Hey there, folks! If you’re knee-deep in the world of commercial real estate, you’ve probs heard of an SNDA. But who the heck “orders” this fancy-sounding document? Well, I’m here to break it down for ya, no legal jargon overload, just straight-up talk. If you’re a tenant, landlord, or lender wondering who’s calling the shots on a Subordination, Non-Disturbance, and Attornment agreement (yep, that’s what SNDA stands for), stick with me. We’re gonna dive into who typically demands this paperwork, why they do, and what it means for everyone involved.

Right off the bat, let’s answer the big question: Who orders the SNDA? In most cases, it’s the lender—specifically, the bank or financial institution tied to the landlord’s property loan. They’re the ones pushing for this agreement to lock down their interests when financing or refinancing a property. But it ain’t always just them; sometimes tenants or even landlords got reasons to nudge for an SNDA too. Let’s unpack this mess and see why lenders are usually the big dogs in this game.

What’s an SNDA, Anyway? A Quick Lowdown

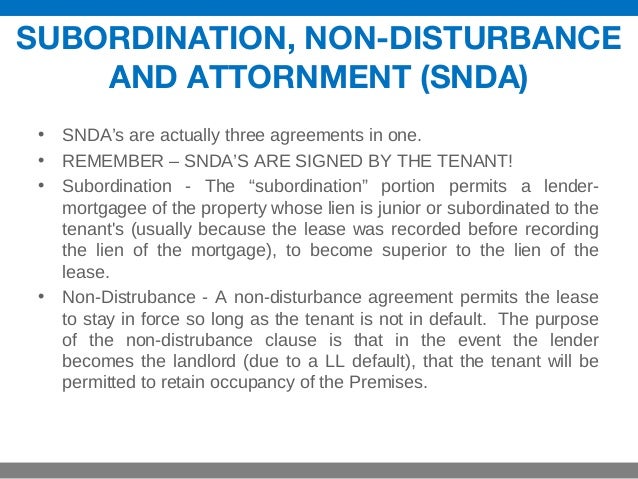

Before we get into the “who,” let’s make sure we’re on the same page about the “what.” An SNDA is a legal agreement in commercial real estate that juggles the rights and priorities between three key players: the landlord, the tenant, and the lender (usually the landlord’s bank). It’s got three parts, each with its own vibe:

- Subordination: The tenant agrees their lease is “below” the lender’s claim on the property. Basically, if things go south, the lender’s got first dibs.

- Non-Disturbance: The lender promises not to kick the tenant out if they foreclose on the landlord, as long as the tenant’s playing by the rules.

- Attornment: The tenant agrees to recognize the lender (or whoever buys the property after foreclosure) as their new landlord if the original landlord defaults.

This little trio of terms keeps the peace—or at least tries to—when money’s tight or deals get messy. Now, let’s figure out who’s got the power to demand this paperwork gets signed

Why Lenders Are Usually the Ones Ordering the SNDA

Alright, let’s get to the meat of it Nine times outta ten, the lender is the one saying, “Yo, we need an SNDA, stat!” Why? ‘Cause they’ve got the most to lose if things go sideways. When a lender finances a commercial property—like a shopping center or office building—they wanna make sure their loan is protected. They’re shelling out big bucks, so they ain’t about to let some pre-existing tenant leases mess up their claim if the landlord can’t pay up

Here’s why lenders are so pushy about SNDAs:

- Protecting Their Lien Priority: Lenders wanna be first in line if the property’s value is on the chopping block. Without an SNDA, older tenant leases might outrank their lien under the “first in time, first in right” rule. Subordination flips that script, putting the lender on top.

- Control After Foreclosure: If the landlord defaults and the lender forecloses, they wanna decide what happens to the tenants. Without subordination, they might be stuck with underperforming tenants or lousy lease terms. An SNDA gives ‘em the power to clear the slate if needed.

- Keeping Things Smooth: The non-disturbance part assures good tenants they won’t get booted, while attornment ensures tenants accept the lender as the new boss if foreclosure happens. It’s all about minimizing drama for the lender.

