Credit scores can influence some of your financial opportunities. Fortunately, you can find ways to improve your score. Credit scores can be confusing, especially when you don’t have debt. You might think that having no debt should mean you have a good credit score, but that is not the case. Credit score models influence your credit score, and debt is a portion of the model.

Having a good credit score is important for getting approved for loans and credit cards at the best rates. So it can be frustrating when your score is lower than expected especially if you don’t have any debt.

I found myself in this situation a while back. I had always been diligent about paying off my credit card balance each month. So I never carried any debt or paid a penny of interest. But when I checked my credit score for the first time I was disappointed to see it was on the low end of the “good” range.

If you have no debt, you may think your credit score should be excellent. But there are a few reasons why you can still end up with a lower than expected score, even if you don’t owe any money.

Why Credit Scores Don’t Directly Measure Debt

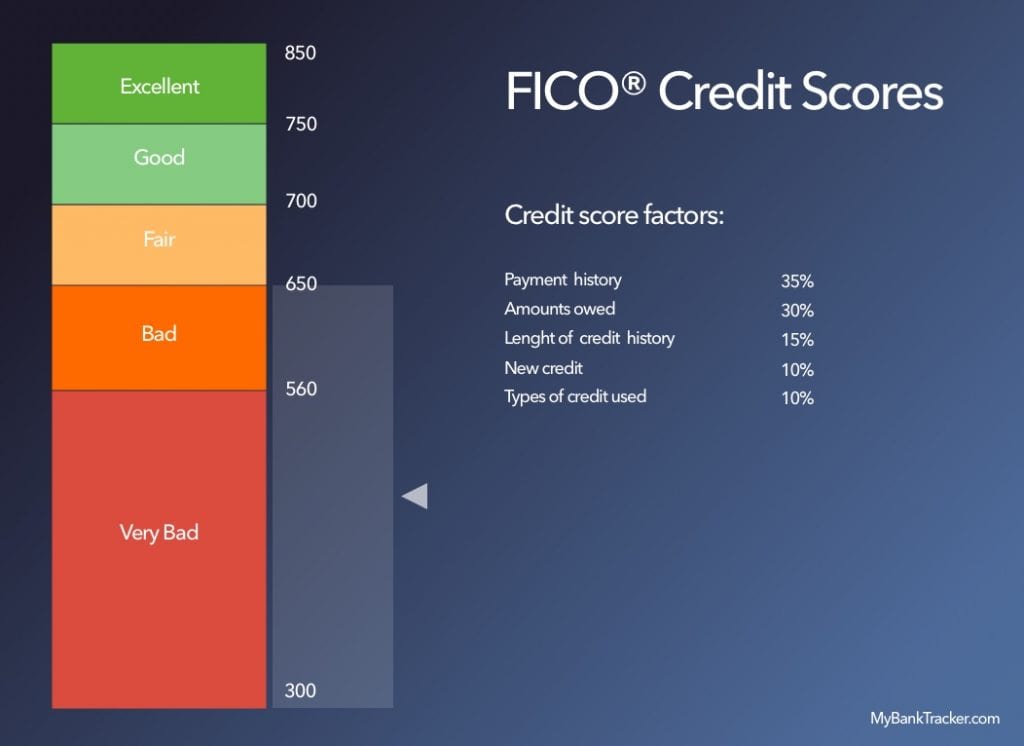

The most common credit scoring model, FICO, looks at the below factors to calculate your score:

- Payment history – 35%

- Credit utilization – 30%

- Length of credit history – 15%

- Credit mix – 10%

- New credit applications – 10%

As you can see, debt makes up only 30% of your FICO score through the credit utilization ratio. This measures how much of your total available credit you are actually using. Even if you pay off balances each month, a high utilization ratio can lower your score.

The other 70% of your score comes from factors not directly related to how much debt you have. Payment history, credit history length, and new credit applications matter just as much, if not more.

So even with no debt whatsoever, here are some reasons your credit score may be lower than expected:

You Have a Short Credit History

The length of your credit history accounts for 15% of your FICO score. In general, the longer your accounts have been open, the better for your score.

If you only have 1-2 years of credit history, that alone can drag down your score. Lenders like to see that you have successfully managed credit for many years.

But don’t worry – as long as you continue using credit responsibly, this factor will improve with time.

You Opened Several New Credit Accounts Recently

When you open new credit card accounts, loan accounts, or have a hard inquiry from a credit check, this can lower your score in the short term.

Too many new accounts in a short period can make you look “credit hungry” and like a risk to lenders. Inquiries and new accounts make up 10% of your FICO score.

Try to limit new applications as much as possible. And when you do need to open new credit, space it out over time to minimize the impact.

