In todays financial landscape, understanding the source of funds (SOF) is crucial for ensuring compliance and preventing financial crimes. Financial institutions must verify the origin of funds to comply with regulations and mitigate risks. This blog post delves into the meaning, importance, best practices, and challenges of verifying the source of funds.

In our years of helping businesses navigate compliance, the question “what is evidence of source of funds?” comes up repeatedly Let’s cut through the confusion and get straight to the point – understanding source of funds documentation is crucial for any business that handles customer money

Understanding Source of Funds (SOF)

Source of Funds (SOF) refers to the origin of the specific money that an individual or business is using for a particular transaction or investment. It’s basically the paper trail that proves where someone got their money from.

When a customer wants to make a significant transaction, financial institutions and many other businesses need to verify that the money isn’t coming from illegal activities. This verification process is a critical component of Anti-Money Laundering (AML) and Know Your Customer (KYC) procedures.

SOF vs. SOW: What’s the Difference?

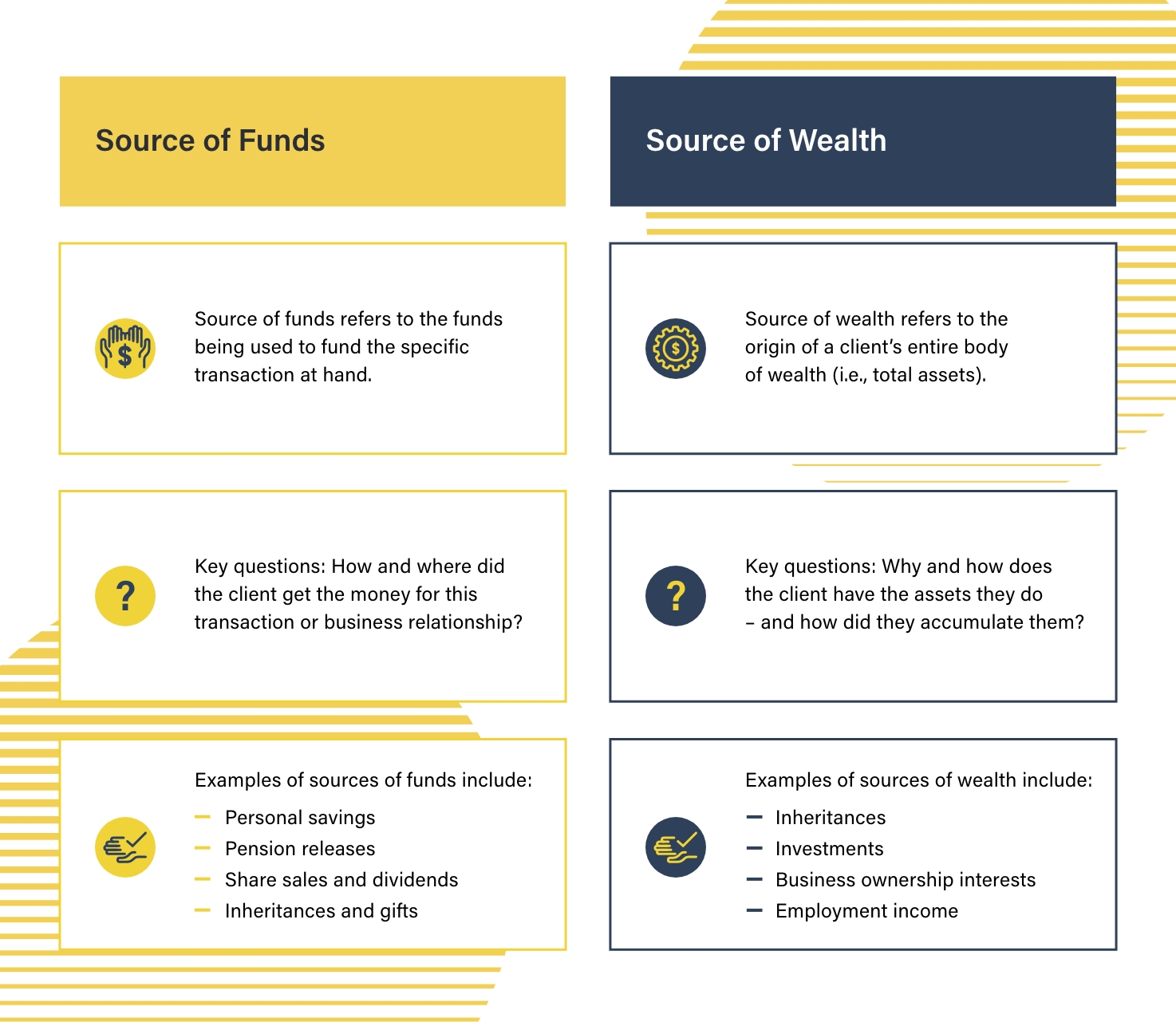

People often mix up Source of Funds (SOF) and Source of Wealth (SOW), but they’re actually different things:

- Source of Funds (SOF) focuses on the specific money used in a particular transaction

- Source of Wealth (SOW) looks more broadly at a person’s overall assets and how they acquired them over time

Think of it this way – SOF is about “where did this specific money come from?” while SOW answers “how did you become wealthy in general?”

Types of Source of Funds Evidence

So what actual documents count as evidence of source of funds? Here are the most common types:

1. Employment Income

- Recent payslips (usually last three months)

- Employment contracts

- Bank statements showing regular salary deposits

- Tax returns or income statements

- Employer confirmation letters

2. Savings

- Bank statements showing consistent deposit history

- Certificates of deposit

- Savings account statements

- Evidence of interest earned

3. Business Income

- Company registration documents

- Business financial statements

- Tax returns for the business

- Proof of business ownership

- Dividend statements

- Stock records

4. Sale of Assets

- Property sale contracts

- Vehicle sale receipts

- Stock/investment sale confirmations

- Business sale agreements

- Real estate valuation documents

5. Inheritance

- Will documents

- Grant of Probate

- Letter from executor

