Ever stared at your investment account wondering if you’re doing this whole “portfolio thing” right? Yeah, me too. When I first started investing, I had no clue what a solid stock portfolio was supposed to look like. Should I buy 100 different stocks? Just stick with S&P 500 index funds? And what the heck is asset allocation anyway?

Let’s break down what actually makes a good stock portfolio without the confusing jargon. By the end of this article, you’ll understand exactly what your investment portfolio should look like based on YOUR specific goals and risk tolerance (not your neighbor’s or that finance guru on TikTok).

What Is an Investment Portfolio Anyway?

Before diving into what makes a “good” portfolio, let’s clarify what we’re talking about. An investment portfolio is basically a collection of all your invested assets—think of it as your financial toolbox containing stocks, bonds, ETFs, mutual funds and other investments.

It’s not actually a physical space (especially now with digital investing), but more of a concept that brings together all your investments under one umbrella. So if you’ve got a 401(k), an IRA, and maybe a regular brokerage account, all those together make up your investment portfolio.

The Foundation: Three Portfolio Models to Consider

When building your portfolio, it helps to have a framework. Here are three common portfolio models based on your risk tolerance:

1. Conservative Portfolio (Income-Focused)

- Composition: Typically 20-30% stocks, 60-70% bonds, 10% cash

- Best for: Retirees or those near retirement, or anyone who needs capital preservation and income

- Characteristics: Lower risk, steady income, modest growth potential

2. Moderate Portfolio (Balanced)

- Composition: About 50-60% stocks, 40-50% bonds, minimal cash

- Best for: Mid-career professionals, those 5-15 years from their financial goals

- Characteristics: Moderate risk and volatility, decent growth potential with reasonable stability

3. Aggressive Portfolio (Growth-Focused)

- Composition: 70-90% stocks, 10-30% bonds, minimal cash

- Best for: Young investors, those with high risk tolerance and long time horizons (10+ years)

- Characteristics: Higher volatility but greater growth potential

Remember, these are just frameworks. Your perfect portfolio might look different based on your personal circumstances.

5 Essential Elements of a Good Stock Portfolio

No matter which model you choose, every good portfolio should have these key elements:

1. Proper Asset Allocation

Asset allocation is fancy finance-speak for how you divide your money between different types of investments. It’s like deciding whether to put your eggs in different baskets, and how many eggs go in each basket.

The classic rule of thumb is to subtract your age from 100 or 110 to determine your stock allocation So if you’re 30, you’d have 70-80% in stocks and 20-30% in bonds. If you’re 60, you’d shift to 40-50% in stocks and 50-60% in bonds.

But rules of thumb don’t always fit everyone, Your allocation should match

- Your time horizon (when you need the money)

- Your risk tolerance (how well you sleep during market crashes)

- Your financial goals (retirement, house down payment, etc.)

2. Diversification Across Different Investments

Diversification means not putting all your money in one place. A well-diversified portfolio might include:

- Different asset classes: Stocks, bonds, perhaps some real estate investments or commodities

- Different sectors: Technology, healthcare, consumer goods, financials, etc.

- Different company sizes: Large-cap, mid-cap, and small-cap companies

- Different geographies: U.S., international developed markets, emerging markets

Think of diversification as your investing insurance policy. When one part of your portfolio struggles, another might shine.

3. Low Overall Costs

This one’s simple but super important! High fees are like termites quietly eating away at your returns. A good portfolio keeps costs low with:

- Low-expense-ratio index funds and ETFs (ideally under 0.2%)

- Minimal trading (to reduce transaction costs and taxes)

- No unnecessary advisory fees unless you’re getting real value

Over decades, even a 1% difference in annual fees can reduce your final portfolio value by 20% or more!

4. Appropriate Risk Level

Your portfolio should let you sleep at night, even during market downturns. If you panic-sell when markets drop, your allocation is probably too aggressive.

I’ve seen friends with 100% stock portfolios who thought they could handle the risk—until their accounts dropped 35% in 2020. Several sold at the bottom, locking in those losses permanently. Ouch!

A good portfolio balances risk and reward based on YOUR comfort level, not what’s theoretically “optimal.”

