The five Cs of credit are important because lenders use these factors to determine whether to approve you for a financial product. Lenders also use these five Cs—character, capacity, capital, collateral, and conditions—to set your loan rates and loan terms.

Hey there business peeps! If you’re hustlin’ to grow your company or just need some cash to keep the lights on you’ve prolly hit the wall of getting a loan. Lenders ain’t just handing out money like candy—they’ve got a checklist, and if you don’t match up, you’re outta luck. That’s where the 6 Cs of Credit come in. These are the golden rules lenders use to size you up and decide if you’re worth the risk. Nail these, and you’re way closer to that sweet funding. Let’s break ‘em down real simple, so you can get prepped and confident before you even walk into that bank.

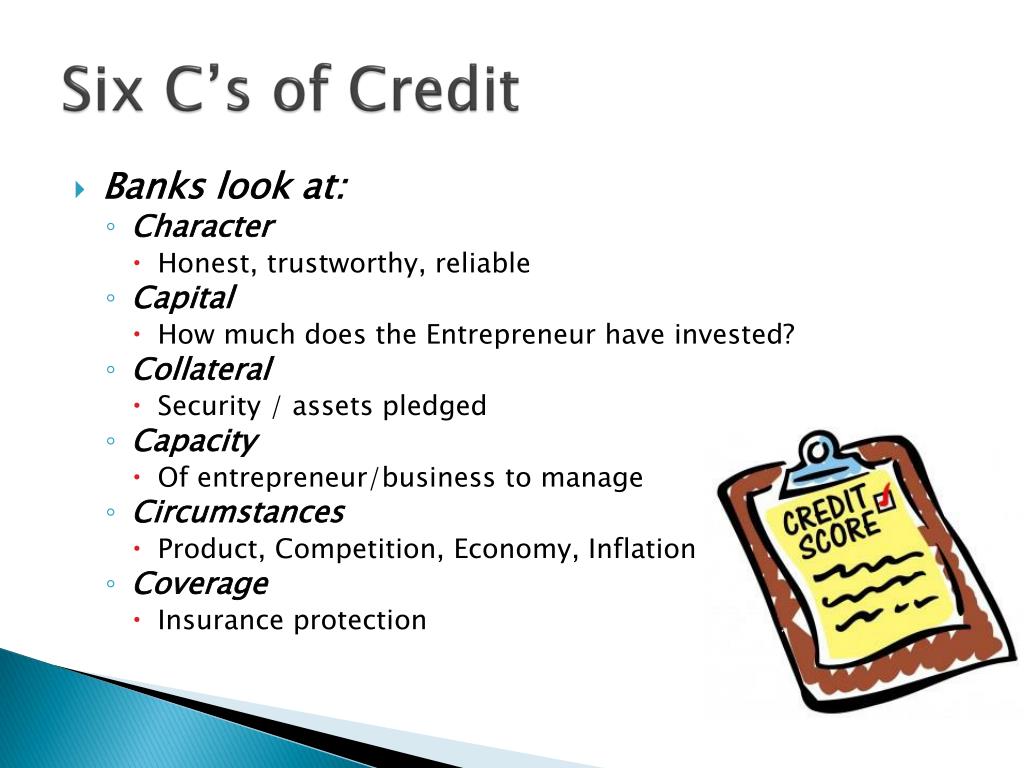

The 6 Cs are Character, Capacity, Capital, Collateral, Conditions, and Credit Score. Sounds like a mouthful, but stick with me—I’m gonna walk you through each one, show you why it matters, and give ya tips to shine in every area Whether you’re a startup dreamer or a seasoned biz owner, understanding these can be your ticket to unlocking the funds you need Let’s dive right in!

What Are the 6 Cs of Credit? A Quick Rundown

Before we get into the nitty-gritty, here’s the big picture. The 6 Cs are like a report card for your business and personal financial vibe. Lenders use ‘em to figure out if you’re a safe bet for a loan or line of credit. Here they are in a neat lil’ list

- Character: Are you trustworthy? Do you handle money like a pro?

- Capacity: Can your biz actually pay back the loan without breakin’ a sweat?

- Capital: How much of your own dough have you put into your business?

- Collateral: Got any assets to back up the loan if things go south?

- Conditions: What’s the loan for, and how’s the economy lookin’?

