The Great Depression was a devastating economic crisis that began in 1929 and lasted through the 1930s It was triggered by a stock market crash in October 1929 and led to widespread unemployment and poverty across the United States During this period, the banking system experienced widespread failures, leading many Americans to lose their life savings. So what exactly happened to people’s money in the bank during the Great Depression?

Bank Failures Were Common

During the Great Depression, bank failures surged to unprecedented levels In total, over 9,000 banks failed throughout the decade of the 1930s. It’s estimated that 4,000 banks failed just in 1933 alone. This was partially driven by the stock market crash, which wiped out the assets backing deposits at many banks As more people defaulted on loans or withdrew their deposits, banks became insolvent.

When a bank failed, it often closed its doors with little notice. Depositors would show up to find their bank shuttered, with no way to access their money inside. Any money left in failed banks was essentially lost forever to depositors. There was no FDIC insurance to safeguard deposits at this time.

Depositors Lost Billions in Savings

The bank failures of the Great Depression wiped out savings for millions of Americans It’s estimated that depositors lost around $140 billion through bank failures from 1929 to 1933 This represented the lifetime savings of many families. When a bank failed, its depositors simply lost everything.

Some of the most famous bank runs happened in the early 1930s. In 1930, the Bank of United States experienced a run and collapsed, taking $200 million in deposits down with it. The failure of this prominent New York bank caused fear among depositors, triggering more runs. In 1933, panicked depositors rushed to withdraw their money from Detroit’s two largest banks, First National Bank and the Guardian National Bank of Commerce, leading to failures.

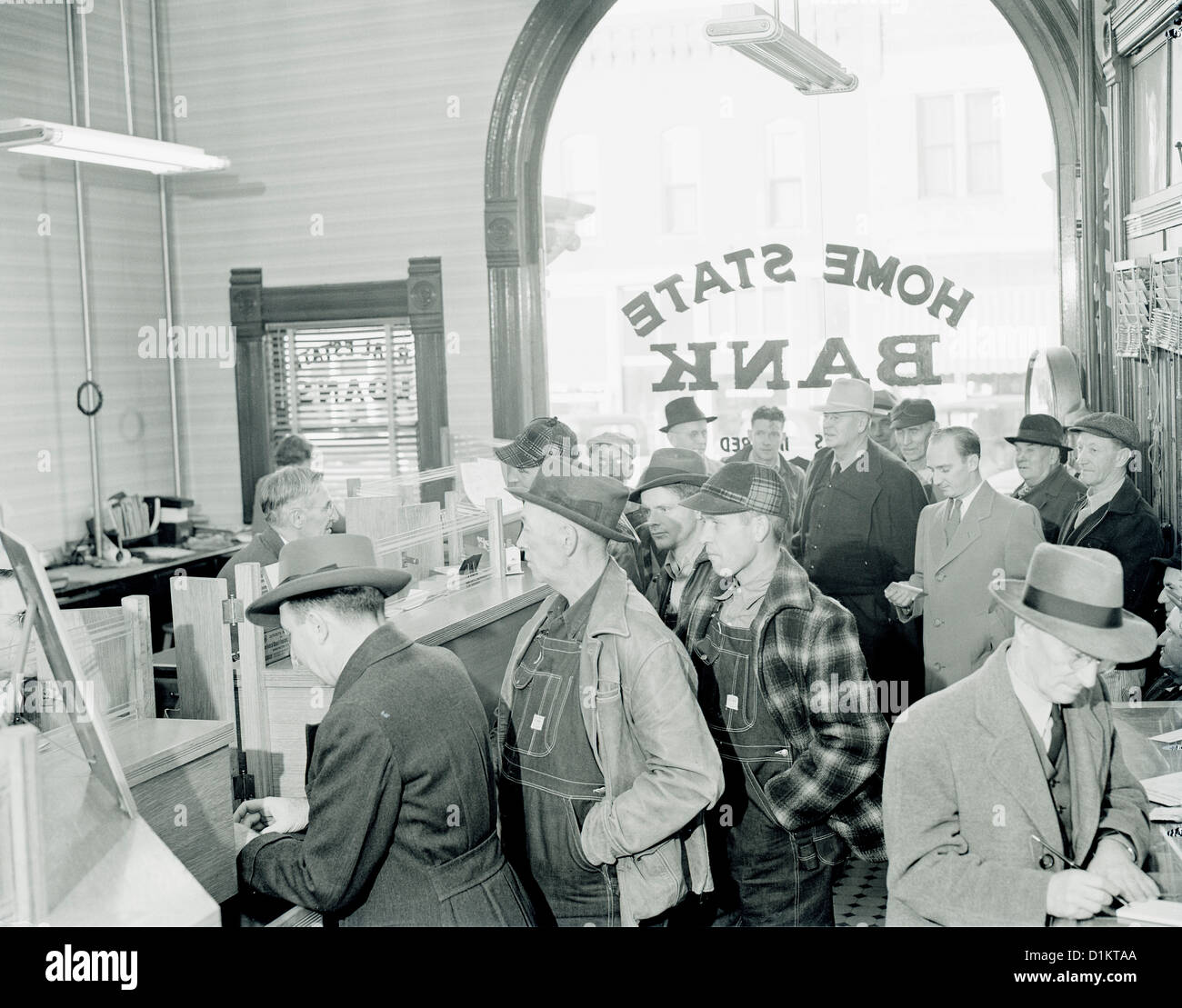

Bank Runs Further Compounded the Crisis

As banks failed during the Depression, it triggered more anxiety among depositors. Nervous depositors rushed to withdraw cash at the first sign of trouble at a bank. But this wave of withdrawals only made conditions worse, pushing more teetering banks into insolvency.