5. Regular Rebalancing

Markets change, and so will your portfolio’s composition. Over time, some investments will grow faster than others, throwing off your carefully planned asset allocation.

Rebalancing means periodically adjusting your portfolio back to your target allocation. Many experts recommend checking annually or when your allocation drifts more than 5% from your targets.

Building Your Portfolio: Step-by-Step

Now that you know what makes a good portfolio, let’s talk about how to actually build one:

1. Decide if You Want to DIY or Get Help

You have options:

- Do it yourself: Build and manage everything on your own using an online broker

- Robo-advisors: Use automated services like Betterment or Wealthfront that build a portfolio based on your goals

- Financial advisor: Work with a professional for personalized advice (best for complex situations)

For beginners, robo-advisors offer a good balance between convenience and cost.

2. Choose the Right Account Type

Different goals require different account types:

- Retirement goals: 401(k), Traditional IRA, or Roth IRA (tax advantages)

- Short to medium-term goals: Regular taxable brokerage account

- Education: 529 plans or Coverdell ESAs

3. Select Your Investments Based on Your Asset Allocation

Once you’ve determined your asset allocation, you need to choose specific investments. Here are common options:

Stocks

Stocks represent ownership in companies and offer the highest growth potential but also the most volatility. You can invest in individual stocks or through funds.

For most people, I recommend keeping individual stocks to no more than 5-10% of your portfolio unless you truly enjoy researching companies and can stomach the volatility.

Bonds

Bonds are loans to companies or governments and are generally safer than stocks but offer lower returns. They provide income and stability to balance out stock volatility.

Funds

Funds offer instant diversification by holding many investments in one package:

- Index funds: Passively track market indexes like the S&P 500

- ETFs (Exchange-Traded Funds): Similar to index funds but trade like stocks

- Mutual funds: Professionally managed collections of stocks/bonds

For most investors, a portfolio built primarily with low-cost index funds or ETFs offers the best combination of diversification, low fees, and simplicity.

4. Start Investing and Monitor Periodically

Once you’ve set up your portfolio:

- Make regular contributions (ideally automated)

- Rebalance annually or when your allocation drifts significantly

- Adjust your strategy as your life circumstances change

Example Portfolios for Different Investors

To make this concrete, here are example portfolios for different situations:

Young Investor (25-35 years old, retirement focused)

- 80-90% stocks (split between US and international)

- 10-20% bonds

- Example fund allocation:

- 50% Total US Stock Market Index Fund

- 30% International Stock Index Fund

- 20% Total Bond Market Index Fund

Mid-Career Professional (35-50 years old)

- 60-70% stocks

- 30-40% bonds

- Example fund allocation:

- 40% Total US Stock Market Index Fund

- 20% International Stock Index Fund

- 35% Total Bond Market Index Fund

- 5% Cash/Money Market

Near Retirement (50-65 years old)

- 40-60% stocks

- 40-60% bonds

- Example fund allocation:

- 30% Total US Stock Market Index Fund

- 15% International Stock Index Fund

- 40% Total Bond Market Index Fund

- 10% Short-Term Bond Fund

- 5% Cash/Money Market

Common Portfolio Mistakes to Avoid

As I’ve helped friends with their portfolios, I’ve seen these mistakes over and over:

- Chasing past performance – Just because a stock or fund did great last year doesn’t mean it will continue

- Over-concentrating in trendy sectors – Remember when everyone loaded up on tech in 1999? Or crypto in 2021?

- Paying high fees – Actively managed funds rarely outperform their benchmarks after fees

- Emotional buying/selling – Making decisions based on fear or FOMO rather than your plan

- Portfolio neglect – Setting it and completely forgetting it for years without rebalancing

When to Adjust Your Portfolio

A good portfolio isn’t static—it evolves with you. Consider reassessing your portfolio when:

- You reach a new life stage (marriage, children, new job)

- Your time horizon changes (getting closer to retirement)

- Your risk tolerance changes (after experiencing a bear market)

- You have a significant financial change (inheritance, home purchase)

Final Thoughts: There’s No “Perfect” Portfolio

Here’s the secret that most financial advisors won’t tell you: there is no objectively “perfect” portfolio. The best portfolio is one that:

- Helps you reach your financial goals

- Lets you sleep well at night

- Is simple enough that you’ll stick with it

- Has costs low enough to not drag down your returns

I’ve seen people succeed with 100% stock index funds, and I’ve seen others thrive with more conservative 60/40 portfolios. What matters most is having a thoughtful plan and the discipline to follow it through market ups and downs.

