A 755 credit score reflects a strong financial track record and responsible credit management. With a score like this, you’re well-positioned to take advantage of favorable loan terms, lower interest rates, and access to premium financial products. However, there’s always room for improvement.

This article will explain the implications of having a 755 score, what factors influence it, and how you can maintain or even elevate it to the excellent credit score range.

A 755 FICO score is considered very good and above average This high credit score unlocks many benefits and financial opportunities In this article, we will dive into what makes a credit score good, the advantages of a 755 score, and tips for further improving it.

What Constitutes a Good Credit Score?

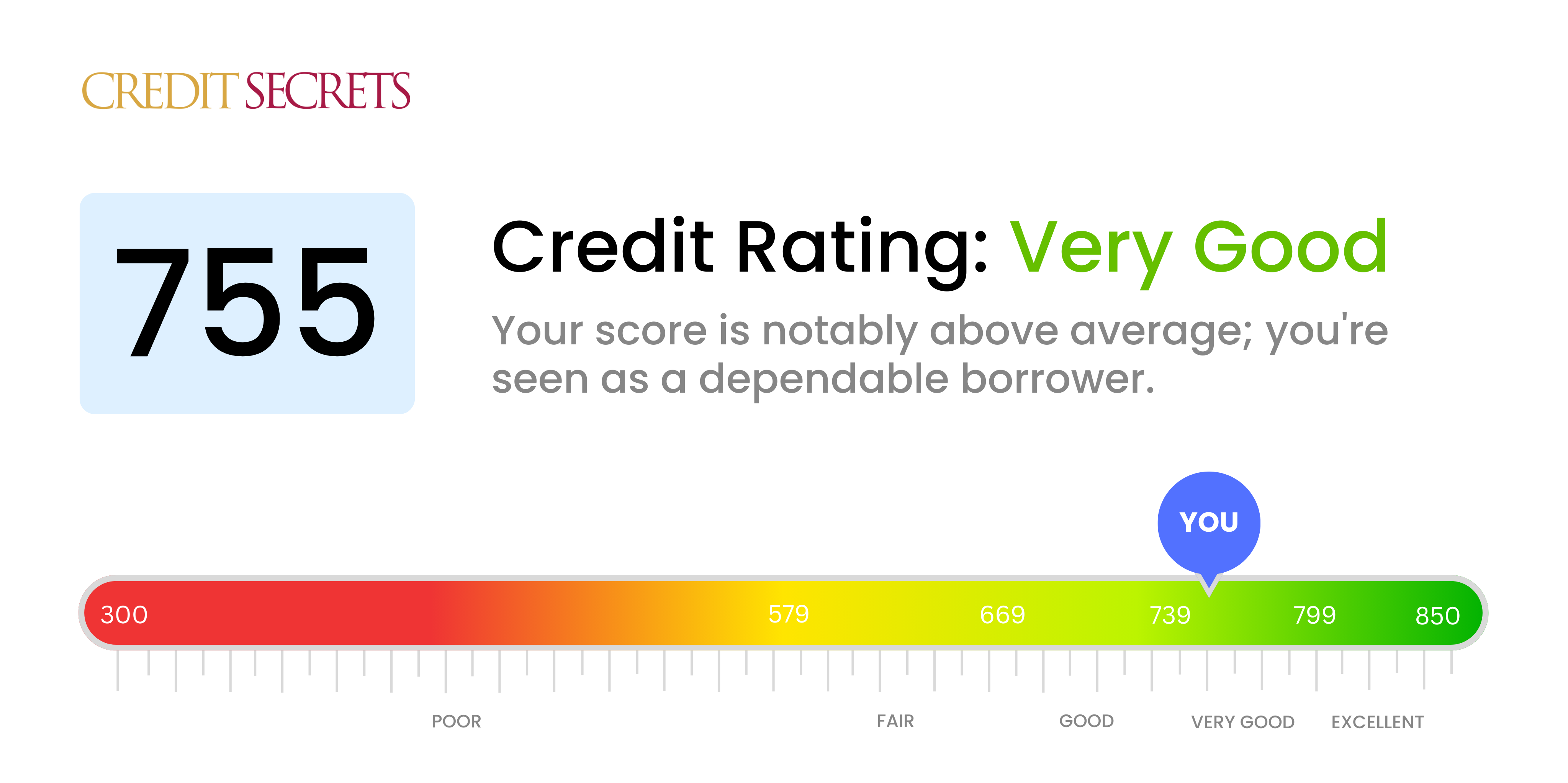

First, it is important to understand credit score ranges. FICO and VantageScore are two major credit scoring models used by lenders. They categorize scores into different tiers:

FICO Score Ranges

- Exceptional: 800+

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor: 579 and below

VantageScore Ranges

- Excellent: 781-850

- Good: 661-780

- Fair: 601-660

- Poor: 500-600

- Very Poor: 300-499

As you can see, a FICO score of 755 falls in the “Very Good” range, while a VantageScore of 755 is considered “Good” Generally, scores above 700 are favorable and classify as good or excellent credit

The Benefits of a 755 Credit Score

A 755 credit score unlocks many financial advantages:

-

Better Loan Terms: You’ll qualify for the best interest rates from lenders, saving thousands over the loan’s lifetime.

-

Increased Approval Odds: With exceptional credit, you’re nearly guaranteed approval for financing and new credit cards.

-

Higher Credit Limits: Issuers will be more generous with credit line increases allowing you to keep utilization low.

-

Strong Negotiation Leverage: You can negotiate lower APRs, waived fees, and other perks from credit card companies and lenders.

-

Lower Insurance Costs: Auto and homeowners insurance companies offer discounts for policyholders with higher credit scores.

-

Premium Credit Card Rewards: Only borrowers with pristine credit gain access to the most lucrative travel and cash back credit card programs.

-

Robust Credit Score: Your high score protects you from fluctuations should an unexpected financial issue arise down the road.

