Trying to pay off your debt can seem overwhelming, but there are strategies that can help. There are generally two different approaches to take to help pay down your debt, and each method has its pros and cons. There is no right or wrong answer when it comes to which method is best because every person’s debt situation differs. Sometimes it might even be a combination of both methods. It is up to you to determine what motivates you and which process may be the best fit for your situation.

Paying off debt can feel like an uphill battle. When you have multiple debts to juggle, it can be hard to know where to start. Should you go for the quick wins and pay off the small balances first? Or methodically knock out the debts with the highest interest rates?

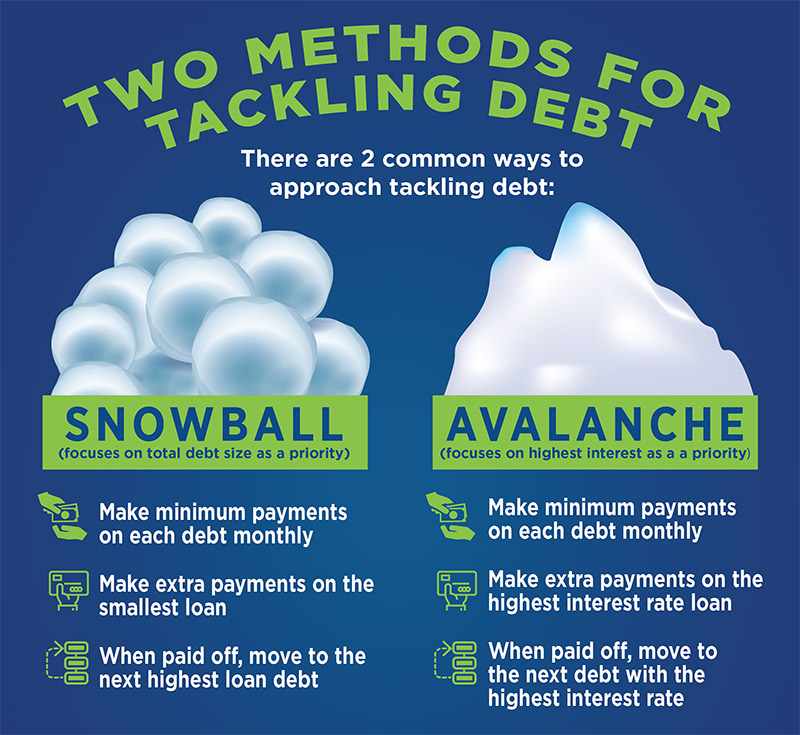

Two popular accelerated debt payoff strategies aim to make paying off debt faster and more systematic the debt avalanche and the debt snowball methods But which one is right for your situation?

How The Debt Avalanche and Debt Snowball Methods Work

The debt avalanche and debt snowball methods are both strategies for paying off multiple debts more quickly,

With both methods. you’ll

- List out all your debts and their balances

- Make minimum payments on all debts except one

- Put any extra money toward paying off the one debt you’re targeting

Once that debt is gone, you move the payment to the next debt on your list. This “avalanche” or “snowball” effect kicks your debt payoff efforts into high gear.

The difference between these two methods is simple:

-

With the debt avalanche method, you pay extra on the debt with the highest interest rate first. This method saves you the most money overall.

-

With the debt snowball method, you pay extra on the debt with the smallest balance first. This method gives you quick wins to stay motivated.

Let’s compare how they work…

The Debt Avalanche Method

The debt avalanche method focuses on paying down your most expensive debt first.

Here’s how it works:

- List your debts from highest to lowest interest rate

- Make minimum payments on all debts

- Put any extra money toward the debt with the highest interest rate

- When that debt is paid off, move to the debt with the next highest rate

This method makes mathematical sense. By eliminating your costly high interest rate debts first, you pay less interest overall.

For example:

You have three debts:

- Credit card at 18% interest: $5,000 balance

- Car loan at 5% interest: $8,000 balance

- Student loan at 3.5% interest: $10,000 balance

With the avalanche method, you would pay off the credit card first since it has the highest interest rate. Once it’s paid off in 7 months, you’d move to the car loan. After another 8 months, the car loan would be gone too.

In one year and 3 months, you would be completely debt free and have paid $830 in interest.

The debt avalanche method can save you hundreds or even thousands of dollars over time compared to other strategies.

The Debt Snowball Method

Unlike the avalanche method, the debt snowball method ignores interest rates. It focuses solely on the size of your debt balances.

Here is how to do the debt snowball method:

- List your debts from smallest balance to largest

- Make minimum payments on all debts except the smallest

- Pay as much as possible toward the smallest debt

- When that debt is gone, move to the next smallest debt

For example:

Using the same debts as the previous example:

- Credit card at 18% interest: $5,000 balance

- Car loan at 5% interest: $8,000 balance

- Student loan at 3.5% interest: $10,000 balance

With the snowball method, you would pay off the credit card first since it has the smallest balance. Then you’d pay off the car loan, followed by the student loan.

Although you would become debt free in the same 15 month timeframe, you would pay more in interest overall – around $1,150.

So why use this method if it costs more? The debt snowball gives you quick wins and can keep you motivated as you pay off debts one by one.

Which Debt Payoff Strategy is Best?

