Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Theres a ton of information out there about buying stocks. Unfortunately, theres far less information about selling stocks.

That’s a mistake, as the sale is when you actually make money. Getting it right can be key to claiming your profits — or, in some cases, cutting your losses.

Have you ever stared at your investment portfolio, watching a stock plummet day after day, yet something inside you refuses to hit that “sell” button? Trust me, you’re not alone. I’ve been there too, and it’s a puzzling feeling that leaves many investors scratching their heads and asking, “Why can’t I just sell my stock already?”

As someone who’s both experienced and studied this phenomenon, I want to dive deep into the psychological barriers that keep us holding onto losing investments longer than we should. These invisible chains aren’t just costing us money—they’re causing unnecessary stress and preventing us from making better financial decisions.

The Emotional Rollercoaster of Investing

Investing isn’t just about numbers and charts—it’s deeply psychological. When I first started trading nobody warned me that my emotions would become my biggest obstacle to success. Let’s face it our brains weren’t designed for the modern stock market.

The truth is selling a losing stock forces us to confront several uncomfortable realities

- We made a mistake

- We lost money

- We have to admit defeat

- We need to reconsider our judgment

These realizations hurt, and our brains have evolved to avoid pain whenever possible. This avoidance creates what experts call “psychological inertia”—a powerful force that keeps us from taking necessary action.

The Top 7 Reasons You Can’t Sell Your Stock

1. Loss Aversion: The Fear That Rules Us All

Loss aversion is perhaps the most poweful psychological barrier to selling stocks. Studies show we feel the pain of losses about twice as intensely as the pleasure of equivalent gains. When faced with a losing position, many investors think:

“If I don’t sell, I haven’t actually lost anything yet.”

This is a dangerous mental accounting trick. The market doesn’t care whether you’ve “realized” your loss or not—the money is already gone. Yet our brains trick us into believing that holding prevents the loss from becoming “real.”

2. The Endowment Effect: Overvaluing What We Own

Once we purchase a stock, a strange thing happens: we begin to value it more highly simply because we own it. This cognitive bias, known as the endowment effect, makes it harder to part with our investments even when objective analysis suggests we should.

I remember buying shares in a tech company several years ago and developing an almost emotional attachment to it. When the company started underperforming, I kept finding reasons to hold on, convincing myself it had special potential that others couldn’t see.

3. Anchoring to Purchase Price: The Magic Number

When I buy a stock at $100, that number becomes magically significant in my mind. If the stock falls to $70, I find myself thinking, “I’ll sell when it gets back to $100.” This is anchoring bias in action—the tendency to fixate on a specific reference point (usually the purchase price) when making decisions.

But here’s the brutal reality: the market doesn’t care what price you paid. Each day, you should evaluate whether your investment is still worth holding based on current information, not historical prices.

4. Sunk Cost Fallacy: Throwing Good Money After Bad

“I’ve already invested so much time and money—I can’t give up now!”

Sound familiar? This is the sunk cost fallacy talking. We often continue investing in losing positions because we’ve already committed significant resources. The more time and emotional energy we’ve invested in researching and monitoring a stock, the harder it becomes to let go.

5. Hope as an Investment Strategy

Hope is essential in life but dangerous in investing. Many investors hold losing stocks based on nothing more than hope things will turn around. We create elaborate narratives about potential comebacks while ignoring deteriorating fundamentals.

I’ve caught myself thinking: “The entire sector is down—it’s not just my stock. When the market recovers, my investment will too!” While sometimes true, this hope-based strategy often leads to deeper losses.

6. Confirmation Bias: Seeing What We Want to See

Once we own a stock, we tend to seek out information that confirms our original investment thesis while dismissing contradictory evidence. This confirmation bias can be deadly to our portfolios.

When my investments start losing value, I notice myself reading only bullish articles and dismissing bearish viewpoints as “not understanding the full picture.” This selective attention creates a distorted reality where recovery always seems just around the corner.

7. Regret Avoidance: The “What If” Paralysis

Many investors hold losing positions because they fear the regret of selling right before a potential rebound. The thought process goes something like:

“What if I sell today and the stock jumps 20% tomorrow? I’d feel like an idiot!”

This fear of future regret creates decision paralysis. However, we rarely consider the opposite scenario—the regret we’ll feel if we don’t sell and the stock continues declining.

The High Cost of Not Selling

Holding onto losing stocks doesn’t just hurt your portfolio’s performance—it carries several hidden costs:

- Opportunity cost: Money tied up in losing investments cannot be deployed in better opportunities

- Mental bandwidth: Struggling with the sell decision consumes valuable cognitive resources

- Emotional toll: Watching losses mount creates unnecessary stress and anxiety

- Deteriorating decision-making: As losses grow, emotional decision-making tends to worsen

How I Learned to Sell My Losers (And You Can Too)

After several painful lessons, I’ve developed strategies to overcome these psychological barriers. Here’s what has worked for me:

1. Implement Automatic Sell Rules

One of the most effective approaches is removing emotion from the equation entirely. I now set predetermined stop-loss levels when I purchase a stock—typically 15-20% below my purchase price. When the stock hits that level, I sell without deliberation.

