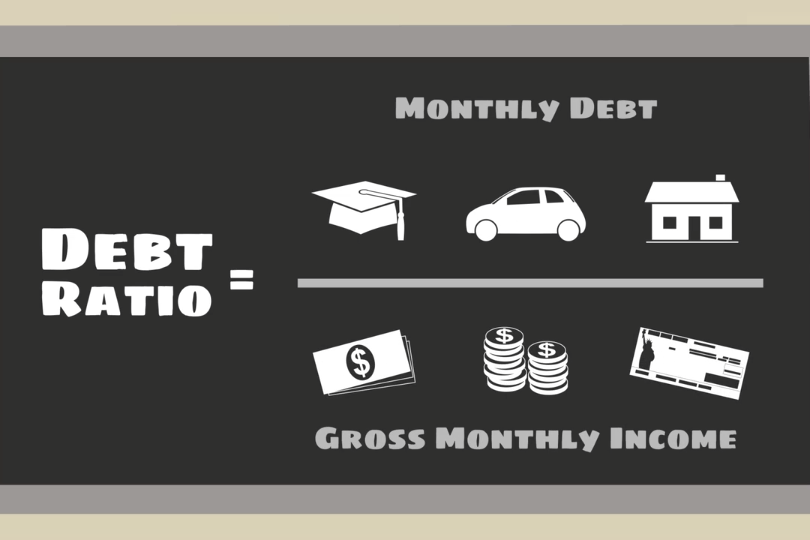

Your debt-to-income ratio (DTI) is an important part of how mortgage lenders evaluate your financial health. DTI ratios represent how much debt you have compared to your income.

It’s important to know your DTI as you consider buying a home. If you have a high amount of debt compared to income, consider `lowering your debt before applying for a loan. Even if you’re prepared to apply for a loan, you may struggle to find a lender willing to work with a high DTI.

Let’s look at DTI, how it works and how it impacts your mortgage application so you can prepare to start shopping for homes.

The debt-to-income (DTI) ratio is one of the most important factors lenders consider when reviewing a mortgage application. This ratio shows the percentage of your gross monthly income that goes toward paying debts, including the proposed new mortgage payment.

FHA loans have specific DTI limits set by the Federal Housing Administration (FHA) to qualify borrowers and reduce risk But the FHA does allow for exceptions under certain circumstances

So what is the highest debt-to-income ratio allowed on an FHA mortgage? Here’s a detailed look at FHA DTI guidelines and limits for 2023

Understanding FHA Debt-to-Income Ratios

There are two types of DTI ratios assessed for FHA loans:

Front-end DTI This includes only housing-related debts like your mortgage, property taxes, insurance, and HOA fees

Back-end DTI: Also known as the total debt ratio, this includes all monthly debt payments like credit cards, auto loans, student loans, etc.

The front-end ratio focuses solely on housing costs, while the back-end looks at your entire debt picture.

Standard FHA DTI Limits

The standard DTI limits set by the FHA are:

- Front-end DTI: 31%

- Back-end DTI: 43%

So for example, if your gross monthly income is $5,000, the front-end DTI limit would be:

- Housing costs ÷ Gross monthly income

- $1,550 ($5,000 x 31%) ÷ $5,000 = 31%

And the back-end DTI limit would be:

- Total monthly debts ÷ Gross monthly income

- $2,150 ($5,000 x 43%) ÷ $5,000 = 43%

These are the baseline DTI ratios for FHA loan qualification. But there are exceptions.

When Higher DTI Ratios Are Allowed

The FHA does give lenders some flexibility to approve borrowers with DTIs above 31% and 43%.

There must be “compensating factors” to offset the additional risk posed by a high DTI mortgage.

Here are some examples of compensating factors that could allow for a higher DTI on an FHA loan:

- Excellent credit history and scores (typically 700+)

- Significant cash reserves after closing

- Minimal increase in housing payment

- Additional income not reflected in gross monthly income

- Significant residual income

With one or more compensating factor present, the lender may approve a back-end DTI up to 50%.

But that’s not the highest allowable ratio…

The Maximum FHA DTI Ratio

The absolute highest DTI ratio allowed on an FHA mortgage is 56.99%.

For a borrower to qualify at this maximum limit, the lender would need to document:

- Very strong compensating factors (as noted above)

- Manual underwriting was used (not automated)

- The borrower has potential for increased future earnings

In reality, few borrowers actually get approved with a DTI at the upper limit of 56.99%. Most lenders will cap their maximum allowed DTI around 50%.

But technically, 56.99% is the highest DTI for FHA qualification if the lender deems the borrower an acceptable risk.

Why DTI Matters for Mortgage Approval

Limiting the debt-to-income ratio is an important way the FHA controls risk. The higher your DTI, the more stretched your finances are.

A high DTI signals potential trouble managing mortgage payments along with other debts. It leaves little wiggle room in your monthly budget.

That’s why lenders prefer to see DTIs below 43% on FHA loans. Borrowers with lower ratios have more available income to handle unexpected expenses and rising costs.

