The heavy metal cards come with big annual fees, but not necessarily the benefits to match.

Many or all of the products on this page are from partners who compensate us when you click to or take an action on their website, but this does not influence our evaluations or ratings. Our opinions are our own.

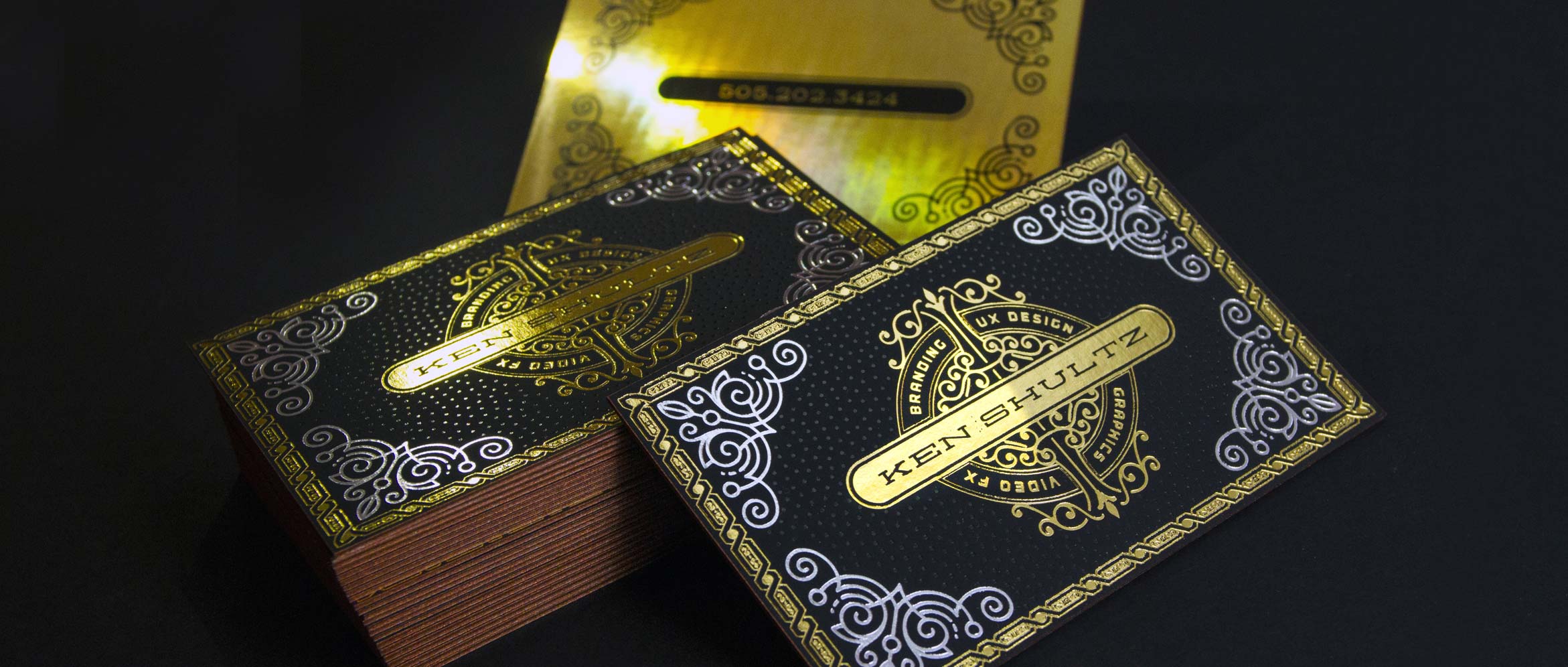

Luxury Card, the provider of a trio of glitzy credit cards for high-end customers, is all about flash. The company markets three premium cards with hefty annual fees, touting their metal construction and fancy perks:

But the value of these cards is relatively lackluster when you take the high annual fees into account. Here’s what you should know about these offers.

When it comes to luxury credit cards, the gold and black card offerings often attract the most attention But which one actually ranks higher? At first glance, it may seem that the gold card edges out the black card However, the truth is more nuanced. In this article, we’ll compare the key features of gold and black cards to determine which card comes out on top.

Luxury credit cards cater to high-net-worth individuals who want premium perks, rewards, and service. They typically have high annual fees, but provide cardholders with exclusive benefits.

The two most coveted colors in the luxury card space are gold and black. Gold symbolizes prestige and wealth, while black denotes exclusivity and elite status.

Major card issuers like American Express and Mastercard offer popular gold and black cards. Examples include:

- American Express Gold Card

- Chase Sapphire Reserve® (metal gold card)

- Mastercard® Gold CardTM

- American Express Centurion Card (black card)

- Mastercard® Black CardTM

But if you had to choose just one, which has the edge – gold or black? Let’s compare the key factors.

Annual Fees

Annual fees are substantially higher for luxury cards compared to standard credit cards.

-

The Mastercard® Gold CardTM has a $995 annual fee.

-

The Mastercard® Black CardTM fee is $495.

So in terms of cost, the black card is clearly more affordable. You save $500 per year with the black card’s lower annual fee.

Winner: Black Card

Rewards and Perks

Rewards rates and perks are where these cards really differentiate themselves.

The Mastercard® Gold CardTM offers:

- 2% value for airfare and cash back redemptions

- $200 annual airline credit

- Global Entry credit

- Priority Pass lounge access

Whereas the Mastercard® Black CardTM provides:

- 2% value for airfare redemptions

- 1.5% value for cash back

- $100 annual airline credit

- Global Entry credit

- Priority Pass lounge access

The gold card has a higher rewards value for cash back, double the airline credit, and comes with a Global Entry credit.

