The most expensive stock is Berkshire Hathaway’s Class A stock. Luckily, its Class B stock is much more affordable.

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and heres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet, Inc. does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Ever wondered which stock is the crown jewel of the financial world? You’re not alone! As an investor or just someone curious about the markets, knowing which companies command the highest valuations can be fascinating. Let’s dive into the world of mega-cap stocks and sky-high share prices to discover what is truly the richest stock in the world.

Understanding “Rich” Stocks: Price vs. Value

Before we jump into the rankings, let’s clear something up. When talking about the “richest” stocks, we could mean two different things

- Highest Market Capitalization – The total value of all a company’s outstanding shares (basically how much the entire company is worth)

- Highest Share Price – The cost of buying just one share of the company

These are totally different measurements! A company can have an enormous market cap but a relatively low share price if they have billions of shares outstanding. Conversely, some companies maintain extraordinarily high individual share prices while having a more modest overall market value.

Let’s look at both to get the full picture.

The Market Cap Giants: The World’s Most Valuable Companies

According to the latest data from CompaniesMarketCap.com (as of November 11, 2025), here are the top 10 companies by market capitalization:

- NVIDIA (NVDA) – $4.846 trillion

- Apple (AAPL) – $3.981 trillion

- Microsoft (MSFT) – $3.760 trillion

- Alphabet/Google (GOOG) – $3.503 trillion

- Amazon (AMZN) – $2.655 trillion

- Broadcom (AVGO) – $1.692 trillion

- Saudi Aramco (2222.SR) – $1.672 trillion

- Meta Platforms/Facebook (META) – $1.592 trillion

- TSMC (TSM) – $1.531 trillion

- Tesla (TSLA) – $1.480 trillion

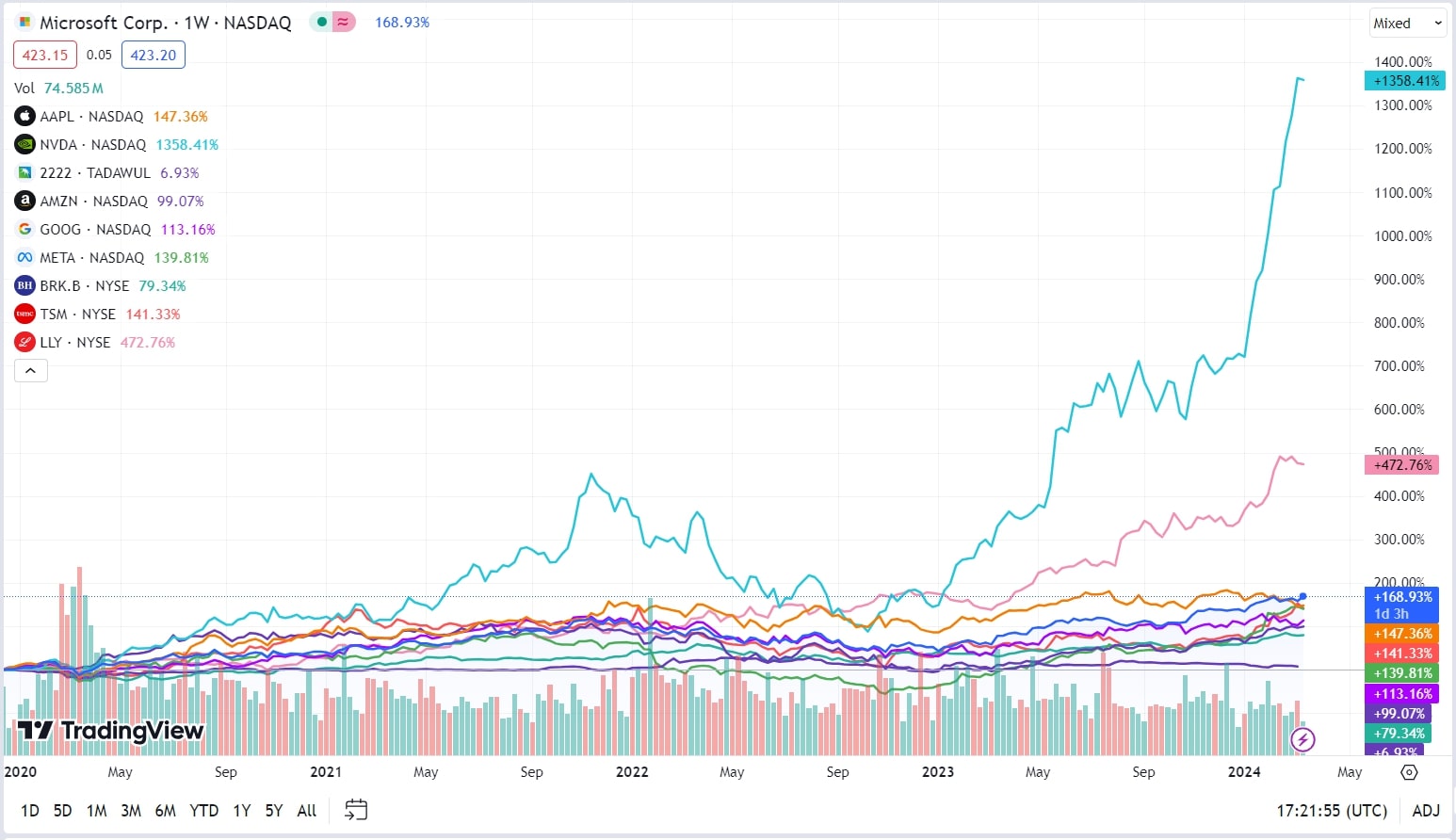

Look at NVIDIA taking the top spot! With nearly $5 trillion in market cap, they’ve surged ahead of the traditional tech giants. What’s interesting is how American companies dominate this list—8 out of the top 10 are U.S.-based corporations.

But remember, market cap isn’t the same as share price. Some of these companies have split their stocks multiple times to keep individual share prices more accessible to everyday investors.

The Highest-Priced Individual Stocks

Now, if we’re looking strictly at share price—which stock would cost you the most to buy just ONE share?

