Hey there folks! Ever wondered how businesses get their hands on some serious dough when banks slam the door in their face? Or how investors are makin’ a killing outside the stock market? Well, lemme introduce ya to somethin’ pretty slick—private debt. If you’re scratchin’ your head thinkin’ “What the heck is that?” don’t worry. I’m gonna break it down for you real simple, with all the juicy details you need to get the big picture. At my lil’ blog, we don’t do boring, so grab a coffee and let’s dive into this financial game-changer.

So, What Exactly Is Private Debt?

Let’s start with the basics. Private debt, sometimes called private credit, is when a company or individual borrows money from private sources—not your typical bank or government bonds sold on public markets. Think of it like gettin’ a loan from a rich uncle or a fancy investment firm instead of walkin’ into a bank branch. These lenders could be hedge funds, private equity firms, or other big-shot investors lookin’ to make a return by lendin’ out their cash.

Here’s the kicker: unlike stocks or public bonds, private debt ain’t traded on any exchange. It’s a behind-the-scenes deal, often custom-made to fit the borrower’s needs. The lender gets paid back with interest, and sometimes there’s extra perks or conditions tied to the loan. It’s a win-win if done right—companies get the funds they desperately need, and investors score predictable returns without the wild ups and downs of the stock market.

Why’s this matter to you? Well, whether you’re a business owner dreamin’ of expansion or just curious about where the smart money’s goin’, private debt is reshapin’ the financial world It’s like the secret sauce that’s keepin’ a lotta companies cookin’ when traditional options dry up.

How Did Private Debt Become a Big Deal?

Now let’s take a lil’ trip back in time. Private debt really started turnin’ heads after the 2008 financial crisis. Banks got spooked, tightened their belts, and said “nope” to a lotta risky loans. That left a huge gap in the market—businesses still needed money to grow or even survive but the usual suspects weren’t playin’ ball. Enter private debt funds, steppin’ in like a hero to fill that void with alternative lendin’ options.

Since then, it’s blown up into a legit asset class of its own. We’re talkin’ billions of dollars flowin’ through these funds—heck, in 2022 alone, private debt funds raised over 200 billion bucks! That’s a lotta cash changin’ hands outside the usual bank system. And it ain’t slowin’ down, with more investors jumpin’ on the bandwagon every year, especially in places like Europe and Asia where it’s catchin’ on fast.

How Does Private Debt Work, Anyway?

Alright, let’s get into the nuts and bolts. If you’re picturin’ a shady back-alley deal, nah, it ain’t like that (well, most of the time). Private debt works through structured funds or direct agreements. Here’s the typical flow, broken down so it don’t hurt your brain:

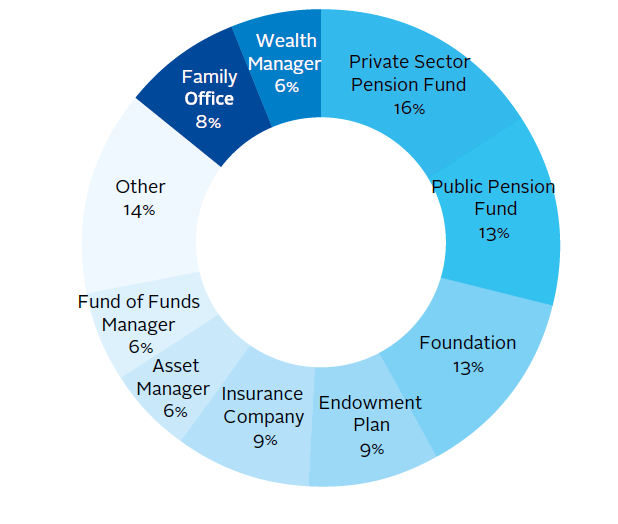

- Fundraisin’ Stage: Private debt managers—think of ‘em as the middlemen—gather money from big players like pension funds, endowments, or even wealthy folks. They pool this cash into a fund, ready to lend out.

- Investment Period: Once the fund’s got the moolah, the manager hunts for companies needin’ loans. When they find a good deal, they call in the investor cash and set up the loan terms—interest rates, repayment schedules, the works.