Remember, investing is a marathon, not a sprint. Focus on the big picture, stick to your plan during market volatility, and keep your costs low. With these principles in mind, your portfolio will be well-positioned for long-term success.

What does your current portfolio look like? Are there changes you’re considering based on what you’ve learned here? The most important step is simply to start—even an imperfect portfolio that you begin building today is better than a “perfect” one you never get around to creating.

How I Pick My Stocks: Investing For Beginners

FAQ

What is considered a good stock portfolio?

A moderately aggressive strategy would contain 80% stocks to 20% cash and bonds. For moderate growth, keep 60% in stocks and 40% in cash and bonds. A good rule of thumb is to scale back the percentage of stocks in your portfolio and increase the percentage of high-quality bonds as you age.

How much is $1000 a month invested for 30 years?

What is the 3-5-7 rule in stocks?

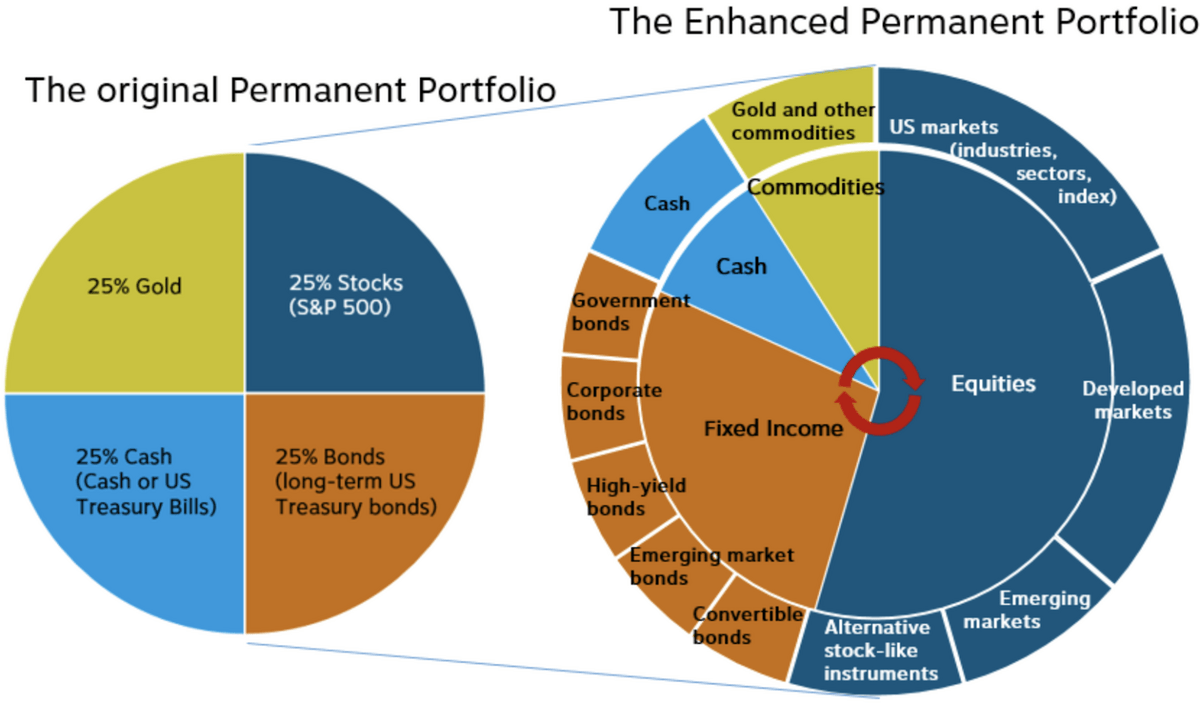

What is a 25 25 25 25 portfolio?