Ever wondered how long it’ll take for your money to double? Let’s be real – most of us don’t wanna spend hours with complex math formulas or financial calculators. That’s where the Rule of 69 comes in handy! It’s a simple shortcut that can give you a quick estimate of when your investments might double in value.

What Exactly is the Rule of 69?

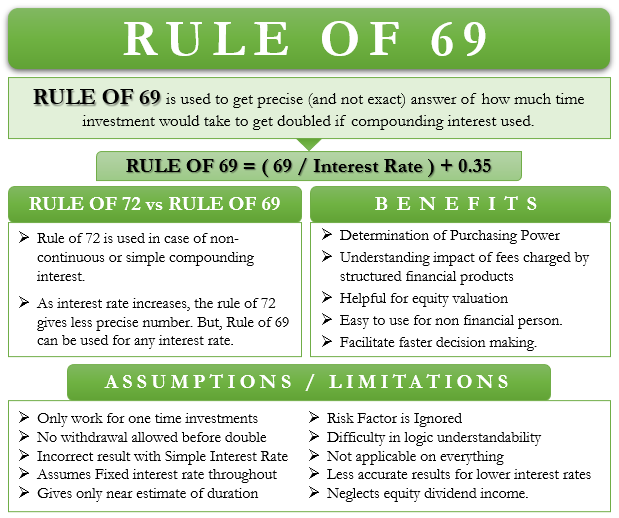

The Rule of 69 is a straightforward calculation that helps you estimate how long it’ll take for an investment to double in value when you’re dealing with continuously compounded interest It’s one of those handy “rules of thumb” that investors and financial planners love to use for quick estimates

Here’s the basic formula

Doubling Period = (69 ÷ Interest Rate) + 0.35

Pretty simple, right? You just divide 69 by your annual interest rate (as a number, not a percentage), add 0.35, and voilà – you’ve got an approximate number of years it’ll take for your investment to double!

How to Use the Rule of 69 (With Examples)

Let’s break this down with some real-world examples:

Example 1: Basic Investment

If you invest $10000 at an annual interest rate of 5% (continuously compounded)

- Doubling Period = (69 ÷ 5) + 0.35

- Doubling Period = 13.8 + 0.35

- Doubling Period = 14.15 years

So, your $10,000 investment would grow to $20,000 in approximately 14.15 years.

Example 2: Higher Return Investment

For a real estate investment with a 20% annual return:

- Doubling Period = (69 ÷ 20) + 0.35

- Doubling Period = 3.45 + 0.35

- Doubling Period = 3.8 years

With this higher return, your investment would double much faster – in just 3.8 years!

When Should You Use the Rule of 69?

The Rule of 69 is most accurate when dealing with:

- Investments with continuous compounding

- Financial scenarios where you need a quick ballpark figure

- Situations where precision isn’t critical

It’s particularly useful for:

- Real estate investors doing initial evaluations

- Financial planners making rough projections

- Anyone who wants to understand the power of compound interest without complex calculations

Rule of 69 vs. Rule of 72 vs. Rule of 70: What’s the Difference?

You might have heard about similar “rules” like the Rule of 72 or the Rule of 70. They’re all related but used in slightly different scenarios:

| Rule | Best Used For | Formula | Additional Notes |

|---|---|---|---|

| Rule of 69 | Continuous compounding | 69 ÷ rate + 0.35 | Most accurate for continuous compounding |

| Rule of 72 | Simple compound interest | 72 ÷ rate | Easier to calculate, good for lower rates |

| Rule of 70 | Regular compounding (not continuous) | 70 ÷ rate | A middle-ground option |

The Rule of 69 is specifically designed for continuously compounded interest, which is why it includes that extra step of adding 0.35. This makes it more accurate for investments where interest compounds continuously rather than at discrete intervals.

