Automatically renews at $0/month. Cancel anytime, no refunds. Includes FICO Score 8. Your lender/insurer may use a different credit score. See important information belowImportant information 11.

Automatically renews at $19.95/month. Cancel anytime, no refunds. Includes FICO Score 8. Your lender/insurer may use a different credit score. See important information belowImportant information 11.

Automatically renews at $29.95/month. Cancel anytime, no refunds. Includes FICO Score 8. Your lender/insurer may use a different credit score. See important information belowImportant information 11.

Automatically renews at $39.95/month. Cancel anytime, no refunds. Includes FICO Score 8. Your lender/insurer may use a different credit score. See important information belowImportant information 11.

1. Your subscription automatically renews monthly at $0 for Free Plan, $19.95 for Basic, $29.95 for Advanced, or $39.95 for Premier, unless you cancel. You may cancel at any time; however, refunds are not available. All subscriptions include a FICO® Score 8, and may include additional FICO® Score versions. Your lender or insurer may use a different FICO® Score than the versions you receive from myFICO, or another type of credit score altogether. Learn more

2. Not all credit report data or transactions are monitored. Monitored credit report data, monitored credit report data change alerts, FICO® Score updates, FICO® Score alerts, monitored transactions, and alert triggers, timing and frequencies vary by credit bureau. Other limitations apply. Learn more

3. The Identity Theft Insurance is underwritten and administered by American Bankers Insurance Company of Florida, an Assurant company. Please refer to the actual policies for terms, conditions, and exclusions of coverage. Coverage may not be available in all jurisdictions. Review the Summary of Benefits.

myFICO is the official consumer division of FICO, the company that invented the FICO credit score. FICO® Scores are the most widely used credit scores, and have been an industry standard for more than 25 years.

Compare your FICO Scores and credit reports from all 3 bureaus—Experian, TransUnion, and Equifax—side-by-side. Understanding your credit has never been easier!

Your credit scores play a crucial role in determining your financial opportunities. While there are many scoring models, FICO® scores remain the most widely used by lenders But navigating the world of FICO® scores can be tricky, especially when it comes to versions like FICO® 2, 4, and 5

These “mortgage scores” are still relied upon by many lenders when approving home loans So getting your hands on these elusive numbers is key to understanding your true creditworthiness

In this complete guide, we’ll break down exactly what FICO® 2, 4, and 5 are, why they matter, and most importantly, how you can access your scores.

What Are FICO® 2, 4, and 5 Scores?

First things first – what makes these scores different?

FICO® 2: Also called Experian/Fair Isaac Risk Model v2. Introduced in 1989 and still widely used for mortgages. Ranges from 300-850.

FICO® 4: Also called Equifax Beacon 5.0. Released in 1995, another popular mortgage score. Same range as FICO® 2.

FICO® 5: Known as TransUnion FICO® Risk Score 04. Debuted in 1996, still used by some lenders. Same range and factors as FICO® 2 and 4.

These scores were designed specifically for mortgage underwriting. While newer models like FICO® 8 are now more commonly used for credit cards and personal loans, many lenders continue relying on versions 2, 4, and 5 when approving home loans.

Why Your FICO® 2, 4, and 5 Scores Matter

You’re probably wondering why these “old” scores still carry so much weight. Here are three key reasons:

1. Mortgage Eligibility

FICO® 2, 4, and 5 play a major role in determining if you qualify for a home loan and the rate/terms you’ll receive. Minimum score requirements generally range from 620-680.

2. Creditworthiness

While FICO® 8 offers a snapshot of your overall credit, mortgage scores provide a more focused view of your risk profile for long-term lending. Knowing these scores gives you a clearer picture of where you stand.

3. Financial Decisions

Your FICO® 2, 4, and 5 scores can impact other financial moves too, like getting approved for an auto loan or credit card. Understanding them helps you make smart money choices.

How to Check Your FICO® 2, 4, and 5 Scores

Ready to get your hands on these mortgage scores? Here are 5 ways to access your FICO® 2, 4, and 5:

1. Ask Your Mortgage Lender

Many lenders provide your mortgage scores upfront in the loan application process. This is often the simplest way to get all three with no extra effort.