Based on data from Investopedia and updated market information, these are the stocks with the highest prices per share:

-

Berkshire Hathaway Class A (BRK.A) – $732,467 per share (as of June 2025)

- Reached an all-time high of $809,350 on May 2, 2025

- Warren Buffett has famously refused to split this stock

-

Chocoladefabriken Lindt & Sprüngli AG (LISN) – CHF 132,200 (Swiss Francs) per share

- Reached an all-time high of CHF 134,000 in 2025

- This Swiss chocolatier is the second-most expensive stock globally

-

NVR Inc. (NVR) – $7,336.93 per share

- Reached an all-time high of $9,924.40 in October 2024

- Primarily a homebuilder operating under brands like Ryan Homes

-

Seaboard Corporation (SEB) – $2,850.63 per share

- All-time high of $4,743.71 in April 2019

- Diversified company involved in pork production and shipping

-

AutoZone (AZO) – $3,709.40 per share

- Reached a high of $3,880.15 in May 2025

- Auto parts retailer that has steadily climbed in value

The difference between Berkshire’s share price and others is MASSIVE. At over $732,000 per share, it dwarfs the price of almost any other stock you can buy. You could purchase a nice house in many parts of the country for the price of a single BRK.A share!

Why Berkshire Hathaway’s Stock Price Is So High

You might be wondering, “Why doesn’t Berkshire just split its stock like other companies?” Good question!

Warren Buffett, the legendary investor behind Berkshire Hathaway, has deliberately chosen NOT to split the company’s Class A shares. He believes the high share price attracts like-minded, long-term investors rather than short-term traders.

Buffett has said that he wants shareholders who think like business owners, not stock flippers. The high price serves as a sort of filter, ensuring that Berkshire’s investor base is stable and committed for the long haul.

For those who can’t afford the Class A shares, Berkshire does offer more affordable Class B shares (BRK.B), which traded at $487.71 as of June 2025. These provide smaller investors a way to own a piece of Buffett’s empire without needing nearly a million dollars for a single share!

Stock Price vs. Company Value: An Important Distinction

I gotta emphasize this again because it’s SUPER important: a high stock price doesn’t necessarily mean a company is more valuable overall.

For example, while Berkshire Hathaway has the highest share price, its total market cap is about $1.071 trillion, making it the 11th most valuable company globally—behind NVIDIA, Apple, Microsoft, Alphabet, Amazon, Broadcom, Saudi Aramco, Meta, TSMC, and Tesla.