The Mathematical Basis for the Rule of 69

For the math nerds among us (I’m kinda one too!), the Rule of 69 is based on the natural logarithm of 2, which is approximately 0.693. When we multiply this by 100, we get 69.3, which is rounded down to 69 for simplicity.

The formula comes from:

- Time to double = ln(2) ÷ r (where r is the rate in decimal form)

- ln(2) ≈ 0.693

- 0.693 × 100 = 69.3, rounded to 69

The addition of 0.35 is a correction factor that makes the approximation more accurate across a wider range of interest rates.

Benefits of Using the Rule of 69

There are several advantages to using this rule:

- Simplicity – You can do the calculation in your head or with a basic calculator

- Quick decision-making – Helps you evaluate investment options rapidly

- No specialized tools needed – No need for financial calculators or spreadsheets

- Accurate for continuous compounding – Better than other rules for this specific type of compounding

- Accessible to non-finance people – Anyone can understand and use it

Limitations to Be Aware Of

Like any rule of thumb, the Rule of 69 isn’t perfect:

- It’s an approximation – Not 100% accurate for all scenarios

- Limited to continuous compounding – Most real-world investments don’t compound continuously

- Less accurate for extreme rates – Works best for moderate interest rates

- Assumes constant rates – Doesn’t account for fluctuating interest rates

- Ignores real-world factors – Doesn’t consider taxes, fees, or inflation

- More complex than Rule of 72 – The extra step of adding 0.35 makes it slightly less intuitive

Real-World Applications in Different Fields

In Real Estate Investing

Real estate investors often use the Rule of 69 to evaluate potential property investments. If they expect a 15% annual return on a rental property, they can quickly estimate that their investment would double in about 5 years [(69 ÷ 15) + 0.35 = 4.95].

In Financial Planning

Financial advisors might use this rule to show clients the impact of different investment strategies. It helps illustrate how even small differences in return rates can significantly affect doubling time.

In Personal Finance

For personal finances, the Rule of 69 can be eye-opening when comparing investment options or understanding the long-term effects of compound interest on savings accounts, retirement funds, or other investments.

Common Misconceptions About the Rule of 69

There are some misunderstandings about this rule that we should clear up:

-

“It’s just another name for the Rule of 72” – Nope, they’re different and used for different types of compounding.

-

“It’s perfectly accurate” – It’s an approximation, not an exact calculation. For precise results, you should use the actual compound interest formula.

-

“It works for all types of investments” – It’s specifically designed for continuously compounded interest, not simple interest or discrete compounding.

-

“The doubling time is guaranteed” – Remember, the rule assumes a constant interest rate, which rarely happens in real-world scenarios.

How to Apply the Rule of 69 in Your Investment Strategy

To make the most of this rule in your investment planning:

-

Use it for initial screening – Quickly evaluate different investment options based on their potential doubling time.

-

Compare different rates – See how various interest rates affect doubling time to understand the impact of finding higher-yield investments.

-

Create a diversified portfolio – Use the rule to ensure you have a mix of investments with different doubling times.

-

Set realistic expectations – Remember that the rule gives approximations, not guarantees.

-

Follow up with detailed analysis – Once you’ve narrowed down your options, use more detailed calculations for final decisions.

The Rule of 69 in Different Economic Environments

The usefulness of the Rule of 69 varies depending on the economic climate:

-

In low-interest environments – When interest rates are very low (like below 3%), the doubling periods become quite long, and small differences in rates have huge impacts on doubling time.

-

During high inflation – You might need to adjust your calculations to account for the real rate of return (nominal rate minus inflation rate).

-

In volatile markets – The rule becomes less reliable when interest rates fluctuate significantly.

Practical Tips for Using the Rule of 69

-

Round your interest rate to make calculations easier (e.g., use 7% instead of 7.25%).

-

Keep a small calculator handy if you’re not confident in your mental math skills.

-

Use the rule in conjunction with other financial metrics for a more complete picture.

-

Double-check with actual compound interest formulas for important decisions.

