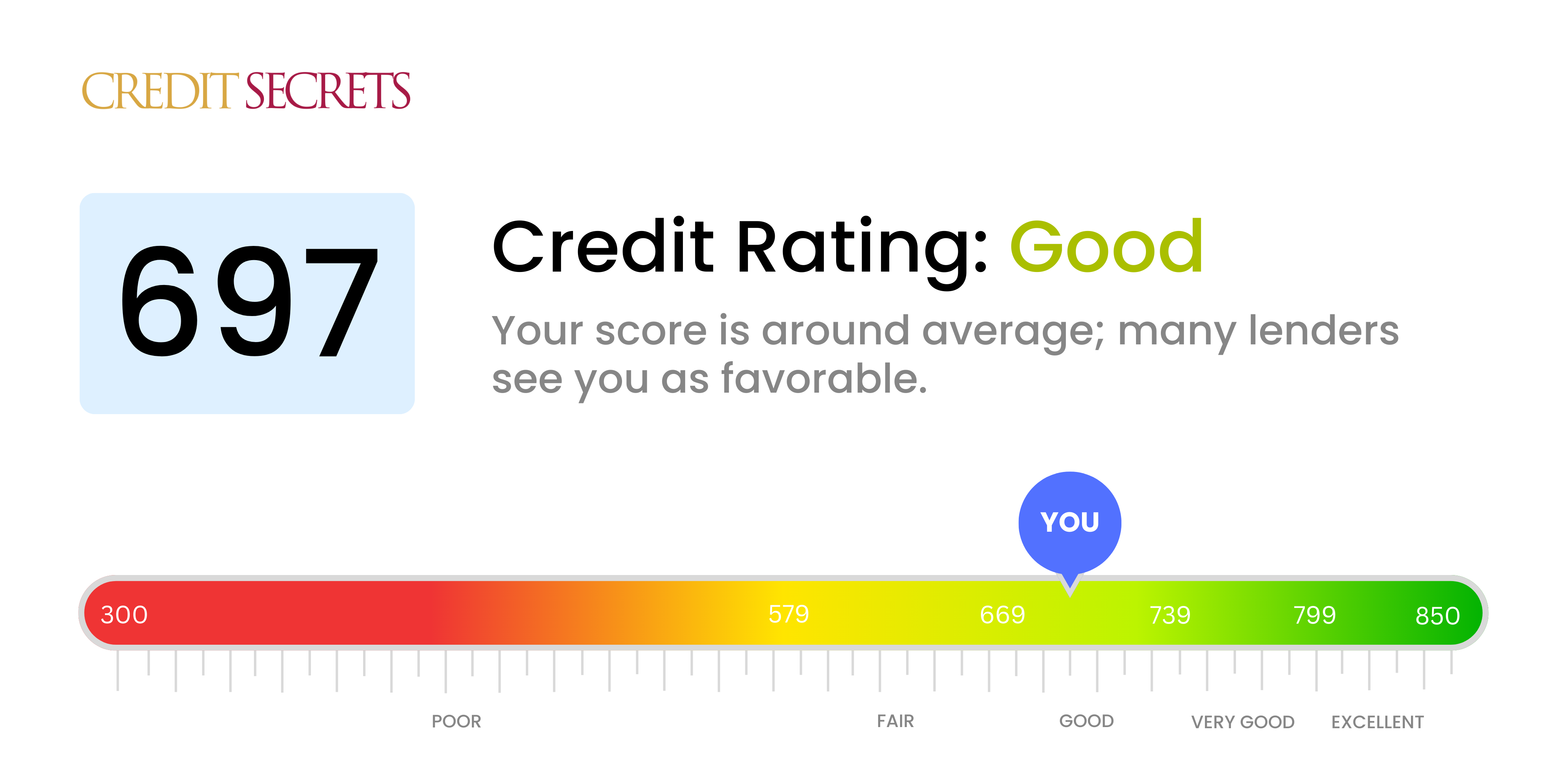

A 697 credit score is considered a “good” credit score, which means you shouldn’t have trouble qualifying for new credit, like a consumer loan or credit card. However, a 697 score falls below the top two FICO® credit tiers — “very good” and “exceptional” — so you likely won’t qualify for a lender’s best interest rates or loan terms.

With a 697 score, lenders will see you as an average risk, since your score isn’t far off from the the average consumer credit score in the U.S., which is 717. Learn more about what a 697 credit score means and what it can get you.