This table illustrates the difference:

| Company | Share Price | Market Cap | Rank by Market Cap |

|---|---|---|---|

| Berkshire Hathaway | $732,467 | $1.071T | 11th |

| NVIDIA | $199.05 | $4.846T | 1st |

| Apple | $269.43 | $3.981T | 2nd |

See how dramatically different these measures can be? NVIDIA’s share price is WAY lower than Berkshire’s, but its overall value is more than 4 times higher!

Recent Changes in the “Richest Stocks” Rankings

The landscape of the world’s most valuable companies changes constantly. If we look back just a few years, Apple was often at the top, with Saudi Aramco occasionally taking the crown. Now NVIDIA has surged ahead, driven by the AI boom.

Some notable recent changes:

- NVIDIA has skyrocketed to become the world’s most valuable company, boosted by AI and chip demand

- Palantir has moved up dramatically to #21 with a market cap of $461.45 billion

- Tesla has maintained its position in the top 10 despite market volatility

- AppLovin has surged into the top 100 at #71 with a market cap of $220.11 billion

What Makes These Stocks So Valuable?

The companies with the highest market caps typically share some common traits:

- Dominant market positions in their industries

- Strong recurring revenue streams

- Network effects that create high barriers to entry

- Global reach and brand recognition

- Innovation that drives future growth

For high-priced individual stocks, the reason is often simply that they’ve chosen not to split their shares. Stock splits don’t change a company’s fundamental value—they just create more shares at lower prices.

Should You Invest in the “Richest” Stocks?

Just because a stock has the highest price or largest market cap doesn’t automatically make it a good investment. Here are some things to consider:

Pros of investing in market cap leaders:

- Often represent stable, established businesses

- Typically have strong financials and cash reserves

- Usually more liquid (easier to buy and sell)

- May be less volatile than smaller companies

Cons to consider:

- May have limited growth potential compared to smaller companies

- Often trade at premium valuations

- A large market cap doesn’t guarantee future performance

- High individual share prices can limit your ability to diversify

For most retail investors, especially beginners, investing in a diversified portfolio through index funds might be wiser than putting all your eggs in one basket—even if that basket is the “richest” stock in the world.

How to Get Exposure to These Expensive Stocks

If you’re interested in owning shares of companies with super-high stock prices but don’t have hundreds of thousands of dollars lying around, you have options:

- Fractional shares – Many brokerages now allow you to buy portions of a share

- ETFs – Exchange-traded funds often include these top companies

- Lower-priced share classes – Like Berkshire’s B shares vs. A shares

- Wait for stock splits – Companies occasionally split shares to make them more accessible

So, what’s the answer to our original question—what is the richest stock in the world?

If we’re talking about share price, it’s clearly Berkshire Hathaway (BRK.A) at over $732,000 per share, followed by Lindt & Sprüngli at over CHF 132,000.

If we’re looking at market capitalization (total company value), then NVIDIA takes the crown at nearly $5 trillion, followed by Apple and Microsoft.

The financial markets are always evolving, with valuations changing daily based on earnings, market sentiment, and global events. What’s clear is that the race for the title of “richest stock” will continue to be fascinating to watch.

Whether you’re looking to invest or just curious about the financial markets, understanding these distinctions helps you make more informed decisions and better understand the economic forces shaping our world.

4 other expensive stocks

Here are a few of the other most expensive stocks on the U.S. market.

Autozone Inc. (AZO)

Price: $4,075 per share

If you own a car, you’re probably familiar with the car parts giant. According to the company, AutoZone is the leading retailer and distributor of replacement car parts in the United States. In addition to selling windshield wipers, antifreeze and engine oil, AutoZone offers customers free warning light diagnostics and partners with mechanics through their searchable Shop Referral program.

How Rich People Really Invest in Stocks

FAQ

What is the top 1 stock in the world?

| # | Name | C. |

|---|---|---|

| 1 | NVIDIA 1NVDA | |

| 2 | Apple 2AAPL | |

| 3 | Microsoft 3MSFT | |

| 4 | Alphabet (Google) 4GOOG |

What is the richest stock?

What company is worth $3 trillion?

Currently, Google’s parent company Alphabet is a company valued at over $3 trillion, having surpassed this milestone in September 2025. Other companies currently valued at more than $3 trillion include Apple, Microsoft, and Nvidia.

Who owns 88% of the stock market?

The distribution of equities across households, the top 10% of Americans own 88% of equities, 88% percent of the stock market. The next 40% owns 12%.