Your credit reports contain a lot of information, but some items are more important than others. Part of the Series Debt Management Guide

What do lenders consider when they look at your credit report? Its a simple question with a complicated answer, because there are no universal standards by which every lender judges potential borrowers. It can depend on both the lender and the type of loan.

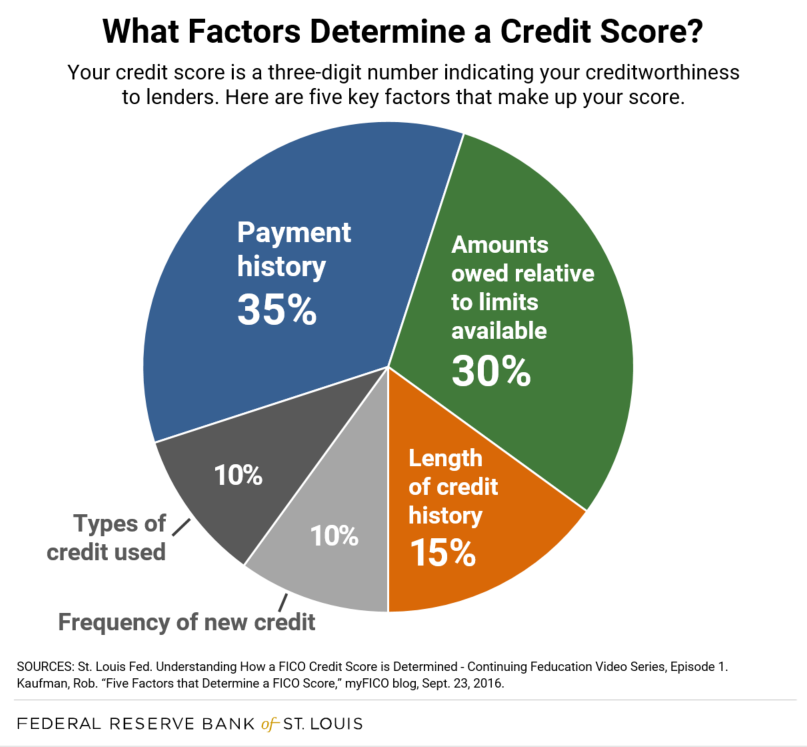

Of course, there are some items that will increase or decrease your odds of approval just about everywhere. Looking at what makes up your FICO score (the most widely used credit scoring model) is a good place to start. FICO scores range from 300 and 850, with anything 670 or above considered good or better. If your score is much lower than that, you will probably find it difficult to borrow money at favorable interest rates and maybe at all.

Your credit score is an important factor that lenders creditors, insurance companies employers, and others use to evaluate your creditworthiness. But have you ever wondered who specifically looks at your credit history to calculate your credit score? Understanding who uses this information and how they determine your score can help you better manage your credit.

The Credit Bureaus

There are three major credit bureaus in the United States that collect your credit information from lenders and creditors and compile it into a credit report:

- Experian

- Equifax

- TransUnion

These bureaus act as clearinghouses that gather account information from banks, mortgage lenders credit card issuers and other creditors. This includes data on

- Your payment history

- Current loan balances

- Credit limits

- Collection accounts

- Public records like bankruptcies and judgments

The credit bureaus source this data directly from the creditors and lenders you have accounts with. They store it in your credit file, which is essentially your credit history.

When a lender or creditor requests your credit report to make a lending decision, the credit bureau will pull your file and send them the information. This allows companies to view your creditworthiness before approving a loan or credit card.

So the credit bureaus compile the raw data used to determine your score. But they are not the ones who actually calculate your credit score.

Credit Scoring Models

While credit bureaus store the data, other companies have developed credit scoring models that analyze your credit information to generate a credit score. The most commonly used models include:

-

FICO Scores: Developed by the Fair Isaac Corporation, FICO scores are the most widely adopted credit scores. Over 90% of lending decisions use FICO scores to determine creditworthiness. The latest FICO scoring model is called FICO Score 10 and 10T.

-

VantageScore: Created by the three credit bureaus, VantageScore uses a slightly different formula than FICO models. But it analyzes much of the same credit data to produce your score.

These scoring models use computer algorithms to evaluate your credit report information and calculate a three-digit number summarizing your creditworthiness.

The algorithms analyze factors like your payment history, amounts owed, credit history length, new credit, and credit mix to estimate your risk level. Using mathematical models, they assign a numerical score based on these factors.

While the credit bureaus provide the details, scoring models like FICO and VantageScore churn through the data to actually determine your credit score.

Lenders, Creditors, and Other Companies

Once your credit score has been calculated by a scoring model, it can then be used by lenders, creditors, and other institutions for their business needs. Here are some examples of industries that may access your credit score to make decisions:

-

Banks: May review your credit score when you apply for a bank account or loan. A higher score can increase approval chances and lower interest rates.

