Credit scores are calculated based on the contents of your credit reports, which may include your payment history, credit utilization, credit mix, and more. Credit scores are important because they are designed to indicate your credit risk, or how likely you are to pay your bills on time and can affect everything from renting an apartment to getting a car loan.

However, its also important to know that you dont only have one credit score — there are different scoring models that lead to different numbers, and the three nationwide credit reporting agencies or CRAs (Equifax®, Experian®, and TransUnion®) will also often show slightly different scores based on which information is reported to them by your lenders.

One score model is the VantageScore, which is the only “tri-bureau” credit scoring model available at all three nationwide credit reporting agencies. Created in 2013, this model ranges from 300 to 850, with a higher score indicating a lower risk for lenders.

VantageScore 3.0 is a popular credit scoring model available at all three of the major credit reporting agencies. Each CRA uses the same formula created by VantageScore, but bases the information it measures on your unique credit file with each organization. This means that, because your credit files often differ between reporting agencies, your VantageScore 3.0 may look slightly different from one credit reporting agency to another. Each nationwide bureau using this one credit score model is a unique aspect of VantageScore and leads to more consistency across bureaus than other models.

Understanding credit scores is an important part of managing your finances. One of the main credit scoring models is the VantageScore, which uses a scale from 300 to 850. But what does a 30 VantageScore in particular signify?

In this comprehensive guide, we’ll break down what a score of 30 means, how the VantageScore model works, and steps you can take to improve a low credit score.

Overview of VantageScore Credit Scoring Models

VantageScore is a credit scoring model developed jointly by the three major credit bureaus – Experian, Equifax, and TransUnion. There have been several iterations of the VantageScore model over the years:

- VantageScore 1.0: Launched in 2006, score range from 501 to 990.

- VantageScore 2.0: Launched in 2010, score range from 501 to 990.

- VantageScore 3.0: Launched in 2013, score range from 300 to 850. This is the most commonly used model currently.

- VantageScore 4.0: Launched in 2017, score range from 300 to 850. Includes machine learning capabilities.

As you can see, VantageScore 3.0 first established the now standard 300 to 850 score range that most models use. The score is calculated based on factors like payment history, credit history age and mix of credit types, credit utilization, and recent credit behaviors.

What Does a Score of 3.0 Mean?

Now that we know some background, what does a 3.0 score actually mean?

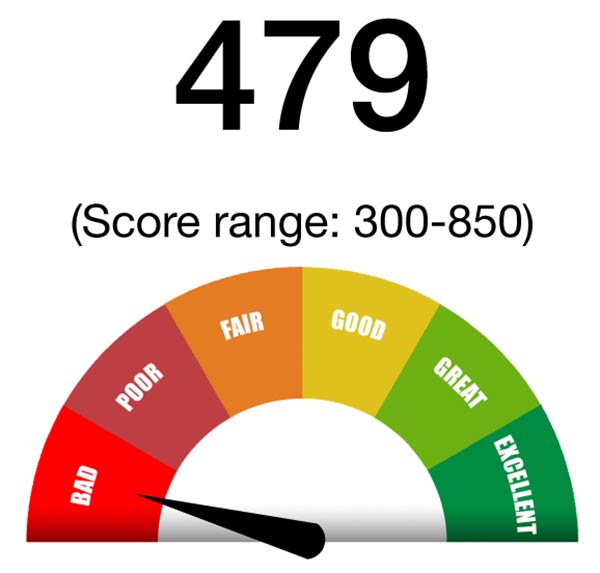

Within the VantageScore 3.0 model, credit scores from 300 to 499 are considered “very poor.” This indicates serious issues with your credit history and accounts.

A score of 3.0 specifically falls at the absolute bottom of the very poor range. It signals major derogatory marks, a lack of diverse credit accounts, high balances and missed payments.

While not impossible to recover from, a score this low presents some significant challenges in accessing credit. Most lenders will view applicants in this range as very high risk.

Key Reasons for a Very Low VantageScore

There are a variety of factors that can contribute to a VantageScore as low as 3.0. Here are some of the most common:

-

Bankruptcies, foreclosures, and other public records: Major negative public records like bankruptcies can significantly lower your score.

-

High credit utilization: Maxing out cards and maintaining high balances compared to your limits damages your score.

-

Late payments and collections: Even one missed payment can ding your score. Multiple late payments or unpaid collections tank it.

-

Short credit history: Scores below 3.0 often indicate a complete lack of any credit history. Building history takes time.

-

High rate of new accounts: Opening many new accounts in a short period signals risk and lowers your score.