- Credit Score: What’s your track record with borrowin’ and payin’ back?

Got it? Cool. Now, let’s zoom in on each of these bad boys and see how you can make ‘em work for you. We’re gonna start with the most personal one, ‘cause let’s be real, lenders wanna know who they’re dealin’ with.

1. Character: Show ‘Em You’re the Real Deal

Character is all about your rep—both personal and professional. Lenders wanna know if you’re the kinda person who keeps their word. Are you honest? Do you pay your bills on time? Have you got a history of managin’ money without messin’ up big time? They’re basically askin’, “Can we trust ya?”

This ain’t just about your business—it’s about you. If you’ve been in the game for a while, your industry cred matters too. Maybe you’ve built solid relationships with suppliers or got a rep for bein’ fair and square. That stuff counts. Lenders might chat with folks in your circle or look at how you’ve handled past debts to get a feel for your vibe.

How to Boost Your Character

- Build relationships early. Get to know local bankers or folks in your community. A personal nod can go a long way.

- Keep your promises. If you owe money to vendors or partners, pay up on time, every time.

- Be transparent. If you’ve had hiccups in the past, own ‘em and show how you’ve grown.

I’ve seen buddies get loans just ‘cause they had a banker who knew ‘em personally and vouched for their grit. It’s like havin’ a wingman at the bank. So, don’t underestimate the power of a good name.

2. Capacity: Prove You Can Pay It Back

Capacity is where the rubber meets the road. Lenders wanna see if your business can actually cough up the cash to repay the loan. They’re gonna dig into your financials—think income statements, cash flow projections, and how much dough you’ve got comin’ in versus goin’ out. If your biz ain’t makin’ enough to cover the payments, they’re gonna think twice.

Imagine you run a lil’ bakery. You’re pullin’ in steady sales, but after rent and ingredients, there’s barely anything left. A lender’s gonna look at that and go, “Hmm, can they handle another bill?” They wanna see you’ve got room to breathe.

Tips to Strengthen Capacity

- Keep your books tight. Track every penny and have clear financial statements ready to show.

- Show growth. If your revenue’s climbin’, highlight that trend to prove you’ve got momentum.

- Cut unnecessary costs. Trim the fat so your cash flow looks healthier.

We’ve all been there, scrapin’ by some months. But if you can show a lender a solid plan for keepin’ the cash flowin’, they’ll be more likely to bet on ya.

3. Capital: Put Your Money Where Your Mouth Is

Capital is about skin in the game. Lenders wanna know how much of your own money you’ve poured into your business. If you’ve invested a chunk of your savings, it tells ‘em you’re serious and ain’t likely to walk away if things get tough. Typically, they like to see you’ve put in at least 10-25% of what you’re askin’ for, though that can vary.

Think about it—if you’re riskin’ your own cash, you’re gonna fight tooth and nail to make the biz work. That’s the kinda commitment they’re lookin’ for. If you’re askin’ for a $100,000 loan but ain’t put a dime in yourself, they might think you’re just playin’ around.

How to Build Your Capital

- Save up before you apply. Even a small personal investment shows you’re all in.

- Reinvest profits. If your biz is makin’ money, put some back in instead of takin’ it all out.

- Be ready to explain. Tell ‘em why your investment matters and how it’s helped grow your company.

I remember pitchin’ for a loan once, and the banker straight-up asked, “What you got on the line?” Showin’ I’d sunk my savings into my gig made ‘em take me serious. So, don’t be shy about provin’ your stake.

4. Collateral: Back It Up with Somethin’ Solid

Collateral is your safety net—and the lender’s too. It’s the stuff you pledge as security for the loan. If you can’t pay back, they can take and sell whatever you’ve put up to cover their loss. This could be real estate, equipment, inventory, or even personal stuff like your car or house. Havin’ collateral can sometimes get ya better terms or a bigger loan.

Not every loan needs it, but if your biz don’t got much history, they might push for somethin’ tangible. It’s like sayin’, “Worst case, you’ve got this to fall back on.” Lenders love that kinda reassurance.

Ways to Secure Collateral

- List your assets. Figure out what you’ve got that’s valuable—machinery, property, whatever.

- Be smart about it. Don’t pledge somethin’ you can’t afford to lose, like your only delivery van.

- Look into guarantees. If you’re short on collateral, check out programs like SBA loans for extra backing.