- Loan Life: Unlike buyin’ a piece of a company (that’s equity), here they’re just lendin’ money. The company pays back over time, usually 7 to 10 years, with interest. It’s a slow burn—investors can’t pull their money out early, it’s locked up tight.

- Wind Down: Toward the end, the manager stops makin’ new loans and just collects repayments. Once it’s all done, final returns get paid out, and everyone’s happy (hopefully).

What’s cool is how flexible this can be. Need a loan for a startup? There’s venture debt. Buyin’ out a company? Leveraged buyout loans got ya covered. It’s like a financial Swiss Army knife—there’s a tool for every job.

Types of Private Debt: A Quick Rundown

Speakin’ of tools, private debt comes in all shapes and sizes. Each type has its own vibe, risk level, and purpose. I’ll toss out the main ones with a quick explainer so you ain’t lost in the jargon:

- Senior Debt: This is the “safest” bet. If a company goes belly-up, senior debt gets paid back first before anyone else. It’s usually tied to assets as collateral, so the lender’s got somethin’ to grab if things go south. Lower risk, but also lower returns ‘cause of that safety net.

- Mezzanine Debt (or Junior Debt): A step riskier than senior debt, this gets paid after senior lenders in a bankruptcy. Higher risk means higher interest rates—more reward if it pans out. It’s popular with mid-sized companies lookin’ to grow.

- Term Loan: A straight-up lump sum of cash given upfront with a set payback plan. Fixed or floatin’ interest, take your pick. Simple and to the point.

- Revolving Credit Facility: Kinda like a credit card for businesses. Borrow up to a limit, pay it back, borrow again. Super handy for ongoing needs.

- Convertible Debt: This one’s funky—the loan can turn into equity (ownership) later on. It’s a hybrid deal, often used by startups.

- Venture Debt: Tailored for young, high-growth startups. Often paired with equity deals, it helps ‘em build credit or protect ownership while they scale.

- Real Estate Debt: Funds lent for buildin’ or buyin’ property. The property itself is collateral, so it’s often less risky.

- Infrastructure Debt: Money for big public projects like roads or power plants. Stable and lower risk since these don’t flop as often as corporate stuff.

- Leveraged Loans: Loans to companies already carryin’ a lotta debt. Risky as heck, but the payoff can be sweet.

See? There’s a flavor for every kinda risk appetite or business need. That’s why private debt’s so darn versatile.

Real-World Examples to Make It Click

I know, all this talk can still feel abstract. So, let’s paint a picture with some real-life (but made-up for privacy) scenarios we’ve seen in the wild. Imagine these:

- Startup Sally: Sally’s got a hot new tech startup, but banks won’t touch her ‘cause she’s got no track record. A private debt fund steps in with venture debt, givin’ her the cash to build her app without givin’ up too much ownership. She pays it back as her company grows.

- Real Estate Ricky: Ricky’s a developer wantin’ to build a fancy apartment complex. He snags a real estate debt loan from a private lender, usin’ the land as collateral. Once the units sell, he clears the debt with profit to spare.

- Big Buyout Bob: Bob’s firm wants to buy out a strugglin’ retailer. They use a leveraged buyout loan from a private debt fund, usin’ the retailer’s assets as security. If they turn the company around, they pay off the loan and cash in big.

These ain’t just stories—they’re the kinda deals happenin’ every day. Private debt makes ‘em possible when banks or public markets ain’t an option.

Private Debt vs. Public Debt: What’s the Diff?

You might be thinkin’, “Isn’t all debt the same?” Nah, not even close. Let’s stack private debt up against public debt to clear the fog. Public debt is what governments or public entities issue—think government bonds or municipal loans. Here’s how they differ:

| Aspect | Private Debt | Public Debt |

|---|---|---|

| Issuer | Private entities (hedge funds, firms) | Governments or public institutions |

| Purpose | Business growth, acquisitions, real estate | Fundin’ public stuff like roads, schools |

| Form | Loans or private securities | Usually bonds anyone can buy |

| Risk | Higher risk, higher interest rates | Lower risk, backed by government faith |

| Tax Perks | Interest ain’t tax-deductible | Interest often tax-deductible |

Bottom line: Public debt’s safer but offers slimmer returns. Private debt’s riskier, but the payoff can be juicier, and it’s way more tailored to specific needs.