-

High number of inquiries: Too many hard credit checks when applying for credit accounts or loans can lower your VantageScore.

Improving an Extremely Low Credit Score

Recovering from a VantageScore as low as 3.0 takes time and discipline. But it can be done with some prudent steps:

-

Pay all bills on time. Set up autopay on accounts whenever possible. Even one late payment can undo progress.

-

Lower credit utilization. Get balances well below 30% of your credit limits, with lower being better.

-

Avoid new accounts and inquiries. Give your score time to recover before applying for more credit.

-

Check for errors on your credit reports. Dispute any incorrect negative information dragging down your score.

-

Consider credit counseling. Non-profit counseling agencies can help analyze your situation and provide guidance.

-

Practice healthy credit habits. Using credit cards responsibly and budgeting will help over time.

-

Let negative information age. As black marks like late payments get older, they have less impact on your score.

Rebuilding from a score of 3.0 will take diligence across many years. But taking the right steps can set you on the path to creditworthiness again. Be patient and focus on developing consistently healthy habits.

Key Takeaways

-

VantageScore 3.0 credit scores range from 300 to 850. Scores 300-499 are considered “very poor”.

-

A 3.0 score is at the absolute bottom of the very poor range, signaling major issues with credit history.

-

Late payments, collections, bankruptcies, high utilization, and lack of credit history are common reasons for such low scores.

-

Raising your score from 3.0 will take years of on-time payments, lower utilization, credit counseling, and avoiding new accounts.

Understanding why your VantageScore credit score is so low is the critical first step toward rehabilitation. With time and discipline, you can rebuild your credit health. Focus on consistently demonstrating responsible behaviors, and your score will gradually improve over time.

How VantageScore 0 Is Calculated

There are six categories that go into calculating your VantageScore — payment history, credit utilization, age and type of credit history, the amount you owe and recent credit behavior — and each carries a different level of influence when determining your score.

- Payment history (extremely influential). Your payment history, or how consistently you are paying your bills on time, is the biggest factor in your credit score. Because payment history is such an important piece, late or missed payments can have a significant overall impact on your credit score.

- Credit utilization (highly influential). Credit utilization, the percentage of your credit limits youre using, is ranked as highly influential in your VantageScore 3.0. Lenders often like to see a utilization rate at or below 30 percent, meaning you are only using about 30 percent of your available credit at any given time.

- Credit age and mix (highly influential). The length of your credit history and your mix of credit accounts is another highly influential factor in this score. Lenders generally want to see long-term, established lines of credit that indicate a responsible borrower. Having a variety of account types with solid payment history, like credit cards, student loans, or a mortgage, is also attractive for lenders and will go into calculating your score.

- The amount you owe (moderately influential). The amount you owe, or your account balances, refers to the amount of recently reported balances on your credit accounts. Its typically best to pay off all your balances on a monthly basis, if possible, to keep the amount you owe low and show lenders that you are able to make on-time payments.

- Your recent credit behavior (less influential). Though your recent credit behavior is less influential than some of these above categories, its still important. Recent behavior may include credit inquiries, an application for a new credit card or taking out a personal loan, all of which can shine a light on your credit behavior.

- Your available credit (less influential). Your available credit refers to how much credit you have that you are not using. This is used as part of your credit score because lenders may want to see that you are only using the credit that you need.

You can sign up for a monthly free VantageScore 3.0 credit score as part of Equifax Core Credit™ – no credit card required. A VantageScore is one of many types of credit scores.

VantageScore vs FICO – Credit Score Ranges (EXPLAINED)

FAQ

Is a 3.0 VantageScore good?

A good credit score falls in the range of 661 to 780 for the VantageScore® 3.0 model. A good credit score is the result of consistent good habits, like making your payments on time and keeping your credit balances low. Your credit score can change when information is updated, added or removed from your credit report.

How do I convert my VantageScore 3.0 to FICO Score?

There is no official method of converting a Vantage Score to a FICO Score. Each scoring model uses different criteria and methods of pulling credit reports data; it’s nearly impossible to convert. However, keeping both scores in mind can give you a much more well-rounded understanding of your credit reports health.

Why is my Vantage 3.0 score higher than FICO?

VantageScore’s credit scores aren’t necessarily higher than FICO’s scores. VantageScore and FICO scores may differ, because they use different scoring models. Scores are also dependent on the information used to calculate them and when they’re calculated.

How rare is an 800 credit score?

An 800 credit score is relatively rare, with approximately 23% of Americans achieving this “exceptional” FICO score range (800-850), according to The Motley Fool.