Improving a 755 Credit Score

A 755 credit score is excellent, but here are tips to inch it even higher:

-

Lower Credit Utilization – Keep balances low across all accounts, ideally below 10%. This factor heavily influences your score.

-

Mix Up Credit Types – Have installment loans (mortgages, auto, student loans) and revolving accounts (credit cards) in your profile.

-

Increase Credit Age – Allow accounts to age rather than closing old ones. Length of history matters.

-

Limit Hard Inquiries – Too many credit checks when applying for new credit makes you look risky. Space out applications.

-

Check Reports – Verify all details are accurate. Dispute any errors with the credit bureaus.

-

Never Miss Payments – Payment history is the biggest factor. Stay perfect in this category.

With diligence and smart credit habits, you can push your 755 credit score into the exceptional 800+ tier. But even at 755, you qualify for the top rates and terms.

Is a 755 Credit Score Good? Final Thoughts

A FICO or VantageScore of 755 is considered very good to excellent credit. With responsible use over time, this score provides approval for the most competitive loan offers, generous credit limits, and premium rewards credit cards reserved only for borrowers with exceptional scores.

While a 755 credit score is great, it can still be improved through actions like lowering credit utilization, limiting hard inquiries, never missing payments, and increasing credit history age and mix. With dedication, you can reach that 800+ “exceptional” score range. But even at 755, you have aced the credit game.

In closing, a 755 credit score unlocks major financial benefits. You can qualify for the best lending terms, lower insurance costs, have strong negotiation power, and access exclusive credit card offers. Overall, this high FICO or VantageScore represents prime credit health.

Financial Products Available to You

With a 755 score, you’re likely eligible for most standard financial products, often with attractive terms. Here’s what you can access:

- Personal loans: You can qualify for personal loans with lower interest rates and flexible repayment options.

- Auto loans: With a 755 score, not only are you eligible for lower interest rates, but many dealerships offer special promotions for borrowers with strong credit, making it easier to finance a car at a low cost.

