Credit scores are like report cards from different teachers. They’re all grading the same student (you) but they weigh things differently based on what they think matters most.

So if you’ve looked at all three major credit bureaus (Experian, Equifax, and TransUnion) and thought, “Why is my Experian score lower than the others?” you’re not imagining things. And no, Experian isn’t out to ruin your life — but the full explanation might surprise you.

Want to help improve your credit score? MoneyLion makes it easy to explore offers from our trusted partners — like credit monitoring, credit report dispute tools, and ways to build credit by paying bills. A stronger score can help you qualify for lower rates and boost your borrowing power.

Having a lower Experian credit score compared to TransUnion and Equifax is a common issue that leaves many people scratching their heads. As confusing as it is, there are some simple explanations for this score discrepancy.

In this article I’ll break down the main reasons why your Experian score may lag behind the other two major credit bureaus. I’ll also give some tips on how to improve your score across the board. Let’s dive in!

The Short Answer

The short answer is that each credit bureau has slight differences in how they calculate your score They don’t share all the same scoring models or data sources, This means your TransUnion and Equifax scores can end up higher even if your overall credit profile is the same

Some key factors leading to Experian score differences:

- Unique data sources

- Separate credit scoring models

- Varied score versions

- Mismatched update schedules

While frustrating, score discrepancies are normal. The good news is you can take steps to boost your Experian score over time.

Why Credit Bureau Scores Vary

Now let’s go a bit deeper on why your Experian, TransUnion and Equifax scores are never exactly the same.

They Use Different Data Sources

This is a big one. The credit bureaus don’t all receive updates from every lender you have accounts with. For example:

- Lender A might report your payment history to TransUnion and Equifax, but not Experian.

- Lender B might only report to Experian and TransUnion.

So your good payment track record with Lender A would help your TransUnion and Equifax scores. But your Experian score won’t get that same boost.

They Have Separate Credit Scoring Models

While all three bureaus use variations of the FICO model, they differ in how scores are calculated:

- Payment history – Experian may weigh this at 35%, while Equifax weighs it at 40%.

- Credit utilization – The bureaus give different importance to this factor.

- Credit history length – The impact of this can vary between bureaus.

So even using the same overall data, the end scores can differ based on model algorithms

They Use Different Score Versions

Adding to the confusion, the bureaus may tap different versions of the FICO model:

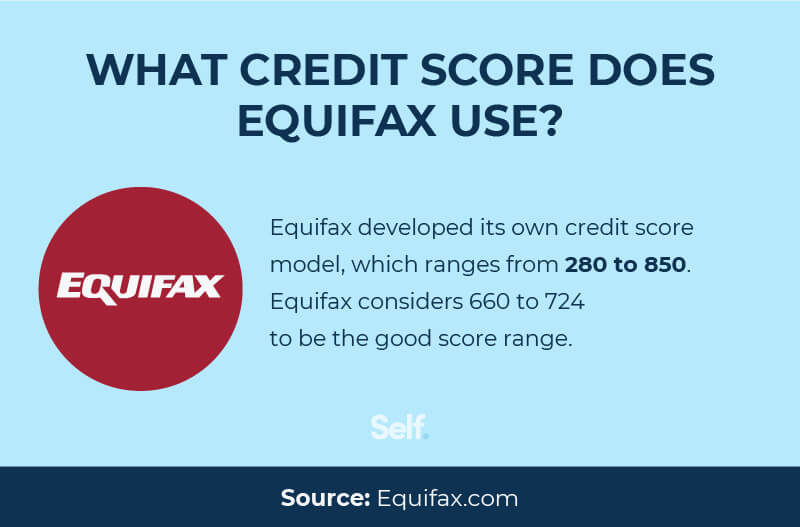

- Equifax could use FICO 8.

- TransUnion might use FICO 9.

- Experian may use FICO Auto Score.

So you could have a FICO 8 score from Equifax that differs from your Experian FICO Auto Score.

Their Data Updates Don’t Always Match

The bureaus refresh your credit data on different schedules. For example:

- TransUnion – Every 30 days

- Experian – Every 34 days

- Equifax – Every 28 days

If you paid down debt or had credit activity between Experian’s longer update cycles, that could temporarily affect your scores.