You Have High Credit Utilization

As mentioned earlier, credit utilization is 30% of your score. This looks at how much of your total available credit you are actually using at one time.

Even if you pay off your balances every month, maxing out your credit cards can result in high utilization and hurt your score.

For the best scores, experts recommend keeping your utilization under 30% across all accounts. So even with no debt, using more than 30% of your total credit limit can bring down your score.

You Have Missed or Late Payments

Payment history makes up the biggest chunk of your score at 35%. Even one missed payment can dramatically lower your credit score.

Set up autopay or payment reminders to avoid missed payments in the future. If you already have some late payments, you can write goodwill letters to your creditors to ask for removal. Just get back on track with on-time payments going forward.

You Don’t Have Enough Credit Mix

Credit mix refers to having different types of credit accounts – credit cards, auto loans, mortgages, student loans, etc. This makes up 10% of your score.

Lenders like to see you can manage different types of credit responsibly. If you only have credit cards, and no installment loan accounts, this could negatively impact your score.

No need to open accounts you don’t need just for mix – but it’s something to keep in mind if your score seems lower than expected.

You Have Incorrect Information on Your Credit Report

Before assuming your credit score is low due to the above reasons, double check your credit report. If there are mistakes or fraudulent accounts bringing down your score, you’ll need to dispute these with the credit bureaus.

Getting errors corrected can significantly boost your score, especially if they relate to missed payments, high balances, or new accounts you didn’t actually open.

Monitor your credit reports regularly to make sure all the information is accurate. If not, file disputes right away to correct it.

Tips to Raise Your Credit Score When You Have No Debt

If you have no current debt, but your credit score is still lackluster, here are some tips to improve it:

-

Keep credit utilization low – Try to keep balances below 10% of your credit limit on each card, even if paying off monthly. This has an outsized impact on your score.

-

Leave accounts open – Avoid closing old, paid off credit cards as this reduces your total available credit and history length.

-

Become an authorized user – Ask a family member with good credit to add you as an authorized user on a long-held account. This can boost your score.

-

Limit new accounts – Don’t open too many new credit accounts close together, as this signals risk to lenders. Space out applications over time.

-

Ask for credit limit increases – Higher credit limits keep utilization lower. Proactively request CLI’s from your credit card companies.

-

Correct report errors – Review all 3 of your credit reports closely. If you find mistakes, file disputes immediately to fix them.

-

Practice good credit habits – Making on-time payments, keeping utilization low, and managing credit responsibly over time will boost your score.

The Bottom Line

Credit scores are complex, so don’t get discouraged if your score seems low even though you have no debt. Factors like credit history length and utilization ratio play a big role.

With time and diligently practicing good credit habits, you can build your score up over the long-term. Monitor your reports, keep utilization low, make payments on time, and be strategic about new credit applications.

While debt certainly doesn’t help, you can absolutely achieve an excellent credit score without carrying any balances. Stay focused on the healthy credit habits above to maximize your score, even if you have no debt at all.

Reasons your FICO score is so low

Now that you understand credit models and how they are weighted on your score, take a look at some reasons your score might be low.

Your report contains errors

Checking your credit report can help you recognize if you have been a data breach victim and if there are any errors on your report. Not all mistakes on your report are a result of identity fraud. For example, a simple error such as a transposed number or someone with a similar name can hurt your credit.

You can address simple mistakes like this if you notify the credit bureaus. After an investigation to determine whether it was an error, you will find the issue rectified. It might take some time, so be patient and diligent. In the end, you can see a boost in your score.

How To Fix A BAD Credit Score ASAP

FAQ

Why does my credit score keep going down when I have no debt?

Thats completely normal. Your credit score is based off of lending and reliability. If youre not borrowing anything, your score will drop. You basically have one less open account in “good standing”, so it’s reporting that you’re utilizing less credit now, which will in turn drop your score.

Why is my credit score low when I owe nothing?

If you have no record of handling credit previously, lenders have no evidence that you can borrow responsibly. This is referred to as having “thin credit” and can give you a lower score than you’d like. Thin credit can mean you have a low credit score, despite having no debt.

Why is my credit score low when I pay everything?

Yes, this is normal. This happens because of how your credit score is calculated. How many open lines of credit you have open plays a large part in that calculation, and because you payed off those loans, thus closing those lines of credit, the calculation gets affected in such a way that your score goes down.

Can you have no debt and a low credit score?

Quick Answer

Having no debt isn’t bad for your credit as long as there is some activity on your credit reports. You can have a great score without paying a penny of interest. Having no credit card debt isn’t bad for your credit scores, but you do need to maintain open and active credit accounts to have the best scores.