- Bank statements showing the inheritance transfer

- Tax clearance documents

6. Gifts

- Signed declaration from the donor

- Proof of funds transfer

- Statement explaining circumstances of the gift

- Documents proving the donor’s own source of funds

- Gift tax returns (if applicable)

7. Loans

- Loan agreements

- Statements from lending institutions

- Mortgage documents

- Evidence of loan payments

8. Investments

- Investment account statements

- Stock certificates

- Dividend statements

- Real estate investment documentation

- Evidence of investment returns

9. Winnings

- Lottery/betting receipts

- Prize confirmation letters

- Bank statements showing winnings deposits

- Tax documentation for winnings

When is SOF Evidence Required?

Not every transaction requires source of funds verification. Typically, SOF evidence is needed in these scenarios

- Large Transactions: Exceeding certain thresholds (often $10,000+ in the US)

- High-Risk Customers: People from countries with weak AML controls

- Politically Exposed Persons (PEPs): Government officials and their families

- Unusual Activity: Transactions that don’t match a customer’s profile

- Certain Industries: Banking, real estate, cryptocurrency, gambling

The Importance of SOF in AML Compliance

Checking where funds come from isn’t just a bureaucratic hassle – it’s a crucial part of fighting financial crime. Here’s why SOF matters:

- Prevents Money Laundering: Makes it harder to clean dirty money

- Stops Terrorist Financing: Helps block funds going to violent extremists

- Regulatory Compliance: Keeps your business on the right side of the law

- Fraud Prevention: Protects your business and customers

- Maintains Reputation: Keeps your business trusted by partners and customers

How to Properly Verify Source of Funds

When we check SOF documents at our company, we follow these best practices:

1. Risk-Based Approach

Apply more scrutiny to higher-risk customers and transactions. Not all SOF checks need the same level of depth.

2. Document Collection

Gather relevant documentation based on the claimed source of funds. Don’t just accept a single document – look for supporting evidence.

3. Verification Process

- Check document authenticity

- Confirm details match customer information

- Ensure amounts make sense for the transaction

- Look for inconsistencies or red flags

4. Explanation Request

Ask customers to explain in their own words where the funds came from. Sometimes this narrative can reveal inconsistencies.

5. Record Keeping

Document every step of your verification process. This creates an audit trail for regulators if questions arise later.