Tips to Raise Your Experian Credit Score

While score discrepancies are normal, here are some tips to potentially improve your Experian score:

-

Pay all bills on time – Payment history is typically the biggest factor. Stay current on everything.

-

Lower credit card balances – Even if you pay in full, high balances relative to limits hurt scores.

-

Limit new credit applications – Too many hard inquiries in a short time can ding your score. Space out applications.

-

Don’t close old accounts – Having longer credit history helps. Keep accounts open unless there’s a fee.

-

Check your Experian report – Dispute any errors you find that may be dragging your score down.

-

Sign up for credit monitoring – This lets you monitor your Experian score monthly and catch any sudden drops.

The bottom line is checking all three of your credit bureau scores regularly. This helps you spot issues specific to any one report. With time and smart credit habits, you can improve your Experian score to match the other two.

Frequently Asked Questions

Which credit score matters most?

This depends on the lender. For mortgages, a blend of all three scores is common. Auto lenders may focus just on Equifax. Know which score your lender uses before applying.

How can I check all three of my scores?

You can access your credit reports and scores for free once a year at annualcreditreport.com. For ongoing monitoring, credit monitoring services provide all three scores. Some credit cards also include free score access.

Is it bad if my Experian score is lower?

Not necessarily. As long as your score meets lender requirements, a lower Experian score itself isn’t damaging. Just focus on keeping all your scores in good shape over time.

Should I dispute my Experian report if my score seems lower?

If you find legitimate credit report errors dragging your Experian score down, absolutely dispute them. Inaccuracies like closed accounts listed as open or late payments you paid on time.

Which credit scoring model do most lenders use?

The FICO score model is most widely used, with FICO 8 being common. But again, check on which specific score version your lender uses to qualify borrowers.

How can I raise my credit score fast?

Improving scores takes patience over time. But making extra debt payments, limiting hard inquiries, and fixing errors can potentially give your scores a boost more quickly.

The Takeaway

It’s common and expected for your Experian, TransUnion and Equifax credit scores to differ somewhat. Each bureau uses unique data and models to calculate your score. But don’t let an Experian lag get you down. Monitoring all three regularly and building healthy credit habits will raise your scores across the board over time.

Why are my credit scores different?

OK, let’s break it down. Your Experian credit score, just like the ones from Equifax and TransUnion, is based on a credit scoring model. The problem? They all weigh the data a little differently.

Your credit score is influenced by:

- Your payment history

- Credit utilization

- Length of credit history

- Credit mix

- Hard inquiries

Each bureau runs its own formula, so your scores will almost always be a little different. Sometimes, that gap can be annoying. Other times, like when your Experian score dropped for no reason, it might even feel personal.

Reasons your credit scores may be different

Why are your credit scores different? Not only does each credit bureau have its own scoring model, but other factors contribute to credit score variances among the three credit bureaus. Here’s a closer look at what’s probably going on behind the scenes.

Not all lenders report to all three credit bureaus. Some might send updates to TransUnion and Equifax but ghost Experian entirely. So if you’ve got a positive payment streak that only TransUnion knows about, that explains why your Experian credit score feels like the odd one out.

Each bureau updates its data on a different schedule. TransUnion might refresh your info every 30 days, while Experian could be running fashionably late. So if you recently paid down debt, that win might show up first on TransUnion — leaving you wondering why is Experian score lower than TransUnion and Equifax.

Let’s say you applied for a loan and the lender pulled only your Experian file. That hard inquiry can ding your score temporarily — but only with Experian. Cue the confusion. If you’ve ever wondered, why is Experian score lower, well, this could be it.

The models used by Experian, Equifax, and TransUnion aren’t twins — they’re more like cousins. While all consider similar factors, they weigh them differently. For example: Experian might weigh payment history at 35%, while TransUnion might weigh it at 40%.

This could potentially answer the question of why is Experian credit score lower. It could also not … in which case, read on.

Don’t forget, there’s more than one version of a FICO score. There’s FICO 8, FICO 9, FICO Auto Score — you get the picture. So even if two bureaus both use Experian data, they might still use different versions of the scoring model. No wonder you’re asking why are Experian scores lower!