement directly with your lender or seek the help of a good debt settlement company. Through either route, youll make an agreement to pay back just a portion of the outstanding debt. If the lender agrees, your debt is reported to the credit bureaus as “paid-settled.”

Debt settlement is generally better for your report than a charge-off because it may even have a slightly positive impact if it erases severe delinquency. However, it doesnt have as good of an impact on your credit as if the debt was paid in full as agreed.

If you settle a debt, the amount that is forgiven may be considered taxable by the Internal Revenue Service (IRS).

Debt Settlement Did WHAT To My Credit Score? Estimate The Impact

FAQ

How many points does a settlement affect credit score?

Debt settlement may not totally ruin your credit score, but it will likely negatively impact it for seven years. Some people see a drop of 100 points or more.

Will a settled account affect my credit?

A settled account is considered a negative event in your credit history, so it will have a negative effect on your credit scores until it expires from your credit report, seven years after the first missed payment that led to settlement. Its effect on your scores will lessen over time.

Does partially settled improve credit score?

If you see a ‘partially settled’ status code, this means that your creditor has accepted an offer of final settlement that is less than the full amount owed. This does negatively affect your credit score, as it shows you have failed to pay the full amount required.

Can you remove settled accounts from a credit report?