Private Debt vs. Private Equity: Don’t Get ‘Em Mixed Up

Another mix-up I see a lot is private debt versus private equity. Both are “private” investments, but they’re apples and oranges. Check this out:

- Private Equity: This is when investors buy a chunk of a company—actual ownership. They’re bettin’ on growth or turnin’ things around, then sellin’ their stake later for a fat profit. High risk, high reward.

- Private Debt: Here, it’s just lendin’ money, not ownin’ anything. You get paid back with interest over time, not waitin’ for a big exit. Lower risk than equity, but returns ain’t as wild either.

Equity’s like gamblin’ on a racehorse—you win big if it wins, lose big if it flops. Debt’s more like a steady paycheck, as long as the borrower don’t default.

Why’s Everyone Jumpin’ on Private Debt Now?

Alright, let’s chat about why private debt’s hotter than a summer BBQ. There’s a few big reasons investors and companies are lovin’ it:

- Low Risk Compared to Equity: In the capital structure, debt gets paid before equity if a company tanks. That makes it a safer bet for cautious investors.

- Decent Returns in Low-Interest Times: When regular interest rates were dirt low for years, private debt offered better returns than public bonds. Even with rates creepin’ up now, floatin’ rate options keep it attractive.

- Diversification: It’s got low correlation with public markets. If stocks crash, your private debt investments might still hold steady, balancin’ your portfolio.

- Customizable Deals: With so many types and structures, there’s always a fit for the market mood or a company’s needs. Flexibility is king.

- Banks Steppin’ Back: Since the ‘90s, banks have lost a ton of market share in loans due to tighter rules. Private debt’s swoopin’ in to pick up the slack.

- Bigger Deals and Funds: Average deal sizes are growin’, with some hittin’ over a billion bucks. Funds are gettin’ larger too, showin’ serious confidence in this space.

Plus, it ain’t just a U.S. thing no more. Europe’s seein’ a big chunk of deal action, and Asia’s market for private debt has nearly tripled in recent years. It’s goin’ global, fam.

Risks and Challenges: It Ain’t All Sunshine

Before ya think private debt’s the golden ticket, lemme hit you with some real talk. It’s got its downsides, and we gotta be straight about ‘em:

- High Illiquidity: Your money’s locked up for years—sometimes a decade. If you need cash quick, tough luck.

- Default Risk: If the borrower can’t pay, you’re in trouble. Senior debt’s safer, but riskier types like mezzanine or leveraged loans can bite ya.

- Higher Interest for Borrowers: Companies payin’ back these loans often face steeper rates than bank loans. It can strain their finances if things go sideways.

- Complex Process: Gettin’ a private debt deal done ain’t a walk in the park. Borrowers need solid business plans, financials, and sometimes legal help to seal the deal.

So, while it’s a sweet option, it ain’t for everyone. Gotta weigh the pros and cons before divin’ in.

How Can You Get in on Private Debt?

Now, I bet some of ya are thinkin’, “Cool, how do I invest in this?” Well, lemme tell ya, it ain’t as easy as buyin’ a stock on your phone app. Private debt’s usually for the big dogs—think institutional investors or high-net-worth folks. Here’s the usual path:

- Join a Fund: Most regular peeps access it through private debt funds. You’d need serious capital and patience, since your money’s tied up.

- Work with Managers: Fund managers handle the deals, so you’re relyin’ on their expertise to pick winners.

- Know the Entry Bar: Often, you gotta be an accredited investor—meanin’ you’ve got a high income or net worth—to even play in this sandbox.

If you’re a small-time investor, it might be outta reach direct-like. But some platforms or advisors can point ya to funds with lower barriers. Just don’t jump in blind—do your homework!

Tools for Private Debt Managers

On the flip side, if you’re runnin’ a private debt fund or managin’ loans, the game’s gettin’ bigger and trickier. You need solid systems to track portfolios, manage deals, and handle repayments. I’ve seen managers struggle without the right tech—missin’ key data or drownin’ in paperwork. There’s software out there built just for this, helpin’ automate stuff like financial trackin’ and reportin’. If you’re in the biz, investin’ in those tools ain’t a luxury, it’s a must.