- Credit cards: In addition to higher limits, many premium credit cards come with rewards, cashback options, and travel perks. You can benefit from 0% introductory APR periods, which make managing large purchases more affordable.

- Lines of credit: You can access flexible lines of credit that allow for easier financial planning and liquidity.

A credit score is a three-digit number that represents your creditworthiness based on your financial behavior. It’s calculated using information from your credit report provided by Equifax, Experian and TransUnion. Lenders use this score to assess the risk of lending you money, determining the terms and interest rates for loans, credit cards, or other financial products. Essentially, your credit score acts as a summary of your financial reliability in the eyes of lenders.

The credit score range typically spans from 300 to 850, with each tier signifying different levels of creditworthiness:

- 300 – 579: Poor

- 580 – 669: Fair

- 670 – 739: Good

- 740 – 799: Very Good

- 800 – 850: Excellent

A 755 score places you firmly in the “very good” range, significantly above the average credit score.

What Does a 755 Score Mean?

An average credit score of 755 falls within the “very good” range, according to the most widely used credit scoring models. This means lenders view you as a low-risk borrower. Most credit companies, banks, and financial institutions will offer you favorable loan terms, including competitive interest rates and higher credit limits on personal loans or lines of credit.

While a 755 score offers many benefits, it’s crucial to continue maintaining good habits to avoid any negative impacts from missed payments or high credit utilization. Services like Dovly AI can help monitor and manage your credit report to ensure you stay on track.

Is 755 Credit Score Good? – CreditGuide360.com

FAQ

What percentage of people have a FICO score over 750?

Twenty-four percent have a FICO® Score between 750 and 799, making the “very good” bracket. Data source: FICO (2024).

Can I buy a house with a 755 credit score?

Buying a home with a 755 credit score may be possible; however, it could be more challenging than if you had an excellent credit score. Some lenders may require a larger down payment, charge higher interest rates or have stricter loan terms.

How good is a 755 FICO score?

Your FICO® ScoreΘ falls within a range, from 740 to 799, that may be considered Very Good. A 755 FICO® Score is above the average credit score. Borrowers with scores in the Very Good range typically qualify for lenders’ better interest rates and product offers.

How to go from 755 to 800 credit score?

… to 800, you’ll need a nearly flawless payment history, a credit utilization rate well below 30%, a healthy mix of credit types, and an extended credit historyMay 2, 2025

Is a FICO ® score of 755 a good credit score?

A FICO ® Score of 755 is well above the average credit score of 714, but there’s still some room for improvement. Among consumers with FICO ® credit scores of 755, the average utilization rate is 18.5%. The best way to determine how to improve your credit score is to check your FICO ® Score.

Do people with a 755 credit score pay their bills on time?

People with credit scores of 755 typically pay their bills on time; in fact, late payments appear on just 24% of their credit reports. People like you with Very Good credit scores are attractive customers to banks and credit card issuers, who typically offer borrowers like you better-than-average lending terms.

How do I get a 755 credit score?

There’s no secret to getting a 755 credit score. Rather, it simply requires consistency and commitment. You need to pay your bills on time, use only a portion of the credit made available to you, and generally work to make any mistakes you’ve made look like freak occurrences rather than standard practice.

Can you get a student loan with a 755 credit score?

Student loans are some of the easiest loans to get with a 755 credit score, seeing as roughly 90% of them are given to applicants with a credit score below 780. A new degree may also make it easier to repay the loan if it leads to more income.

Can you get a car loan with a 755 credit score?

You should be able to get approved for a decent car loan with a 755 credit score, considering that roughly 80% of all auto loans go to people with credit scores below 780. Still, it’s important to compare your auto loan options carefully if you want to get a low APR.

What is the difference between Fico and VantageScore?

While FICO and VantageScore take different approaches to age groupings — one uses roughly 10-year age ranges while the other uses broader generational ranges — the average scores for specific ages are similar to one another. For example, the average score for a 25-year-old is 680 and 667, respectively. Stress less. Track more.