Your credit score is one of the most important numbers in your financial life It gives lenders an idea of how creditworthy you are – whether you’ll be able to pay back money you borrow

But what does a specific score like 697 actually mean? Is it good or bad? Does it make a difference compared to scores that are just a little higher or lower?

In this comprehensive guide, we’ll breakdown exactly what a 697 credit score means and how it impacts your ability to get loans and credit cards.

Overview of Credit Scores

Before diving into the specifics of a 697 score, let’s do a quick overview of credit scores in general:

-

Credit scores are three-digit numbers, generally ranging from 300 to 850, that represent your “creditworthiness.” The higher the number, the more likely you are to pay back debts.

-

There are a few different credit scoring models, but FICO and VantageScore are the most widely used. Although they have minor differences, both score ranges mean basically the same thing.

-

Scores are broken out into categories like poor, fair, good, very good, and exceptional. Each lender sets their own criteria, but in general, the higher your score, the better off you are.

-

Key factors that influence your score include payment history, credit utilization ratio, credit history length, credit mix, and new credit inquiries. Good behaviors will raise your score over time, while missed payments and high balances can lower it.

-

You can check your credit scores for free from sources like Credit Karma and Experian. Monitoring your scores helps you understand your credit health.

Now let’s dive into what a 697 credit score means specifically.

What a 697 Credit Score Means

A credit score of 697 is considered “good” credit according to both the FICO and VantageScore rating systems.

Specifically, it falls into the “good” ranges of:

- 670-739 for FICO

- 661-780 for VantageScore

This means a 697 score is above the “fair” range but below “very good” or “exceptional” credit. It’s better than about 33% of consumers but not as strong as the top 30%.

Here’s how a 697 score stacks up:

Credit Score Ranges

| Score Range | Category |

|---|---|

| 800-850 | Exceptional |

| 740-799 | Very Good |

| 670-739 | Good |

| 580-669 | Fair |

| 300-579 | Very Poor |

So while a 697 score doesn’t put you at the top tier, it still signifies relatively healthy credit compared to many other consumers. Lenders will see you as an acceptable borrower.

Credit Card and Loan Approval Odds

In practical terms, how does a 697 score impact your ability to get approved for credit cards and loans?

The short answer is that a 697 score keeps plenty of doors open, but doesn’t give you access to the very best rates and terms.

Here are some examples of what you can expect with a 697 score:

-

Credit Cards – You should be approved for most unsecured cards, including rewards cards, but may not get giant credit limits or 0% intro APR offers. Your APR is likely to be on the higher end.

-

Auto Loans – Approval is likely but interest rates probably won’t be rock bottom. You may need a sizable down payment to get favorable financing.

-

Mortgages – Getting a conventional mortgage is feasible but you’ll pay a higher rate than someone with very good or exceptional credit. Alternatives like FHA loans may offer better terms.

-

Personal Loans – While approval is possible, interest rates on a personal loan will be on the steeper side, making it expensive to borrow.

The bottom line is that a 697 score keeps plenty of lending options open to you. But it’s not high enough to get the very best deals. Taking steps to boost your score into the very good range can save you money.

How a 697 Compares to Surrounding Scores

Looking at scores right around 697 shows how small differences can impact your borrowing prospects:

-

Scores in the 680s – Very similar to 697. You might see slightly higher rates but overall prospects are still decent.

-

Scores in the 700s – A score of 700 is considered the start of very good credit. Getting approved becomes noticeably easier with 700+ scores.

-

Scores in the 660s – Dropping below 670 puts you in the fair range. You’ll pay higher rates and likely need to put more money down to get approved.

So while being on the cusp of very good credit isn’t hugely different than a 697 score, falling just below 670 can limit your opportunities and make borrowing more expensive.

Even a difference of 10-20 points can impact your interest rates. So monitoring your scores closely is important.

How to Improve a 697 Credit Score

While a 697 score gives you access to plenty of credit, there are still good reasons to try increasing it:

- Lower interest rates save you money on credit cards, loans, and mortgages

- Higher approval chances for the best rewards credit cards

- Increased borrowing power and credit limits

Here are some tips to improve a credit score around 697:

-

Pay all bills on time – Payment history is extremely influential. Set up autopay or reminders to never miss due dates.

-

Keep balances low – High utilization hurts your score. Try to keep balances under 30% of your credit limits.