2. Order Directly From Credit Bureaus

You can purchase FICO® 2, 4, and 5 directly from Experian, Equifax, and TransUnion to compare numbers from all three bureaus side-by-side.

3. Use a FICO® Score Provider

Services like myFICO give access to your FICO® 8 alongside mortgage FICO® scores 2, 4, and 5 from each bureau.

4. Try Credit Monitoring Services

Some credit monitoring sites like Experian CreditWorksSM offer your mortgage FICO® scores with ongoing tracking as part of paid subscription plans.

5. Check With Free Score Providers

A handful of free score sources like Credit Karma provide FICO® 2, 4, and 5. But these tend to have limitations like one-bureau only scores.

Tips for Raising Your FICO® 2, 4, and 5 Scores

Once you have your scores, you can start taking steps to improve them. Here are some top tips for boosting your mortgage FICO® scores:

- Pay all bills on time – Payment history has the biggest impact, so never miss payments.

- Lower credit card balances – Keep balances low, ideally under 30% of your credit limit.

- Limit new credit applications – Too many new accounts can lower your scores.

- Correct errors on your credit reports – Dispute and remove any inaccurate information.

- Pay down debt – The lower your balances, the better for your scores.

Take Control of Your FICO® 2, 4, and 5 Scores

Checking your FICO® 2, 4, and 5 scores is a crucial first step to understanding where you stand with lenders. By monitoring these mortgage scores and taking actions to improve them over time, you can put yourself in a strong position to achieve your homebuying goals.

The world of credit scoring is complex, but arming yourself with knowledge about your FICO® 2, 4, and 5 gives you power. Now you have a complete guide to accessing these scores and using them to build a solid financial foundation.

See how it works

What youll get with FICO® Free

We’ve got you covered

Checking your credit with FICO will not affect your FICO Scores.

We are here with toll-free support if you need us.

We use 128-bit encryption to protect the transmission of your data to FICO.

The FICO® Score is your key to understanding how lenders view you. See if you have offers available from trusted partners for loans, credit cards, and more.

How To Get FICO Score 2 4 5 Free? – CreditGuide360.com

FAQ

How can I get my FICO 5 score?

FICO® Score Open Access

Over 200 financial institutions provide FICO Scores for free to their customers through the program. If your bank, credit card issuer, auto lender or mortgage servicer is one of them, you can see your FICO® Scores, along with the top factors affecting your scores, for free.

How do I get my free FICO score 2?

You can sign up for a free account on myFICO.com to access your monthly FICO score based on your Equifax credit report.

What does FICO score 2 mean?

While the foundational elements are consistent across FICO® models, FICO® Score 2 is fine-tuned to assess mortgage-related risk. This means it might weigh certain credit activities differently than other models, calculating a different score than other FICO® Score models, such as FICO® Score 8.

How do I calculate my FICO score?

