When you sell something at a profit, the IRS generally requires you to pay capital gains tax. Capital gains taxes can apply to various types of investments, including stocks, vehicles, and some real estate. However, you may qualify for a capital gains tax exemption. Here are some key things you should know about capital gains taxes.

The One Big Beautiful Bill that passed includes permanently extending tax cuts from the Tax Cuts and Jobs Act, including increasing the cap on the amount of state and local or sales tax and property tax (SALT) that you can deduct, makes cuts to energy credits passed under the Inflation Reduction Act, makes changes to taxes on tips and overtime for certain workers, reforms Medicaid, increases the Debt ceiling, and reforms Pell Grants and student loans. Updates to this article are in process. Check our One Big Beautiful Bill article for more information.

Have you ever sold something and made a profit, then wondered if you need to pay taxes on that extra cash? That’s what capital gains tax is all about – but not everyone has to pay it! Whether you’ve sold stocks, your home, or other valuable items, understanding who gets a pass on these taxes could save you thousands of dollars.

What Are Capital Gains Anyway?

Before diving into exemptions, let’s clarify what we’re talking about. According to the IRS almost everything you own for personal or investment purposes is considered a “capital asset.” This includes

- Your home

- Household furnishings

- Stocks and bonds

- Vehicles

- Collectibles

When you sell one of these assets for more than your “cost basis” (what you paid for it plus any improvements) that profit is called a capital gain. For example if you bought a stock for $2,000 and sold it for $3,500, your capital gain would be $1,500.

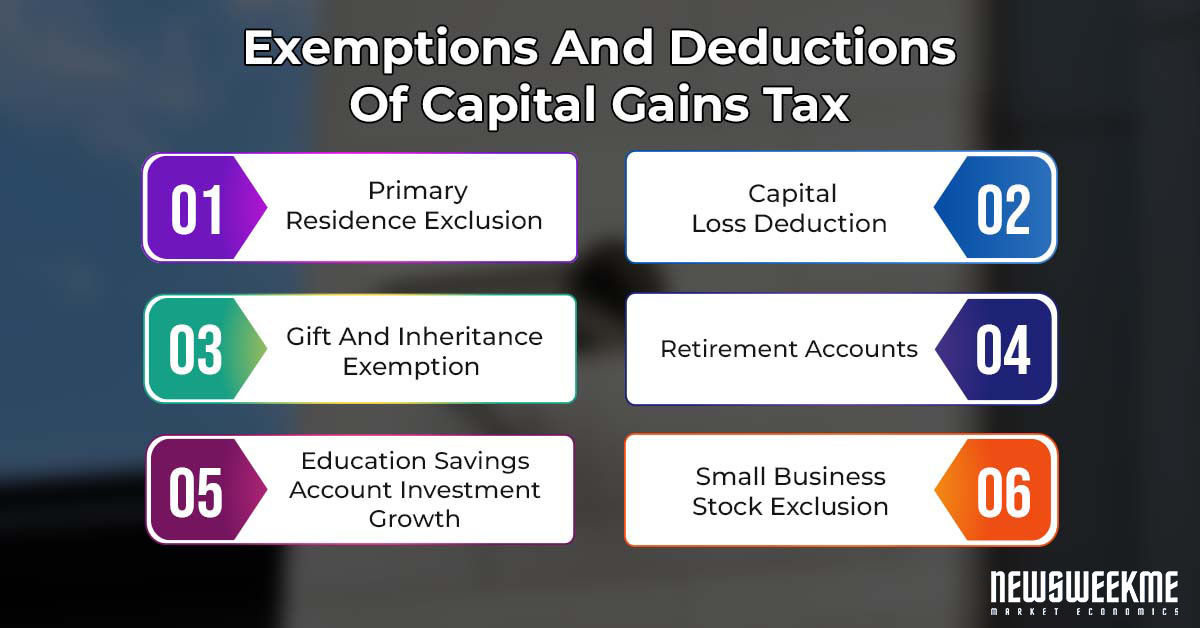

The Big Exemptions: Who Doesn’t Have to Pay?

1. Low-Income Taxpayers (0% Tax Rate)

One of the biggest groups that effectively gets an exemption is people with modest incomes. For the 2025 tax year, you pay a capital gains rate of 0% if your taxable income falls below:

- $47,025 for single filers and married filing separately

- $94,050 for married filing jointly and qualifying surviving spouse

- $63,000 for head of household

This means if your total taxable income (including your capital gains) stays under these thresholds, you won’t pay any federal tax on those gains!

