Getting a mortgage to buy a home is one of the biggest financial decisions most people make. And the down payment is often the biggest barrier, especially for first-time homebuyers.

That’s where FHA loans can help They only require a 35% down payment if you have a credit score of 580 or higher,

In this comprehensive guide. we’ll explain everything you need to know about FHA loan down payments

What is an FHA Loan?

FHA loans are government-insured mortgages that allow buyers to purchase a home with a low down payment of just 3.5% if their credit score is 580 or above.

These loans are insured by the Federal Housing Administration (FHA). The FHA is part of the Department of Housing and Urban Development (HUD).

Some key benefits of FHA loans include:

- Low down payments starting at just 3.5%

- More flexible credit requirements than conventional mortgages

- Competitive interest rates

FHA loans are popular with first-time home buyers, low-to-moderate income buyers, and those with less-than-perfect credit.

FHA Loan Down Payment Requirements

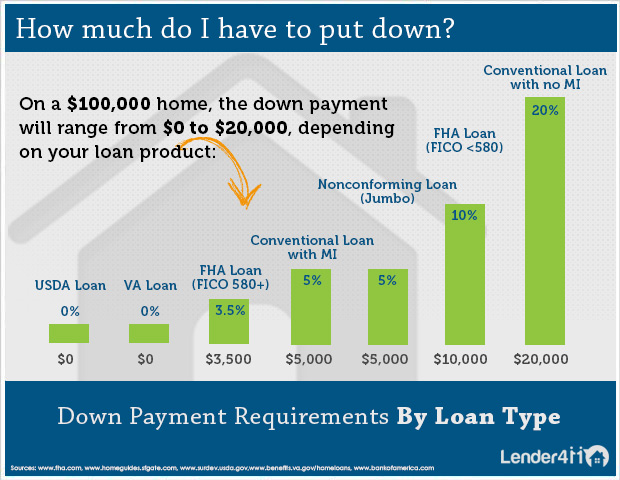

The minimum down payment on an FHA loan depends on your credit score:

- Credit Score 580+: 3.5% down payment

- Credit Score 500-579: 10% down payment

So if you have a 580 credit score or higher, you can buy a $200,000 home with just $7,000 down with an FHA loan.

Keep in mind that while 3.5% is the minimum set by the FHA, some lenders may have stricter requirements.

FHA Mortgage Insurance

With an FHA loan, you’ll also need to pay mortgage insurance premiums (MIP) to protect the lender from default.

There are two types of MIP:

-

Upfront MIP – 1.75% of the total loan amount, paid at closing. For a $200,000 loan that’s $3,500.

-

Annual MIP – 0.85% of the loan amount per year. For a $200,000 loan that’s about $136/month.

The annual MIP lasts for the life of the loan. To remove it, you’ll need to refinance once you have 20% equity.

FHA Loan Gift Funds

The FHA allows generous gift funds to help with your down payment:

-

Gifts can come from family members, employers, charities and government agencies.

-

Gifts must be documented and there must be a paper trail showing the gift funds.

-

Gift funds can be used for all or part of the down payment.

Down Payment Assistance Programs

Many state and local governments offer down payment assistance programs (DPAs) to help FHA borrowers. These programs provide grants, loans or matched savings to assist with down payments.

DPAs can be a huge help in allowing buyers to get into a home with little money out of pocket.

Alternatives to FHA Loans

If you have a good credit score (usually 620+), you may want to look at low down payment conventional loans like:

-

Conventional 97 – 3% down payment on a conventional loan.

-

HomeReady – 3% down payment from Fannie Mae, for low-to-moderate income buyers.

-

Home Possible – 3% down payment from Freddie Mac.

Two other popular low down payment mortgages are VA and USDA loans. These allow qualified buyers to purchase a home with 0% down.

Other FHA Loan Requirements

In addition to down payment and credit score requirements, here are some other key points about FHA loans:

-

FHA Loan Limits – Vary by county, but up to $970,800 in high cost areas.

-

Debt-to-Income Ratio – FHA requires a maximum debt-to-income ratio (DTI) of 50%. Many lenders prefer 43% or less.

-

Cash Reserves – You’ll need 2-3 months of mortgage payments in reserve after closing.

-

Home Inspections – FHA requires a home appraisal and may require inspections if potential issues are found.

The Bottom Line

The low 3.5% down payment requirement on FHA loans makes them one of the most affordable mortgage options out there. Just make sure you account for the mortgage insurance premiums.

If your credit score is below 580, an FHA loan will be very hard to obtain. In that case, focus on credit repair first before applying.

To sum up, if you want to buy a home with minimal cash out of pocket, the low down payment requirements of an FHA loan can be a great option. Just be sure to compare all your mortgage possibilities before choosing the best loan for your situation.

Estás ingresando al sitio de U.S. Bank en español Algunos materiales y servicios podrían estar disponibles solamente en inglés. Los enlaces incluidos en esta comunicación podrían dirigirte a sitios web en inglés.

An FHA loan is a government-backed conforming loan insured by the Federal Housing Administration. FHA loans have lower credit and down payment requirements for qualified homebuyers. For instance, the minimum required down payment for an FHA loan is only 3.5% of the purchase price. The FHA mortgage calculator includes additional costs in the estimated monthly payment. Such as, a one-time, upfront mortgage insurance premium (MIP) and annual premiums paid monthly.

See how much you might be able to borrow.

This FHA loan calculator provides customized information based on the information you provide. But, it assumes a few things about you. For example, that you’re buying a single-family home as your primary residence. This calculator also makes assumptions about closing costs, lender’s fees and other costs, which can be significant.

Estimated monthly payment and APR example: A $265,375 base loan amount with a 30-year term at an interest rate of 6.250% with a down payment of 3.5% and no discount points purchased would result in an estimated principal and interest monthly payment of $1,663 over the full term of the loan with an Annual Percentage Rate (APR) of 7.478%.1

NEW FHA Loan Requirements 2024 – First Time Home Buyer – FHA Loan 2024

FAQ

How much do I need to make to buy a $300K house with an FHA loan?

To buy a $300K house, you’ll generally need to earn a household income around $80,000 per year, assuming 20% down, a 6.5% interest rate, and moderate existing debts.

What is the required down payment for a FHA loan?

What is the downside of an FHA loan?

How much is 3.5 down payment on a $400,000 house?