Ever been in that nail-biting situation where you’re constantly refreshing your bank account waiting for money to appear? Yeah, me too. And when you’re expecting a CashNetUSA deposit, knowing exactly when those funds will land can mean the difference between paying a bill on time or facing those dreaded late fees.

If you’ve applied for a loan with CashNetUSA and are wondering “what time will my CashNetUSA deposit hit my account?” you’ve come to the right place. I’ve done the research so you don’t have to keep checking your balance every five minutes.

The Quick Answer: CashNetUSA Deposit Timing

For those who need the info fast (and I know you do), here’s the short version:

Applications approved before 1 30 p.m. CT Monday-Friday are generally funded same business day subject to your bank’s processing times. Applications approved outside these hours are typically funded the next business day.

But there’s more to understand about the timing of your CashNetUSA deposit.

Understanding CashNetUSA’s Funding Timeline

Let’s break down the exact timing of when you can expect to see that money hit your account:

Approval Time Matters Most

CashNetUSA’s funding process depends heavily on when your application gets approved:

- Approved before 1:30 PM CT on weekdays? → Expect same-day funding

- Approved after 1:30 PM CT or on weekends? → Funds typically arrive next business day

- Need additional verification? → Add an extra business day after verification completes

I’ve noticed that CashNetUSA is pretty consistent with these timeframes, but your bank’s processing speed ultimately determines exactly when you’ll see the cash available in your account.

Bank Processing Times Can Vary

Even after CashNetUSA sends your money, your bank needs time to process the incoming transfer. This is where things can get a bit unpredictable:

- Major banks typically process ACH transfers within a few hours

- Smaller banks or credit unions might take longer

- Some banks don’t process deposits during weekends or holidays

For example, if CashNetUSA approves your loan at 1:00 PM CT on Friday and sends the funds immediately, but your bank doesn’t process weekend deposits, you might not see the money until Monday morning.

Factors That Can Delay Your CashNetUSA Deposit

Sometimes deposits take longer than expected. Here’s why that might happen:

Additional Verification Requirements

According to the CashNetUSA FAQ page, “Some applications may require additional verification. In such cases, if approved, funds will be disbursed by the following business day after the additional verifications are complete.”

Common verification requests include:

- Proof of income

- Bank statement verification

- Identity confirmation

If you receive a request for additional documents, sending them promptly is crucial to avoid delays.

Bank Holiday Schedule

Banks don’t process transactions on federal holidays. If your approval coincides with one of these dates, expect your deposit to arrive the next business day:

- New Year’s Day

- Martin Luther King Jr. Day

- Presidents’ Day

- Memorial Day

- Juneteenth

- Independence Day

- Labor Day

- Columbus Day/Indigenous Peoples’ Day

- Veterans Day

- Thanksgiving Day

- Christmas Day

Technical Issues

Sometimes technical glitches happen. If you’ve waited longer than expected based on the guidelines above, it might be due to:

- System outages at CashNetUSA

- Banking network disruptions

- Issues with your specific account

How to Check Your CashNetUSA Deposit Status

Wondering if your money is on the way? Here’s how to check:

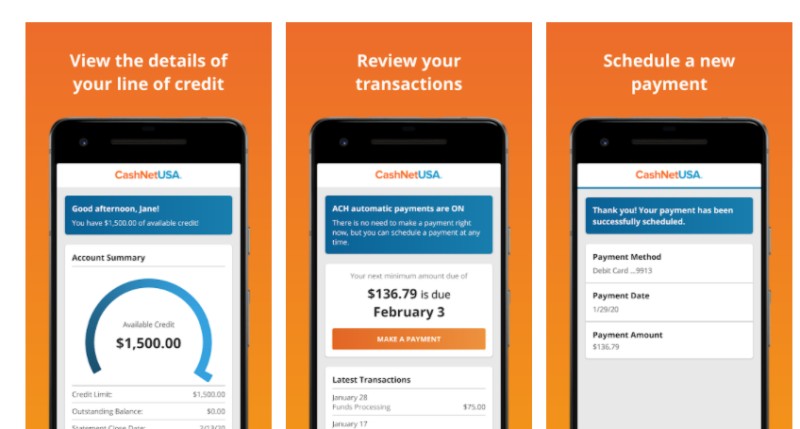

- Log in to your CashNetUSA account

- Navigate to your Account Home

- Check the Message Center for any updates

CashNetUSA usually sends notifications via email about deposit status, so keep an eye on your inbox too. They send all important communications to the email address on file.

If you’re not receiving emails from CashNetUSA, they recommend adding [email protected] to your address book or whitelist to prevent communications from going to spam.

What If My Deposit Is Delayed?

If your deposit hasn’t arrived when expected, don’t panic! Here’s what to do:

- Double-check your approval time against the funding schedule

- Verify your bank account information is correct in your profile

- Contact CashNetUSA customer service at 888.801.9075

CashNetUSA’s customer service team can check the status of your deposit and provide more specific information about when you can expect to receive funds.

Tips for Getting Your CashNetUSA Deposit Faster

Want your money ASAP? I’ve got some insider tips:

Apply Early in the Day

Since applications approved before 1:30 PM CT on weekdays get same-day funding, submitting your application early in the morning gives you the best chance for quick funding.