This rule-based approach bypasses the psychological pitfalls that trap many investors. The decision becomes automatic rather than emotional.

2. Reframe the Selling Decision

Instead of thinking, “If I sell, I’m locking in a loss,” try reframing as:

“I’m freeing up capital to make better investments.”

This shift in perspective highlights the opportunity rather than the loss. I also ask myself: “If I didn’t already own this stock, would I buy it today at the current price?” If the answer is no, that’s a strong signal to sell.

3. Conduct Regular Portfolio Reviews

I’ve found that scheduled, systematic portfolio reviews help me make more objective decisions. During these reviews, I evaluate each holding based on current fundamentals, not my purchase price or how long I’ve owned it.

Some questions I ask during these reviews:

- Does this investment still align with my strategy?

- Have the fundamentals deteriorated?

- Is there a better use for this capital elsewhere?

- What would an objective observer advise?

4. Start Small When Selling

If you find yourself paralyzed when trying to sell a losing position, consider selling in increments. I sometimes start by selling 25% of a declining position, which accomplishes two things:

- It breaks the psychological barrier of taking action

- It reduces the position size, making the final decision less emotionally charged

5. Create Accountability

Tell someone about your investment plan and sell criteria before you buy. Having to explain why you’re not following your own rules can create powerful accountability.

I have an investing buddy who serves as my accountability partner. When I’m hesitating to sell a losing position, explaining my rationale to him often exposes the emotional biases clouding my judgment.

Learning from the Pros: What Successful Investors Do Differently

Professional investors understand the psychological challenges of selling and have developed systems to counter them:

- Warren Buffett focuses on fundamental business value rather than stock prices

- Ray Dalio uses systematic decision-making frameworks

- Howard Marks emphasizes thinking in probabilities rather than certainties

These investors don’t let emotions drive their decisions. They recognize psychological biases and create systems to counteract them.

When Holding Actually Makes Sense

While this article focuses on overcoming psychological barriers to selling, sometimes holding a declining stock is the right move. Valid reasons to hold might include:

- The investment thesis remains intact despite price decline

- The broader market or sector is declining temporarily

- New information suggests the current price represents a better buying opportunity

- You’re following a true long-term strategy with appropriate diversification

The key is ensuring your decision to hold stems from rational analysis, not emotional attachment or cognitive biases.

Final Thoughts: Breaking Free from Investment Inertia

Learning to sell losing investments might be the most valuable skill you can develop as an investor. By understanding the psychological forces that keep us holding losing positions, we can create strategies to overcome them.

Remember that selling a losing stock isn’t admitting defeat—it’s admitting reality. And in investing, acknowledging reality is the first step toward better results.

The next time you find yourself unable to sell a stock that’s consistently underperforming, revisit this article. Identify which psychological barriers are holding you back, and implement the strategies we’ve discussed to overcome them.

Your future self (and portfolio) will thank you.

Have you ever struggled to sell a losing investment? What psychological barriers held you back? I’d love to hear your experiences in the comments below!

How do you sell stock?

You sell stock by placing an order with your broker. You fill out an order form that will ask what stock you want to sell, if you want to sell in shares or dollars, how much you want to sell, and if you want to sell via a market or limit order. Ideally, youll be selling the stock after it has grown in value from when you bought it, locking in a profit. The stock-selling order form will look something like this:

This is what an order form for selling stock looks like on Fidelity. Most brokerages will have a similar process.

3 steps to selling stocks

When you sell depends on your investing strategy, your investing timeline, and your tolerance for risk.

Sometimes though, loss aversion and fear get in the way. There are good reasons and bad reasons to sell stocks. Check your emotions when youre ready to pull the trigger.Advertisement

Charles Schwab |

Public |

Coinbase |

|---|---|---|

| NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.8 /5 |

NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.6 /5 |

NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.6 /5 |

|

Fees $0 per online equity trade |

Fees $0 |

Fees 0% – 4% varies by type of transaction; other fees may apply |

|

Account minimum $0 |

Account minimum $0 |

Account minimum $0 |

|

Promotion None no promotion available at this time |

Promotion Earn a 1% uncapped match when you transfer your investment portfolio to Public. |