Ain’t gonna lie, puttin’ up collateral feels risky. I’ve hesitated before, thinkin’, “What if I lose this?” But if it’s the difference between gettin’ funded or not, it might be worth the gamble.

5. Conditions: Set the Stage for Success

Conditions ain’t just about you—it’s about the bigger picture. Lenders look at what you’re usin’ the loan for, the terms (like interest rates and repayment schedules), and the overall economic vibe. Are you borrowin’ to expand or just to survive a slow season? Is your industry hot or floppin’? They’re also peekin’ at the market and competition to see if you’ve got a fightin’ chance.

Let’s say you’re in a biz like restaurants, which got a rep for high failure rates. Lenders might get twitchy unless you’ve got a killer plan to stand out. Same goes if the economy’s in a funk—they’re more cautious.

How to Handle Conditions

- Be clear on purpose. Explain exactly why you need the money and how it’ll help.

- Know your industry. Show you understand the challenges and got a game plan to tackle ‘em.

- Stay flexible. If terms ain’t ideal, negotiate or shop around for a better deal.

We can’t control the economy, but we can control how we pitch our story. Make ‘em see you’ve thought through every funky scenario.

6. Credit Score: Your Financial Report Card

Last but def not least, your Credit Score. This is the number that sums up your borrowin’ history. Paid bills on time? Score goes up. Missed payments? It tanks. Lenders check both your personal and business scores, especially if your biz is new. A high score screams, “I’m reliable!” while a low one might limit your options or jack up interest rates.

They pull reports from big players like Dun & Bradstreet or Equifax to see the full picture. If your biz credit ain’t built yet, your personal score carries more weight, and you might hafta personally guarantee the loan.

Boostin’ Your Credit Score

- Check your reports. Look for errors and fix ‘em quick.

- Pay on time, always. Even small bills like utilities count toward your history.

- Keep debt low. Don’t max out credit lines—it looks risky.

I’ve had my score dip before ‘cause of a dumb late payment, and man, it stung when applyin’ for credit. Stay on top of it, y’all—it’s worth the hassle.

Why Do Lenders Care About the 6 Cs?

Alright, let’s flip the script for a sec. Why are lenders so obsessed with these 6 Cs? Simple—they’re in the biz of makin’ money, not losin’ it. Every loan’s a gamble, and the 6 Cs help ‘em figure out if you’re a safe bet or a potential headache. They wanna minimize risk while maximizin’ profit. If you check most of these boxes, they feel good about handin’ over the cash.

Think of it like this: they’re investin’ in you. If your Character’s shaky or your Capacity’s weak, they’re worried they won’t get paid back. But if you’ve got strong Capital and Collateral, it’s like insurance for ‘em. The Conditions and Credit Score just round out the full risk picture. It’s all about balancin’ their books while helpin’ you grow.

A Handy Cheat Sheet for the 6 Cs

Wanna quick reference to keep track? Here’s a table to pin up or screenshot for your next loan prep sesh:

| C of Credit | What It Means | How to Nail It |

|---|---|---|

| Character | Your trustworthiness and rep | Build relationships, pay on time |

| Capacity | Your biz’s ability to repay | Show strong cash flow, cut costs |

| Capital | Your personal investment in the biz | Invest your own money, reinvest profits |

| Collateral | Assets to secure the loan | Offer valuable stuff, consider guarantees |

| Conditions | Loan purpose and economic climate | Be clear on needs, know your industry |

| Credit Score | Your borrowin’ history | Pay on time, check reports for errors |

Keep this handy, and you’ll have a roadmap to impress any lender.

Real Talk: How the 6 Cs Work Together

Here’s the thing—ya don’t hafta be perfect in all 6 Cs to get approved. Strengths in one can make up for weaknesses in another. Got a so-so Credit Score but killer Capacity with cash flow pourin’ in? That might tip the scales. Or maybe your industry Conditions are rough, but your Character and Collateral are rock-solid. Lenders look at the whole package, not just one piece.

I’ve seen folks with shaky scores still snag loans ‘cause they had a fat stack of Capital and a clear plan. It’s about paintin’ a picture of reliability, even if a corner or two’s a lil’ blurry. So don’t sweat if one area ain’t perfect—double down on what you’ve got goin’ for ya.