I’ve seen deals where lenders flat-out refuse to fund a refinance unless SNDAs are signed by major tenants. They’re like “No paperwork no cash, buddy.” And honestly, can ya blame ‘em? They’re covering their behinds in a high-stakes game.

Do Tenants or Landlords Ever Order an SNDA?

Now, don’t get it twisted—lenders ain’t the only ones who might want an SNDA on the table. Tenants and landlords can step up too, though it’s less common. Let’s break this down a bit.

Tenants Pushing for an SNDA

Sometimes, a tenant—especially a big one with a lotta dough sunk into their space—might say, “Hey, I want some guarantees here!” They’re usually after the non-disturbance piece, which protects their right to stay put even if the landlord tanks. Think about a retailer who’s dropped a fortune on customizing their store in a plaza. They ain’t keen on getting evicted just ‘cause the landlord couldn’t pay the bank. So, they might negotiate for an SNDA upfront, or at least ask for it when a new lender comes into play.

Landlords Getting in on the Action

Landlords? Yeah, they might nudge for an SNDA too, mostly to sweeten the deal for tenants or keep their lender happy. A landlord looking to refinance might proactively get SNDAs from tenants to show the bank they’ve got everything under control. Plus, offering non-disturbance protection can make a property more attractive to potential renters. It’s like saying, “Don’t worry, fam, you’re safe here even if I mess up.”

But let’s be real—most of the time, it’s the lender cracking the whip. Tenants and landlords usually sign on ‘cause they gotta, not ‘cause they’re dying to order one up themselves.

How This Plays Out in Real Life: A Shopping Center Story

Let’s paint a picture to make this stick. Imagine a big ol’ shopping center in, say, Maryland. The landlord owns the joint, with 20 retail spots—17 rented out, 3 empty. They’ve got debt from when they bought the place, but interest rates are lookin’ sweet, so they wanna refinance with a new lender. This new bank says, “Cool, but we need first dibs on this property, and we want SNDAs from 15 of them 17 tenants.”

Why only 15? We’ll get to that in a sec. For now, let’s see how each part of the SNDA shakes out and who’s driving the bus.

- Subordination in Action: The lender’s all about making sure their lien trumps the existing leases. Without subordination, if they foreclose, they’re stuck with whatever tenant deals were there before their loan. Maybe some tenants ain’t paying on time, or their rent’s way below market. The lender wants the option to boot ‘em and start fresh. So, they “order” the SNDA to lock in that priority.

- Non-Disturbance for Tenant Peace: The tenants, on the other hand, get a lil’ safety net. As long as they’re paying rent and not causing a ruckus, the lender agrees not to mess with their lease, even after foreclosure. A tenant might not “order” the SNDA, but they sure as heck appreciate this part.

- Attornment Keeps Things Rolling: If the lender takes over, the tenants gotta treat ‘em as the new landlord. No sneaky renegotiations for lower rent. This bit’s another win for the lender, who’s likely the one demanding the agreement in the first place.

Back to them 15 tenants—why not all 17? Well, I reckon the lender figured the other two are on short leases, maybe expiring soon. It ain’t worth the hassle or cost to chase down SNDAs for tenants who’ll be gone before any foreclosure kerfuffle happens. See, lenders are picky, but they ain’t dumb. They weigh the risk and decide who’s gotta sign.

Breaking Down the Benefits: Who Gets What from an SNDA?

To really get why someone would order an SNDA, let’s lay out what each party gains. I’ve whipped up a quick table to keep it clear and snappy.

| Party | What They Get from SNDA | Why They Might Order It |

|---|---|---|

| Lender | Priority over tenant leases, control after foreclosure, smooth transition with attornment. | Main reason they order it—protects their loan big time. |

| Tenant | Assurance they won’t get kicked out if they’re in good standing (non-disturbance). | Might request it if they’ve invested a lot in the space. |

| Landlord | Makes property more appealing to tenants, helps satisfy lender demands for financing. | Could push for it to close a deal or attract renters. |

As you can see, the lender’s got the biggest stake in ordering an SNDA. They’re the ones with the cash on the line, so they’re usually steering this ship. But tenants and landlords ain’t just along for the ride—they’ve got their own reasons to care.

