Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

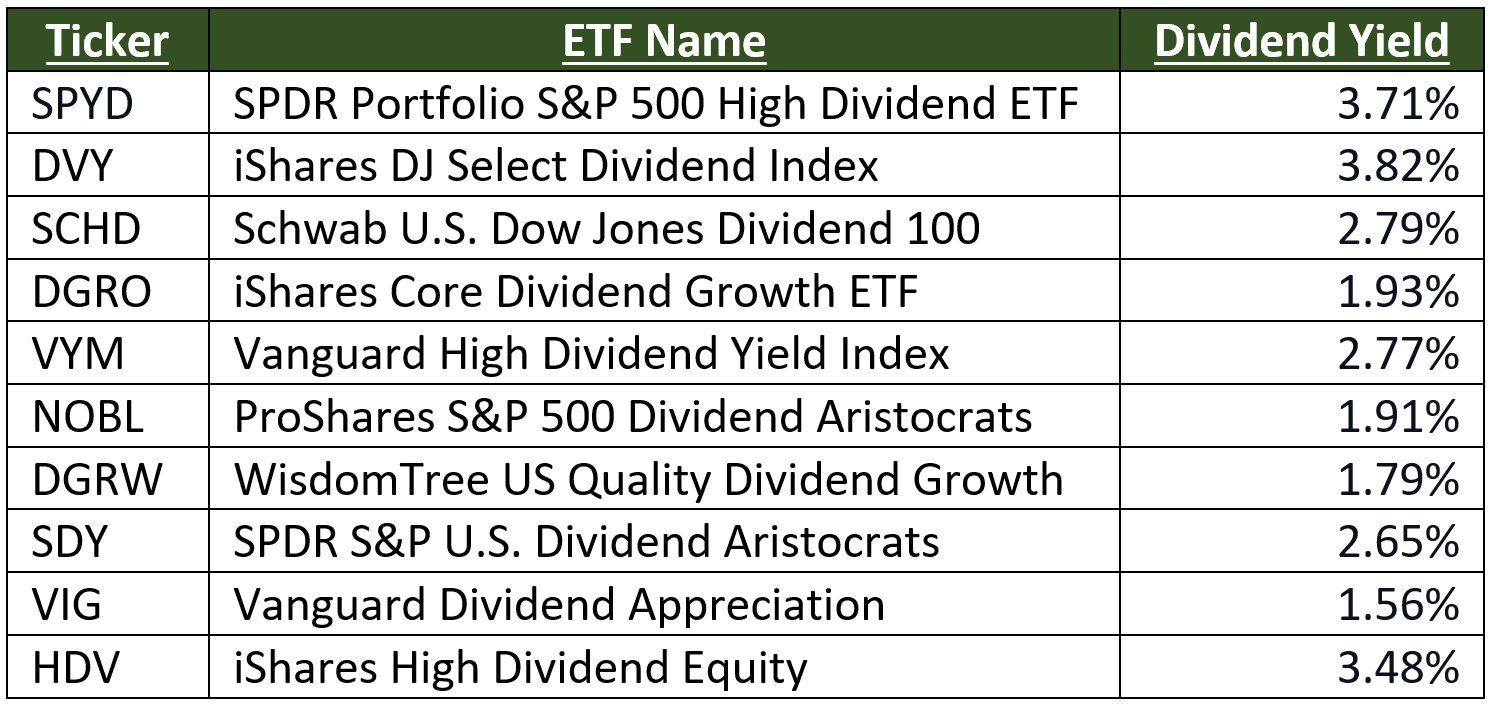

Dividend ETFs offer a way to build a diversified, income-generating portfolio. Investments that pay dividends can provide a steady stream of income, which can either be reinvested to improve overall returns, or distributed as cash (or to fund another investment). Dividend ETFs can have an advantage over dividend stocks, because they hold a number of different investments, which spreads your money across multiple companies. This buffers your risk — if one company performs poorly or cuts its dividend, the others should balance that out. Our list below includes dividend ETFs currently paying high yields.

Dividends can be a powerful source of income, and during times of stock market volatility, dividend-paying companies may even be more stable than their growth-stock peers. To generate income, some investors harness dividends by investing in dividend stocks individually, but theres another option for those who want to save some time and energy: high-dividend ETFs.

Are you tired of watching your investments crawl along while inflation eats away at your savings? Me too! That’s why I’ve been obsessing over dividend ETFs lately. If you’re looking to generate some serious passive income from your investments, you’ve probably wondered which ETF has the highest dividend yield?

I’ve done the legwork for you, digging through the latest data as of November 2025 to find those juicy high-yield dividend ETFs that could potentially pad your pocket with regular income.

The Current Dividend King: KBWY Leads the Pack

According to the latest data from NerdWallet, the Invesco KBW Premium Yield Equity REIT ETF (KBWY) currently wears the crown with an impressive 1005% dividend yield. That’s seriously high—like, “Is this for real?” high

But before you rush to pour your life savings into KBWY, let’s take a deeper look at what’s available in the high-dividend ETF space and what you should consider before investing.