Bank runs further dried up the credit necessary to support businesses and consumers. As banks collapsed, surviving banks became reluctant to lend out any cash. They needed to conserve their limited capital to avoid failure. The loss of billions in deposits and lack of credit crushed spending and business investment, worsening the economic downturn.

Deposit Insurance Was Created to Restore Confidence

In response to the banking crisis, Congress created the FDIC through the Glass-Steagall Act of 1933. Deposit insurance aimed to restore consumer confidence in banks by guaranteeing deposits up to a certain limit. Initially, the insurance limit was $2,500, and later raised to $5,000.

The establishment of deposit insurance effectively ended bank runs. Consumers no longer needed to rush to recover deposits from a struggling bank, since their savings were protected by the FDIC up to the insurance limit. Deposit insurance brought stability to the banking system and remains an essential safeguard today.

How the FDIC Protects You Today

Fortunately, we now have extensive protections in place to prevent another Great Depression-era banking collapse. The FDIC insures bank deposits up to at least $250,000 per depositor today. This means your checking and savings accounts are safe even if the bank fails.

The FDIC directly pays back depositors for any insured funds lost up to the $250,000 limit. It covers all types of bank accounts, including checking, savings, money market, and CDs. When a bank does fail, the FDIC works quickly to reimburse insured deposits within days.

FDIC insurance gives you confidence to keep your funds in an FDIC member bank. You can rely on a safety net up to $250,000 should the bank fail for any reason. Just look for the FDIC member logo when opening a deposit account.

Your Money is Safer Today, But Not Risk-Free

While bank failures are now rare events, they can still happen. Over 500 FDIC insured banks failed during the 2008-2012 financial crisis. And even with FDIC coverage, bank accounts do carry some risk:

-

You may lose access to funds temporarily if the bank fails while the FDIC steps in.

-

Interest rates on savings accounts often lag inflation, reducing the purchasing power of your money over time.

-

There is no FDIC insurance for investment products like stocks and bonds. You can still lose money in brokerage accounts due to market volatility.

So it’s important to diversify your assets and not put all your eggs in one basket. Consider keeping some cash holdings outside of the bank as an emergency fund. And investing some of your wealth can provide higher return potential and inflation protection compared to deposit accounts alone.

Protect Yourself with Smart Savings and Investment Strategies

The banking crisis of the Great Depression taught us an important lesson about safeguarding our hard-earned savings. While banks are safer today thanks to FDIC coverage, there are still steps you can take to protect your money:

-

Keep 3-6 months of living expenses in an emergency fund in a savings account. Look for a high-yield savings account to maximize returns.

-

Consider keeping some cash at home in a safe place to cover immediate expenses in case you lose bank access temporarily.

-

Invest for long-term growth potential and inflation protection. Diversify among stocks, bonds, real estate, and other assets appropriate for your goals and risk tolerance.

-

Check that your bank carries FDIC insurance before opening an account. Credit unions have similar NCUA deposit protection.

-

Split funds between multiple banks to maximize FDIC coverage if you have over $250,000 in cash savings.

-

Read the financial news and your bank’s reports to watch for any emerging signs of trouble. Move your money if stability becomes a concern.

By using smart savings strategies and diversifying your investments, you can protect your hard-earned money. While we can’t predict the next economic crisis, these tips can help safeguard your finances.

What Happens If You Have Both an IRA and a Regular Account?

The FDIC covers different ownership categories separately, meaning your IRA and your regular bank accounts could each get the full $250,000 in coverage. For instance, if you have a CD within an IRA worth $200,000 and a savings account with $100,000 in the same bank, each would be insured up to $250,000. This means, in total, you’d be fully covered for the entire $300,000.

Note that for insurance purposes, all of your IRA deposits are combined. So, if you hold multiple IRAs at the same bank, their balances are added together under the FDIC’s $250,000 limit.

What You Can Do to Stay Safe

If you’re concerned about the security of your savings and retirement funds during an economic downturn, the first thing to do is ensure your accounts are with FDIC-insured banks. This simple step is crucial to protecting your money from bank failures.

Next, consider how you allocate your funds. You can maximize FDIC protection by spreading your deposits across different banks or different ownership categories. Additionally, if you hold IRAs, you might want to evaluate the balance of risk between safer deposits like CDs and riskier investments like stocks.

Last, for those with larger deposits, the use of multiple accounts or banks can help you stay within the insurance limits and protect as much of your savings as possible.

How were Banks Affected by the Great Depression?

FAQ

What happens to your money in the bank during a depression?

The FDIC is your safety net. It insures deposits up to $250,000 per depositor, per bank, for each account ownership category—be it a checking account, savings account, or certificate of deposit (CD). So, in the worst-case scenario where your bank fails, you’ll be reimbursed for any loss of deposits up to that limit.

Where is the safest place for money in a depression?

U.S. Treasury bonds are frequently a go-to investment as they are backed by the U.S. government and offer safety and stability, which can help a portfolio weather a recession. They provide steady interest income, often gain value when stocks decline and play a role as a hedge against equity market volatility.

Is my money safe during a depression?

You won’t lose money in a deposit account during a recession as long as it’s in a federally-insured account and within the limits of the insurance.

Is my money safe if the banks crash?