Understanding Beta in Simple Terms

Beta, that mysterious Greek letter (β) that often shows up when you’re researching stocks, isn’t just a fancy financial term. It’s actually a powerful tool that can help you make smarter investment decisions. As someone who’s been navigating the investment world for years, I’ve found that understanding beta can be a game-changer for both new and experienced investors.

So what exactly does beta mean? In its simplest form beta measures how volatile a stock is compared to the broader market. The market (usually represented by the S&P 500) always has a beta of 1.0. When a stock has a beta higher than 1.0, it means it’s more volatile than the market. A beta lower than 1.0 indicates it’s less volatile.

But there’s so much more to this concept than just a number! Let’s dive deeper into what beta really means for your investment strategy

How Beta Actually Works in Practice

When I first learned about beta, I struggled to understand how it applied to real-world investing. Here’s what I’ve learned:

Beta essentially describes how a stock’s returns respond to market swings. It’s calculated using regression analysis, which looks at the relationship between a stock’s returns and the market’s returns over time.

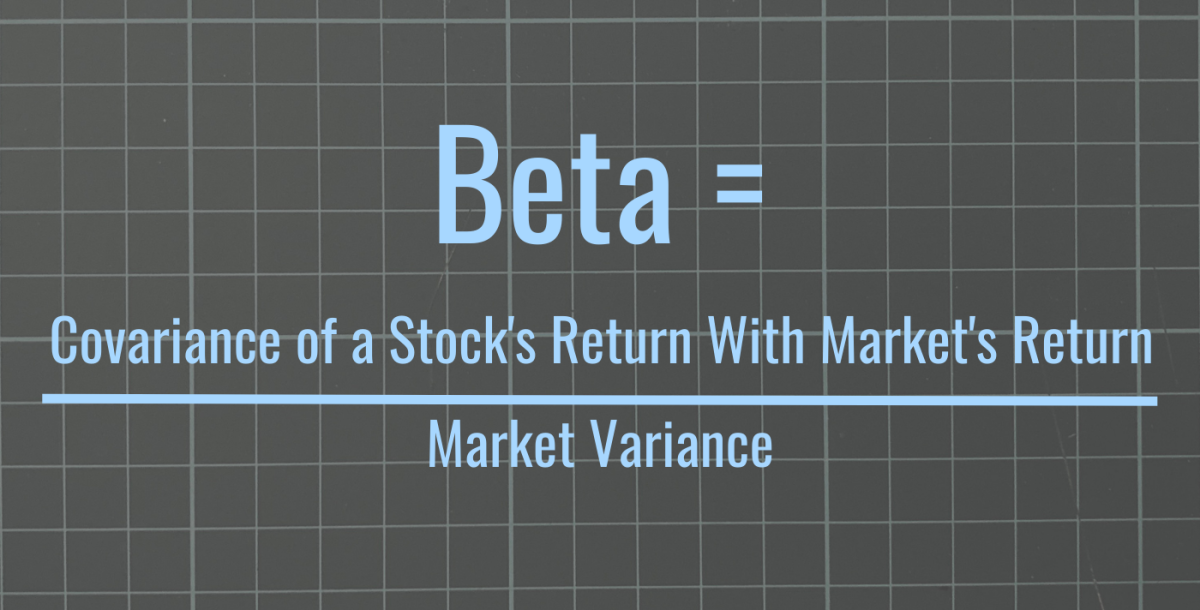

The formula looks like this:

Beta coefficient (β) = Covariance(Re, Rm) / Variance(Rm)Where:

- Re = return on individual stock

- Rm = return on overall market

- Covariance = how changes in stock returns relate to market returns

- Variance = how far market data points spread from average value

Don’t worry if math isn’t your thing! The good news is you don’t need to calculate beta yourself. You can find the current beta of any stock on most financial websites and stock trading platforms.

Beta Values and What They Mean

Understanding what different beta values actually tell you is crucial for making informed investment decisions:

| Beta Value | What It Means | Example |

|---|---|---|

| Beta = 1.0 | Stock moves exactly with the market | If S&P 500 rises 2%, stock rises 2% |

| Beta > 1.0 | Stock is more volatile than the market | If beta is 1.5 and market rises 2%, stock rises 3% |

| Beta < 1.0 | Stock is less volatile than the market | If beta is 0.5 and market rises 2%, stock rises 1% |

| Negative Beta | Stock moves opposite to the market | If beta is -1.0 and market rises 2%, stock falls 2% |

Tech stocks typically have higher betas, while utility stocks often have lower betas. Gold miners and some specialized ETFs might even have negative betas.

Real-World Applications: How Investors Actually Use Beta

In my experience, beta is most useful in these key areas:

1. Risk Assessment

Beta helps me gauge how much risk a stock might add to my portfolio. If I’m already heavily invested in high-beta stocks, adding another might increase my portfolio’s volatility beyond my comfort level.

2. Portfolio Diversification

I often use beta to ensure I have a mix of high and low beta stocks. This helps balance my portfolio’s risk profile.

- High-beta stocks (β > 1.0): Offer potential for greater returns but with increased risk

- Low-beta stocks (β < 1.0): Provide more stability but potentially lower returns

3. Market Timing Strategy

During bull markets, I might lean toward higher-beta stocks to maximize returns. When I anticipate market downturns, I tend to shift toward lower-beta stocks to minimize losses.

4. Performance Expectations

Beta helps set realistic expectations. If a stock has a beta of 1.5 and the market is up 10% for the year, I might expect the stock to be up roughly 15% (though this isn’t guaranteed).