Promotion None no promotion available at this time |

| Learn More | Learn More | Learn More |

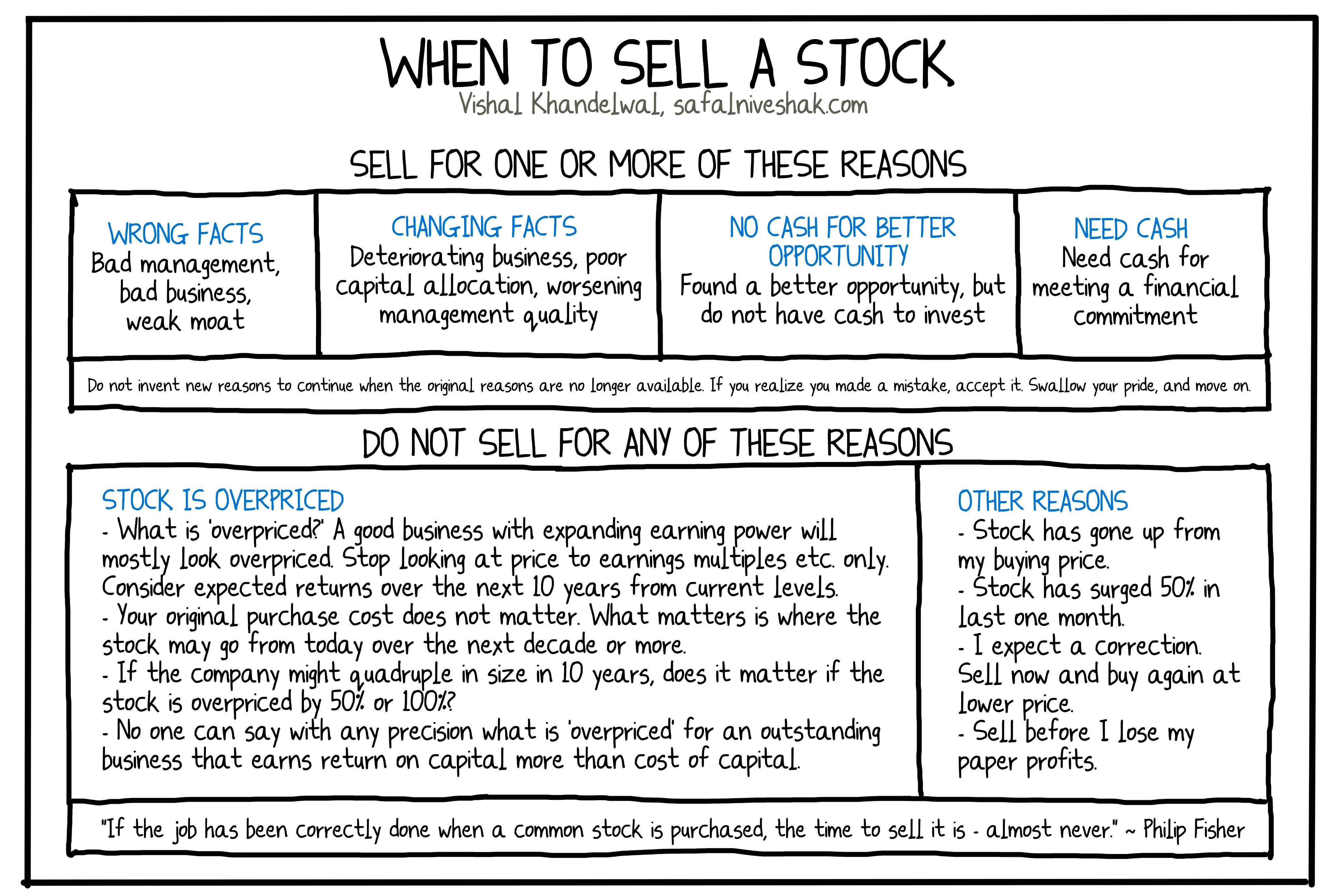

Ongoing poor performance relative to the competition, irresponsible leadership and management decisions you don’t support may all make the list of good reasons. Maybe you’ve decided your money would do better elsewhere, or you’re harvesting losses to offset gains for which you’ll owe income taxes.

Bad reasons typically involve a knee-jerk reaction to short-term stock market fluctuations or one-off company news. Bailing when things get rocky only locks in your losses, which is the opposite of what you want. (You know the saying: Buy low, sell high.) Before you sell, think about why you bought the stock in the first place. Did you consider what news or circumstances would make you sell it? Go over your reasoning to ensure you’re not giving in to an emotional response you might later regret.

» Prone to emotional investing? Check out robo-advisors

How to AVOID Taxes (Legally) When you SELL Stocks

FAQ

Why can’t I cash out my stocks?

Sold Stock:

Funds from sold stock take one full business day to settle before they can be withdrawn. For Example: If you were to sell stock on Friday, the trade would settle on Monday.

How do I cash out my stocks?

How to get rid of stock that won’t sell?

To remove a stock from your portfolio, sell the shares through your brokerage account. Keep records of the sale date, price, and any commissions paid. Report gains or losses on your tax return using IRS Form 8949 and Schedule D. Retain transaction documents for at least three years in case of IRS review.

Why can’t I sell a stock I just bought?

If your account is too new, or your brokerage believes you don’t have enough investing experience, it may restrict your trading capabilities. It can also impose trading limits if you don’t keep enough cash in your account. Day traders should also consider the tax consequences of frequently buying and selling stocks.