Learn about how your credit score can impact the FHA lown down payment requirement, and the assistance options that are available to you.

FHA loans are one of Americas most popular mortgage loan options — and for good reason. They have low credit score requirements, affordable mortgage rates, and a down payment minimum requirement of 3.5%, making them a great option for first-time homebuyers or those who just don’t have much cash saved up.

Could an FHA loan be a good fit for your current financial situation? Here’s how much you’ll need to put down to use one.

Buying a home is an exciting milestone in life but saving up for the down payment can feel daunting. This is where an FHA loan comes in handy. FHA loans require lower down payments and have flexible credit requirements making homeownership more accessible. But what exactly is the minimum down payment for an FHA loan? Let’s break it down in this comprehensive guide.

FHA Loans Overview

First, let’s start with an overview of FHA loans FHA stands for Federal Housing Administration – this government agency insures lenders against loss on mortgages, allowing them to offer more flexible terms

Some key highlights of FHA loans:

- Offered by private lenders and insured by the FHA

- Require a low down payment of just 3.5% for borrowers with credit scores of 580 or higher

- Allow lower credit scores starting at 500

- Charge an upfront mortgage insurance premium and annual mortgage insurance premium

So in exchange for less stringent requirements, you pay a bit more in fees compared to conventional loans. But for borrowers who may not qualify for other loan types, FHA loans can make homeownership achievable.

What is the Minimum Down Payment on an FHA Loan?

Now let’s get to the crux of the matter – what is the bare minimum you can put down when getting an FHA mortgage?

The minimum down payment on an FHA loan depends on your credit score:

-

Credit score of 580 or above: The minimum down payment is 3.5% of the purchase price.

-

Credit score between 500 – 579: The minimum down payment is 10% of the purchase price.

So if you have good credit (580+ score), you can get away with putting just 3.5% down on an FHA mortgage. For lower credit applicants, 10% down is required.

Let’s look at some examples

-

For a $250,000 home, a buyer with a 620 credit score would need to put down $8,750 (3.5% of $250,000).

-

For that same $250,000 home, a buyer with a 550 credit score would need to put down $25,000 (10% of $250,000).

As you can see, having a higher credit score makes a significant difference in the FHA down payment amount!

Additional Costs to Close an FHA Loan

The down payment is not the only cash you need at closing when getting an FHA mortgage. Here are other costs to budget for:

Closing Costs

Closing costs on an FHA loan range from 3-6% of the purchase price. On a $250,000 home, that comes out to $7,500 – $15,000 in closing fees. Seller concessions can help cover up to 6% of closing costs.

Upfront Mortgage Insurance Premium

FHA borrowers must pay an upfront mortgage insurance premium of 1.75% of the total loan amount. On a $250,000 loan, this premium is $4,375. You can pay this at closing or roll it into the loan amount.

Annual Mortgage Insurance Premium

On top of the upfront premium, you’ll pay an annual mortgage insurance premium included in your monthly payments. This ranges from 0.45% – 1.05% depending on your loan terms and down payment amount.

Why Does FHA Have Lower Down Payment Requirements?

FHA loans are structured to be more accessible to a wider pool of borrowers. Here are some reasons why FHA down payment minimums are lower:

-

Lenient gift rules – Borrowers can use funds gifted from family, nonprofits and other approved sources. Makes it easier to come up with the down payment.

-

Lower credit requirements – FHA loans only require a 500 credit score, whereas conventional loans typically want scores of at least 620. Gives more borrowers a chance at approval.

-

Government-backing – The FHA insurance provides security to lenders and allows them to take on more risk with low down payments.

So the FHA essentially exchanges lower requirements for borrower fees like mortgage insurance. This allows more people to qualify while compensating lenders for the added risk.

FHA Down Payment Assistance Programs

The FHA minimum down payment on your own may still be a stretch for some buyers. The good news is there are down payment assistance programs available, including:

-

State/local programs – State housing agencies and nonprofit groups offer down payment grants and forgivable loans. HUD lists these options by state.

-

Employer programs – Some companies provide down payment gifts as an employee benefit.

-

VA grants – Veterans Affairs offers grants to service members and low-income veterans buying with an FHA loan.

-

401(k) loans – Borrowers can take a loan against their 401(k) and use it for the down payment.

