Mutual funds have become a go-to investment vehicle for millions of people. They’re popular, accessible, and seem like a safe bet for beginners. But here’s the thing – they aren’t as risk-free as many believe. I’ve been researching investment options for my portfolio lately, and what I discovered about mutual fund risks was eye-opening.

In this article, I’ll walk you through what mutual funds are and the various risks they carry. Whether you’re a newbie investor or someone with experience, understanding these risks is crucial before you put your hard-earned money into any mutual fund.

What Are Mutual Funds, Anyway?

Before diving into the risks, let’s quickly cover what mutual funds actually are.

A mutual fund is an investment vehicle that pools money from many investors to purchase a collection of stocks, bonds or other securities. These funds are managed by professional investment advisers registered with the SEC (Securities and Exchange Commission).

When you invest in a mutual fund you’re essentially buying a small piece of a large diversified portfolio. Each share represents partial ownership of the fund’s holdings and the income those investments generate.

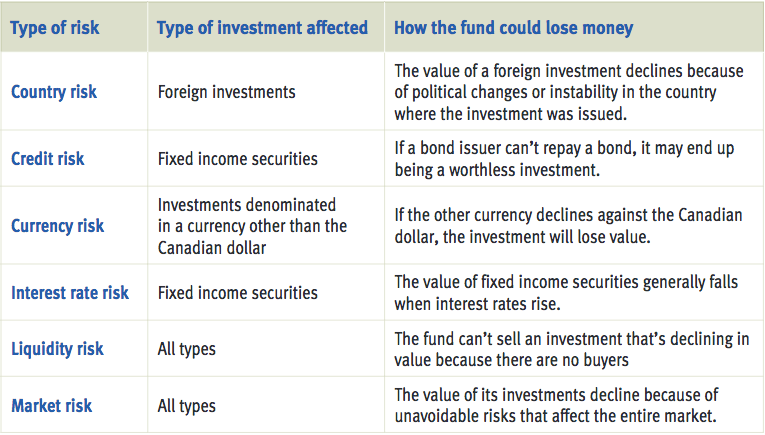

The Major Risks of Mutual Funds You Can’t Ignore

Despite their popularity, mutual funds come with several significant risks that every investor should understand. Let’s break them down:

1. Market Risk

This is the biggie that affects virtually all mutual funds. You may lose some or all of the money you invest because the investments held by a fund can go down in value When the overall market declines, most mutual funds will feel the impact.

For example, during the 2008 financial crisis, even well-managed mutual funds saw massive losses as the entire market crashed. Some stock-based mutual funds lost 30-40% of their value in just a few months!

Market risk can’t be eliminated through diversification because it affects the entire market. It’s just part of the investment landscape we have to accept.

2. Interest Rate Risk

This particularly affects bond funds. When interest rates rise, bond prices typically fall. If you own a bond fund during periods of rising interest rates, you might see your investment value decline.

Let me give you an example: In 2022, as the Federal Reserve aggressively raised interest rates to combat inflation, many bond funds experienced double-digit losses. This surprised many conservative investors who thought bond funds were “safe” investments!

3. Credit Risk

Bond and money market funds are exposed to credit risk – the possibility that the issuers of the bonds held in the fund might default on their debt obligations.

If a company whose bonds are held by your mutual fund goes bankrupt, the fund’s value will take a hit. This happened to many high-yield bond funds during the COVID-19 pandemic when several companies defaulted on their debt.

4. Inflation Risk

Even if your mutual fund provides positive returns, those returns might not keep pace with inflation. This means your purchasing power could decrease over time, even if the nominal value of your investment increases.

For instance, if your mutual fund returns 2% annually while inflation runs at 3%, you’re effectively losing 1% of your purchasing power each year. Ouch!

5. Manager Risk

Unlike index funds that passively track market indexes, actively managed mutual funds rely on the expertise of fund managers to make investment decisions. If the manager makes poor choices, your fund will underperform.

Studies have repeatedly shown that the majority of actively managed funds underperform their benchmark indexes over long periods. This suggests that manager risk is real and significant!

6. Liquidity Risk

While mutual funds are generally considered liquid investments, some specialized funds might invest in securities that are difficult to sell quickly without a substantial price discount.

During market panics, even mainstream mutual funds can experience liquidity problems. In March 2020, some bond funds temporarily had issues meeting redemption requests as the bond market seized up during the early days of the pandemic.

7. Dividend and Interest Payment Fluctuations

Dividends or interest payments may also change as market conditions change. This means the income you receive from your mutual fund isn’t guaranteed and could decrease unexpectedly.

For retirees who depend on mutual fund dividends for living expenses, this variability can create serious budget challenges.

Types of Mutual Funds and Their Specific Risks

Different types of mutual funds carry different levels and types of risks. Here’s a breakdown:

Stock (Equity) Funds

- Risk Level: Generally highest among mutual funds

- Key Risks: Market volatility, economic downturns, sector-specific issues

- Potential Downside: Can lose significant value during market corrections (20-30% or more)

Bond (Fixed Income) Funds

- Risk Level: Moderate, though varies based on bond types

- Key Risks: Interest rate changes, credit defaults, inflation

- Potential Downside: Can lose value when interest rates rise or bond issuers default

Money Market Funds

- Risk Level: Lowest among mutual funds, but not zero

- Key Risks: Inflation risk, potential for “breaking the buck”

- Potential Downside: May not keep pace with inflation, rare possibility of losses

Target Date Funds

- Risk Level: Varies based on time until target date

- Key Risks: Asset allocation may not match personal risk tolerance

- Potential Downside: May be too conservative or aggressive for individual needs

No FDIC Insurance – A Critical Risk Many Overlook

Here’s something super important that many new investors miss: Mutual funds are not guaranteed or insured by the FDIC or any other government agency. This means there’s no safety net if things go south.

