Hey folks! I’ve been getting a ton of questions about where the market’s headed so I thought I’d tackle this head-on today. The question on everyone’s mind will the market go back up in 2022? Let’s dive into what we know, what the experts are saying and how you might position yourself.

The Market’s Recent Rollercoaster

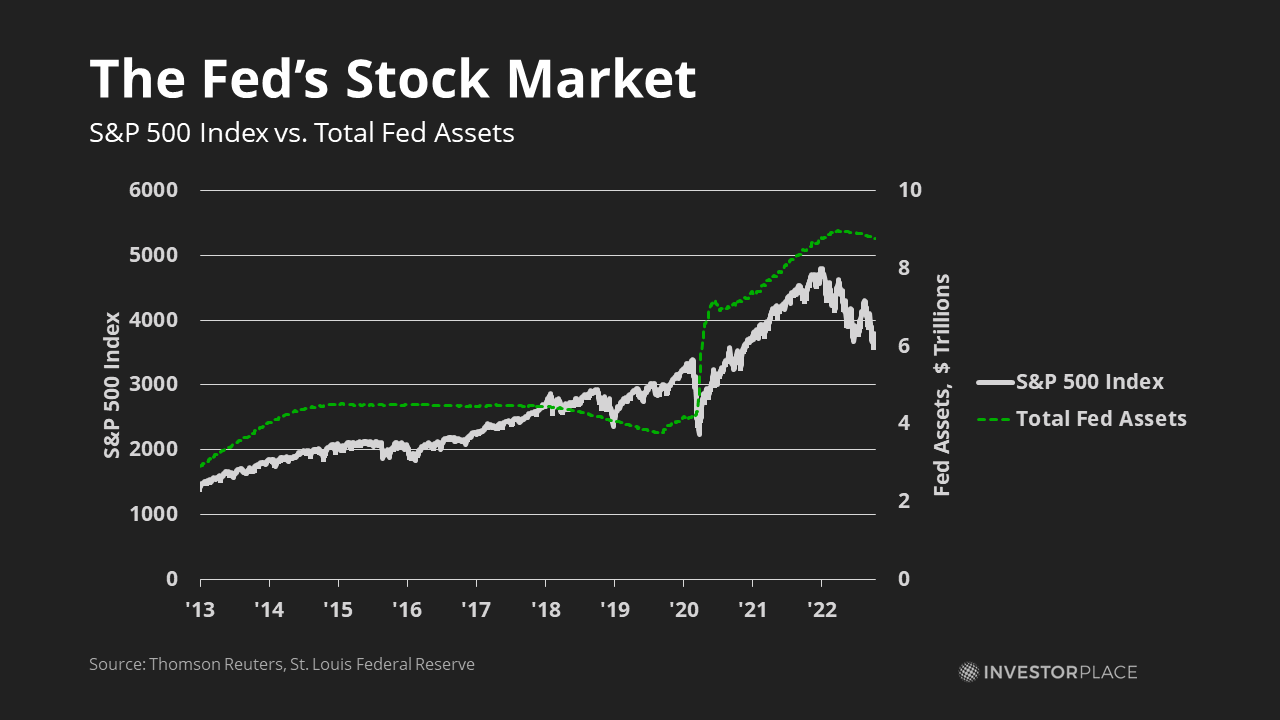

The stock market has certainly given investors a wild ride lately. After rebounding strongly from pandemic lows we’ve seen significant volatility in recent months. The S&P 500 experienced modest retreats from record highs after periods of strong performance, leaving many wondering if we’re due for a more substantial correction.

Many of you have probably noticed your investment portfolios taking a hit Trust me, you’re not alone – I’ve been watching my retirement account with one eye closed!

Key Factors Influencing Market Direction

Several important factors are influencing current market conditions:

Inflation & Interest Rate Policies

The Federal Reserve’s interest rate policies remain a critical variable for market direction. The Fed has implemented rate cuts in response to changing economic conditions, with investors closely watching for signs of additional cuts.

As Bill Merz, head of capital markets research with U.S. Bank Asset Management Group, points out: “Market volatility has picked up with increased concerns about artificial intelligence spending and uncertainty over Federal Reserve interest rate cuts.”

Tariffs & Trade Tensions

Trade policies and tariffs continue to create uncertainty in markets. Higher tariff rates for major trading partners significantly affect U.S. import costs and potentially inflation.

Consumer Spending & Corporate Earnings

Despite concerns, consumer spending has remained relatively robust. According to recent data, Americans are still spending on discretionary items like movie tickets, restaurant visits, and travel.

Corporate earnings have generally been solid, providing support for stock prices even amid other concerns. As Rob Haworth of U.S. Bank notes, “Companies remain nimble,” with analysts raising earnings forecasts, which supports upward-trending equity prices.

Expert Perspectives on Market Recovery

Financial experts have varied outlooks on whether the market will recover strongly in 2022:

Tom Hainlin, national investment strategist with U.S. Bank Asset Management Group, suggests investors focus on underlying economic indicators rather than short-term market moves.

Eric Freedman, chief investment officer for U.S. Bank Asset Management Group, encourages a long-range view: “Stay invested, but make sure you are in the right asset allocation.” He emphasizes that volatile markets help focus investors on realistic conversations about risk tolerance.