-

Remember to add the 0.35 – This is the step that people often forget when using this rule!

The Rule of 69 is definitely a valuable tool in an investor’s toolkit, especially for those dealing with continuously compounded interest. While it’s not perfect, it provides a quick and reasonably accurate way to estimate doubling time without resorting to complex calculations.

For everyday investors and financial planning, it’s often accurate enough to guide initial decision-making and understand the power of different interest rates. Just remember its limitations and use more precise calculations when making significant financial decisions.

So next time you’re evaluating an investment opportunity or trying to understand how long it’ll take to double your money, give the Rule of 69 a try! It might just save you some time and help you grasp the potential of your investments more intuitively.

FAQs About the Rule of 69

Q: Is the Rule of 69 more accurate than the Rule of 72?

A: For continuously compounded interest, yes. For simple compounding or low interest rates, the Rule of 72 might be more appropriate.

Q: Can I use the Rule of 69 for negative growth rates?

A: Yes, but in that case, it would tell you how long it would take for your investment to lose half its value!

Q: Does the Rule of 69 account for taxes and fees?

A: No, it only considers the raw interest rate. You’d need to use your after-tax, after-fee rate of return for a more realistic estimate.

Q: Who invented the Rule of 69?

A: The rule is derived from mathematical principles related to natural logarithms and compound interest, so it doesn’t have a single inventor.

Q: Can I apply the Rule of 69 to population growth or other non-financial scenarios?

A: Absolutely! The rule works for any continuously compounded growth rate, including population growth, bacterial growth, etc.

What is the Rule of 69?

The Rule of 69 is used to estimate the amount of time it will take for an investment to double, assuming continuously compounded interest. The calculation is to divide 69 by the rate of return for an investment and then add 0.35 to the result. Doing so yields an approximately correct estimate of the time period required. For example, an investor finds that he can earn a 20% return on a property investment, and wants to know how long it will take to double his money. The calculation is:

(69 ÷ 20) + 0.35 = 3.8 years to double his money

Using the Rule means that a prospective investment can be easily analyzed with a calculator, rather than needing an electronic spreadsheet for a more precise return calculation.

Disadvantages of the Rule of 69

While the Rule of 69 can be quite useful, there are also some problems associated with it, which are as follows:

- Limited to continuous compounding. The Rule of 69 is specifically designed for investments that use continuous compounding, which is rare in real-world financial scenarios. Most investments compound interest annually, quarterly, or monthly rather than continuously. This limitation reduces the rules practicality for estimating doubling time in typical investment settings.

- Complexity compared to the Rule of 72. The Rule of 69 is more complex and less intuitive than the Rule of 72, which is simpler to apply for discrete compounding intervals. The need to understand and apply the concept of continuous compounding can be confusing for investors without a strong mathematical background. As a result, many prefer the Rule of 72 for its ease of use and similar accuracy for most practical purposes.

- Less accurate for low or high interest rates. While the Rule of 69 is precise for continuous compounding, its accuracy diminishes at very low or very high interest rates. In such cases, the approximation can either overestimate or underestimate the actual doubling time, leading to misleading conclusions. This issue makes it less reliable compared to more detailed financial models.

- Ignores real-world factors. The Rule of 69 does not account for taxes, fees, inflation, or other real-world factors that can affect investment growth. By focusing solely on the interest rate, it oversimplifies the complexities involved in long-term financial planning. This can result in overly optimistic estimates of how quickly investments will double.

- Challenging for non-finance professionals. The concept of continuous compounding and the mathematical basis of the Rule of 69 can be difficult for individuals without a background in finance or mathematics to grasp. This complexity can discourage its use by everyday investors who may find simpler rules, like the Rule of 72, more accessible and understandable.

These disadvantages highlight why the Rule of 69, despite its accuracy for continuous compounding, is less commonly used in practice compared to other rules for estimating doubling time.