2. Home Sellers (Primary Residence Exclusion)

Got a profit from selling your home? You might be completely exempt from capital gains tax thanks to what’s probably the most valuable exemption in the tax code.

You can exclude up to:

- $250,000 in capital gains if you’re single

- $500,000 in capital gains if you’re married filing jointly

But you gotta meet these three conditions:

- You owned the home for at least 2 years total

- You used it as your main residence for at least 2 years during the 5-year period before the sale

- You haven’t excluded gain from another home sale in the 2 years before this sale

This is HUGE for homeowners! In many markets, this exclusion covers all the profit most people make when selling their homes.

3. Retirement Account Investors

When you invest through qualified retirement accounts like:

- 401(k)s

- Traditional IRAs

- Roth IRAs

You’re not subject to capital gains tax on the investments within those accounts. For Roth IRAs specifically, qualified withdrawals are completely tax-free, including any capital gains!

This is why financial advisors are always nagging people to max out their retirement contributions – it’s a legit way to shield investments from capital gains tax.

4. Investors Using Tax-Loss Harvesting

While not technically an exemption, you can offset capital gains with capital losses. If you sold some investments at a loss, those losses can cancel out your gains for tax purposes.

For example, if you had $10,000 in capital gains but also had $7,000 in capital losses in the same year, you’d only be taxed on the net gain of $3,000.

Even better: If your capital losses exceed your gains, you can deduct up to $3,000 of the excess loss against your other income. Any remaining losses can be carried forward to future years.

5. Small Business Stock Holders (Section 1202)

If you’ve invested in certain small business stocks (qualified small business stock under Section 1202), you might be eligible to exclude up to 100% of your capital gains.

However, this comes with strict requirements:

- Stock must be from a C corporation

- Must have been acquired at original issue

- Corporation must have less than $50 million in assets

- Must hold the stock for more than 5 years

This is a complex exemption with lots of rules, but for qualifying small business investors, it’s incredibly valuable!

Other Important Exemptions Worth Knowing

Inherited Assets (Step-Up in Basis)

When you inherit assets like stocks or property, you get what’s called a “step-up in basis.” This means the cost basis of the asset becomes its fair market value on the date of the previous owner’s death – not what they originally paid for it.

This effectively wipes out any capital gains that occurred during the deceased person’s lifetime. So if your parent bought a stock for $10,000 that was worth $100,000 when they passed away, your basis would be $100,000 – and you’d only pay capital gains on profits above that amount when you sell.

Charitable Donations

Donating appreciated assets to charity? You might get a double tax benefit:

- You avoid paying capital gains tax on the appreciation

- You can claim a charitable deduction for the full market value of the donated asset

This is why wealthy folks often donate stocks or property instead of cash – it’s way more tax-efficient!

1031 Exchanges for Real Estate

If you’re selling investment or business property, you can defer capital gains tax through what’s called a 1031 exchange. This lets you roll your profits into a similar property without paying taxes on the gain.

The rules are strict though:

- Must be “like-kind” property (generally real estate for real estate)

- Must identify the replacement property within 45 days

- Must complete the exchange within 180 days

It’s not an exemption forever – more like kicking the tax can down the road – but it allows investors to build wealth without taking a tax hit with each property change.

Length of Ownership Matters

The time you hold an asset before selling it dramatically affects your tax rate:

Short-Term Capital Gains (Held ≤ 1 Year)

- Taxed at your ordinary income tax rates (potentially up to 37%)

- No special exemptions or rates

Long-Term Capital Gains (Held > 1 Year)

- Qualify for the lower capital gains tax rates (0%, 15%, or 20%)

- Most tax exemptions apply to long-term gains

Just by holding investments for longer than a year, many taxpayers can reduce their tax rates by 10-20%!

Special Cases and Lesser-Known Exemptions

Capital Gains for Military Personnel

If you’re an active duty military member who needs to sell your home because of a permanent change of station, you may qualify for a prorated exclusion even if you don’t meet the usual 2-year ownership and use tests.

Medical Expense-Related Sales

If you sell an asset specifically to pay for medical expenses, you might qualify for a reduced capital gains tax rate or partial exclusion.

First-Time Homebuyer Withdrawals

First-time homebuyers can withdraw up to $10,000 from traditional IRAs without the usual 10% early withdrawal penalty, though regular income tax would still apply.

