Liquid investments, like money market accounts and treasury notes, are beneficial for those needing immediate funds. These are generally low-risk investments, offering stable returns.

Choosing between liquid and illiquid investments, or creating a balanced blend of both, can affect an investors portfolios flexibility and profitability. So, understanding liquidity is essential to making informed investment decisions.

This article will explore in detail: which investment has the least liquidity and discuss the pros and cons of liquid and illiquid investments.

Liquidity is the capability of swiftly converting an investment into cash without disrupting its market price. It significantly impacts an investments risk profile and potential returns, influencing crucial investment decisions.

Market conditions and the nature of the asset often dictate the liquidity of an investment. Liquid assets, such as stocks traded on major exchange applications or the stock market, typically have high liquidity. It is because of their high trading volume and short time to sell. Liquidity in investments is measured primarily by trading volume and time to sale. Assets that can be sold quickly are deemed good liquid investments.

Trading volume signifies the volume of shares or contracts that are actively bought and sold on the market. Highly liquid investments with an ample trading volume indicate that the investment can be easily bought or sold without significantly affecting its market price.

The volume of accessible funds in a specific market determines liquidity. Greater availability of funds signifies more options for potential buyers and sellers, fostering a more liquid market.

The number of active participants also impacts the liquidity of funds. A market with a larger pool of potential buyers and sellers encourages robust competition. Competition not only ensures competitive pricing but also tightens the bid-ask spread, which is an indication of improved liquidity. The enhanced competition also results in rapid order execution, a critical market value, and liquidity measure.

Different asset classes have varied levels of liquidity. Stocks and bonds typically have high liquidity. Policies and regulatory environment can also affect liquidity. The accessibility and transparency of money market information is another critical determinant of liquidity. With reliable and current data about an asset or security, investors are empowered to make more informed decisions.

Information access can aid in identifying investments that are viable liquid assets or the least liquid assets. In a scenario with limited information, investors might be wary of trading security, adversely impacting an investments liquidity.

Assets with shorter time horizons, time to sell, or high trading volume generally mean higher liquidity. Numerous financial platforms analyze commodities, stocks, currencies, and other investments in real-time. They also provide live data on bid-ask spreads and other liquidity indicators.

A well-structured financial ecosystem with transparent market information significantly boosts liquidity. It enables investors to discern which investment carries the least liquidity. Thus, information is instrumental in making sound low-risk investment decisions.

Have you ever wondered why some investments are harder to cash out than others? I’ve been exploring the world of investment liquidity recently, and it’s fascinating how some assets can be so valuable yet so difficult to convert to cash when you need it.

In this comprehensive guide, I’ll walk you through the most illiquid investments in the market today, why they’re considered illiquid, and what that means for your portfolio strategy.

What Exactly is Liquidity in Investments?

Before diving into the least liquid assets, let’s clarify what we mean by “liquidity.” Simply put, liquidity refers to how quickly and easily an investment can be converted to cash without significantly impacting its market price.

When I talk about a “liquid” investment, I’m talking about something you can sell rapidly without losing much of its value in the process. On the flip side, “illiquid” investments take longer to sell and might require accepting a lower price to find a buyer quickly.

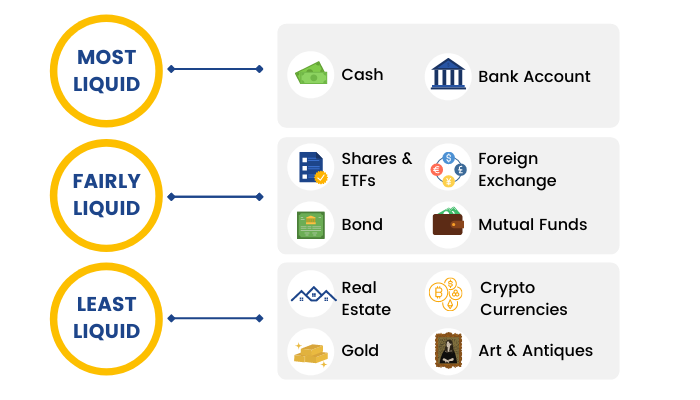

Liquidity isn’t just a yes-or-no quality—there’s actually a whole spectrum from extremely liquid (like cash itself) to extremely illiquid (like some of the investments we’ll discuss below).

Factors That Affect Investment Liquidity

Several key factors determine how liquid an investment is

- Trading volume – How many units are bought and sold daily

- Time to sell – How long it takes to complete a transaction

- Market conditions – Overall economic environment

- Number of active participants – How many buyers and sellers exist

- Accessible funds – Available capital in the market

- Type of asset class – Different asset types have inherent liquidity characteristics

- Regulatory environment – Rules that might restrict sales

- Market information access – Transparency about the investment

The Least Liquid Asset: Direct Ownership in Private Companies

After reviewing multiple sources, I can confidently say that direct ownership in private companies is generally considered the least liquid investment When you own shares in a private business, there’s typically no readily available market to sell your shares

Even if you find a potential buyer, the transaction can take months to process due to:

- Limited pool of potential buyers

- Complex valuation processes

- Lengthy due diligence requirements

- Potential regulatory restrictions

- Contractual limitations on transfers

Unlike publicly traded stocks where you can sell with a click, private company stakes often require finding someone who specifically wants to invest in that particular business—and who’s willing to pay what you think it’s worth.

Other Extremely Illiquid Investments

Beyond private company ownership, several other investments rank extremely low on the liquidity spectrum:

1. Private Equity Investments

Private equity funds typically lock up investor capital for 5-10 years or more. These funds invest in private companies with the goal of improving and eventually selling them, which takes considerable time.

