A mortgage is one of the biggest debts you’ll have in your lifetime. While you may be working toward tackling credit debt, a car loan, student loans or all the above, the balance of your mortgage may be a little harder to chip away at.

If you’re motivated, you can make an additional mortgage payment yearly. One way to do this is by making biweekly mortgage payments. This means you’ll make an extra payment each year that could potentially pay your mortgage off several years earlier.

However, take a moment to consider whether this plan is feasible for you. Many factors go into biweekly mortgage payments, so it’s important to know what they are and how they can impact your finances before making the switch.

When you take out a mortgage, you typically make one payment each month toward the loan’s principal and interest. This monthly payment schedule is familiar, easy to budget for, and works well for most homeowners.

However, some lenders give borrowers the option to pay biweekly instead. With this schedule, you split your monthly payment in half and pay it every two weeks. At first glance, biweekly payments may seem complicated compared to simple monthly payments. But for the right homeowner, this strategy can save thousands of dollars in interest and help you pay off your home faster.

In this article, we’ll compare monthly and biweekly mortgage payments to help you decide if switching to biweekly is the right move for your financial situation.

How Biweekly Payments Work

With biweekly payments, you pay half your normal monthly mortgage amount every two weeks. Over the course of a year, this adds up to the equivalent of one extra monthly payment.

For example, if your monthly mortgage payment is $2,000, you’d pay $1,000 every other week, making 26 biweekly payments annually rather than 12 monthly payments.

It’s important to note that biweekly payments don’t reduce your monthly payment amount. You still owe the full monthly payment; you just split it into two smaller installments.

Biweekly Payments Help You Pay Off Your Mortgage Faster

The key benefit of biweekly payments is that extra payment you make each year. By making 13 months’ worth of payments annually instead of 12, you pay down your mortgage principal faster. This helps you build equity quicker while saving a bundle on interest costs over the life of your loan.

For example, let’s look at a $300,000 mortgage with a 30-year term and 4% interest rate.

-

With monthly payments, it would take 30 years to pay off and cost $215,068 in interest.

-

With biweekly payments, you’d pay off the loan in under 25 years and save over $50,000 in interest costs.

The savings and payoff time depend on your specific loan details, but the effect is clear: Biweekly payments accelerate your payoff timeline significantly compared to monthly payments.

Other Benefits of Biweekly Payments

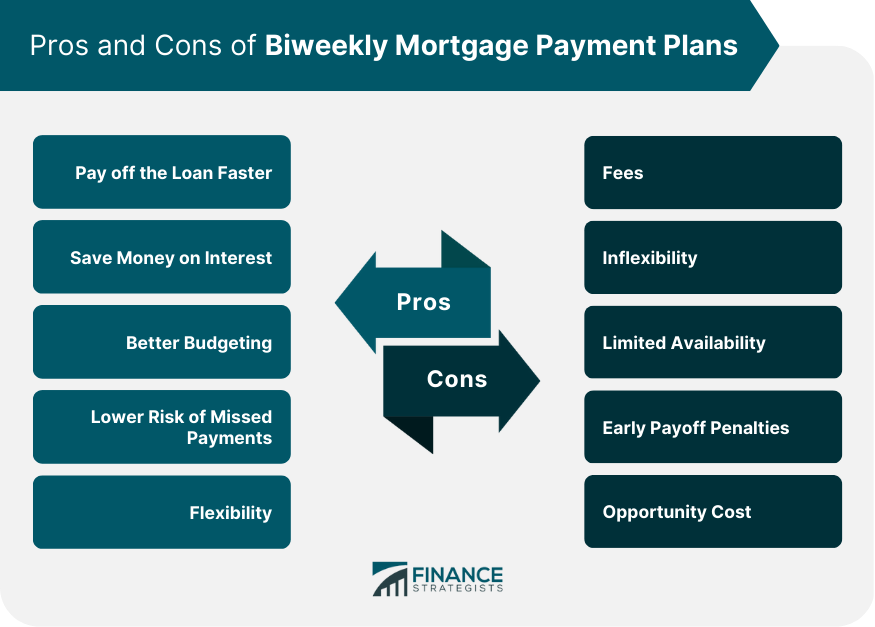

In addition to paying your mortgage off faster and reducing total interest costs, biweekly payments offer other advantages like:

-

Faster equity building You gain equity with every mortgage payment, and extra payments help you build equity faster

-

Potential to remove PMI sooner. Once you reach 20% equity in your home, you may be able to cancel private mortgage insurance (PMI) with an conventional loan. Biweekly payments get you there quicker.

-

Better budgeting. Some borrowers feel biweekly payments make budgeting easier since you pay smaller amounts more frequently rather than large lump sums each month.

-

Lower lifetime costs. Paying your mortgage off faster means you have less time to accumulate interest. This greatly reduces the total you’ll pay over the full loan term.

