A FICO® ScoreÎ of 733 falls within a span of scores, from 670 to 739, that are categorized as Good. The average U.S. FICO® Score, 714, falls within the Good range. A large number of U.S. lenders consider consumers with Good FICO® Scores “acceptable” borrowers, which means they consider you eligible for a broad variety of credit products, although they may not charge you the lowest-available interest rates or extend you their most selective product offers.

Approximately 9% of consumers with Good FICO® Scores are likely to become seriously delinquent in the future.

When it comes to buying a car, your credit score is a crucial factor that impacts the loan terms and interest rates you can qualify for. Specifically, a credit score of 733 falls into the “good” credit range, which means you have a decent shot at getting approved for an auto loan. But is a 733 credit score good enough to get you the best auto loan rates? Let’s take a deeper look.

What Does a 733 Credit Score Mean?

A 733 credit score is considered “good” by FICO’s scoring model, one of the most commonly used credit scoring systems. FICO scores range from 300 to 850, with higher scores indicating lower credit risk to lenders.

Specifically a 733 falls into the “good” credit tier that runs from 670 to 739. The average FICO score of U.S. consumers is 710 so a 733 puts you slightly above average.

While not excellent a 733 credit score demonstrates responsible credit usage to most lenders. You likely pay bills on time, maintain low credit utilization and have established length of credit history. This makes you look like a relatively low-risk borrower.

Can I Get a Car Loan with a 733 Credit Score?

The short answer is yes With a 733 credit score, you should be able to qualify for an auto loan from most lenders

According to Experian data, over 60% of auto loans go to borrowers with credit scores below 740. So your 733 score is well within the approved range for a standard car loan.

However, with a 733 score you may not get the absolute best rates or terms offered by lenders. Those are usually reserved for people with credit scores in the very good to exceptional ranges (740+ according to FICO).

The better your credit score, the more options you have when it comes to securing the ideal auto loan for your needs and budget.

What Auto Loan Terms Can I Expect with a 733 Score?

While you can expect to be approved, the exact terms of your auto loan will depend on factors beyond just your credit score. Your income, existing debts, and the loan amount requested also play a role.

But in general, here’s what a 733 credit score could mean for your prospective auto loan:

-

Interest Rates: With a 733 score, expect average interest rates of 4-7% for a new car loan, or 6-9% for a used car loan. Subprime borrowers may see even higher rates.

-

Approval Limits: Most lenders will approve loans up to 115% of a vehicle’s value with a 733 score. So if you’re looking at a $15,000 car, you could potentially get approved for a loan around $17,250.

-

Down Payment: Typically a 10-20% down payment is recommended for borrowers with good credit. Putting more money down can help lower your interest rate.

-

Loan Term Length: You should be able to qualify for a 4-6 year auto loan term with a 733 score. Longer terms increase total interest paid but lower the monthly payment.

Tips for Getting the Best Car Loan with a 733 Score

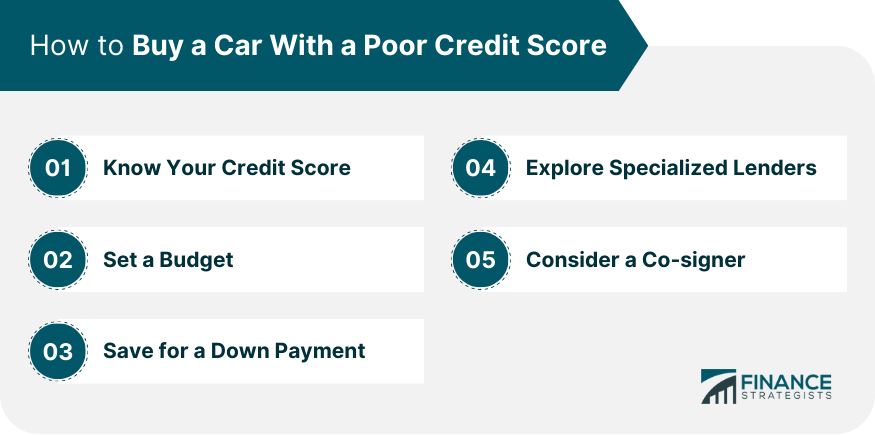

While a 733 credit score makes you eligible for an auto loan, there are things you can do to optimize the process:

-

Shop around with multiple lenders and compare rate quotes. Even slight variations in APR can impact affordability.

-

Aim for a lower loan-to-value ratio by putting more money down, if possible. This presents less risk to the lender.

-

Consider having a cosigner with better credit to potentially improve your chances at lower rates.

-

Check your credit reports to ensure there are no errors negatively impacting your score.

-

Make a larger down payment to get better rates and show lenders you’re financially committed.

-

Shorten the loan term length to pay less interest over the life of the loan, if budget allows.

How to Improve Your Credit Score for an Even Better Auto Loan

While a 733 credit score makes you eligible for a car loan, you still have room for improvement. Here are key tips for boosting your credit score even more:

-

Pay all bills on time, every time. Payment history is the biggest factor in your score.