Alternatives to FHA Loans

FHA loans aren’t the only option for low down payment mortgages. Here are a few alternatives if you don’t qualify for FHA:

-

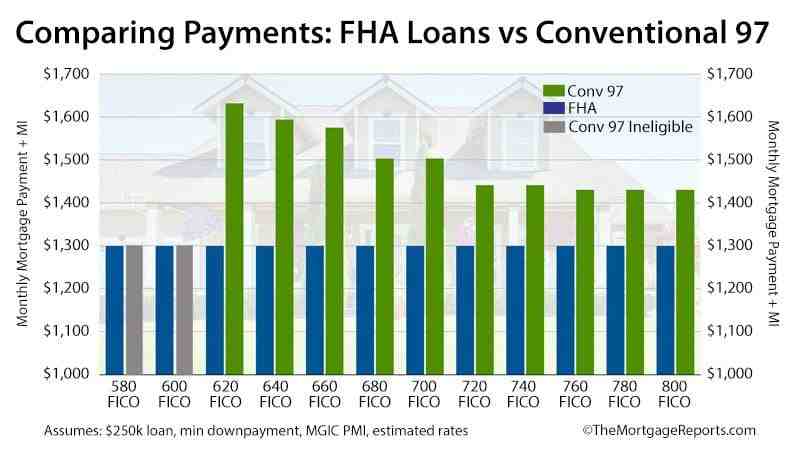

Conventional 97 – Allows 3% down for buyers with good credit. You pay private mortgage insurance.

-

VA loans – Offer 0% down for qualified veterans and active military. No PMI.

-

USDA loans – 100% financing available in eligible rural areas for low/moderate income borrowers.

While FHA loans offer flexibility, make sure to shop around for the best rates and terms for your situation.

The Bottom Line

The minimum down payment on an FHA loan is just 3.5% if you have a 580+ credit score. This makes buying a home more feasible for borrowers who can’t afford the larger down payments of conventional mortgages.

Make sure to factor in closing costs and mortgage insurance premiums when budgeting for an FHA loan. Down payment assistance programs are also available if needed. While FHA loans are a good option, be sure to compare all your mortgage alternatives before deciding. But with the low minimum down payment requirements, FHA loans can put homeownership within your reach!

FHA Loan Minimum Down Payment

Like most mortgages, FHA loan down payments must be paid upfront and cannot be rolled into your loan payment. Uniquely, FHA loans technically have two different down payment thresholds. The absolute lowest down payment on an FHA loan is 3.5% of the total loan amount, but only if you have at least a 580 FICO® credit score. If your credit score is between 500 and 579, it is still possible to qualify, but you must put 10% down.

Here’s a look at how those down payments break down on a $350,000 loan balance:

| Credit score* | Down payment requirement | Down payment amount |

|---|---|---|

| 580+ | 3.5% | $12,250 |

| 500-579 | 10% | $35,000 |

Although FHA guidelines allow for credit scores as low as 500 with a 10% down payment, many lenders set their minimum credit score requirements higher to reduce risk. Lenders that do accept lower scores may also impose stricter terms, like higher interest rates, additional documentation, or larger down payments.

Neighbors Bank’s current minimum credit score requirement is 620. However, you may be able to qualify with certain compensating factors. Check your eligibility here!

FHA Down Payment MIP Requirements

For FHA loans, the mortgage insurance premium (MIP) requirement depends on your down payment and credit score. There are two types of FHA MIP: upfront and annual. In 2024, the upfront MIP is 1.75% of the loan amount, and the annual mortgage insurance premium (MIP) ranges from 0.45% to 1.05% depending on your loan-to-value (LTV) ratio.

All FHA borrowers have to pay the upfront premium, however, even if you qualify for a 3.5% down payment, you also have to pay annual mortgage insurance for the life of the loan unless you make a 10% down payment at closing. If you make a 10% or more down payment when you close on an FHA loan, you can cancel the monthly MIP after 11 years.

FHA Loan vs. Conventional Loans (Mortgage): The Pros and Cons Before You Choose | NerdWallet

FAQ

What is the lowest possible down payment on an FHA loan?

FHA might be just what you need. Your down payment can be as low as 3.5% of the purchase price.

How much do I need to make to buy a $300K house with an FHA loan?

To buy a $300K house, you’ll generally need to earn a household income around $80,000 per year, assuming 20% down, a 6.5% interest rate, and moderate existing debts.

What is the FHA 3.5% rule?

… even if you qualify for a 3.5% down payment, you also have to pay annual mortgage insurance for the life of the loan unless you make a 10% down payment at …Jan 16, 2025

Can I put $20 down on an FHA loan?