MarketWatch Guides may receive compensation from companies that appear on this page. The compensation may impact how, where and in what order products appear, but it does not influence the recommendations the editorial team provides. Not all companies, products, or offers were reviewed. Find your best auto loan rate

We at the MarketWatch Guides Team will explain how much you should spend on a car loan payment and your options for purchasing and financing a new or used car. When you’re shopping for a vehicle, it pays to compare the best auto loan rates and best auto refinance rates from providers. Key Takeaways

Buying a new car is an exciting experience. But it also involves a lot of financial planning. One of the most important considerations is figuring out what kind of car loan you can realistically afford. This ensures you don’t overextend your budget and end up with unmanageable monthly payments.

When determining the car loan amount you can afford, there are a few key factors to take into account:

Your Income and Expenses

The first step is looking at your current income and expenses. Add up your monthly take-home pay after taxes. Then make a list of your fixed monthly expenses like rent, utilities, insurance, debt payments, etc. The difference between your income and expenses represents how much you have available to put toward a monthly car payment.

As a general guideline, your total monthly auto expenses including the loan payment, insurance, gas and maintenance should not exceed 20% of your take-home pay. And your loan payment alone should be no more than 10-15% of your monthly income.

For example, if your take-home pay is $4,000 per month, you could budget up to $800 for total car costs. And your loan payment should not exceed $400-600. Keeping the loan payment under 15% gives you room for other ownership costs

Loan Term

The length of your loan also impacts affordability. Longer terms of 5-6 years mean lower monthly payments, but you pay more interest over the life of the loan. Aim for the shortest term you can manage ideally 3 years for used cars and 5 years for new.

Running the numbers on both short and long loan terms gives you a good idea of the payment difference. Just don’t let the lower payment on a longer-term loan make you think you can afford more car than your budget allows.

Interest Rates

The APR or interest rate on your loan greatly affects the monthly payment. Rates are influenced by your credit score, down payment, whether the car is new or used, and current market rates.

Getting pre-approved lets you know the rate you qualify for. This gives you bargaining power when negotiating your financing rate at the dealership. If your credit is good, aim for rates of 4-7%. If it’s fair or bad, expect rates of 7-15%. The higher the rate, the more it will cost you each month.

Down Payment

A larger down payment reduces the amount you have to finance, lowering your monthly payment. Try to put down at least 10% if possible. On a $30,000 car, that’s $3,000. More is better, even if it’s just $500-1,000 on a used car.

If you’re strapped for cash, options like trade-in credit can supplement your down payment. Just be aware of the trade-in value and any remaining loan balance you may have.

Price of the Car

Naturally the sales price affects loan affordability. That shiny new $40,000 SUV might fit your budget if you get a long loan, but it won’t leave room for other expenses.

Take a realistic look at the total price you can afford based on your down payment, monthly payment budget, and loan details. Include taxes and fees in your calculations – don’t just look at the sticker price.

Usage and Running Costs

Think about your driving needs – will you take long commutes or road trips? How many miles do you drive annually? Factoring in insurance, gas and maintenance costs gives you a complete affordability picture.

For example, a gas-guzzling truck or SUV may fit your budget payment-wise. But you’ll pay much more at the pump vs. a hybrid or electric car.

Your Credit Score

Your credit score not only influences your loan interest rate, it determines the loan amount you can qualify for. Consumers with credit scores below 620 may have trouble getting approved. Scores of 720 or higher get the best rates and maximum loan amount.

Before applying, check your credit score so you know where you stand. If it’s low, take steps to improve it before financing. Or explore lenders that work with bad credit.

Cost Calculators

Online tools like the car affordability calculator from Edmunds and Kelley Blue Book help estimate your affordable payment and loan amount based on various inputs. Enter your target monthly payment, down payment, loan details, taxes/fees and other costs to see the total loan amount and price range you can afford.

Playing around with different down payments, terms and car prices gives you a realistic affordability assessment before visiting dealerships.

Total Cost of Ownership

Crunching numbers is essential, but also think long-term. Will you drive the car for many years after paying it off? Or do you plan to trade it in after a few years? This impacts whether buying or leasing makes more financial sense.