Have All Documentation Ready

Prepare these documents before applying to avoid delays:

- Recent pay stubs

- Bank statements

- Government-issued ID

- Proof of residence

Keep Your Account Information Updated

Outdated banking info is a common cause of deposit delays. To update your bank information, CashNetUSA requires:

“Latest bank statement for new bank account displaying your name, bank account number, and bank routing number”

You’ll need to email this to [email protected] or fax to 866.413.3888 at least two business days before your expected deposit date.

Understanding ACH Transfers: How CashNetUSA Sends Your Money

CashNetUSA uses ACH (Automated Clearing House) transfers to send funds to your account. According to their FAQ:

“ACH (Automated Clearing House) is a form of electronic debit. When we present an ACH request to your bank, the bank will send us the specified amount of loan fees and/or principal that were outlined in your loan agreement.”

This same system will be used to deposit your loan funds. ACH transfers are secure but typically take 1-3 business days to complete, depending on the financial institutions involved.

State-Specific Deposit Timing Considerations

It’s important to note that CashNetUSA operates under different regulations depending on your state. Some states have specific cooling-off periods or other requirements that might affect when you can receive funds.

For example, in Texas, CashNetUSA operates as a Credit Access Business (CAB) to arrange loans between customers and third-party lenders, which might affect processing times.

Always check the Rates & Terms page for your specific state to understand any unique timing considerations.

My Personal Experience with CashNetUSA Deposits

I’ve used CashNetUSA services before, and in my experience, their timing estimates are pretty reliable. The one time my deposit was delayed, it was because I had recently changed banks and hadn’t updated my account information correctly.

The lesson? Double-check all your information before submitting your application!

Common Questions About CashNetUSA Deposits

Will my deposit come on weekends?

Generally no. Since CashNetUSA only processes approvals Monday through Friday, and most banks don’t process ACH transfers on weekends, weekend deposits are rare. If you’re approved on Friday after the cutoff time, expect your deposit on Monday (barring holidays).

Can I get my CashNetUSA deposit early?

There’s no official way to receive your deposit earlier than the standard processing times. The fastest option is to apply early on a weekday morning to maximize the chance of same-day funding.

Why is my bank showing a pending deposit?

If you see a pending deposit from CashNetUSA, that’s good news! It means the money has been sent and is being processed by your bank. Most banks make pending deposits available the next business morning, but policies vary.

What happens if I provide incorrect banking information?

If you provide incorrect banking information, your deposit will be rejected and returned to CashNetUSA. You’ll need to contact customer service at 888.801.9075 to update your information and reprocess the deposit, which will cause delays.

Final Thoughts

Waiting for a CashNetUSA deposit can be stressful when you need funds quickly. The good news is that their process is relatively straightforward and efficient compared to many other lenders.

Remember the key timing:

- Approved before 1:30 PM CT on weekdays → Same-day funding (typically)

- Any other time → Next business day funding

By understanding these timeframes and keeping your account information updated, you can minimize delays and get access to your funds as quickly as possible.

If you’ve applied and are still wondering “what time will my CashNetUSA deposit hit my account?” just remember that while CashNetUSA processes quickly on their end, your bank’s processing speed ultimately determines when you’ll see those dollars in your account.

Have you had experience with CashNetUSA deposits? Was your money deposited when expected? We’d love to hear your experiences in the comments!

Quick Solutions for Common Questions

The receipt of your funds will vary based on the time at which your application is approved. You will receive an email notification once your application has been approved.

Monday through Friday: If your application is approved by 1:30 p.m. CT Monday – Friday, you will generally receive your funds by end of that day. If your application is approved after 1:30 p.m. CT, you will generally receive your funds from the lender by the next business day.

Friday 1:30 p.m. CT to Sunday 1:30 p.m. CT: If your application is approved between 1:30 p.m. CT Friday and 1:30 p.m. CT Monday, you will receive your funds on Monday, unless it is a bank holiday.

The exact time of funding depends on when your bank will post ACH (Automated Clearing House) credits to your bank account. If you expect to receive funds on a certain day but do not see the funds in your bank account, you should first contact your banks ACH department.

Before final approval, you may receive an email regarding your loan status. Please check the email that you used to apply for a loan, as we will use that email address to request additional information that we might need to finalize the processing of your loan application. Please follow the directions in the email and reply to [email protected] with the additional documents. As soon as we receive this information, we will be able to finish processing your loan request. Should you need to contact us, you can call 888.801.9075 or chat to get in touch with one of our customer service representatives.

You can call 888.801.9075 or chat to get in touch with one of our customer service representatives. They will be able to provide you with more information on what payment options are available to you.

Due date adjustments may be possible depending on your state of residence, loan type and application information. If you are in need of a due date adjustment, please call 888.801.9075 or chat with us.

You can log in to your CashNetUSA account and see how much you owe on your current loan.

Once logged in to your CashNetUSA account, you can click on the “Payments” tab to make a payment towards your outstanding balance. Clicking on the “Make a Payment” tab takes you to a page where you can select the amount you would like to pay.

To update your bank account information, please email a copy or photo of the following document to us at [email protected] or fax to 866.413.3888:

- Latest bank statement for new bank account displaying your name, bank account number, and bank routing number

If you know your customer or loan ID, please include them in your email — this will help us locate your account faster. Please make all information changes at least two business days before your loan payment date.