Top 7 High-Dividend ETFs (November 2025)

Here are the current highest-yielding dividend ETFs based on the latest market data:

| Ticker | ETF Name | Dividend Yield |

|---|---|---|

| KBWY | Invesco KBW Premium Yield Equity REIT ETF | 10.05% |

| XSHD | Invesco S&P SmallCap High Dividend Low Volatility ETF | 6.91% |

| DIV | Global X SuperDividend U.S. ETF | 6.55% |

| NUDV | Nuveen ESG Dividend ETF | 5.52% |

| SPYD | SPDR Portfolio S&P 500 High Dividend ETF | 4.64% |

| SPDV | AAM S&P 500 High Dividend Value ETF | 3.96% |

| RDIV | Invesco S&P Ultra Dividend Revenue ETF | 3.93% |

Just looking at these numbers, I know you might be ready to dump everything into KBWY. Hold your horses! There’s more to consider than just the yield percentage.

Why High Dividend ETFs Aren’t Always What They Seem

Whenever I see yields above 6%, my spidey senses start tingling. Here’s what you need to understand about those super-high yields:

-

Higher risk profile – That 10% yield from KBWY doesn’t come without significant risk. As a REIT-focused ETF, it’s heavily exposed to real estate market fluctuations.

-

Dividend sustainability – Sometimes a high yield is the result of the ETF’s price falling dramatically while the dividend hasn’t yet been cut. This can create temporarily inflated yields that won’t last.

-

Sector concentration – Many high-yield ETFs are heavily concentrated in specific sectors like REITs, energy, or utilities, which reduces diversification.

-

Expense ratios matter – Even with high yields, a high expense ratio can eat into your returns. Always check what you’re paying in fees.

Understanding Why Dividend ETFs Make Sense

Despite the warnings, dividend ETFs can be fantastic investment vehicles. Here’s why we love them:

- Instant diversification – Instead of picking individual dividend stocks, an ETF gives you exposure to dozens or hundreds in one purchase.

- Regular income stream – Dividends can provide reliable cash flow, especially valuable during retirement.

- Potential stability – Dividend-paying companies are often more established and stable than growth-focused firms.

- Reinvestment power – You can reinvest those dividends to take advantage of compound growth over time.

How to Choose the Right Dividend ETF

When I’m looking at dividend ETFs, I don’t just chase the highest yield. Here’s my checklist:

1. Look Beyond the Yield

The dividend yield is just the beginning. I also check:

- 5-year returns – How has the ETF performed over time?

- Expense ratio – Lower is generally better. Look for under 0.50%.

- Assets under management (AUM) – Larger funds tend to be more stable.

- Dividend growth history – Is the dividend increasing over time or just high right now?

2. Consider the ETF’s Holdings

What companies make up the ETF? Are they:

- Large caps – Generally more stable

- Mid or small caps – Potentially higher growth but also higher risk

- Sector-specific or broadly diversified – More sectors = more diversification

3. Match the ETF to Your Investment Goals

Different dividend ETFs serve different purposes:

- Income now – If you need cash flow immediately, higher current yields might be priority.

- Income growth – For long-term investors, dividend growth rate may matter more than current yield.

- Tax efficiency – Some dividend ETFs are more tax-efficient than others.

Can You Actually Live Off ETF Dividends?

This is the million-dollar question, literally! Can you retire and live off dividend ETF income?

It’s possible, but you’ll need to do the math carefully. Using the 4% rule as a general guideline:

For a $1 million portfolio invested in an ETF yielding 4%, you’d generate about $40,000 in annual dividend income. Is that enough for your lifestyle? Don’t forget to consider:

- Social Security benefits

- Pension income

- Other investment income

- Tax implications

- Inflation over time

For most people, dividend ETFs work best as part of a broader income strategy rather than the sole income source.

Real-World Example: What $100,000 in KBWY Would Generate

Let’s put some real numbers to this. If you invested $100,000 in KBWY with its current 10.05% yield:

- Annual dividend income: Approximately $10,050

- Monthly income: About $837.50

But remember, that high yield comes with higher risk and potential volatility. The ETF’s principal value could fluctuate significantly.

Potential Red Flags with Ultra-High Yield ETFs

When evaluating ETFs like KBWY with its 10%+ yield, watch for these warning signs:

- Recent significant price drops – Which artificially inflate the yield percentage

- Declining dividend payments – If the actual dollar amount paid is decreasing

- Extreme sector concentration – Like being 100% in REITs or energy

- Small fund size – Which might indicate less stability

- High expense ratios – Which eat into your returns

My Personal Strategy with Dividend ETFs

I don’t put all my eggs in the highest-yielding basket. Instead, I blend different types:

- Core dividend ETFs – Like SPYD (4.64% yield) for stability

- Higher-yield satellite positions – Smaller allocations to ETFs like KBWY (10.05%)

- Dividend growth ETFs – Which focus on companies increasing dividends over time

This way, I get some high current income while also positioning for long-term growth.