Why Private Debt Matters to Us All

Zoomin’ out, let’s think about the bigger picture. Private debt ain’t just some Wall Street gimmick—it’s changin’ how businesses grow and how money moves. For companies, it’s a lifeline when banks say no. For investors, it’s a way to diversify and score steady returns. Even if you ain’t directly involved, the ripple effects hit the economy we all live in—more jobs from growin’ businesses, more projects gettin’ funded, you name it.

I reckon it’s somethin’ worth keepin’ an eye on. Whether you’re dreamin’ of startin’ a company or just wanna understand where the financial world’s headin’, private debt’s a piece of the puzzle. It’s like knowin’ the backroads when the highway’s jammed—sometimes, it’s the only way to get where ya goin’.

Wrappin’ It Up with a Bow

So, there ya have it—private debt in all its glory. We’ve covered what it is (loans from private players), how it works (through funds and custom deals), the types (from senior to venture), and why it’s blowin’ up (flexibility and bank gaps). We’ve even tossed in the risks and how ya might dip a toe in if you’ve got the means.

What Is Private Debt?

Broadly, private debt (or private credit) refers to loans that are privately negotiated between two parties as opposed to traditional syndicated bank loans or bonds issues that are more widely available to fixed income investors.

Private debt started to gain more investor attention and assets following the 2008-2009 financial crisis, when banks were under pressure to reduce risk on their balance sheets and tighten lending standards. By comparison, some other alternative asset classes, such as hedge funds and private equity, are relatively more mature and have more assets under management (AUM). With AUM surpassing $1.5 trillion by 2024 and could surpass $2.6 trillion by 2026, according to Preqin (Exhibit 1).Private debt has grown faster than the broader alternatives market (Exhibit 1)

Source: Preqin, Future of Alternatives 2029; AUM values for 2024 to 2029 forecasted by Preqin.

Private debt started to gain more investor attention and assets following the 2008-2009 financial crisis, when banks were under pressure to reduce risk on their balance sheets and tighten lending standards. By comparison, some other alternative asset classes, such as hedge funds and private equity, are relatively more mature and have more assets under management (AUM). However, private debt AUM grew to almost $1.2 trillion by the end of 2021 and could reach $2.7 trillion by 2026, making it one of the fastest-growing alternative asset classes.

Historically, from a credit-rating perspective, private debt has been compared most closely to non-investment grade syndicated leveraged loans and high-yield bonds, but there are several differences. Syndicated leveraged loans and high-yield bonds are usually rated by credit rating agencies—which is helpful for assessing default risk—and can be traded on secondary markets.

Private loans, by contrast, do not tend to be independently rated, so credit default risk can be harder to evaluate. A secondary market for private debt is growing yet still lacks the degree of activity as in private equity or traditional fixed income; therefore, private debt remains less liquid. These factors can make private debt riskier so that it is priced at a premium to traditional fixed income investments, offering the potential for higher yields and returns (Exhibit 2).

Private debt can also provide a differentiated source of returns for a portfolio through a variety of structures and strategies. A vehicle often utilized to access private debt investments is a fund structured as a limited partnership. Unlike some other private investments, private debt funds often have a shorter fund life, due to shorter maturity dates or prepayment prior to maturity.1 Evergreen private debt vehicles are also increasingly available for advisors seeking limited liquidity, with roughly $500 billion in assets under management in these vehicles in 2024.2Advisors tend to allocate to private debt seeking income, diversification, and higher returns (Exhibit 2)

Source: CAIS and Mercer, “The State of Alternative Investments in Wealth Management 2023,” December 2023.

From a credit-rating perspective, private debt is generally considered comparable to non-investment grade syndicated leveraged loans and high yield bonds but there are several differences. Syndicated leveraged loans and high yield bonds are usually rated by credit rating agencies, which is helpful for assessing default risk, and can be traded on secondary markets. Private loans do not tend to be rated, so credit default risk can be harder to evaluate and there may not be an active secondary market, which makes the securities much less liquid. These factors can make private debt riskier so that it is priced at a premium to traditional fixed income investments, offering the potential for higher yields and returns for investors.