So should you go with avalanche or snowball? Here are some key factors to consider:

Go with avalanche if you want to:

- Pay the least interest possible

- Pay off debt quickly

- Take a logical, mathematical approach

Go with snowball if you want to:

- Get quick wins to stay motivated

- Pay off small nagging debts first

- Use emotions rather than math to guide you

Other factors:

-

Interest rates: The wider the gap between your highest and lowest interest debts, the more money avalanche will save you.

-

Your financial discipline: If you need emotional wins to stay on track, snowball may be better. If you easily stick to a plan, opt for avalanche.

-

Your timeline: The snowball method can help you pay off short-term smaller debts before longer-term bigger ones if that aligns with your goals.

-

Math: Calculate the difference in interest paid between methods. If it’s minimal, snowball is fine. If it’s hundreds or thousands of dollars, go avalanche.

Tips for Success With These Methods

Whichever method you choose, follow these tips to make it work:

-

Automate payments and transfers so you easily put extra money toward your target debt each month

-

Track your progress in a spreadsheet or app to stay motivated

-

Cut expenses temporarily during debt payoff to free up even more cash

-

Celebrate each milestone – it keeps you going!

-

Re-evaluate as needed. If circumstances change, you can switch methods or debts to target.

The Bottom Line

The debt snowball and avalanche methods help you take charge of multiple debts. Avalanche saves money, while snowball provides emotional wins. Look at your own finances, personality, and goals to decide which is the best debt payoff strategy for you. Then automate payments, track progress, and celebrate to crush those debts even faster.

Esta página solo está disponible en inglés

Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español.

Trying to pay off your debt can seem overwhelming, but there are strategies that can help. There are generally two different approaches to take to help pay down your debt, and each method has its pros and cons. There is no right or wrong answer when it comes to which method is best because every person’s debt situation differs. Sometimes it might even be a combination of both methods. It is up to you to determine what motivates you and which process may be the best fit for your situation.

What to know about the snowball vs. the avalanche method

The “snowball method,” simply put, means paying off the smallest of all your loans as quickly as possible. Once that debt is paid, you take the money you were putting toward that payment and roll it onto the next-smallest debt owed. Ideally, this process would continue until all accounts are paid off. As you roll the money used from the smallest balance to the next on your list, the amount “snowballs” and gets larger and larger and the rate of the debt that is reduced is accelerated.

In contrast, the “avalanche method” focuses on paying the loan with the highest interest rate loans first. Similar to the “snowball method,” when the higher-interest debt is paid off, you put that money toward the account with the next highest interest rate and so on, until you are done. By focusing on the loans that are the most expensive to carry in the long run, you should pay less over time as the higher interest loans are addressed first.

You may save some money with the “avalanche method,” but if the principal is large, the time it may take to pay off debt with the highest interest can be discouraging and make it difficult to stick to the plan. Paying off small debts quickly can feel rewarding. If you prefer to see progress quickly and work your way up, then the “snowball method” may be a better fit for your debt management goals.

Putting the different methods to work

To apply the “snowball method” or the “avalanche method” to your financial situation, get organized by following these steps:

“Snowball Method” |

“Avalanche Method” |

|

|---|---|---|

| 1. | Make a list. Organize any payment information, total amount owed, minimum monthly payments and due dates. | Make a list. Organize any payment information, total amount owed, minimum monthly payments and due dates. |

| 2. | Sort them out. Arrange your list of accounts from smallest to largest dollar amount owed. | Sort them out. Arrange your list of accounts from the highest interest rate to the lowest interest rate on each bill. |

| 3. | Budget beyond the minimum. Determine how much extra you can afford to put toward the monthly minimum payment for your smallest debt, after paying the minimum payments on all of your other outstanding debts. Remember, if you do not have enough for even the minimum on each of your debts, it can hurt your credit score. | Budget beyond the minimum. Determine how much extra you can afford to put toward the monthly minimum payment for your highest interest rate account, after paying the minimum payments on all of your other outstanding debts. Remember, if you do not have enough for even the minimum on each of your debts, it can hurt your credit score. |

| 4. | Roll over payments as you make progress: When you’ve paid off the smallest debt, take the money previously used — the monthly payment and the little extra you budgeted — and put it toward the next-smallest debt. | Roll over payments as you make progress: When you’ve paid off the account with the highest interest rate, take the money previously used — the monthly payment and the little extra you budgeted — and put it toward the next-highest interest rate account debt. |

Snowball vs Avalanche: What Is The Best Way To Tackle Debt?

FAQ

Is it better to do avalanche or snowball method?

Generally speaking avalanche is certainly saves interest and snowball is easier for momentum and behavior. Advice is typically given out for avalanche if a large balance/high interest dominates the debt and snowball if a variety of mixed debts exist.

Which method is best to pay off debt the fastest?

Debt avalanche: Focus on paying down the debt with the highest interest rate first (while paying minimums on the others), then move on to the account with the next highest rate, and so on. This might help you get out of debt faster and save you money over the long run by wiping out the costliest debt first.

Why might someone choose the snowball method over the avalanche method?

You might choose to use snowball method because it can provide a psychological boost by quickly eliminating smaller debts, which can help to build motivation and momentum for tackling larger obligations.

Why would anyone use the snowball method instead?

The debt snowball method is more effective than the debt avalanche method because you pay off the smallest balance first—which gives you the motivation and the momentum to keep going.