How to Buy Dividend ETFs

Ready to add some high-dividend ETFs to your portfolio? Here’s how:

- Open a brokerage account if you don’t already have one

- Research dividend ETFs using the criteria we’ve discussed

- Compare expense ratios across similar ETFs

- Check trading volume to ensure liquidity

- Consider dollar-cost averaging rather than investing all at once

Most online brokers now offer commission-free ETF trading, making it easy and cost-effective to build your dividend portfolio.

Final Thoughts: The Highest Yield Isn’t Always the Best Choice

While KBWY currently holds the crown for highest dividend yield at 10.05%, that doesn’t automatically make it the best choice for every investor. The “best” dividend ETF depends on your:

- Investment timeline

- Risk tolerance

- Income needs

- Tax situation

- Overall portfolio strategy

For some investors, a more moderate yield from a diversified ETF like SPYD (4.64%) might actually deliver better total returns with less volatility.

Remember that crazy-high yields often come with crazy-high risks. Don’t get blinded by double-digit percentages without understanding what’s behind them.

But with careful research and a clear investment strategy, dividend ETFs can be powerful tools for generating income while maintaining growth potential in your portfolio. Whether you’re looking to supplement your current income or build a retirement cash flow machine, these dividend powerhouses deserve a place in your investment toolkit.

What’s your experience with dividend ETFs? Are you focusing on current yield or dividend growth? I’d love to hear your thoughts!

7 high-dividend ETFs

Below is a list of 7 large-cap U.S. dividend ETFs, ordered by annual dividend yield. Note that some high-dividend ETFs may come with higher risk (rather than the stability some dividend investors are looking for). Always read the fine print, investigate dividends that seem too good to be true and look at the components of the ETF to determine if it fits in your portfolio.

|

The best high-dividend ETF is Invesco KBW Premium Yield Equity REIT ETF (KBWY), which currently has a dividend yield of 10.05%. This is based on our screen of U.S. equity ETFs, which excludes inverse, leveraged and actively managed ETFs and any with expense ratios over 0.5%. |

||

|---|---|---|

|

Ticker |

Company |

Dividend Yield |

|

KBWY |

Invesco KBW Premium Yield Equity REIT ETF |

10.05% |

|

XSHD |

Invesco S&P SmallCap High Dividend Low Volatility ETF |

6.91% |

|

DIV |

Global X SuperDividend U.S. ETF |

6.55% |

|

NUDV |

Nuveen ESG Dividend ETF |

5.52% |

|

SPYD |

SPDR Portfolio S&P 500 High Dividend ETF |

4.64% |

|

SPDV |

AAM S&P 500 High Dividend Value ETF |

3.96% |

|

RDIV |

Invesco S&P Ultra Dividend Revenue ETF |

3.93% |

|

Source: Finviz. ETF data is current as of November 4, 2025, and is intended for informational purposes only. |

||

» Ready to start investing? See our picks for the best brokers for ETFs

High-dividend ETFs may generate income

Dividend-paying ETFs can be a great tool for those looking to increase cash flow and diversify their investments. They offer a simple solution to getting exposure to a specific investing niche — in this case, stocks that pay a regular dividend.

You can use those dividends to pad your income as many retirees do. You can also reinvest those dividends back into the fund to better take advantage of compound interest and grow your investment portfolio. Whatever you choose, dividend-paying ETFs make it easy to add a large variety of investments to your portfolio all at once.

» Wondering about the taxes? Learn more about dividend tax ratesAdvertisement

Charles Schwab |

Public |

Coinbase |

|---|---|---|

| NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.8 /5 |

NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.6 /5 |

NerdWallet rating NerdWallets ratings are determined by our editorial team. The scoring formula for online brokers and robo-advisors takes into account over 15 factors, including account fees and minimums, investment choices, customer support and mobile app capabilities.

4.6 /5 |

|

Fees $0 per online equity trade |

Fees $0 |

Fees 0% – 4% varies by type of transaction; other fees may apply |

|

Account minimum $0 |

Account minimum $0 |

Account minimum $0 |

|

Promotion None no promotion available at this time |

Promotion Earn a 1% uncapped match when you transfer your investment portfolio to Public. |

Promotion None no promotion available at this time |

| Learn More | Learn More | Learn More |

Top 5 Monthly Dividend ETFs with High Growth

FAQ

What ETFs pay the highest dividends?

How do I make $1000 a month in dividends?

a month in dividends, you’ll need a large investment portfolio and a strategy to generate a consistent dividend yield, as the required capital depends on the average annual yield of your investments.

For example, a portfolio with ayield would require about

to generate

per month, while a portfolio with a

yield would require approximately

.

What ETF has 12% yield?

The YieldMax® Target 12™ Big 50 Option Income ETF (BIGY) is an actively managed exchange-traded fund that seeks to generate a target annual yield of 12% and capital appreciation through investments in a select portfolio of 15 to 30 publicly traded U.S. large-cap companies.

Which ETFs have the highest returns?