In a Nutshell Experian vs. Credit Karma: Which is more accurate for your credit score? You may be surprised to know that the simple answer is that both are accurate. Read on to find out what’s different between the two companies, how they get your credit score, and why you have more than one credit score to begin with.

If you’re confused about which credit score to pay attention to, we don’t blame you. But rather than comparing Experian vs. Credit Karma for credit score accuracy, you may want to understand first why you have multiple credit scores — and how your scores affect your financial progress.

Having multiple credit scores from different sources that don’t match can be confusing. You may be wondering why your Credit Karma and Experian credit scores don’t align.

I’ll explain in this article why credit scores differ between Credit Karma and Experian which score matters most and how you can improve your credit.

Reasons for Credit Score Differences

There are a few key reasons why your Credit Karma and Experian credit scores likely don’t perfectly match:

1. Different Credit Reporting Agencies

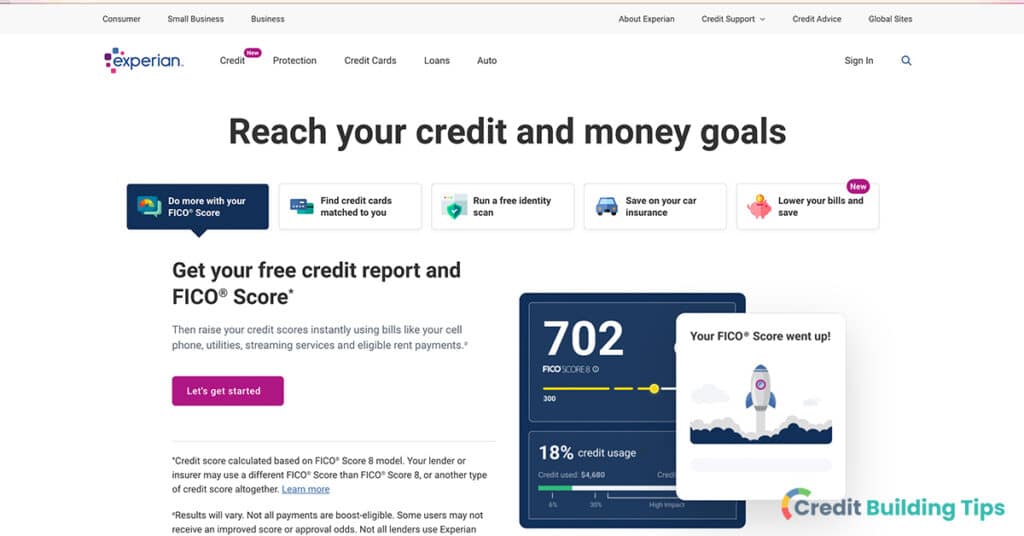

The three major consumer credit reporting agencies are Experian, Equifax, and TransUnion. Credit Karma provides your VantageScore credit scores from Equifax and TransUnion. Meanwhile, Experian provides your FICO score from their credit report data.

Since each agency collects different information on your credit history, the data in your reports varies across agencies This causes score differences

2. Different Credit Scoring Models

Your FICO score from Experian uses the FICO scoring model, while your scores from Credit Karma use the VantageScore model. Both evaluate similar credit factors like payment history, but have different algorithms.

FICO scores range from 300-850, while VantageScores fall between 501-990. The scoring model discrepancy is a key driver of score differences.

3. The Score Version

Over 25 FICO score versions and 10+ VantageScore versions exist, all with distinct score ranges. The specific FICO or VantageScore version pulled by Credit Karma or Experian impacts your score.

For example, your FICO 8 score from Experian will differ from your VantageScore 3.0 at Credit Karma. Same with specialized industry scores for auto, mortgage, or credit card lending.

4. When Scores Are Accessed

If you check your Credit Karma and Experian scores at different times, new information may have been added to your credit reports to alter your scores.

For the most apples-to-apples comparison, you’ll want to check your scores from different sources on the same day.

Which Credit Score Matters Most?

The credit score most important to monitor is the one used by your lender. Here are a few rules of thumb:

-

For credit cards or personal loans, your FICO 8 is widely used.