The minimum investment is often in the millions, making private equity predominantly accessible to institutional investors and high-net-worth individuals. While returns can be substantial, your money is essentially inaccessible during the lock-up period.

2. Venture Capital

As a subset of private equity, venture capital investments in startups are highly illiquid. Success typically depends on an exit strategy through an IPO or acquisition by a larger company, which can take many years—if it happens at all.

The uncertainty and long timeframe make venture capital among the least liquid investment options available.

3. Real Estate

While more liquid than private company ownership, real estate still ranks very low on the liquidity spectrum. Selling property involves:

- Finding a buyer (which can take months or years in slow markets)

- Negotiating price and terms

- Conducting inspections

- Navigating legal paperwork

- Closing procedures

The process is time-consuming, and you can’t sell just a portion of a property if you need only some of your investment back. Location and market conditions dramatically affect how quickly you can sell, with properties in less desirable areas potentially taking years to move.

4. Art and Collectibles

Investing in art, antiques, rare coins, or other collectibles means entering a niche market where liquidity depends entirely on finding the right buyer who appreciates the specific item’s value.

The market for these items is unpredictable and subjective, with values fluctuating based on trends and collector interest. Finding buyers often requires specialist auctions or dealers, making these assets particularly difficult to convert to cash quickly.

Other Notable Illiquid Investments

While not quite as illiquid as those mentioned above, these investments also present significant liquidity challenges:

5. Hedge Funds

Many hedge funds impose “lock-up” periods during which investors cannot withdraw their money. These periods typically range from one to three years, though some can be longer.

Even after the lock-up period, withdrawals might only be permitted at specific intervals (quarterly or annually) and with advance notice.

6. Certificates of Deposit (CDs)

While CDs are considered low-risk, they’re designed to be held until maturity. Early withdrawal typically triggers penalties that can significantly reduce your returns.

7. Limited Partnership Interests

These investments often provide tax benefits and potentially high returns but come with restrictions on when and how an investor can exit the partnership.

8. Retirement Accounts

While the investments within retirement accounts might be liquid, accessing funds from accounts like 401(k)s and IRAs before retirement age typically results in penalties and additional tax liabilities.

The Pros and Cons of Illiquid Investments

Before you run away from illiquid assets completely, it’s worth considering their potential benefits:

Benefits of Illiquid Investments:

- Potentially higher returns: Illiquid investments often provide an “illiquidity premium”—higher potential returns to compensate investors for tying up their capital

- Reduced volatility: Less frequent trading can mean less price fluctuation

- Portfolio diversification: These investments often behave differently from traditional market securities

Risks of Illiquid Investments:

- Difficulty accessing your money: You can’t quickly convert to cash in emergencies

- Pricing challenges: Without frequent transactions, it’s harder to know the true market value

- Potential for forced sales at a loss: If you must sell quickly, you might have to accept a much lower price

How to Manage Liquidity Risk in Your Portfolio

If you’re considering illiquid investments, here are some strategies I recommend:

- Understand your financial situation and risk tolerance: Be honest about your current and future financial needs

- Diversify across the liquidity spectrum: Balance liquid and illiquid investments appropriately

- Maintain an emergency fund: Keep enough liquid assets to cover unexpected expenses

- Consider your investment timeline: Match investment liquidity with your time horizon

- Seek professional advice: Financial advisors can help create a well-diversified portfolio aligned with your goals

Bottom Line: Which Investment Should You Choose?

The “right” level of liquidity depends entirely on your personal financial situation, goals, and risk tolerance. While direct ownership in private companies might be the least liquid asset class, that doesn’t make it a bad investment—just one that requires careful consideration.

For most investors, I recommend a balanced approach with some highly liquid investments (like publicly traded stocks and bonds) alongside some less liquid options that offer potential for higher returns.

Remember, every investment decision involves trade-offs. Understanding where your investments fall on the liquidity spectrum is just one piece of creating a successful portfolio that helps you reach your financial goals.

Have you invested in illiquid assets? What has your experience been like? I’d love to hear your thoughts in the comments!

Low Trading Volume Securities

Securities with low trading volume, often associated with smaller companies or less popular stocks, can be low-liquidity investments. The lack of buyers and sellers can lead to significant price swings.

Commodity investments can range from a relatively liquid futures contract to physical commodities, which can be harder to sell quickly due to logistical factors.

Treasury notes, also known as treasury inflation-protected securities, are medium-term securities issued by the government. They are less liquid than savings bonds and other investments because the long maturity period ranges from two to 10 years. However, they are considered one of the best low-risk investments due to government backing.

The Benefits And Risks Of Illiquid Investments

Illiquid investment opportunities come with challenges. However, they can be robust investing strategies for investors when used judiciously and in line with an individuals financial goals and risk tolerance.

Lets discuss some key advantages and risks associated with low liquidity investments.

Most liquid assets and least liquid assets

FAQ

Which asset is the least liquid?

- Cash in a savings account (the most liquid)

- Publicly-traded stocks.

- Corporate bonds.

- Mutual funds.

- Exchange-traded funds.

- Assets like real estate, private equity, and collectibles (the least liquid)

What are low liquidity assets?

Less liquid assets, also called illiquid assets, are those that are not easily or quickly converted into cash. Examples include real estate, collectibles, private equity, and certain business equipment or inventory. Selling these assets often requires more time, effort, and may result in a lower price if a quick sale is needed.

What investment has the least liquidity?

What is the minimum liquid asset?

Minimum Liquidity refers to the minimum amount of liquid assets that an individual, company, or financial institution must maintain to ensure they can meet short-term obligations and continue operations without financial strain.