But the FHA also wants to provide affordable financing options. So they allow for exceptions over 43% DTI with compensating factors as explained above.

How to Check Your Debt-to-Income Ratio

Figuring out your own DTI is easy. Just follow these steps:

1. Document your gross monthly income

Add up all income you receive before taxes and deductions. Use your current earnings.

2. List all monthly debt obligations

Include credit cards, auto, student loans, alimony, child support, and other debts with a monthly payment.

3. Calculate housing costs

For a purchase, use estimated payments for mortgage principal, interest, taxes, insurance and HOA fees.

For a refinance, use your actual current housing payments.

4. Divide debt by income to get DTI

Divide just the housing costs by gross monthly income for front-end DTI.

Divide total monthly debts by gross monthly income for back-end DTI.

This quick DTI check can give you an idea of where your ratios stand before applying for an FHA loan.

Tips for Lowering Your DTI to Qualify

If your DTI is over 43%, here are some tips to improve your ratios:

- Pay down revolving debts like credit cards and lines of credit

- Pay off installment loans with the highest monthly payments first

- Make extra mortgage principal payments to lower payment on a refinance

- Shop for lower homeowners insurance rates

- Increase your income with a second job or side gig

- Remove authorized user accounts boosting your utilization

- Consolidate debt into a new loan with lower payment

Even small improvements to your debt or income can have a noticeable impact on DTI. Doing a little debt restructuring before applying for an FHA loan can help your chances of approval.

The Bottom Line

FHA loans allow for more flexibility on debt-to-income ratios than conventional mortgages. But there are still limits in place to control risk.

The maximum DTI for FHA approval is 56.99%. But most lenders will cap ratios around 50%. Getting approved at the upper limits requires solid compensating factors.

Knowing the FHA DTI guidelines and how lenders assess risk is important for borrowers. This ensures you take the right steps to strengthen your application before applying. And gives you the best shot at an FHA loan approval.

Convert your result to a percentage

Your initial result will be a decimal. To express your DTI ratio as a percentage, multiply the result by 100. In this example, your gross monthly income is $3,000, and your minimum monthly payment total is $900. When you divide $900 by $3,000, you’ll get 0.30. Multiply 0.30 by 100 to get 30, making your DTI ratio 30%.

You’d likely meet a lender’s DTI requirement because the DTI ratio falls below 43%.

Take the first step toward the right mortgage

Apply online for expert recommendations with real interest rates and payments

High Debt to Income Ratio Mortgage | Top 4 Options

FAQ

What is the highest debt-to-income ratio for FHA?

While FHA loans allow higher ratios (up to 43% or even 50% with compensating factors), staying below 36% gives you more room to manage other expenses and reduces financial stress.

What is the 75% rule for FHA loans?

The 75% rule for FHA loans is a guideline that states that 75% of a property’s rental income must cover the monthly mortgage payment. This rule only applies to properties with three or four units. When purchasing a multiunit property with an FHA loan, you’re still required to live in one of the units.

What is the maximum debt-to-income ratio for home possible?

Debt-to-Income Ratio (DTI): Generally, a maximum DTI of 50% is required, but some lenders may allow higher DTIs with strong compensating factors. Private Mortgage Insurance (PMI): Home Possible® requires private mortgage insurance when the down payment is less than 20%.

What disqualifies you for an FHA loan?

What is the maximum debt-to-income ratio for an FHA loan?

The max debt-to-income ratio for an FHA loan is 43%. In other words, your total monthly debts (including future monthly mortgage payments) shouldn’t exceed 43% of your pre-tax monthly income if you want to qualify for an FHA loan.

Is a higher debt-to-income ratio a good idea for a FHA loan?

FHA loans generally limit the total debt-to-income ratio to 43% for borrowers. But a higher DTI may be allowable if the borrower has at least one compensating factor, as explained below. The debt-to-income ratio (DTI) is a percentage that shows how much of a person’s income is used to cover his or her recurring debts.

What is FHA debt to income ratio?

The debt to income ratio calculation helps determine the borrower’s ability to repay the loan. The standard FHA guidelines allow for a DTI of 43%, however much higher ratios of up to 56.9% are allowed with compensating factors. These FHA DTI limits are more flexible than conventional loans.

How much debt does an FHA loan use?

According to the FHA official site, “The FHA allows you to use 31% of your income towards housing costs and 43% towards housing expenses and other long-term debt.” Those percentages should be examined side-by-side with the debt-to-income requirements of a conventional home loan. Can you get an FHA loan with high debt to income ratio?

What debt ratios do I need to qualify for an FHA loan?

When it comes to FHA loan qualification, you actually have two debt ratios: The front-end ratio looks at mortgage and housing-related debts only. This would include your monthly mortgage payments, property taxes, etc. The back-end DTI ratio considers all of your monthly recurring debts.

How do you calculate FHA debt-to-income ratio?

To calculate the front-end debt-to-income ratio for an FHA loan, mortgage lenders simply divide the borrower’s total monthly housing expenses by their gross monthly income. But only the housing-related debts are used for the front-end calculation.