Your credit card account comes with a preset spending limit: your credit limit. Credit card issuers generally offer you a credit limit they believe you can repay, based on your income and credit history. Understanding how your credit limit works may help you manage your credit card responsibly and qualify for a higher limit in the future.

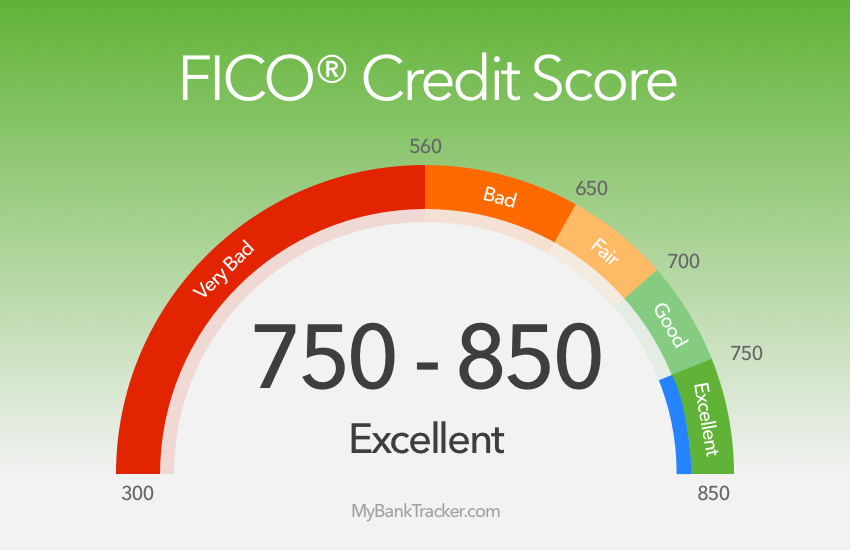

Achieving a credit score of 750 is a major milestone This score unlocks access to the best interest rates and highest credit limits But how high can your credit limit go with a 750 score? Let’s explore the secrets to maximizing your credit potential,

What Factors Determine Your Credit Limit?

While your 750 credit score is a key component, lenders consider other variables too:

-

Income – Higher income indicates greater ability to repay debt, This helps justify higher credit limits

-

Existing Debt – Too much current debt makes lenders cautious about extending additional credit. Keep debt low to boost chances of a higher limit.

-

Payment History – Consistent, on-time payments prove financial responsibility. This strengthens your case for a higher limit

-

Credit History Length – Longer credit histories provide more data to evaluate risk. This may support a higher limit.

-

Credit Utilization – Lower utilization ratios signal responsible credit management. Lenders reward this with higher limits.

-

Card Type – Premium travel cards tend to offer higher minimum limits, like $10,000 for the Chase Sapphire Reserve®.

Estimating Your Limit Range

With a 750 score, expect initial credit limits between $1,000 – $15,000. But the upper limit could be far higher through credit line increases.

For premium cards, approved borrowers frequently report starting limits of $10,000 – $20,000. This initial limit provides a foundation to build on.

Strategies to Reach Your Maximum Limit Potential

Follow these tips to keep climbing towards your peak credit limit:

-

Boost income through promotions, side hustles, or a new job. Higher income supports larger credit lines.

-

Pay down balances to lower your debt-to-income ratio. This frees up borrowing capacity for higher limits.

-

Maintain perfect payment history through auto-pay and diligent monitoring. On-time payments are crucial.

-

Keep credit utilization low, ideally below 30%. Demonstrate responsible credit management.

-

Request credit line increases after 6 months or more of on-time payments.

-

Apply for premium travel cards that offer higher minimum starting limits.

-

Improve your credit by disputing errors on your credit reports. Excellent scores support the highest limits.

With patience and responsible credit habits, your limits can steadily rise over time. Aim high, but 750 already provides exceptional access to credit. Enjoy the journey!

Frequently Asked Questions

What is the typical credit limit for a 750 credit score?

With a 750 score, expect initial credit limits between $1,000 – $15,000. Approved borrowers for premium cards often report starting limits of $10,000 – $20,000.

What factors allow for a higher credit limit?

Higher income, lower debt, perfect payment history, long credit history, low utilization ratio, and excellent credit scores help justify higher credit limits to lenders.

How can I increase my chances of getting a high limit?

Strategies include increasing income, paying down balances, maintaining on-time payments, requesting credit line increases after 6+ months of responsible use, and applying for premium travel cards.

Is there a credit card that offers guaranteed high limits?

No card guarantees a high limit, but premium travel cards like the Chase Sapphire Reserve have high published minimum limits starting at $10,000.

How much income do I need for a high limit card?

There’s no set income threshold, but you’ll likely need at least a $60,000 – $100,000 yearly income to qualify for premium cards with higher starting limits.

What credit utilization ratio helps get a high limit?

Ideally keep your credit utilization ratio below 30%. The lower your utilization, the better for qualifying for higher limits.

How long does it take to get a high limit?

It takes time to build credit and qualify for higher limits. Expect at least 6 months, but often 1+ years of responsible card use to earn significant credit line increases.

What if I get a lower limit than I expected?

If approved for a lower limit than hoped for, continue practicing good credit habits. After 6+ months, you can request an increase. Your limit will rise over time.

Scoring 750 is a monumental achievement. Use these strategies to fully capitalize on your credit potential. With prudent financial habits, the sky’s the limit – your limits can steadily climb higher. The rewards of financial responsibility await.

What happens if you go over your credit limit?

Depending on the terms of your cardmember agreement, your credit card issuer may charge you a fee for going over your limit, or the transaction may be declined.

Personal income and monthly expenses

Your income and housing costs may help determine your credit limit. If an applicant has a high income with a relatively low rent or mortgage, they may have more financial flexibility to manage credit card debts. Thus, they may qualify for a higher spending limit, depending on other factors.