Historical Context: What Past Corrections Tell Us

Looking at market history provides some valuable perspective:

- Markets have experienced numerous corrections throughout history

- Recovery periods vary but markets have historically trended upward over long timeframes

- New all-time highs are often followed by further new highs

As Haworth wisely points out, “New all-time highs are often followed by new all-time highs.”

Market Breadth: A Positive Sign?

One encouraging sign for potential market recovery is the expansion of market breadth. Unlike previous years when just a few sectors (particularly tech) drove most gains, 2025 has seen a broader range of industries performing well:

- Financials reached new all-time highs

- Industrials set new records

- Utilities have performed strongly

- Mid-cap and small-cap stocks have nearly closed performance gaps with large caps

This broader participation suggests a healthier market environment that may be more resilient to sector-specific challenges.

Strategies for Navigating Current Market Conditions

So what should YOU do? Here are some practical strategies:

1. Maintain Appropriate Diversification

Diversification remains crucial during market volatility. Ensure your portfolio includes different asset classes that don’t all move in the same direction at once.

2. Consider Dollar-Cost Averaging

For those with cash on the sidelines, a dollar-cost averaging approach may be wise. This involves investing fixed amounts at regular intervals rather than all at once.

3. Align With Your Time Horizon

Your investment approach should match your time horizon. If you won’t need the money for many years, short-term volatility matters less.

4. Check Your Risk Tolerance

Market downturns provide a real-world test of your true risk tolerance. If recent market moves caused excessive stress, it might be time to reconsider your asset allocation.

5. Avoid Emotional Decisions

Perhaps most importantly, avoid making emotional decisions based on short-term market moves or headlines.

What About Cash on the Sidelines?

If you’ve been holding extra cash as a precaution and missed recent market rallies, consider implementing a systematic approach to reinvesting. Haworth advises using dollar-cost averaging to invest over time rather than trying to time the perfect entry point.

My Personal Take

I’ve been through a few market cycles myself, and I’ll tell ya – trying to time the market perfectly is nearly impossible. Last time I thought I had it all figured out, I pulled money out right before a major rally. Oops!

Instead of obsessing over “will the market go back up in 2022,” I’m focusing more on ensuring my portfolio matches my long-term goals and risk tolerance. I’ve slightly increased my emergency fund but kept my retirement contributions steady.

A Balanced Perspective

While no one can predict with certainty whether the market will go back up in 2022, maintaining a long-term perspective is essential. Markets have historically rewarded patient investors, though the path is rarely smooth.

As Eric Freedman emphasizes, “If you determine you need to adjust your portfolio positioning, utilize a prudent transition plan.”

Questions to Ask Yourself

Before making any significant changes to your investment strategy, consider:

- Has my financial situation or goals changed?

- Am I comfortable with my current risk level?

- Do I have adequate cash reserves for emergencies?

- Am I properly diversified across different asset classes?

- What is my investment time horizon?

While the question “will the market go back up in 2022?” doesn’t have a simple yes or no answer, history suggests that markets tend to recover over time. The key is having a strategy that allows you to ride out volatility while still making progress toward your financial goals.

Now might be an excellent time to check in with a financial professional who can help ensure your portfolio aligns with your time horizon, risk appetite, and long-term objectives.

Remember, successful investing isn’t about perfectly timing market ups and downs but about creating a sustainable strategy you can stick with through various market conditions. Stay focused on your long-term goals, remain appropriately diversified, and avoid making decisions based purely on emotion.

What’s your take on current market conditions? Have you made any changes to your investment strategy? Drop a comment below – I’d love to hear your thoughts!

Estás ingresando al sitio de U.S. Bank en español Algunos materiales y servicios podrían estar disponibles solamente en inglés. Los enlaces incluidos en esta comunicación podrían dirigirte a sitios web en inglés.

Capitalize on today’s evolving market dynamics.

With markets in flux, now is a good time to meet with a wealth advisor.

The government shutdown complicates the economic outlook

The Federal government shut down for the 11th time since 1980 after lawmakers failed to reach a spending deal. Spending on critical services, including the postal service, Social Security and Medicare, air travel, and the military continue, but most other government workers are furloughed. The shutdown is delaying important economic data releases such as weekly unemployment claims, monthly retail sales, and the Bureau of Labor Statistics’ employment report. However, high-frequency alternative data continues to show resilient consumer activity. Movie theatre box office receipts, airport checkpoint traffic, and restaurant bookings highlight robust discretionary spending, while private sector retail sales gauges like Johnson Redbook reflect normal spending levels at department stores.

The Stock Market is CRASHING BIG Again Today! (Here’s Why)

FAQ

Is the stock market expected to go up in 2025?

Shifting trade policy creates significant uncertainty around company earnings forecasts. Kostin’s team maintained its projection for the growth in S&P 500 stocks’ earnings-per-share at 7% in 2025 and 7% the following year.

How long will it take for the stock market to recover?

5. The stock market has historically recovered quickly from corrections. The average time to recovery from a 5%-10% downturn is three months. The average time to recovery from a 10%-20% correction is eight months.

How long was the stock market down in 2022?

The 2022 stock market decline was a bear market that included the decline of several stock market indices worldwide between January and October 2022.

Will the stock market ever rise again?

“While short-term uncertainties may keep markets range-bound in the near term, improving macro indicators and a strong earnings trajectory could set the stage for a rally from the second half of 2026 onward.”