The Limitations of Beta You Should Know About

I’d be doing you a disservice if I didn’t mention the shortcomings of beta:

-

Based on historical data: Beta is calculated using past performance, which doesn’t guarantee future results.

-

Assumes normal distribution: The theory assumes stock returns follow a normal statistical distribution, which isn’t always true in real markets.

-

Time-dependent: A stock’s beta changes over time as company fundamentals and market conditions evolve.

-

Not effective for long-term investment: Beta is more useful for short-term risk assessment than for evaluating long-term investment potential.

-

Doesn’t consider fundamentals: Beta ignores company-specific factors like earnings growth, management quality, and competitive advantages.

Balancing Beta in Your Portfolio: My Approach

When building my own portfolio, I don’t rely solely on beta, but I definitely use it as one important factor. Here’s my strategy:

For Conservative Investors

If you’re risk-averse (like my parents are), consider weighting your portfolio toward low-beta stocks (β < 1.0). Utilities, consumer staples, and large established companies often have lower betas and provide more stability.

For Aggressive Investors

If you’re comfortable with volatility and seeking growth (which I was in my 20s), higher-beta stocks (β > 1.5) in sectors like technology and emerging markets might align with your goals.

For Balanced Investors

Most of us fall somewhere in between. I personally aim for a mix of:

- 50-60% medium-beta stocks (β between 0.8 and 1.2)

- 20-30% low-beta stocks (β < 0.8)

- 10-20% high-beta stocks (β > 1.2)

This approach helps me participate in market growth while managing downside risk.

Beta vs. Other Risk Measures

Beta isn’t the only way to assess investment risk. I often use it alongside these other measures:

- Alpha: Measures a stock’s performance compared to its expected return based on beta

- Standard Deviation: Shows how much a stock’s returns vary from its average return

- Sharpe Ratio: Evaluates risk-adjusted performance

- R-squared: Indicates how closely a stock’s movement correlates with its benchmark

Using these measures together gives me a more complete picture of risk than beta alone.

Practical Examples of Beta in Action

Let’s look at how beta might play out with different types of investments:

Example 1: Technology Stock (β = 1.8)

If the market rises 10%, this stock might be expected to rise about 18%.

If the market falls 10%, this stock might be expected to fall about 18%.

Example 2: Utility Stock (β = 0.6)

If the market rises 10%, this stock might be expected to rise about 6%.

If the market falls 10%, this stock might be expected to fall about 6%.

Example 3: Gold Mining Stock (β = -0.2)

If the market rises 10%, this stock might be expected to fall about 2%.

If the market falls 10%, this stock might be expected to rise about 2%.

Remember, these are statistical expectations, not guarantees. Individual stocks can behave differently based on company-specific news and other factors.

Common Questions About Beta

During my investing workshops, I get lots of questions about beta. Here are the most common ones:

Is a high beta good or bad?

Neither! It depends on your investment goals and risk tolerance. High beta means higher potential returns but also higher risk.

Does beta predict future performance?

No, beta only measures past volatility relative to the market. It doesn’t predict future returns or even future volatility with certainty.

Should I avoid high-beta stocks?

Not necessarily. High-beta stocks can be appropriate for certain portions of your portfolio, especially if you have a long time horizon and can tolerate volatility.

Can beta be negative?

Yes! A negative beta means the stock tends to move in the opposite direction of the market. Gold miners sometimes have negative betas, as do some specialized ETFs designed to perform inversely to market movements.

How often should I check a stock’s beta?

Beta values change over time, so I recommend checking them quarterly or when significant company or market changes occur.

Tips for Using Beta in Your Investment Strategy

After years of incorporating beta into my investment decisions, here are my top tips:

-

Use beta as one factor, not the only factor. Company fundamentals and growth prospects matter too!

-

Consider your time horizon. Beta matters more for short-term investments than for long-term holdings.

-

Look at beta in context. A high-beta stock in a stable industry might be less risky than a lower-beta stock in a rapidly changing sector.

-

Check the benchmark. Make sure the beta you’re looking at uses a relevant benchmark. A small-cap stock’s beta should ideally be measured against a small-cap index.

-

Combine with other metrics. Use beta alongside other risk measures for a more complete picture.

The Bottom Line on Beta

Beta is a useful tool that helps me understand how volatile a stock might be compared to the broader market. While it has limitations and shouldn’t be the only factor in investment decisions, it provides valuable insight into potential risk.

For my investment strategy, I’ve found beta most helpful when:

- Assessing how a new stock might affect my portfolio’s overall risk profile

- Balancing high and low-beta investments across different market sectors

- Adjusting my holdings based on my current risk tolerance and market outlook

Remember, successful investing isn’t about avoiding risk entirely—it’s about understanding and managing risk appropriately for your specific goals. Beta is one important tool that helps me do exactly that.

Whether you’re just starting out or you’re an experienced investor, understanding what beta means can help you make more informed investment decisions and build a portfolio that aligns with your risk tolerance and financial goals.

Do you use beta when making investment decisions? I’d love to hear your thoughts and experiences!

Articles Related to beta

“Beta.” Merriam-Webster.com Dictionary, Merriam-Webster, https://www.merriam-webster.com/dictionary/beta. Accessed 9 Nov. 2025.

Examples of beta in a Sentence

Middle English betha, from Latin beta, from Greek bēta, of Semitic origin; akin to Hebrew bēth beth First Known Use

14th century, in the meaning defined at sense 1

1862, in the meaning defined at sense 1 Time Traveler