-

For mortgages, lenders often consider your FICO 2, 4, or 5 scores.

-

For auto loans, you’ll want to know your FICO Auto Score 8 or 9.

While it’s good to know your scores at Credit Karma and Experian, your focus should be on the specific score your lender will use since that’s what determines your approvals.

If you’re unsure which exact score a lender uses, monitoring your VantageScore at Credit Karma along with your Experian FICO score gives you decent visibility into your credit health.

How to Improve Your Credit Scores

While every scoring model is slightly different, you can take the same core actions to lift your Equifax, TransUnion, and Experian credit scores:

-

Pay all bills on time. Payment history is typically the biggest factor in your scores. Set up autopay if you can.

-

Keep credit card balances low. High balances hurt your credit utilization ratio. Stay below 30%, or even better 10%, of your total limit.

-

Avoid applying for new credit. Too many applications in a short period indicates risk and lowers scores. Space out applications by 6 months to a year.

-

Check all three credit reports. Verify they’re error-free. Dispute any inaccuracies with the credit bureaus.

-

Build credit history. As the length of your positive credit history grows, so can your scores.

Checking both your Credit Karma and Experian scores gives you a 360° view of your credit. But remember, building good financial habits matters far more than any single score. By making on-time payments, limiting balances, and monitoring your credit, you’ll be on the path to strong Credit Karma and Experian scores.

Why is my Experian credit score different from Credit Karma?

To recap, Credit Karma provides your TransUnion credit score, which is different from your Experian credit score.

While the credit reference agencies look at the same sort of things — your payment history, credit use, length of credit history, and new credit — lenders sometimes only report your account information to one or two of the CRAs instead of all three.

So if Experian has access to different information about your credit than Equifax or TransUnion, your scores from each of the CRAs might also be different.

And even if the three major CRAs may have the same information, each CRA has proprietary algorithms that might score you differently.

But that doesn’t mean one credit score is more or less accurate than the others.

Instead of comparing your Experian credit scores to the scores you find on Credit Karma, we recommend you look at how each credit score changes over time. Is it going up or down?

Experian vs Credit Karma: What’s the difference?

Credit Karma and Experian play different roles when it comes to your credit.

Experian is one of the three major credit reference agencies in the UK, along with Equifax and TransUnion. These companies compile information about you into reports that are used to generate your credit score.

Credit Karma isn’t a credit reference agency, which means we don’t determine your credit score.

Instead, we work with TransUnion to provide you with your free credit report and free credit score. We also offer recommendations for credit cards, personal loans, and car finance.

Experian vs Credit Karma – Which One Is Better?

FAQ

Is Experian or Credit Karma more accurate?

How far off is Credit Karma from your actual credit score?

How Many Points Off Might Credit Karma Be? The difference between your Credit Karma score and lender-pulled scores typically ranges from a few points to around 20-50 points, though larger variations can occur. The most significant differences usually stem from: Missing information from Experian.

Is Experian accurate for credit score?

Why is my Experian credit score so much higher?

Your credit reports from Experian, TransUnion and Equifax could have different information because creditors can choose which bureau(s) they want to report to, as well as what they report and when. As a result, the same scoring model could give you different credit scores based on each of your three credit reports.

How does Credit Karma compare with Experian?

While Experian compiles your credit report and determines your credit score, Credit Karma simply shows you credit scores and report information from Equifax and TransUnion. Think of it this way — Credit Karma is like a newspaper that writes about the credit scores other companies give you. But we have no influence over your scores.

Does Credit Karma provide FICO scores or Experian credit reports?

Credit Karma does not provide FICO scores or Experian credit reports. Credit Karma is not a credit bureau; it is an online financial platform that makes credit bureaus’ information available to consumers. Members can check and monitor their credit scores and credit reports for free.

Why is my Credit Karma credit score lower than Experian?

There are a few reasons your Credit Karma credit score is lower than your Experian score. Some companies only report your credit history with them to one or two credit bureaus. Not all three. So If a negative public record shows on TransUnion but not Experian, that creates the gap between your credit scores.