Extra Bits in an SNDA: More Than Just the Big Three

Now, an SNDA ain’t just about subordination, non-disturbance, and attornment. There’s other stuff baked in that might influence who wants one signed. Here’s a couple extras I’ve noticed in deals:

- Limitation of Liability: This one’s a sneaky win for the lender. It says if they foreclose and step in as landlord, they ain’t responsible for whatever mess the old landlord left behind. This kinda thing makes lenders even more eager to order an SNDA, ‘cause it shields ‘em from headaches.

- Estoppel Clauses: Tenants often gotta confirm stuff like when their lease started, that they ain’t in default, and they haven’t paid rent way ahead. It’s like a heads-up to the lender about what they’re walking into. Again, lenders love this, so it’s another reason they’re the ones demanding the paperwork.

These extras show why lenders are so gung-ho about getting SNDAs in place. It’s not just about priority—it’s about covering all their bases.

Why Might a Lender Skip Ordering an SNDA for Some Tenants?

I touched on this earlier with our shopping center story, but let’s dig a lil’ deeper. Lenders don’t always order SNDAs for every single tenant. Why not? ‘Cause they’re playing a cost-benefit game. Here’s some reasons they might pass on a few:

- Short-Term Leases: If a tenant’s lease is up in a few months, the lender might figure, “Meh, they’ll be gone before any trouble brews.” No point in the paperwork hassle.

- Low-Risk Tenants: Maybe a tenant’s got a rock-solid track record, or their space ain’t critical to the property’s value. The lender might shrug and say, “We’re good without it.”

- Time and Money: Getting SNDAs signed takes effort—legal fees, negotiations, chasing down signatures. If the risk feels small, they might skip it for minor players.

This kinda thinking shows how lenders are usually the ones ordering, but they’re strategic about it. They ain’t gonna waste time on every little detail unless it’s worth it.

Negotiation: The Hidden Battle Over SNDAs

Here’s a tidbit we gotta talk about—SNDAs ain’t just handed out like candy. There’s often a back-and-forth, especially between lenders and tenants. While the lender might “order” the agreement, tenants can push back on terms. For instance, the limitation of liability bit? Tenants might argue, “Hold up, I don’t want the new landlord off the hook for everything!” And lenders might dig in, wanting max protection.

I’ve been around deals where a big tenant flat-out refused to sign unless the non-disturbance clause was ironclad. They had leverage ‘cause their rent was a huge chunk of the property’s income. So, even if the lender orders the SNDA, other parties can shape how it looks. It’s a team sport, sorta, but the lender’s usually the coach calling the plays.

Why Should You Care About Who Orders the SNDA?

Alright, let’s bring this home. Why does it matter who’s ordering the SNDA? ‘Cause it tells ya who’s got the most to gain—or lose—in a deal. If you’re a tenant, knowing the lender’s behind it means you gotta check the non-disturbance part to make sure your biz won’t get tossed out. If you’re a landlord, you might need to play mediator to keep both lender and tenants happy. And if you’re a lender… well, you already know you’re running the show, don’t ya?

Understanding who’s pushing for the SNDA also helps ya figure out where the power lies in a transaction. It’s like a sneak peek into the deal’s dynamics. Plus, if you’re on the receiving end of an SNDA request, knowing it’s likely coming from the lender gives ya context on why it’s non-negotiable (or at least feels that way).

Practical Tips: What to Do If an SNDA Lands on Your Desk

Whether you’re a tenant, landlord, or even a smaller lender, here’s some down-to-earth advice on handling an SNDA when it’s “ordered” your way:

- Read Every Word: Don’t just sign ‘cause someone’s rushin’ ya. Make sure you get what subordination means for your rights, or how attornment locks ya in with a new landlord.

- Negotiate if You Can: Especially for tenants—push for strong non-disturbance protection. If you’ve sunk cash into your space, you deserve some guarantees.

