Understanding your credit report is an important part of managing your personal finances. Credit reports often appear cryptic, but the various alphanumeric codes indicate important parts of your financial status — including some, like code G or “collections,” that could have serious repercussions if neglected.

Have you ever checked your credit report and come across an ambiguous code like “Grid Code G”? As confusing as it sounds, this code carries some serious implications for your financial standing. In this comprehensive guide, we will demystify Grid Code G, unpack what it means, and outline the steps you can take when you have this remark on your credit file.

What Is Grid Code G?

Grid Code G is an alphanumeric code that appears on your credit report to indicate that you have an account in collections or default. It is typically denoted in the “Payment History” section of your credit file.

This code is assigned when you have failed to pay a debt obligation like a credit card, personal loan, auto loan, mortgage, or utility bill for an extended period. After several months of non-payment, the original creditor writes off your debt and sells it to a collection agency. The agency then tries to recover the amount owed by contacting you for repayment.

Once the collection account is reported to the credit bureaus, it is marked with a Grid Code G. This serves as a warning sign to future lenders that you have a history of unpaid debts, which can make you seem like a high-risk borrower.

How Does It Impact Your Credit Score?

The presence of a Grid Code G can seriously damage your credit score. Here’s a look at some of the factors that determine the severity of the impact

-

Age of Delinquency The longer your debt has been in delinquency, the worse the credit score damage. A recent collection hurts less than an older one

-

Size of Debt: Larger collection amounts tend to hurt more than smaller ones.

-

Overall Credit Profile: If you have a short credit history or limited number of accounts, a collection can be extremely damaging. But if you have a long positive history, the impact may be less pronounced.

Generally, a single collection can bring your credit score down by 50-100 points or even more in some cases. This can sabotage your chances of getting approved for loans, credit cards, rentals, cell phone plans, and even jobs.

How To Remove Grid Code G From Your Credit Report

Here are some tips to get a collection deleted from your credit file:

-

Pay off the debt: Settling the outstanding balance with the collection agency can motivate them to request deletion from your credit report. But make sure to get this agreement in writing first.

-

Negotiate for pay-for-delete: You could negotiate to pay a portion of the amount owed in exchange for the removal of the collection record.

-

Dispute inaccurate information: If you find any errors in the collection entry, such as the amount owed or date, you can dispute it with the credit bureaus to get it corrected or removed.

-

Wait for it to fall off: Collection accounts stay on your report for up to 7 years. If the debt is older than that, it must be removed. You can also wait for the collection to age beyond the 2-year mark when the impact starts diminishing.

How To Avoid Future Code G Remarks

To steer clear of collections accounts in the future, make sure to:

-

Pay all your bills on time each month. Even a 30-day delay can lead to collections.

-

Maintain low credit utilization. Maxing out cards increases risk.

-

Don’t bite off more debt than you can chew based on your income.

-

Build emergency savings to cover bills in case of job loss or reduced income.

-

Communicate with creditors if you anticipate payment issues and need more time.

-

Consolidate high-interest debts to make repayment easier.

-

Monitor your credit regularly so you can catch and dispute errors early.

The Takeaway

While an ominous-sounding credit code, Grid Code G simply indicates you have a debt in collections – a common scenario for millions of consumers. The financial impact can be lessened by addressing the collection account and improving credit behaviors going forward. With diligent monitoring and prudent money management, you can clear up the code G remark and rebuild your credit over time.

Cleaning Up a Code G

Consumer payment histories remain on a credit report for two years. If you know your accounts are all paid up and the code G is there in error, call your lender and your credit bureau immediately.

Your credit rating will drop significantly if an active collection notice remains on your report.

Consumer Payment History Codes

Video of the Day

Code G, found in the “consumer payment history” section of an Experian credit report, means that at least one account is in collections. This code is applied if the loan — possibly a credit card, car loan or line of credit — is so far past due the lender felt it necessary to turn the file over to a collection agency.

Video of the Day

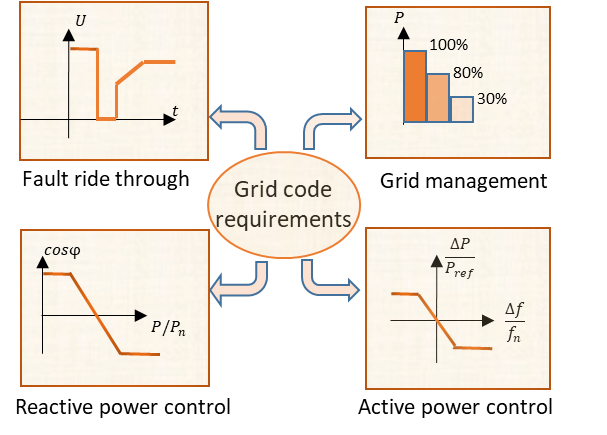

What is electricity grid code?

FAQ

What is a grid code G collection?

If you see a “Grid Code G” collections line on your credit report, it means your debt is overdue and has been turned over to collections. It’s important to remedy this as soon as possible as these types of remarks hurt your credit health.

What is the grid code GC0137?

GC0137 proposes to introduce: Definitions for Grid Forming Capability, and the types of power and current injection or response characteristics that plant with such capability must be capable of providing, in the Grid Code Glossary & Definitions.

What is the meaning of grid code?

Definition. The grid code, also known as the transmission code in some countries, is the set of rules a transmission system operator (TSO) uses to define conditions for accessing the electricity grid.

What are status codes on a credit report?

Credit Report Status Codes

Payments monthly will be shown with a status code which shows if the payment has been made on time. A status code of ‘0’ under each month shows all payments have been made on time. A status code of ‘1’ shows that a payment was one month late.