-

Keep credit card balances low. Try to keep your utilization under 30%.

-

Avoid unnecessary hard inquiries by limiting new credit applications.

-

Build your credit history by keeping old accounts open. The length of your history matters.

-

Diversify credit by having a mix of loan types – credit cards, auto loans, mortgages, etc.

-

Dispute and correct any errors on your credit reports. Mistakes can drag down your score.

-

Sign up for credit monitoring to track your score and catch issues early.

With diligent credit management over time, you can potentially push your 733 score solidly into the “very good” tier, opening the door to prime auto loan rates. Be patient and stick to good financial habits.

The Road Ahead

A 733 credit score provides a helpful starting point in your auto loan journey. While not perfect, it signifies to lenders that you are a responsible borrower able to manage debt and make payments on time.

With prudent planning, smart shopping, and care taken to optimize other factors like income and down payment amount, a 733 credit score can still get you an auto loan with decent rates and terms. However, working to improve your credit score even more will offer you the most affordable financing options.

Staying the course with your Good credit history

Your 733 credit score puts you solidly in the mainstream of American consumer credit profiles, but some additional time and effort can raise your score into the Very Good range (740-799) or even the Exceptional range (800-850). To keep up your progress and avoid losing ground, steer clear of behaviors that can lower your credit score.

Factors that affect your credit score include:

Payment history. Delinquent accounts and late or missed payments can harm your credit score. A history of paying your bills on time will help your credit score. Its pretty straightforward, and its the single biggest influence on your credit score, accounting for as much as 35% of your FICO® Score.

Credit usage rate. To determine your credit utilization ratio, add up the balances on your revolving credit accounts (such as credit cards) and divide the result by your total credit limit. If you owe $4,000 on your credit cards and have a total credit limit of $10,000, for instance, your credit utilization rate is 40%. You probably know your credit score will suffer if you “max out” your credit limit by pushing utilization toward 100%, but you may not know that most experts recommend keeping your utilization ratio below 30% to avoid lowering your credit scores. Credit usage is responsible for about 30% of your FICO® Score.

Length of credit history. Credit scores generally benefit from longer credit histories. Theres not much new credit users can do about that, except avoid bad habits and work to establish a track record of timely payments and good credit decisions. Length of credit history can constitute up to 15% of your FICO® Score.

Total debt and credit. Credit scores reflect your total amount of outstanding debt you have, and the types of credit you use. The FICO® Score tends to favor a variety of credit, including both installment loans (i.e., loans with fixed payments and a set repayment schedule, such as mortgages and car loans) and revolving credit (i.e., accounts such as credit cards that let you borrow within a specific credit limit and repay using variable payments). Credit mix can influence up to 10% of your FICO® Score.

Recent applications. When you apply for a loan or credit card, you trigger a process known as a hard inquiry, in which the lender requests your credit score (and often your credit report as well). A hard inquiry typically has a short-term negative effect on your credit score. As long as you continue to make timely payments, your credit score typically rebounds quickly from the effects of hard inquiries. (Checking your own credit is a soft inquiry and does not impact your credit score.) Recent credit activity can account for up to 10% of your FICO® Score.

How to improve your 733 Credit Score

A FICO® Score of 733 provides access to a broad array of loans and credit card products, but increasing your score can increase your odds of approval for an even greater number, at more affordable lending terms.

Additionally, because a 733 FICO® Score is on the lower end of the Good range, youll probably want to manage your score carefully to prevent dropping into the more restrictive Fair credit score range (580 to 669).

The best way to determine how to improve your credit score is to check your FICO® Score. Along with your score, youll receive information about ways you can boost your score, based on specific information in your credit file. Youll find some good general score-improvement tips here.

What Credit Scores Do Dealerships Use For Auto Loans?

FAQ

Can I get a car loan with a 733 credit score?

Most lenders consider someone with a credit score of 733 to be relatively low risk. So, if you’re looking to apply for a new credit card, mortgage, personal or auto loan, you should have plenty of available options with competitive interest rates and terms.

What can I get with a 733 credit score?

| Type of Credit | Do You Qualify? |

|---|---|

| Home Loan | YES |

| Personal Loan | YES |

| Auto Loan | YES |

| No Annual Fee Credit Card | YES |

What credit score do you need to buy a $30,000 car?

To qualify for a $30,000 car loan, most lenders prefer to see a credit score of at least 660 to 700. That being said, your credit score is only one part of the equation. Lenders will also consider: Your debt-to-income ratio (how much you owe compared to how much you earn)

What credit score is needed for a $20,000 car loan?

There’s no minimum credit score required to get an auto loan. However, a credit score of 661 or above—considered a prime VantageScore® credit score—will generally improve your chances of getting approved with favorable terms. For the FICO® Score Θ , a good credit score is 670 or higher.