Common Challenges in SOF Verification

We’ve run into several problems when verifying source of funds:

1. Incomplete Documentation

Customers often provide partial evidence that doesn’t fully prove their source of funds. For example, they might show a property sale contract but not the bank statement showing the proceeds.

2. Customer Frustration

Let’s be honest – nobody enjoys being asked for lots of documentation. Customers may get frustrated or abandon transactions when faced with extensive requirements.

3. International Variations

Different countries have different documentation standards and formats, making it harder to verify foreign sources.

4. Complex Fund Flows

Money often moves through multiple accounts or involves several transactions, making it difficult to trace.

5. Technological Limitations

Manual verification is time-consuming and prone to error, but not all automated systems are sophisticated enough to handle complex cases.

Best Practices for SOF Compliance

To make your source of funds verification effective without driving away customers:

- Clear Communication: Explain why you need this information and how it protects everyone

- User-Friendly Process: Make document submission as simple as possible

- Automation: Use technology to streamline verification where appropriate

- Staff Training: Ensure your team understands what to look for

- Consistent Procedures: Apply the same standards to all similar transactions

- Regular Updates: Keep your SOF requirements current with changing regulations

Red Flags in Source of Funds Verification

Watch out for these warning signs that might indicate problematic sources:

- Reluctance to provide information

- Documents that appear altered or fake

- Funds coming from high-risk jurisdictions

- Complex ownership structures obscuring the true source

- Funds passing through multiple accounts without clear purpose

- Source of funds that doesn’t match the customer’s profile

- Cash-intensive businesses with limited documentation

Our Experience with SOF Verification

I remember one client who tried to deposit a large sum but couldn’t properly document where it came from. They insisted it was from “various business deals” but had no paperwork. When we stuck to our requirements, they eventually withdrew their application – a clear red flag that something wasn’t right.

On the flip side, we’ve helped legitimate customers understand what documentation they needed and guided them through the process. In one case, a customer was trying to use inheritance funds but didn’t know what documents to provide. With our guidance, they were able to assemble proper documentation and complete their transaction.

Final Thoughts

Understanding what counts as evidence of source of funds isn’t just about ticking regulatory boxes – it’s about protecting your business and contributing to a safer financial system. By implementing a systematic, risk-based approach to SOF verification, you can meet your compliance obligations while still providing a good customer experience.

The key is balance – being thorough enough to catch suspicious activity without creating unnecessary friction for legitimate customers. With the right processes in place, source of funds verification becomes a manageable part of your overall compliance program rather than a burden.

Have you struggled with SOF verification in your business? Or maybe you’ve found effective ways to streamline the process? We’d love to hear about your experiences in the comments below!

Frequently Asked Questions

Q: Is a bank statement enough to prove source of funds?

A: Usually not by itself. Bank statements show money movement but don’t necessarily explain the original source. They should be combined with other evidence like payslips, sale contracts, or inheritance documents.

Q: How far back should source of funds evidence go?

A: This depends on the risk level and transaction size, but typically 3-6 months for regular transactions and up to several years for large or high-risk situations.

Q: What if a customer can’t provide formal documentation?

A: This is challenging but common. Consider accepting alternative evidence while applying enhanced due diligence. If sufficient evidence can’t be provided, you may need to decline the transaction.

Q: How is SOF different for businesses versus individuals?

A: Business SOF often focuses on financial statements, contracts, and business activities, while individual SOF typically involves personal income, savings, and assets.

Q: Do different countries have different SOF requirements?

A: Yes! While the basic principles are similar across jurisdictions following FATF guidance, specific requirements and thresholds vary by country. Always check local regulations.

Invest in People

Allocate resources for training, technology, and well-being. Overworked investigators cannot maintain integrity under stress.

Culture thrives when leaders model integrity consistently â especially when no one is watching.

AI-Powered Detection and Triage

The best providers go beyond rules-based alerts. They use AI to:

- Reduce false positives by learning from past investigations

- Prioritise alerts based on actual risk exposure

- Surface hidden patterns like mule networks or trade-based layering

- Simulate new scenarios before deployment

Leading platforms incorporate community-driven or expert-validated typologies, such as:

- Romance scams

- Deepfake impersonation

- QR code money laundering

- Synthetic identity fraud

This is especially important for Singapore, where scam methods evolve quickly and exploit local platforms.