-

Improved financial discipline. Making biweekly payments takes commitment. Staying on top of them can help you build better financial habits.

Things to Consider Before Switching to Biweekly Payments

Biweekly mortgage payments aren’t for everyone. Before switching, make sure you:

-

Have a budget that supports biweekly payments. Look at your income, expenses, and account history to ensure you can comfortably afford the new schedule.

-

Understand any fees your lender charges for biweekly payments. Some lenders let you split payments at no cost, while others charge setup and/or processing fees. Ask before enrolling.

-

Avoid third-party biweekly payment services. Some companies claim they’ll manage split payments for you, but they often have high fees that outweigh any interest savings. It’s better to handle biweekly payments yourself.

-

Get written approval from your lender. Not all lenders allow biweekly payments, so check the loan terms. If they permit it, have them confirm the change in writing.

-

Make sure there’s no prepayment penalty. While uncommon, some loans charge you if you pay down the balance too fast. Verify there’s no penalty for paying early.

As long as you have the budget for it and your loan allows it, switching to biweekly mortgage payments can be a smart financial move. But it also takes commitment and proactive planning.

Frequently Asked Questions About Biweekly Mortgage Payments

If you’re considering changing to a biweekly payment schedule, you likely have questions. Here are answers to some common FAQs about biweekly mortgage payments.

How much faster will biweekly payments pay off my mortgage?

It varies, but you can expect biweekly payments to shorten your payoff timeline by several years. For a 30-year mortgage, you may pay off the loan 5-10 years early by splitting your monthly payment in two.

Can I switch back to monthly payments if needed?

In most cases, yes. Talk to your lender about their policy, but you should be able to revert to monthly payments if biweekly doesn’t work out. Just have them confirm the change in writing again.

Do all mortgage lenders offer biweekly payments?

Unfortunately, no. Many lenders accommodate them, but some don’t have the systems in place. Check your loan documents or call your lender to find out if they support biweekly payments.

What if I can’t afford to pay half my mortgage every two weeks?

Even paying a few extra payments per year can make a difference. If biweekly is too much, look at what you can afford monthly, whether that’s an extra $100, $200, etc. Every bit toward principal helps.

Can biweekly payments negatively impact my credit score?

No. As long as you make all payments on time, it can only help your credit by showing financial responsibility and lowering your debt. Just be sure you have the available funds before committing.

Do I need to notify my lender before switching to biweekly?

Yes. Get written approval from your lender before changing payment frequency. That way there’s documentation allowing biweekly payments in case any issues arise later.

How do I set up biweekly mortgage payments?

Contact your lender to enroll if they offer an official program. Otherwise, you can make manual split payments yourself through your bank. Just be disciplined about sending half your monthly amount every other week.

Are there fees for paying my mortgage biweekly?

Potentially. Some lenders let you split payments at no cost, while others charge setup and/or processing fees. Third-party services also tend to have high fees. Understand the costs before enrolling.

The Bottom Line

Biweekly mortgage payments take commitment, planning, and budgeting. But for homeowners who can swing it, this schedule can trim years off your payoff timeline and save you thousands in interest costs over the loan term.

Carefully consider your financial situation, loan terms, and lender’s requirements first. But if you have the means, switching from monthly to biweekly payments could be a smart move toward paying off your home faster.

See what you qualify for

Biweekly payments are half of your monthly payment paid every 2 weeks. Because a year has 52 weeks, this works out to 26 biweekly payments. Since these payments are half the full amount of your monthly mortgage, they equate to 13 full payments.

Biweekly mortgage payments save you money by adding one principal-only payment per year. The reason making biweekly payments lowers your overall interest is because this method pays the principal balance faster, therefore, there’s less money that can be charged interest. Choosing this method could remove several years’ worth of interest payments.

The math behind biweekly mortgage payments

Using real numbers, let’s take a look at how much you’ll save in interest when you use a biweekly repayment schedule.

Let’s say you purchased a home for $200,000 with a 30-year fixed-rate loan. You put down $40,000 (20%) and have an interest rate of 4%. Your monthly mortgage payment is $764, which pays your principal and interest. If you make monthly payments for the life of the loan, by the time your mortgage is paid off, you’ll have paid a total of $274,991 on the loan, thanks to interest.

Now, let’s say you decide to make biweekly payments instead. With this payment method, you pay $382 (half your monthly payment) every two weeks. If you make biweekly payments for the life of the loan, once your mortgage is paid off, you’ll have paid a total of $256,288 on the loan, and you’ll pay off your mortgage in 25 years and 9 months (cutting 4 years and 3 months of payments off your mortgage). With biweekly payments, you’ll have total interest savings of $18,703.

| Monthly payment: $764 | Biweekly payment: $382 |

|---|---|

|

Total interest: $114,991 |

Total interest: $96,288 |

|

Time for repayment: 30 years |

Time for repayment: 25 years and 9 months |