-

Check for errors – Incorrect late payments or other mistakes can wrongly lower your score. Dispute any errors.

-

Limit hard inquiries – Too many credit checks in a short period can ding your score. Only apply for credit selectively.

-

Ask for credit line increases – Higher limits help keep utilization low for a score boost. Ask issuers periodically for CLI’s.

-

Monitor your reports – Regularly checking your credit reports catches problems before they hit your scores.

With diligent credit management over time, you can potentially push your 697 score solidly into the very good zone, improving your financial opportunities.

The Takeaway

A 697 credit score represents good credit that keeps most lending options open to you. It’s a sign of relatively healthy credit management.

But improving your score further into the very good or exceptional ranges can save you money through lower interest rates. Plus it gives you better approval chances for top rewards credit cards and loans.

Knowing the nuances of what different score ranges mean allows you to properly evaluate your credit situation. Monitoring your scores lets you chart your progress as you work to maximize your credit health.

Can I Get an Auto Loan With a 697 Credit Score?

With a 697 credit score, there’s a good chance you’ll qualify for an auto loan with a decent rate. But you likely won’t be offered a lender’s most competitive APR.

According to Experian’s State of Finance Market Report from the fourth quarter of 2023, the average new auto loan rate for “prime” borrowers (with a 661-780 VantageScore) was 7.01%. By comparison, borrowers who were considered “super prime” (with a 781-850 VantageScore) received the best rates on a new car loan, averaging 5.64% APR; “nonprime” borrowers (with a 601-660 VantageScore), on average, received a 9.60% APR rate.

What Else Can You Get With a 697 Credit Score?

The most direct advantage of a 697 credit score is that it tells creditors that you’re generally a reliable borrower who is likely to repay their debt. In turn, creditors may be more willing to offer you good interest rates and borrowing terms to gain your business.

With a good credit score like 697, you might experience benefits in other areas of your life. For example, a landlord might favor your rental application over applicants with fair or poor credit because they see you have a decent track record for paying your bills. You might also be able to sign up for a new utility account without a deposit requirement, or qualify for a better insurance rate thanks to your 697 score.

A future employer might check your credit to find out whether you have a compromised financial situation, particularly for jobs that involve finances or require security clearance. A 697 credit score means you likely don’t have any major red flags in your credit reports.

Is A Credit Score Of 697 Good? – CreditGuide360.com

FAQ

What can a 697 credit score get you?

Whether you’re looking for a new cash back credit card, travel rewards card, or retail credit card, a 697 FICO score can help you qualify. You might even qualify for a 0% interest credit card.

How good is a 697 credit rating?

Your score falls within the range of scores, from 670 to 739, which are considered Good. The average U.S. FICO® ScoreΘ , 714, falls within the Good range.

What is an excellent credit score?

An excellent credit score generally falls within the 800 to 850 range. Scores in this range indicate a very low risk to lenders and often lead to the best interest rates and loan terms.

Can I get a loan with a 697 credit score?

What Credit Score Is Needed for a Personal Loan? A credit score of 700 or 750 and above is needed for a personal loan.

Is 697 a good credit score?

An 697 credit score falls within the range that is typically considered to be good credit. Lenders will often consider a score in this range for loan approval. However, it isn’t in the “very good” or “exceptional” credit tiers, and generally won’t qualify for a lender’s best interest rates or loan terms.

Is a 697 FICO ® score good?

A 697 FICO ® Score is Good, but by raising your score into the Very Good range, you could qualify for lower interest rates and better borrowing terms. A great way to get started is to get your free credit report from Experian and check your credit score to find out the specific factors that impact your score the most.

What type of credit card approval chances does a 697 score offer?

With a credit score of 697, you stand a fair chance of being approved for a credit card. This score is seen as near-good by most lenders, and generally indicates a history of fairly responsible credit management.

What is a 697 CIBIL score?

Lenders are likely to approve loans for a 697 score, though the terms may include slightly higher interest rates or stricter repayment conditions. Interest rates for borrowers with a 697 CIBIL score may not be the lowest, but they are more competitive compared to those with lower scores.

What is a good credit score?

Your score falls within the range of scores, from 670 to 739, which are considered Good. The average U.S. FICO ® Score Θ, 714, falls within the Good range. Lenders view consumers with scores in the good range as “acceptable” borrowers, and may offer them a variety of credit products, though not necessarily at the lowest-available interest rates.