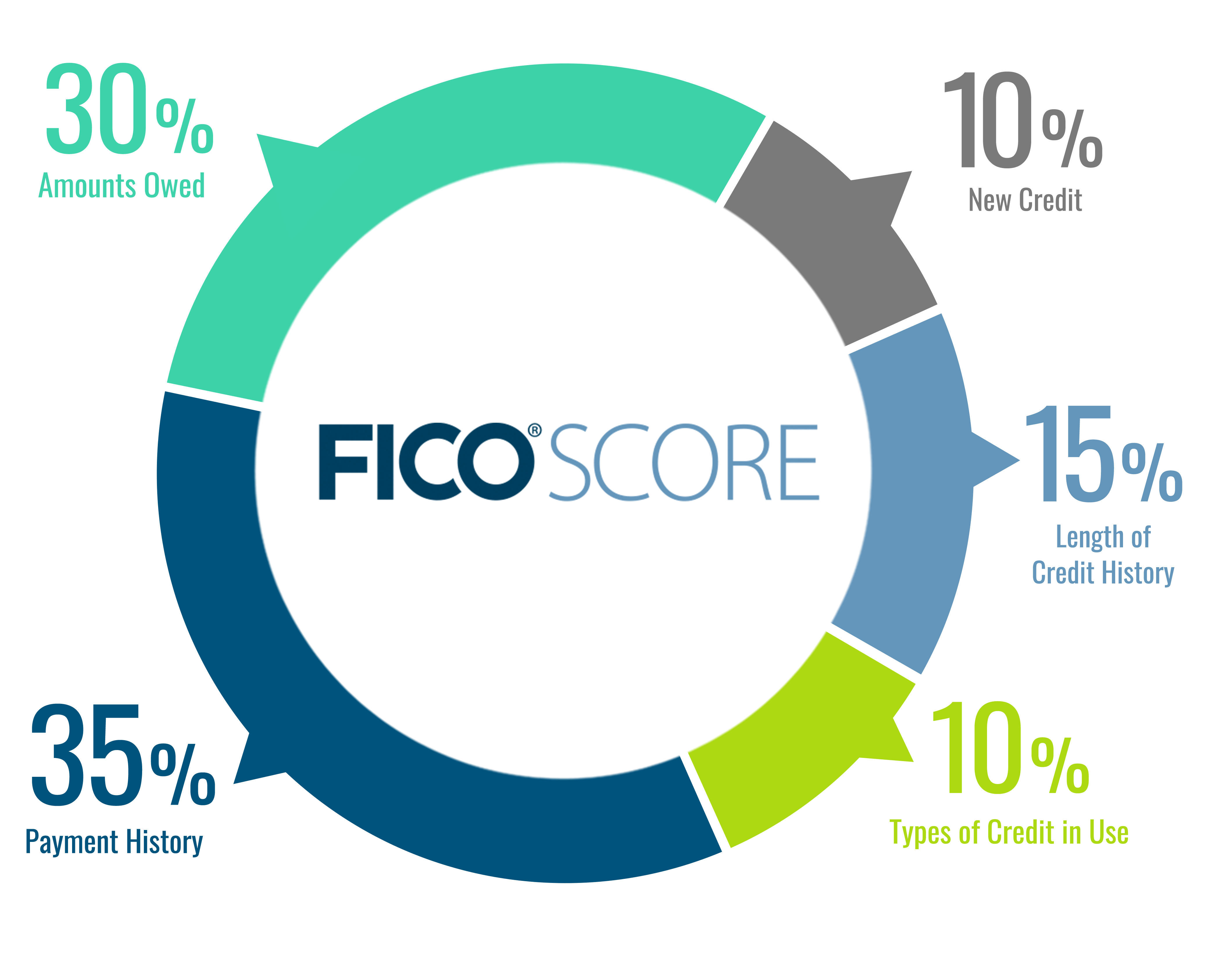

The main categories considered are a person’s payment history (35%), amounts owed (30%), length of credit history (15%), new credit accounts (10%), and types of credit used (10%). FICO scores are available from each of the three major credit bureaus, based on information contained in consumers’ credit reports.

How can I get my FICO ® score for free?

There are several ways to get your FICO ® Scores, both for free and at a cost. You can get your FICO ® Score for free from hundreds of financial services companies, including banks, credit unions, credit card issuers and credit counselors that participate in the FICO ® Score Open Access program and offer free scores to customers.

Do You Know Your FICO score?

FICO Scores are used in 90% of U.S. lending decisions, making it key to know your credit score. Here are resources that provide access to your free FICO Score. The next time you’re ready to apply for a credit card, auto loan or mortgage, first check your FICO Score, the three-digit score lenders use to determine creditworthiness.

How is a FICO score calculated?

Your FICO score is calculated based on a variety of factors, such as your payment history, outstanding balances, length of credit history, new credit and credit mix. FICO Scores are an industry standard and touted as the most widely used credit scores. What’s the difference between VantageScore and FICO?

How can I track my FICO score?

While you are working to build your credit, you can use Discover to help track your FICO score. In addition to having access to your free FICO credit score each month, you’ll be able to learn more about the factors that make up your scores.

Where can I See my FICO score?

If your bank, credit card issuer, auto lender or mortgage servicer participates in FICO ® Score Open Access, you can see your FICO ® Scores, along with the top factors affecting your scores, for free. Below is a list of some lenders participating in FICO ® Score Open Access. How can I get my FICO 2 score up?

What is a FICO ® score?

A FICO ® Score is a credit score that’s developed and offered by FICO ®. The company, originally named Fair Isaac Corporation, released its first credit bureau-based credit score in the 1980s. Since then, FICO ® has created different types of credit scores and released new versions of its scores that have updated how calculations are made.