Unlike bank deposits that are typically insured up to $250,000 by the FDIC, mutual fund investments can lose value and there’s no government backstop to make you whole.

When I first learned this, it completely changed how I thought about the “safety” of mutual funds compared to bank accounts. It’s a fundamental distinction every investor should understand.

Hidden Costs That Eat Away at Returns

While not risks in the traditional sense, fees and expenses represent a different kind of risk – the risk that your returns will be significantly reduced over time.

High Expense Ratios

Many mutual funds charge annual expense ratios ranging from 0.5% to 1.5% or even higher. These fees are deducted from your returns regardless of how the fund performs.

Over decades, these expenses can dramatically reduce your wealth. For example, a 1% higher annual fee on a $100,000 investment over 30 years could reduce your final balance by more than $170,000!

Sales Charges (Loads)

Some mutual funds charge front-end loads (when you buy), back-end loads (when you sell), or both. These charges can be as high as 5.75% of your investment amount!

If you invest $10,000 in a fund with a 5% front-end load, only $9,500 actually gets invested. You’re immediately starting with a 5% loss!

Management Abuses

Less common but still concerning are practices like:

- Churning: Unnecessary trading that generates commission fees

- Window dressing: Buying recent winners before reporting periods to make performance look better

- Style drift: Deviating from the stated investment strategy without informing investors

Tax Inefficiencies Can Hurt Your Returns

Mutual funds can create tax headaches that reduce your real returns:

Capital Gains Distributions

Mutual funds must distribute realized capital gains to shareholders annually. This means you might receive taxable distributions even in years when your fund loses value!

I remember one year when my mutual fund was down 10% for the year, yet I still had to pay taxes on capital gains distributions. Talk about adding insult to injury!

Limited Tax Control

Unlike individual stocks or ETFs, mutual funds don’t allow you to control when you realize capital gains. The fund manager’s decisions determine your tax bill.

For investors in high tax brackets, this lack of tax control can significantly reduce after-tax returns over time.

How to Mitigate Mutual Fund Risks

While you can’t eliminate all risks, here are some strategies to minimize them:

1. Diversify Across Asset Classes

Don’t put all your money in one type of mutual fund. Spread investments across stock funds, bond funds, and perhaps some alternative investments to reduce overall portfolio risk.

2. Check Fund Expense Ratios

Look for funds with low expense ratios – preferably under 0.5% for passive index funds and under 1% for actively managed funds.

3. Consider Index Funds

Index funds typically have lower costs and avoid manager risk since they passively track market indexes rather than relying on a manager’s investment picks.

4. Research Fund Managers

For actively managed funds, research the manager’s experience, track record, and investment philosophy before investing.

5. Monitor Your Investments

Regularly review your mutual fund performance and make adjustments if funds consistently underperform their benchmarks.

6. Match Funds to Your Time Horizon

If you’ll need the money soon, choose more conservative funds. For long-term goals, you can afford to take more risk with stock-focused funds.

Real-Life Example: When Mutual Funds Go Wrong

Back in 2008, I had a friend who invested heavily in a sector-specific mutual fund focused on financial companies. When the financial crisis hit, his fund plummeted by over 60%! He panicked and sold at the bottom, locking in those massive losses.

The lesson here isn’t that mutual funds are terrible – it’s that understanding the risks and having a proper allocation based on your risk tolerance and time horizon is crucial.

Alternatives to Consider

If mutual fund risks concern you, consider these alternatives:

-

Exchange-Traded Funds (ETFs): Similar diversification benefits but with greater tax efficiency and typically lower costs

-

Individual Bonds: Allow you to hold until maturity, eliminating interim price fluctuations

-

Certificates of Deposit: FDIC-insured up to $250,000, guaranteeing your principal

-

Target-Risk Funds: Maintain a consistent risk level rather than changing allocation based on a target date

The Bottom Line: Should You Invest in Mutual Funds?

Despite the risks I’ve outlined, mutual funds remain appropriate investments for many people. They offer professional management, diversification, and accessibility that few other investment vehicles can match.

The key is understanding the risks, choosing funds aligned with your goals and risk tolerance, and having realistic expectations about potential returns and losses.

Remember, no investment is risk-free, and higher potential returns almost always come with higher potential risks. We just need to make sure those risks are ones we understand and are willing to accept.

So, are mutual funds right for you? Only you can decide, but now you’re armed with knowledge about the risks involved. And that’s the first step toward making smart investment decisions!

What’s your experience with mutual funds? Have you encountered any of these risks firsthand? I’d love to hear your thoughts in the comments below!

Why Mutual Funds Over Index Funds?

FAQ

What is the risk in mutual funds?

Mutual funds offer relatively safe investment options but are not entirely risk-free. They are exposed to various risks, such as market volatility, sector or stock concentration, inflation, liquidity constraints, interest rate fluctuations, and credit risk, which can impact overall performance.

What are the downsides of mutual funds?

Mutual funds — a type of investment that lets you buy a collection of securities — offer convenience, professional management and diversification. There are a few drawbacks with mutual funds, including high fees, uncontrollable tax events and no intraday trading.

Is there a risk of losing money in mutual funds?

Yes, mutual funds can lose money, especially in volatile categories. While they have the potential for great returns, they also carry higher risks due to market fluctuations. Understanding this balance between risk and reward is crucial before investing in mutual funds.

What is the biggest problem with mutual funds?

However, they also come with drawbacks such as high fees, potential tax inefficiencies, and limited control over investment decisions. Before investing, research any mutual fund carefully to understand its investment mix, risks, and costs, and ensure it aligns with your financial goals.