The black card trails on rewards value and airline credit amount. But it still includes solid rewards on airfare and some travel perks.

Winner: Gold Card

Exclusivity

Exclusivity carries weight in the luxury card space. The harder a card is to acquire, the more elite it is perceived,

The Centurion black card is the most exclusive. It reportedly requires you to spend $250,000+ a year on your American Express card.

The Mastercard black card is more accessible. You can apply for it without a special invitation. There are no published spending requirements.

The gold cards are even easier to acquire. Their eligibility requirements are simply good credit and the ability to afford the annual fee.

So black cards are more exclusive than gold cards in general. But the Mastercard black card is an exception, with a relatively attainable exclusivity level.

Winner: Black Card

Status Symbol

Wealthy cardholders also value luxury cards for their status symbol appeal. Brandishing a heavy metal black or gold card has prestige attached to it.

The gold card gets the edge here though. Gold radiates affluence. The 24k gold plated and hefty feel of gold cards make a statement.

Black cards still carry clout. But their darker metal construction is a bit more low key.

Winner: Gold Card

Customer Service

Concierge service is a hallmark of luxury cards. The level of individualized service you receive plays a big role in the card experience.

In this arena, the Mastercard black and gold cards are on equal footing. They both provide 24/7 access to Luxury Card Concierge specialists for personalized assistance.

So for customer service, it’s a draw. Both cards deliver premium concierge access.

Winner: Tie

The Verdict

Based on our head-to-head comparison, the gold card edges out the black card when combining all factors.

The gold card’s higher rewards rates, bigger airline credit, and flashy gold design outshine the black card’s assets of a lower annual fee and increased exclusivity.

However, the best card for you depends on your priorities:

-

If status and exclusivity matter most, go for the black card.

-

If rewards value is your top concern, lean towards the gold card.

Both cards provide an elevated level of service, perks, and prestige. Whichever luxurious metal card you choose, you can rest assured it will deliver a superior cardmember experience.

The cards are pricey

Issued by Barclays, the cards in the Luxury Card portfolio have annual fees in the triple digits. The Mastercard Gold Card is the priciest, with a fee just south of $1,000 a year, while the Mastercard Titanium Card is the least expensive. In the middle is the Mastercard Black Card, which launched in 2016 as a rebranded version of the old Visa Black.

The cards can get even more costly if you want to add another person to the account. For each authorized user, you’ll pay:

- $95 on the Luxury Card™ Mastercard® Titanium Card™.

- $195 on the Luxury Card™ Mastercard® Black Card™.

- $295 on the Luxury Card™ Mastercard® Gold Card™.

A high annual fee on a credit card isn’t necessarily a deal-breaker if you can get more value out of the card in rewards and benefits. But with these cards, that can be hard to do.

The Luxury Card™ Mastercard® Black Card™ is not the same product as The Centurion Card from American Express, which is also commonly referred to as the Black Card.

SOME CARD INFO MAY BE OUTDATEDAll information about The Centurion® Card from American Express and the Business Centurion® Card from American Express has been collected independently by NerdWallet. The Centurion® Card from American Express and the Business Centurion® Card from American Express are no longer available through NerdWallet. |

The rewards are just OK

The Luxury Card website says cardmembers “receive leading airfare and cash back redemption rates.” But dig a little deeper and the rewards arent actually better than the competition.

Here’s how much theyre worth:

- Luxury Card™ Mastercard® Titanium Card™: Points are worth 2 cents apiece for airfare redemptions and 1 cent apiece for other redemptions.

- Luxury Card™ Mastercard® Black Card™. Points are worth 2 cents apiece for airfare redemptions, 1.5 cents apiece for cash back and 1 cent apiece for other redemptions.

- Luxury Card™ Mastercard® Gold Card™: Points are worth 2 cents apiece for both airfare redemptions and cash back and 1 cent apiece for other redemptions.

Sure, the points on these cards can be worth up to 2 cents apiece, which is double the standard 1 cent per point offered on many cards. But youll only earn 1 point per dollar spent. Assuming you redeem all your rewards for 2 cents per point, this is essentially the same earnings rate as Capital One Venture X Rewards Credit Card. Each mile is worth 1 cent, but youll earn 2 miles per dollar on most purchases.

Even though the Capital One Venture X Rewards Credit Card has an annual fee of $395, you have the potential to eke even more value out of your points by transferring them to a travel loyalty program. This card and its chief competitors the Chase Sapphire Reserve® (annual fee: $550) and The Platinum Card® from American Express (annual fee: $695) have multiple airline and hotel partners that allow you to transfer your points to loyalty programs at a 1-to-1 rate (Terms apply). If you transferred points on one of these cards to a partner to take advantage of a high-value redemption, you might be able to get, say, 5 cents of value out of each point.

The cards in the Luxury Card collection don’t have transfer partners; the maximum value you can get out of each point is 2 cents.

AMEX Black Card Explained

FAQ

Which is better, a black card or a gold card?

Mastercard Gold cardholders receive up to $200 in annual air travel credit toward flight-related purchases, including airline tickets, baggage fees, and upgrades, while Mastercard Black cardholders receive up to $100 in annual air travel credit. This credit is automatically applied to your account.

What is higher than a gold card?

Platinum Credit Card

This card type offers more privileges and benefits than silver or gold cards, including add-on cards, fuel surcharge waivers, exclusive rewards or deals on shopping, dining, lifestyle and entertainment. Membership and annual fees are higher as well.

Which color credit card is the highest?

Premium luxury credit cards, or “black cards,” are the most exclusive credit cards on the market.

What card is higher than a black card?