Carefully weigh affordability today with long-term costs like depreciation and maintenance. Understanding your ownership habits prevents bad financial decisions.

Create a Budget

Organize your affordability research into a detailed budget. This keeps you grounded when encountering tempting options at the dealership. Outline factors like:

- Target monthly payment

- Down payment amount

- Ideal loan APR

- Preferred loan term

- Estimated insurance, gas and maintenance costs

- Total budget for monthly car expenses

- Target car price range

Sticking to your well-calculated budget helps ensure you get a car loan you can actually afford. Don’t get swayed by monthly payments that seem “close enough” but stretch your finances. Find the optimal loan details that fit both today’s budget and your long-term financial health.

Shop Around

Visit multiple dealerships and get pre-approved by a few lenders before deciding. This allows you to compare rates and negotiate the best financing terms. Consider options like credit unions that offer lower rates.

If the payment is too high with one lender, keep looking for a better loan fit. Remember to negotiate the final price too – look up invoice prices and fair purchase prices to determine the dealer’s profit margin. Don’t be afraid to walk away if the numbers don’t align with your budget.

Adapt Your Budget if Needed

Remain open to adjusting your budget if you can’t find a suitable loan or car. Can you increase your down payment, shorten the loan term, or lower your target purchase price? How much can you trim monthly expenses to accommodate a higher payment?

Re-evaluating your budget keeps your expectations realistic. Don’t let ego get in the way of sound financial decisions when car buying.

Determining “what kind of car loan can I afford?” takes research and number crunching. But the effort pays dividends by giving you financial security. Entering a car loan you can’t afford is a recipe for stress and money problems. Take the time to run the calculations, create a detailed budget and stick to it. This ensures you get excited about your new car instead of regretting overspending.

Calculate How Much Car You Can Afford

There are several ways to finance a car purchase, including going through your bank, getting a loan from a dealership or using a third-party loan provider. We’ll explain each one in more detail below.

Calculate Loan Amount and Term Length

Once you’ve calculated your affordable monthly payment, you can determine how much you can borrow. The amount a lender will let you borrow depends on several factors, including:

- Whether you buy a used or new car: New car loans tend to have lower annual percentage rates (APRs) than used cars.

- Your credit score: This will affect the APR on the loan and how much the bank is willing to lend you.

- Your loan term: This is how many months you’ll have to pay your auto loan off.

The below showcases results from our 2023 consumer survey, which questioned 2,000 customers with experiences in auto loans. Nineteen percent of those respondents had a loan term of 60 months — making 60 months the most popular loan term length in the survey.

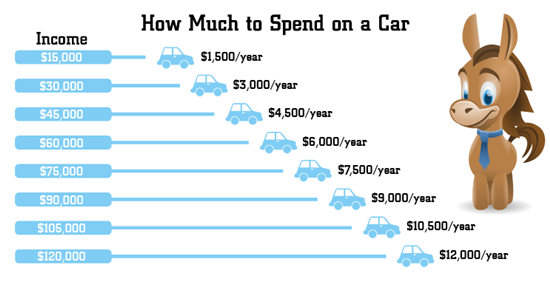

How Much Car Can You Really Afford? (By Salary)

FAQ

What car can I afford based on my salary?

We recommend you aim to spend about 10% of your take-home income on your monthly car payment. So, if you take home $3,000 each month after taxes, you might be comfortable having a vehicle with a monthly payment of around $300.

How do I know if I can afford a car loan?

NerdWallet suggests spending no more than 10% of your take-home pay on a car loan payment and no more than 20% for total car expenses — which also includes things like gas, insurance, repairs and maintenance.

How much can I borrow for a car based on my income?

There’s no perfect formula for how much you can afford, but our short answer is that your new-car payment should be no more than 15% of your monthly take-home pay. If you’re leasing or buying used, it should be no more than 10%.

What is the 50/30/20 rule for car payments?

Set your car payment budget

50% for needs such as housing, food and transportation — which, in this case, is your monthly car payment and related auto expenses. 30% for wants such as entertainment, travel and other nonessential items. 20% for savings, paying off credit cards and meeting long-range financial goals.