Opportunity Zone Investments

Investing capital gains in designated “Opportunity Zones” can defer and potentially reduce your tax liability on those gains.

Common Misconceptions About Capital Gains Exemptions

Let’s clear up some confusion:

❌ Myth: “Personal items like cars and electronics are exempt from capital gains tax.”

✅ Reality: They’re not automatically exempt, but since most personal items depreciate, you typically don’t have a gain to report. If you sell a personal item for a profit, that gain is technically taxable.

❌ Myth: “If I use the money from selling stocks to buy more stocks, I don’t have to pay capital gains.”

✅ Reality: Unlike real estate 1031 exchanges, there’s no general provision allowing you to defer taxes by reinvesting in stocks (except within retirement accounts).

❌ Myth: “Business income is subject to capital gains tax rates.”

✅ Reality: Regular business income is taxed as ordinary income, not capital gains. This includes people who regularly buy and sell items for profit.

Planning Strategies to Maximize Exemptions

Time Your Asset Sales

If your income fluctuates year to year, try to sell appreciated assets during a year when your income is lower to potentially qualify for the 0% capital gains rate.

Gift Appreciated Assets

Instead of giving cash to family members in lower tax brackets, consider gifting appreciated assets. When they sell, they might qualify for the 0% capital gains rate (depending on their income).

Consider Tax-Efficient Fund Placement

Hold tax-inefficient investments (like those that generate a lot of taxable distributions) in tax-advantaged accounts, and more tax-efficient investments in regular brokerage accounts.

Final Thoughts: Don’t Let Taxes Drive All Your Decisions

While it’s smart to understand capital gains exemptions, don’t let tax concerns be the only factor in your investment decisions. Sometimes, it makes perfect sense to sell an asset and pay the tax if:

- Your investment outlook has changed

- You need the money for important goals

- You want to diversify your portfolio

- The asset no longer fits your investment strategy

The best approach? Be aware of the exemptions you might qualify for, but make investment decisions based on your overall financial plan and goals.

Remember: tax rules change frequently, so what’s true today might not apply next year. Working with a qualified tax professional can help ensure you’re taking advantage of all available exemptions while staying compliant with current tax law.

Have you sold any assets this year? You might be eligible for one of these exemptions – it’s definitely worth checking before tax time rolls around!

Investment and Self-employment taxes done right

A local specialized expert matched to your unique situation will get your taxes done 100% right, guaranteed with TurboTax Live Full Service. Your expert will find every tax deduction you deserve & file for you as soon as today.*

Capital losses can offset capital gains

As anyone with much investment experience can tell you, things dont always go up in value. They go down, too. If you sell an investment asset for less than its cost basis, you have a capital loss. Typically, you can use capital losses from investments to offset capital gains. But you cant use them to offset gains from selling personal property.

For example:

- You made $50,000 in long-term gains by selling one stock. But, you lost $20,000 from selling another. So, you may only be taxed on $30,000 of long-term gains.

- $50,000 – $20,000 = $30,000 long-term capital gains

If capital losses exceed capital gains, you may be able to use the loss to offset up to $3,000 of other income. If you have more than $3,000 in capital losses, this excess amount can be carried forward to future years to similarly offset capital gains or other income in those years.

Who Is Exempt From Capital Gains Tax? – CountyOffice.org

FAQ

What makes you exempt from capital gains tax?

In most cases, your home has an exemption

You can do this if you meet all three conditions: You owned the home for a total of at least two years. You used the home as your primary residence for a total of at least two years in the last five-years before the sale.

Who qualifies for 0% capital gains tax?

| SINGLE FILERSTaxable income | |

|---|---|

| $0 to $48,350 | 0% |

| $48,351 to $533,400 | 15% |

| $533,401 or higher | 20% |

| MARRIED FILING JOINTLYTaxable income |

How do you avoid capital gains tax?

Tax-advantaged retirement accounts allow you to avoid capital gains taxes altogether. To minimize your tax burden, you can hold your most tax-efficient investments in your taxable brokerage account, while holding less tax-efficient assets in your tax-advantaged accounts.

How do seniors avoid capital gains tax?

The IRS allows no specific tax exemptions for senior citizens, either when it comes to income or capital gains. The closest you can come is contributing to a Roth IRA or Roth 401(k) with after-tax dollars, allowing you to make qualified withdrawals on a tax-free basis.