Have you ever wondered what it actually means to be “wealthy”? Is it simply about having fancy cars and a big house? Or is there something deeper that defines true wealth? As someone who’s spent years studying personal finance, I can tell you that wealth is a journey with distinct stages – and understanding where you are can be incredibly powerful for your financial future.

In this article, I’m gonna break down the different levels of wealth as defined by the experts at Money Guy. Their framework gives us a clear roadmap of how wealth progresses – from simply paying your bills to achieving complete financial abundance. Let’s dive in and see where you might be on this journey!

What Does Being “Wealthy” Really Mean?

Before we jump into the specific levels, let’s clear something up. Many people confuse being “rich” with being “wealthy” – but they’re not the same thing!

Being rich often means high income, luxury cars, or a fancy house. It’s the outward appearance of wealth. But true wealth? That’s something different entirely.

True wealth is about freedom – the freedom to focus on what matters to you and do what you want, when you want, how you want. It’s not just about numbers in your bank account.

Interestingly, according to the Money Guy Wealth Survey, about 75% of millionaire clients don’t even consider themselves wealthy! This shows that wealth is subjective and constantly evolving as we grow.

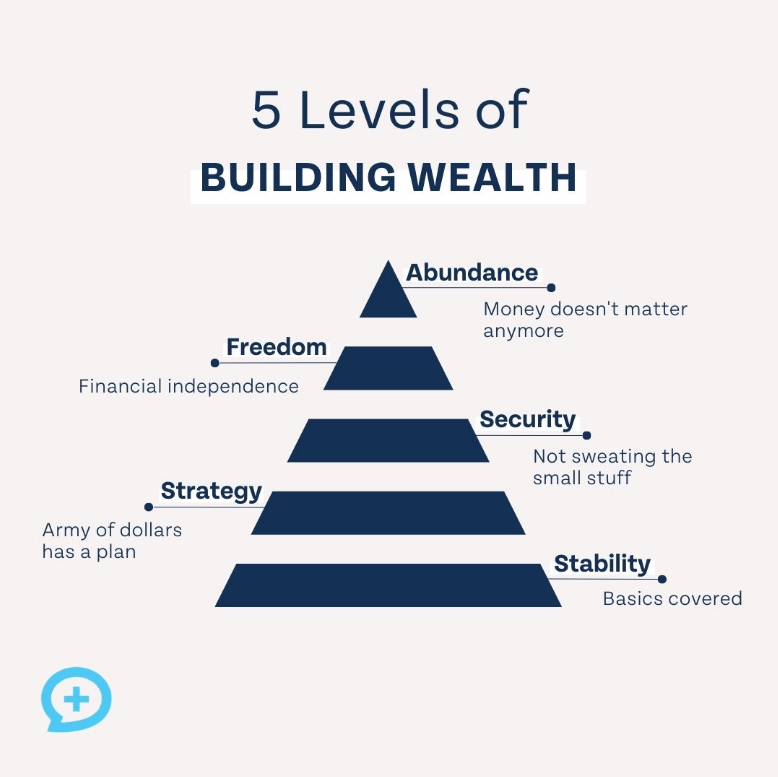

The 5 Levels of Wealth Explained

Unlike other financial frameworks that might have you jumping around between steps, the 5 Levels of Wealth are pretty linear – you progress from one to the next. Let’s explore each level:

Level 1: The Financial Stability Stage

The basics At this level you can consistently pay your bills without stress.

This might seem basic, but it’s actually a huge achievement! About 40% of Americans struggle to pay for basic needs, so if you’re comfortably covering your expenses you’re already ahead of many.

Traps to avoid at this stage:

- Don’t focus only on monthly payments

- Avoid ignoring your emergency fund

- Don’t neglect insurance deductibles

Success indicators

- You’re developing saving habits

- You’ve eliminated credit card debt

- You’re living within your means

Even small steps count here! Cutting back on unnecessary expenses and being intentional with your spending can make a massive difference.

Level 2: The Financial Strategy Stage

At Level 2, your money has a purpose beyond just being reserves. You’re actively putting your dollars to work through investments like Roth IRAs and 401(k)s.

Traps to avoid:

- Only 16% of Americans save more than 15% of their income yearly

- Don’t miss this opportunity! Retirement saving is YOUR responsibility

- Don’t procrastinate on setting up investment accounts

Success indicators:

- You’re saving 20-25% toward future goals

- You’ve automated most of your financial life

- You track your net worth annually

This stage is all about giving your money marching orders and making sure it’s working hard for your future.

Level 3: The Financial Security Stage

By this point, you don’t sweat the small stuff anymore. You’ve got confidence in your financial strategy and know you’re on the right track.