- Talk to a Pro: I ain’t a lawyer, but I know legal mumbo-jumbo can trip ya up. Get someone who knows real estate law to look it over.

- Know Your Leverage: If you’re a major tenant or a landlord with a hot property, you might have wiggle room to tweak terms, even if the lender ordered it.

We’ve all been in spots where paperwork feels like a chore, but an SNDA ain’t something to sleep on. It can save your bacon—or burn it—if a deal goes belly-up.

Wrapping It Up: Lenders Lead, But Everyone’s in the Game

So, who orders the SNDA? Most of the time, it’s the lender—the bank or mortgagee financing the property. They’ve got the cash and the risk, so they’re the ones demanding this agreement to protect their lien, control foreclosure outcomes, and keep things tidy. But tenants and landlords ain’t just bystanders. Tenants might push for protection, and landlords might use SNDAs to seal a deal or attract renters. It’s a dance, and while the lender’s leading, everyone’s gotta step in time.

If you’re tangled up in a commercial real estate deal, take a hard look at any SNDA that comes your way. Figure out who’s ordering it and why. It might just clue ya into the bigger picture. And hey, if you’re unsure, don’t hesitate to chat with someone who’s been through the wringer on these things. Got questions or a wild SNDA story of your own? Drop a comment below—I’d love to hear how you’ve navigated this legal jungle! Let’s keep the convo rollin’.

Who We Are Submenu

One of the closing documents in a real estate financing transaction involving leased property is a subordination, non-disturbance and attornment agreement (SNDA). SNDAs have a number of purposes. They serve to connect the lender with the tenant and they provide other uses as well.

Additional Provisions in SNDAs

These three provisions in an SNDA are typically and generally noncontroversial in most instances. Many SNDAs contain other terms that provide certain benefits to lenders. Many of these may be objectionable to tenants.

SNDAs may include estoppel certificates from the tenants. These may include a statement identifying the original lease, all amendments to it and all collateral agreements regarding it; an acknowledgment that the landlord does not have any remaining construction obligations; an assertion that the tenant is not in default under the lease and has always used the lease in a manner consistent with the terms of the lease; a statement that the landlord is not in default under the lease and that the tenant has no claim against the landlord (or a description of any defaults or claims); and a representation that the tenant has not assigned, sublet or mortgaged its interest in the property. The estoppel provisions may also include other information that the lender may consider relevant, such as whether the tenant has exercised any option or rights under the lender; whether the tenant has any remaining options or rights under the lease; or whether other agreements, such as reciprocal easement agreements, are in effect.

SNDAs frequently provide that the tenant will give to the lender copies of all notices that the tenant is required to furnish to the landlord, and they sometimes state that the lender will have an additional period of time to cure any defaults by the landlord under the lease. Lenders may include in the SNDA a statement that if the landlord is in default under the lease, the lender will be given as much time as it needs to complete a foreclosure of the property or otherwise to gain possession of the property before the cure period commences. SNDAs may also provide that the lender will not be held accountable for defaults of the landlord that the lender cannot cure, such as the landlord’s bankruptcy.

What is an SNDA?

FAQ

Who requests an snda?

If you’re a tenant of commercial property, it’s possible that your landlord has asked or will ask you to enter into a Subordination, Non-Disturbance and …Jan 30, 2018

Why does a lender want an SNDA?

Lenders benefit from SNDAs because this gives the mortgage priority over individual leases. They can transfer ownership of the property from one hand to the other without fearing the tenants will abandon their leases.

How does an SNDA work?

… the tenant agrees to subordinate its lease to the mortgagee’s lien in exchange for the mortgagee’s agreement to honor the terms of the lease if mortgagee …Feb 3, 2021

What is the difference between NDA and SNDA?

The “N” in SNDA stands for “non-disturbance”. While the subordination agreement gives the lender priority over the tenant’s rights under its lease, the non-disturbance agreement (NDA) is designed to protect the tenant’s rights under the lease in the event of a foreclosure.