-

Credit card companies: Analyze your credit score to decide whether to approve your new card application. Also use scores to set credit limits and interest rates.

-

Mortgage lenders: Verify your creditworthiness by checking your credit score when you apply for a home loan. A higher score can qualify you for better mortgage terms.

-

Auto lenders: Assess your credit score when you apply for an auto loan to determine the loan amount and APR you qualify for.

-

Landlords: May check your credit score to evaluate your renter application. However, there are also ways for renters with poor credit to get approved.

-

Insurance companies: In some cases, use credit-based insurance scores to gauge risk levels and set premiums for policies.

-

Employers: Can request a modified credit report to evaluate job candidates in certain states, though your score itself is not provided.

-

Cell phone companies: May verify your creditworthiness by reviewing your score when signing up for a new mobile plan.

-

Utility companies: Can request your credit score when applying for new electric, gas, water, or cable accounts. A lower score may require a deposit.

Tips for Managing Your Credit Score

Since your credit score has such a big influence on your financial opportunities, it’s important to maintain a healthy score. Here are some tips:

-

Check your credit reports from each bureau annually and dispute any errors you find to keep your information accurate.

-

Pay all bills on time to maintain a positive payment history – your most important scoring factor. Set up autopay if needed.

-

Keep credit card balances low to avoid having high credit utilization ratios that drag down your score.

-

Be careful applying for new credit since hard inquiries from multiple applications can ding your score temporarily.

-

Monitor your score regularly to catch any major changes and address them promptly. Sign up for free credit monitoring services.

While you can’t control who uses your credit information, you do have power over the data used to calculate your score. Monitoring your credit and making smart financial choices will help you achieve your best scores possible.

Your Credit Mix

From credit cards to car loans and mortgages, there are a variety of ways consumers use credit. From a lenders perspective, variety is good. Lenders like to see that their prospective clients have experience using multiple sources of credit in reliable ways, particularly the kind of credit they are offering. That doesnt mean, however, that you should open a new type of credit account just for the sake of your credit score. As FICO itself says, “Dont worry, its not necessary to have one of each.” FICO score calculations give a 10% weight to the types of credit an individual has.

Most people have more than one FICO score. For example, FICO offers scoring models tailored to mortgage lenders, auto lenders, and credit card issuers. So even if you obtain your credit score, it may not be identical to the one the lender is using.

How Credit Scores Are Calculated

FICO scores are calculated based on five weighted factors: payment history, amounts owed, length of credit history, new accounts, and credit mix. Heres a look at each.

Credit Scores and Credit Reports Explained in One Minute

FAQ

Who uses credit history?

Credit reports are used most often by lenders to determine whether to provide you with credit and how much you will pay for it. Credit reports are also used by insurance companies, employers, and landlords.

Who has authorization to use your credit report?

While the general public can’t see your credit report or score, some people and companies have a legal right to access that information. That includes lenders, creditors, landlords, employers, insurance companies, government agencies and utility providers. Here’s what you need to know about your rights and theirs.

Who decides my credit score?

Your credit score is based on the credit history in your credit report, so it’s important to make sure your credit report is accurate. The three nationwide credit bureaus — Equifax, Experian, and TransUnion — let you get your report for free online once a week from each bureau at AnnualCreditReport.com.

Who will check your credit history Why?

Along with many other pieces of information, potential lenders, and creditors – including credit card companies, mortgage lenders and auto lenders – may use your credit scores and credit history to help make lending decisions. These companies want to know how likely you are to pay the money they lend back as agreed.

What information is used to calculate my credit score?

Your accounts, payment history, and inquiries into your credit are examples of credit report information used to calculate your credit score. When you apply for a credit card or loan, the creditor or lender uses your credit score to inform their decision on whether to issue you credit or not.

Why is payment history important to your credit score?

That’s because your payment history accounts for 35% of your FICO score, making it the most important of the five credit factors. When you make your debt payments, creditors report those payments to the credit bureaus, and you gradually build a good payment history. Eventually, those payments will help to boost your score.

Does my credit report include my credit history?

It also will generally not include your history with utilities such as cable and phone bills nor your rental payment history. You can monitor your credit report regularly as this information is used to calculate your credit score.

What factors determine your credit score?

Five factors determine your credit score: pay history for loans and lines of credit; credit utilization; credit history length; credit mix; new credit and hard inquiries. Tina Russell/The Penny Hoarder Some of the links in this post are from our sponsors. We provide you with accurate, reliable information.

What does a credit score mean?

A credit score is a number — typically between 300-850 — that estimates how likely you are to repay a loan and make the payments on time. Credit scoring systems calculate your credit score in different ways, but the scoring system most lenders use is the FICO score. Your credit score is based on information in your credit report.

Who checks your credit score?

Lenders aren’t the only ones who check credit scores, however. Your utility company, landlord, and cell phone company may all check your credit score to get a picture of how reliable and financially stable you are. Creditors and lenders also use your credit score to set the pricing and terms for your credit card or loan.