Traps to avoid:

- Watch out for lifestyle creep! (This is a big one that I’ve personally struggled with)

- Don’t overindulge just because you can

- Remember that overspending can reduce the joy of special purchases

Success indicators:

- You can spend on small luxuries without worrying

- You might enjoy daily small splurges (like that morning Starbucks)

- You’ve got margin for some bucket list items

- You might purchase luxury items with cash or pay them off quickly

This is where financial life starts to feel really good – you’ve got breathing room!

Level 4: The Financial Freedom Stage

This is the wealth level most people dream about. At this stage, you can truly do what you want, when you want, how you want.

Traps to avoid:

- Make sure your math is right – don’t assume your savings are enough

- Know what you’re retiring TO, not just what you’re retiring FROM

- Don’t lose purpose once work becomes optional

Success indicators:

- Your investments can cover your cash flow needs

- You can be your own boss if you choose

- Your net worth is double what The Millionaire Next Door formula suggests

(The formula: age × income ÷ 10)

Reaching this level means you’ve become what financial experts call a “Prodigious Accumulator of Wealth” or PAW. You’re officially “Balance Sheet Affluent” rather than just “Income Statement Affluent.”

Level 5: The Financial Abundance Stage

At the highest level, money simply doesn’t restrict you anymore. You have complete freedom to vision plan and decide what legacy you want to leave.

Traps to avoid:

- Don’t wait until this level to build experiences and memories

- Don’t miss the journey while focusing only on the destination

Success indicators:

- You focus on quality of experiences rather than cost

- You’re thinking beyond yourself – how can you make the world better?

- You’re considering your legacy and impact

At this level, the question becomes: How will you use your Financial Abundance for good?

Where Are You on the Wealth Journey?

Understanding your current wealth level isn’t about comparing yourself to others. It’s about gaining clarity on where you are and what your next steps should be.

Here’s a quick reference table to help you identify your current level:

| Wealth Level | Key Characteristic | Next Step Focus |

|---|---|---|

| Level 1: Stability | Can pay bills consistently | Build emergency fund, eliminate high-interest debt |

| Level 2: Strategy | Money has investment plan | Save 20%+, automate finances, track net worth |

| Level 3: Security | Don’t sweat small expenses | Manage lifestyle creep, enjoy some luxuries |

| Level 4: Freedom | Work becomes optional | Ensure math is right, find purpose beyond work |

| Level 5: Abundance | Complete financial freedom | Focus on legacy and making an impact |

I’m personally working through Level 3 right now, and it’s been eye-opening to recognize both the privileges and challenges of this stage. The framework has helped me avoid some costly mistakes (like upgrading my lifestyle too quickly).

How to Move Up the Wealth Ladder

No matter where you currently stand, there are practical steps you can take to move to the next level:

Moving from Level 1 to Level 2:

- Save at least 15% of your income

- Maximize retirement contributions

- Eliminate all high-interest debt

- Build a fully-funded emergency fund

Moving from Level 2 to Level 3:

- Increase savings rate to 20-25%

- Diversify investment strategies

- Maintain consistent investing habits

- Avoid lifestyle inflation as income grows

Moving from Level 3 to Level 4:

- Calculate your “financial independence number”

- Accelerate debt payoff (including mortgage)

- Consider additional income streams

- Maximize tax-advantaged accounts

Moving from Level 4 to Level 5:

- Develop an estate plan

- Consider charitable giving strategies

- Focus on legacy planning

- Explore mentorship opportunities

Remember that wealth-building isn’t a race. Each level has its own challenges and joys, and rushing through them might mean missing important lessons along the way.

Final Thoughts: Wealth Is More Than Money

As we wrap up, I want to emphasize something important: true wealth isn’t just about reaching a certain number. It’s about creating a life where money serves as a tool for freedom, purpose, and impact.

No matter what level you’re currently at, recognize that:

- Each level has unique challenges and opportunities

- Progress isn’t always linear

- The journey itself has valuable lessons

- Your definition of “enough” might change over time

I’ve found that understanding these wealth levels has given me more clarity and purpose in my financial journey. Instead of chasing an arbitrary “rich” status, I’m building toward true financial freedom – and that makes all the difference.

What level of wealth are you currently at? And what steps are you taking to move to the next one? Understanding your position on this wealth ladder could be the motivation you need to take your finances to the next level.

Remember: wealth isn’t about fancy cars or designer clothes. It’s about freedom, security, and the ability to live life on your own terms. And that journey starts right where you are today.

Gain clarity on your financial goals, break free from arbitrary numbers, and design a wealth strategy that truly aligns with your life.

If you like this article, feel free to click the ❤️ or button on this post so more people can discover it on Substack

A few weeks ago, I was sitting with 12 founders in my mastermind when the conversation turned to a topic that so many of us think about frequently but rarely discuss openly—money.

How will your life change after you hit your number?

Money is one of those subjects that often carries unspoken assumptions, hidden fears, and unconscious desires, simply because we don’t talk about it enough. Like any important relationship in our lives, the first step to understanding and improving it is bringing it into the open.