What Are Common Types of Private Debt Strategies and How Do They Work?

We describe common categories of private debt, which feature a range of risk and return profiles.

- Direct lending refers to private corporate loans that are typically backed by future cash flows or specific assets of a company, including physical property. The debt may be structured as senior, junior, or mezzanine.

- Distressed debt strategies seek out companies that are undergoing financial difficulties, such as bankruptcy proceedings, generally with the intention of gaining control and increasing the value of the company through a variety of strategies including restructuring, becoming equity owners, or realizing a relatively higher private market valuation versus the public market.

- Special situations can include debt investments across the capital structure, trading in the secondary market, direct origination, or distressed debt.

- Structured debt is typically used by companies that have highly specialized and specific needs. Additionally, structured debt helps borrowers mitigate the risk of underlying assets through the process of securitization. Collateralized loan obligations (CLO), asset-backed securities (ABS), and mortgage-backed securities (MBS) are all examples of structured debt.

- Mezzanine debt strategies provide subordinated financing positioned between senior debt and equity in the capital structure, typically offering higher yields through fixed-interest payments coupled with equity-linked instruments such as warrants.

- Asset-based lending or specialty finance tend to include a diverse range of niche asset types, often with less correlation to broad economic conditions. These strategies generally involve loans that use a borrower’s assets, or cash flows from those assets, as collateral. They may be classified by industry segment, such as consumer credit, equipment finance, litigation finance, music/film royalties, structured settlements and infrastructure finance, among others.

Private Debt

FAQ

What is private debt in simple terms?

Private debt, or private credit, is the provision of debt finance to companies from funds – rather than banks, bank-led syndicates, or public markets. In established markets, such as the US and Europe, private debt is often used to finance buyouts, though it is also used as expansion capital or to finance acquisitions.

What is the significance of private debt?

Investors say[1] their top reasons for including private debt in their portfolio are diversification, reducing portfolio volatility, a reliable income stream, and risk-adjusted return.

What is public vs private debt?

Public debt is the debt owed by national, state, and local governments. Private debt is the debt owed by households, businesses, and nonprofits,3 which are also called private nonfinancial entities. Private nonfinancial debt excludes borrowing by the government or financial firms, such as banks.

What is the difference between debt and private debt?

Unlike public debt, traded on the open market, private debt is not listed on stock exchanges and involves private agreements between lenders and borrowers. It is typically used by businesses that need capital but prefer not to rely on banks or issue public bonds.

What is a private debt fund?

Private debt includes any debt held by or extended to privately-held companies. It comes in many forms, including loans and bonds, but commonly involves private credit, when other asset managers make loans to private companies. A variety of general partner (GP) credit investors manage private credit or other debt funds.

What is private debt?

Private debt includes any debt held by or extended to privately held companies. It comes in many forms, including loans and bonds, but commonly involves private credit, when other asset managers make loans to private companies. A variety of general partner (GP) credit investors manage private credit or other private debt funds.

What are the different types of private debt?

Let’s explore the primary types of private debt that you’ll encounter. Direct lending is one of the most straightforward forms of private debt. In direct lending, private investors, often through specialized funds, lend money directly to businesses.

What is private debt & why is it important?

Private debt encompasses all borrowing by individuals, households, and businesses. This debt is larger than public debt in the U.S. and typically carries higher default risk. As of December 2023, U.S. private debt reached 216.5% of GDP. This includes everything from your mortgage to corporate bonds issued by major companies.

Is private debt a good investment?

Private debt includes private debt funds, hedge funds, high-yield bonds, collateralised loan obligations (CLOs) and more. When looking at private debt compared to private equity or venture capital, private debt is often considered less risky and more reliable. Another benefit of private debt is that deals are privately negotiated.

What is the difference between private and public debt?

In summary, the key differences between private and public debt lie in liquidity, risk and return, access to capital, and regulation. Investors seeking higher returns and more flexibility may find private debt appealing, while those looking for safer, more liquid investments may prefer public debt.