Practical Steps to Prep for Your Loan App

Now that you know the 6 Cs, let’s talk action. Preppin’ for a loan ain’t just about understandin’ this stuff—you gotta roll up your sleeves and get your ducks in a row. Here’s a step-by-step to make sure you’re lender-ready:

- Step 1: Assess Yourself First

Take a hard look at where you stand on each C. Be brutal—where you slippin’? Fix what you can before applyin’. - Step 2: Gather Your Paperwork

Get financial statements, tax returns, and asset lists together. Lenders love organized folks. - Step 3: Build Your Case

Write out why you need the loan and how you’ll use it. Tie it to growth, not just survival, if ya can. - Step 4: Shop Around

Don’t settle for the first lender. Compare terms, rates, and vibes. Some banks are stricter on certain Cs than others. - Step 5: Get a Second Opinion

Chat with a mentor or financial buddy. They might spot gaps you missed.

We’ve all been nervous before a big pitch, but preppin’ like this takes the edge off. I’ve walked into meetings feelin’ like a boss just ‘cause I had my stuff straight.

Common Pitfalls to Dodge

While you’re gearin’ up, watch out for these traps that can tank your app faster than you can say “denied”:

- Ignorin’ Your Credit Score: Don’t assume it’s fine—check it. A surprise low score can mess up everything.

- Bein’ Vague on Purpose: If you can’t explain why you need the money, lenders get suspicious. Be crystal clear.

- Skippin’ Collateral Options: Even if you think you got nothin’, dig deeper. Sometimes personal assets can save the day.

- Underestimatin’ Conditions: If your industry’s in a slump, don’t ignore it—address how you’ll thrive anyway.

I’ve made the mistake of glossin’ over details before, and lemme tell ya, it don’t end well. Take the time to cover your bases.

Wrappin’ It Up: Your Path to Funding Awaits

So, there ya have it—the full scoop on the 6 Cs of Credit. Masterin’ Character, Capacity, Capital, Collateral, Conditions, and Credit Score ain’t just about checkin’ boxes; it’s about showin’ lenders you’re a solid investment. Whether you’re a small biz hustler or runnin’ a bigger operation, these are the keys to unlockin’ the funding you need to crush your goals.

Start by takin’ a hard look at where you stand. Build on your strengths, patch up the weak spots, and walk into that loan meeting with swagger. We believe in ya, and with a lil’ grit and prep, you can make lenders believe in ya too. Got dreams to fund? Get to work on these Cs today, and let’s turn that “maybe” into a big fat “yes” from the bank! Drop a comment if you’ve got questions or wanna share your loan journey—I’m all ears.

Improving Your 5 Cs: Character

Prospective borrowers should ensure that credit history is correct and accurate on their credit report. Adverse, incorrect discrepancies can be detrimental to your credit history and credit score. Consider implementing automatic payments on recurring billings to ensure future obligations are paid on time. Paying monthly recurring debts and building a history of on-time payments help to build your credit score.

Which of the 5 Cs is the most important?

Each of the five Cs has its own value, and each should be considered important. Some lenders may carry more weight for categories than others based on prevailing circumstances.

Character and capacity are often most important for determining whether a lender will extend credit. Banks utilizing debt-to-income (DTI) ratios, household income limits, credit score minimums, or other metrics will usually look at these two categories. Though the size of a down payment or collateral will help improve loan terms, these two are often not the primary factors in how a lender determines whether to expend credit.

The 6 C’s of Credit

FAQ

What are the 6cs of credit?

The 6 C’s of credit are a framework lenders use to assess the creditworthiness of borrowers, especially for business loans. They include Character, Capacity, Capital, Collateral, Conditions, and Credit Score.

What are the 6 principles of credit?

Whether you’re seeking a small business loan or business credit line, lenders will assess your application for financing based on six factors: capacity, capital, collateral, conditions, creditworthiness and character.

What are the Cs in credit?

Students classify those characteristics based on the three C’s of credit (capacity, character, and collateral), assess the riskiness of lending to that …

What are the 6 things in the Truth in lending Act?

Total of payments, Payment schedule, Prepayment/late payment penalties, If applicable to the transaction: (1) Total sales cost, (2) Demand feature, (3) Security interest, (4) Insurance, (5) Required deposit, and (6) Reference to contract.