This article will help you to have a powerful, clarifying conversation with yourself and others about money.

The motivational speaker Zig Ziglar has a great line on money;

What I’ve learned—both from my own journey and from working with leaders at every stage of success—is that money is a means, not the end.

It’s natural for money to be a motivator. It represents security, freedom, opportunity. But too often, we assign it arbitrary, oversized meaning without ever questioning what we actually need to live a life that feels full, rich, and aligned with our values.

That’s why the Tony Robbins scene from the doc “ I am not your guru” sticks with me.

In one of his business mastery courses, Tony is asking people in the audience how much money they need for ultimate financial freedom.

He calls on a young entrepreneur, early 20s who stands up without hesitation, “a billion dollars.”

Tony smiles and asks him why he needs $1 billion, he goes on to tell him about owning his own private jet, owning an island, owning houses, and all of his favorite places.

Tony calmly guides him through an exercise, asking him how much he wants to fly, how often he wants to visit his private island, how much each house would cost. Tony knows how much these cost, because he has all of them.

As they work through the exercise, the young entrepreneur realizes that he couldn’t possibly need more than $200 million in the bank to live the life of his absolute dreams.

He had locked onto a number—a billion dollars—without ever breaking it down. And when he did? He realized he needed 80% less than he thought.

I see this all the time. I get to work with exited founders who still don’t feel like they’ve “made it” and early-stage entrepreneurs who think they need 10x more than they actually do. The truth is, if you don’t define your number—if you don’t get clear on what financial success actually looks like —you’ll always be chasing something just out of reach.

One thing I can most certainly promise you, an arbitrary amount of money will never fix an underlying story that we don’t have enough.

Understanding and achieving financial freedom can be a confusing journey. Fortunately, it can be navigated much more confidently with clear milestones.

Tony Robbins created one of my favorite exercises that outlines five distinct levels of wealth, each representing a deeper stage of financial security and freedom. It is the simplest and and most effective framework for establishing a deeper sense of clarity around money and exactly how much we need to feel safe, secure and ultimately free.

Here is The 5 Levels of Wealth Exercise…

Start a blank document and write down your answers for each level of wealth to the best of your ability.

Definition: At this foundational level, your investment income covers essential living expenses, including housing (mortgage or rent), utilities, food, transportation, and insurance for you and your immediate family.

Calculation:

- Total Monthly Essentials: Calculate your average monthly costs for housing, utilities, food, transportation, and insurance.

- Annual Requirement: Multiply this monthly total by 12 to determine your annual essential expenses.

- Investment Needed: Divide your annual essential expenses by your expected investment return rate to find the total investment required. For instance, if your annual essentials total $100,000 and you anticipate a 5% return, youd need $2,000,000 invested ($100,000 / 0.05).

- The 5% number comes from the average return of the S&P 500 over longer time horizons. (Typically quoted between 5-7%)

Definition: This stage covers all essentials plus a portion of discretionary spending, such as dining out, entertainment, and modest travel.

Calculation:

- Discretionary Expenses: Determine your average monthly spending on non-essentials like dining, entertainment, and travel.

- Vitality Expenses: Add 50% of your monthly discretionary expenses to your total monthly essentials.

- Annual Requirement & Investment Needed: As with Financial Security, annualize this total and divide by your expected return rate (6%) to find the necessary investment.

Definition: At this level, your investment income fully covers your current lifestyle, eliminating the need to work for income.

Calculation:

- Total Monthly Expenses: Sum all monthly expenses, both essential and discretionary.

- Annual Requirement & Investment Needed: Annualize this total and divide by your expected return rate to determine the investment required.

Definition: This stage allows for additional luxuries, such as upscale travel, luxury vehicles, or vacation properties, funded by your investment income.

Calculation:

- Desired Luxuries: Estimate the annual cost of desired luxury items or experiences.

- Total Annual Requirement: Add this to your Financial Independence annual requirement.

- Investment Needed: Divide by your expected return rate to find the total investment necessary.

What Every Level of Wealth ACTUALLY Feels Like

FAQ

What are the 5 classes of wealth?

Here’s a wealth class framework described by Bo Hanson, CFA, CFP® that breaks out 5 groups by net worth: the bottom 25%, the lower middle class, upper middle class, upper class, and the wealthiest 10%.

What are the 7 types of wealth?

What are the 4 tiers of wealth?

The four stages of wealth are typically defined as Stability, Accumulation/Growth, Security/Preservation, and Freedom/Legacy. In the first stage, you focus on paying bills and building a stable financial foundation. The second stage involves growing your wealth through investing. The third stage is about preserving your assets and generating income. The final stage is using your wealth for personal fulfillment and passing a legacy to others.

What are the 5 types of wealth?

In The 5 Types of Wealth, Sahil Bloom offers a transformative guide, full of practical steps and actionable insights, for redesigning your life around five types of wealth: Time, Social, Mental, Physical, and Financial.