Your FICO Score is what lenders, landlords and other service contractors refer to when determining whether you’re a responsible borrower and measure how likely it may be that you’ll default on a payment contract.

The sooner you become familiar with how to build up a solid FICO Score and understand how it impacts your financial life, the better off you’ll be when it comes time to apply for a loan, credit card or even an apartment lease or cell phone contract.

Let’s go through what exactly a FICO Score is, why it matters, how it’s calculated, how to start building your credit score and where to get your score for free.

As someone looking to take out a loan, you may be wondering whether LendingTree uses FICO scores when matching you with lenders. FICO scores are one of the main credit scores lenders use to determine your creditworthiness so it’s an important question. In this article we’ll take an in-depth look at how LendingTree handles FICO scores and credit checks.

What is a FICO Score?

First, let’s start with a quick overview of what FICO scores are. FICO stands for Fair Isaac Corporation, the company that created the FICO credit scoring model back in 1989. FICO scores range from 300 to 850, with higher scores indicating lower credit risk.

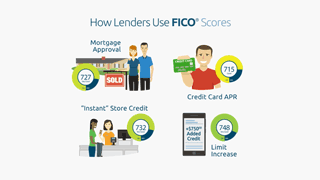

Lenders use your FICO scores from the three major credit bureaus – Equifax, Experian, and TransUnion – to determine your creditworthiness when you apply for loans or credit cards Each bureau has its own version of your FICO score that’s based on the information in your credit report at that bureau

Why Do Lenders Rely on FICO Scores?

FICO scores have become the industry standard for lenders when evaluating creditworthiness for a few key reasons:

-

Proven to predict risk – Extensive research has shown that FICO scores effectively predict the likelihood that someone will become 90 days late on a credit obligation in the next 24 months

-

Fair and objective – The FICO scoring formulas only consider credit report data, not demographic or lifestyle factors. This makes them a fair and unbiased way to assess credit risk.

-

Standardized – FICO provides a consistent scoring model across the industry, allowing easy comparison between consumers.

-

Required by most lenders – The vast majority of lenders rely on FICO scores to make lending decisions, especially for mortgages, auto loans, and credit cards.

Does LendingTree Use FICO Scores?

Now that we’ve covered the basics of FICO scores, let’s get back to the main question – does LendingTree use FICO scores?

The short answer is yes, but not directly. Here’s how it works:

-

LendingTree provides you with a VantageScore credit score, not a FICO score. The VantageScore is similar to FICO but uses credit report data from all three bureaus.

-

However, the lenders in LendingTree’s network that make loan offers do use FICO scores in their underwriting process.

-

So while LendingTree doesn’t pull your FICO scores themselves, the lenders they match you with will likely perform a hard inquiry to view your FICO scores when evaluating your application.

This allows LendingTree to give you an initial ballpark score without impacting your credit, while lenders can still rely on your FICO scores to make final lending decisions.

Prequalification vs. Hard Inquiry

When you get matched with lenders through LendingTree, you start off with prequalification. This means lenders make you conditional offers using just your stated information, not a full credit check yet.

Prequalification relies on a soft credit inquiry, which does not affect your credit scores. But if you move forward with a lender’s offer, they will then do a hard inquiry to view your FICO scores and finalize the loan.

Hard inquiries can cause a small temporary drop in your scores by a few points. But rate shopping for a mortgage or auto loan within a 30 day period counts as just one inquiry, so shopping LendingTree lenders won’t penalize your scores.

FICO Scores Used by Each Lender

While LendingTree provides your VantageScore, the particular FICO scores each lender uses may vary:

-

Mortgages – Most mortgage lenders will use FICO Score 2 (Experian), 5 (Equifax), and 4 (TransUnion).

-

Auto Loans – Auto lenders typically check FICO Auto Score versions, specialized for auto lending risk.

-

Credit Cards – Issuers tend to use overall FICO 8 scores from one or more bureaus.

-

Personal Loans – Lenders often check just one bureau’s FICO 8 score or another main model.

So make sure to check which scores a lender uses before applying if your scores vary significantly between bureaus.

Tips for Improving Your FICO Scores

Since lenders decide your rates and approval odds based on your FICO scores, it pays to improve them ahead of applying for a loan. Here are some tips:

- Pay all bills on time every month

- Keep credit card balances low

- Limit new credit applications

- Correct any errors on your credit reports

- Build credit history with responsible use

Checking your latest FICO scores through LendingTree or your credit card company can give you an idea of where you stand before applying. Scores of 700 and above will get you the best rates.

The Bottom Line

While LendingTree provides your VantageScore for free to give you an idea of your credit standing, lenders in their marketplace do rely on your FICO scores when making offers and final decisions. So maintaining excellent FICO scores remains critical for getting approved and securing the best loan terms.

By understanding how LendingTree interacts with your credit as you shop for a loan, you can ensure the process goes smoothly. Prequalification lets you explore options without a hard credit check, while eventually authorizing lenders to view your FICO scores helps them accurately assess lending risk.

Does everyone have a FICO Score?

Consumers who have a short credit history or few accounts on their credit reports might have a “thin credit file.” This is a term for consumers who don’t have enough information on their credit reports to generate a credit score, including with the FICO model.

Over 60 million Americans have thin credit files, according to Experian. If you’re among that group, you could end up with a poor credit score or unable to be scored by FICO. It can also make it difficult to get approved for new credit, whether it’s a credit card or home loan. And if you are approved, your thin credit file makes it more likely that you’ll get stuck with high interest rates that will make borrowing more expensive.

While it may seem like a Catch-22, to build a good credit score and history, you need to show that you can responsibly manage credit over a period of time. So, start small, as outlined above, and start building!

How Does LendingTree Get Paid? LendingTree is compensated by companies whose listings appear on this site. This compensation may impact how and where listings appear (such as the order or which listings are featured). This site does not include all companies or products available.

Your FICO Score is what lenders, landlords and other service contractors refer to when determining whether you’re a responsible borrower and measure how likely it may be that you’ll default on a payment contract.

The sooner you become familiar with how to build up a solid FICO Score and understand how it impacts your financial life, the better off you’ll be when it comes time to apply for a loan, credit card or even an apartment lease or cell phone contract.

Let’s go through what exactly a FICO Score is, why it matters, how it’s calculated, how to start building your credit score and where to get your score for free.

LendingTree Honest Review – Watch Before Using

FAQ

Which is better, FICO or VantageScore?

We find, on average, VantageScore 4.0 scores are higher than Classic FICO scores, especially for refinance loans and for investor properties and second homes. Both credit scoring models effectively distinguish between high-risk and low-risk borrowers.

What credit score is needed to buy a $300K house?

What FICO Score do I need to get a loan?

Most conventional mortgages require first-time homebuyers to have a minimum credit score of 620 for approval.